This version of the form is not currently in use and is provided for reference only. Download this version of

Form ST-45

for the current year.

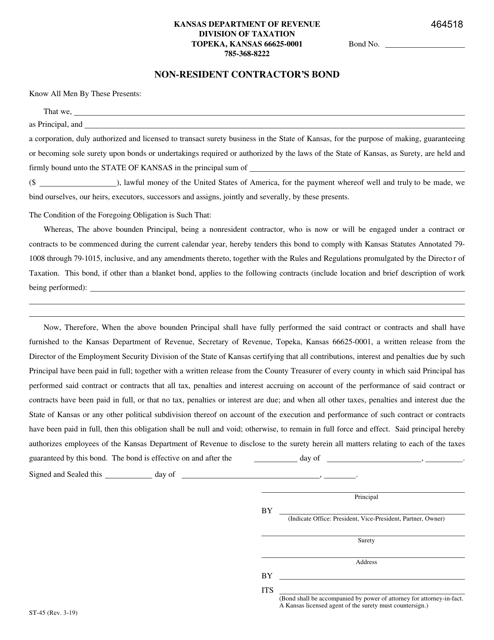

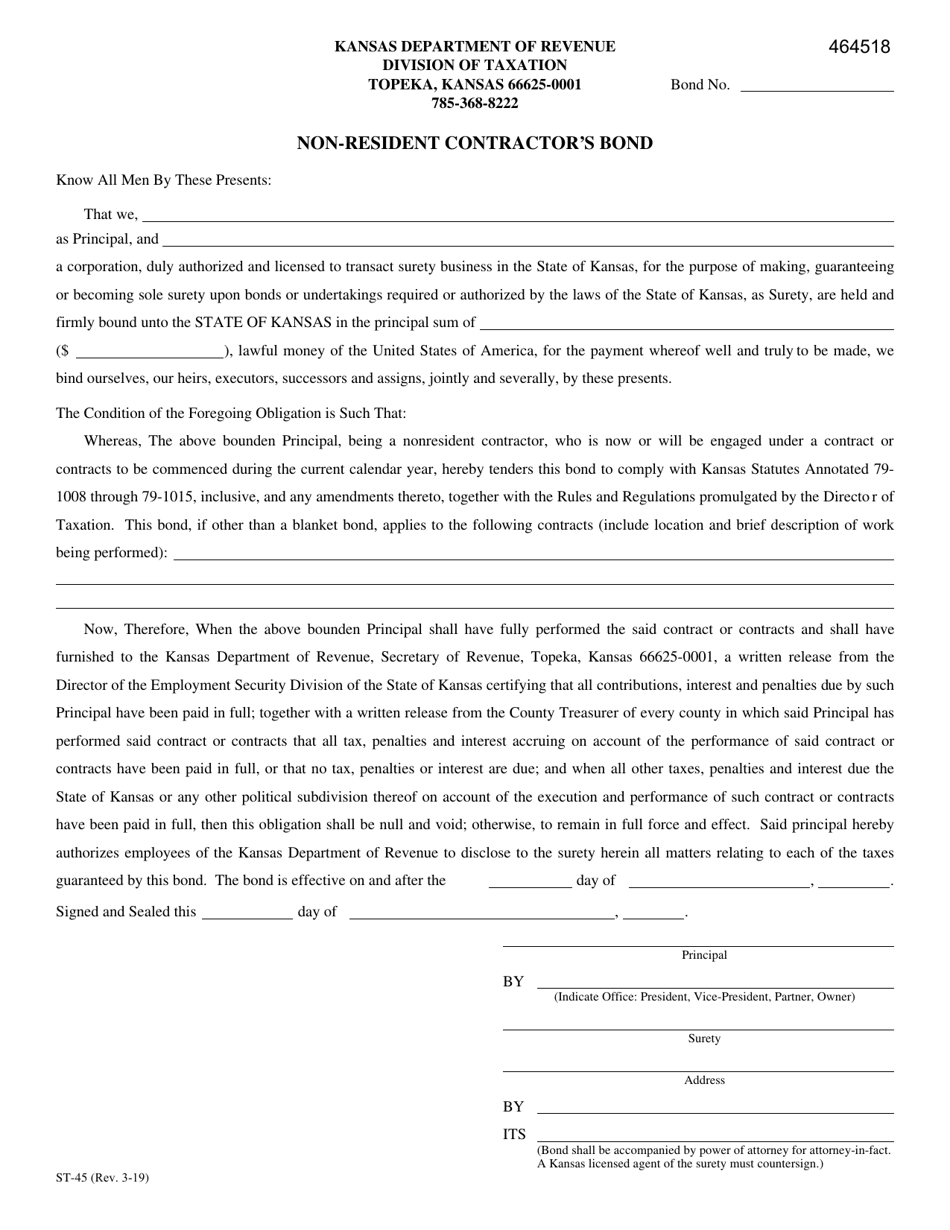

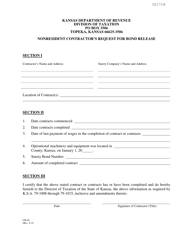

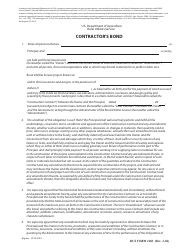

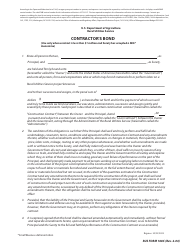

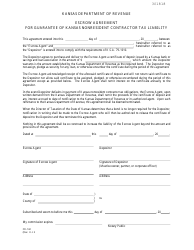

Form ST-45 Non-resident Contractor's Bond - Kansas

What Is Form ST-45?

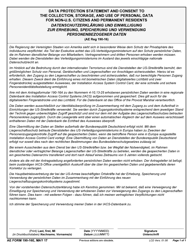

This is a legal form that was released by the Kansas Department of Revenue - a government authority operating within Kansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is a Form ST-45 Non-resident Contractor's Bond in Kansas?

A: Form ST-45 is a bond required by the state of Kansas for non-resident contractors to guarantee payment of sales and use taxes.

Q: Who needs to fill out a Form ST-45 Non-resident Contractor's Bond in Kansas?

A: Non-resident contractors who are performing construction work in Kansas and are not registered for sales and use tax purposes need to fill out this form.

Q: What is the purpose of the Form ST-45 Non-resident Contractor's Bond?

A: The purpose of this bond is to ensure that non-resident contractors fulfill their obligations to pay sales and use taxes in Kansas.

Q: What information is required to fill out a Form ST-45 Non-resident Contractor's Bond?

A: The form requires the contractor's name, address, federal employer identification number, type of work being performed, estimated amount of the contract, and other related details.

Q: Is the Form ST-45 Non-resident Contractor's Bond refundable?

A: No, the bond is not refundable. It serves as a guarantee for payment of sales and use taxes in Kansas.

Q: Are there any alternatives to the Form ST-45 Non-resident Contractor's Bond?

A: Yes, non-resident contractors can provide an equivalent security deposit or a cashier's check in lieu of the bond.

Form Details:

- Released on March 1, 2019;

- The latest edition provided by the Kansas Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form ST-45 by clicking the link below or browse more documents and templates provided by the Kansas Department of Revenue.