This version of the form is not currently in use and is provided for reference only. Download this version of

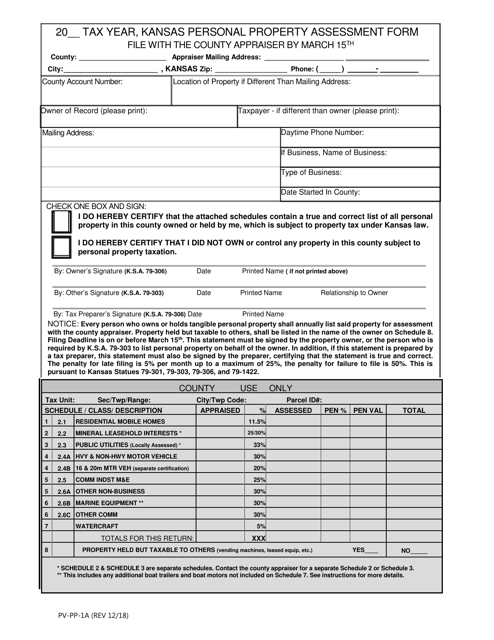

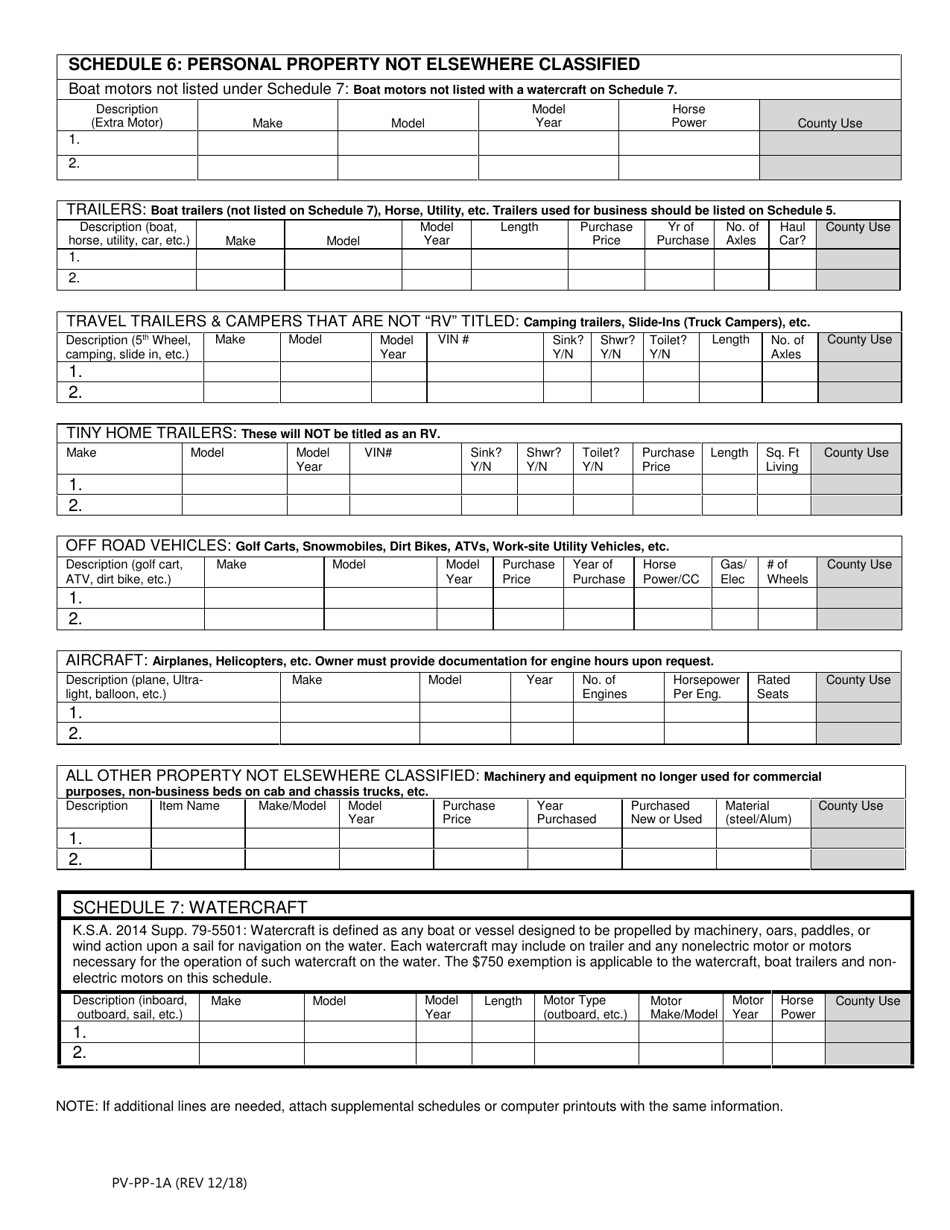

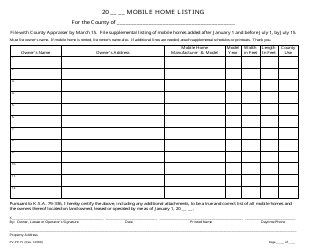

Form PV-PP-1A

for the current year.

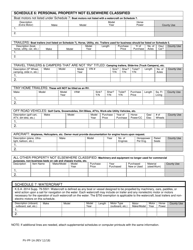

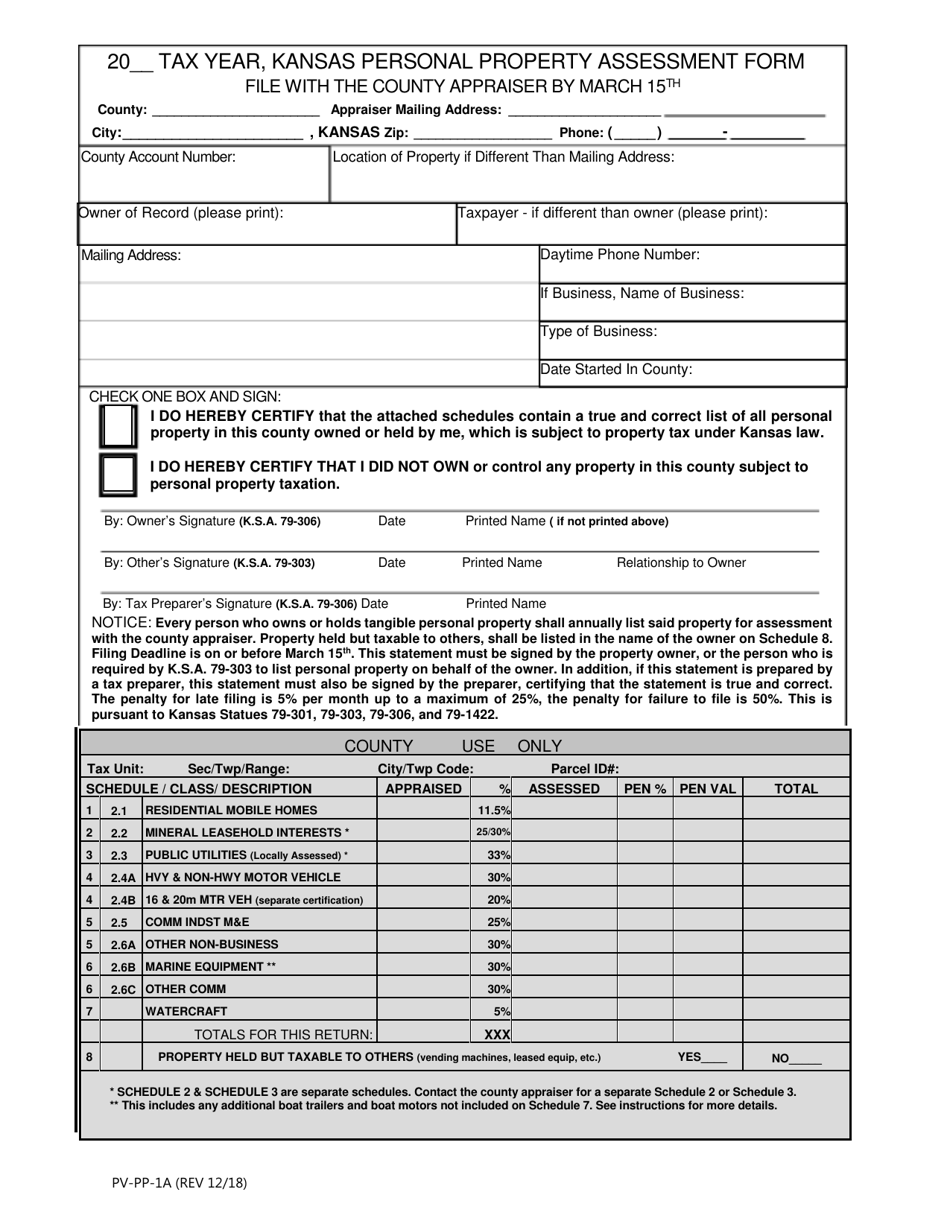

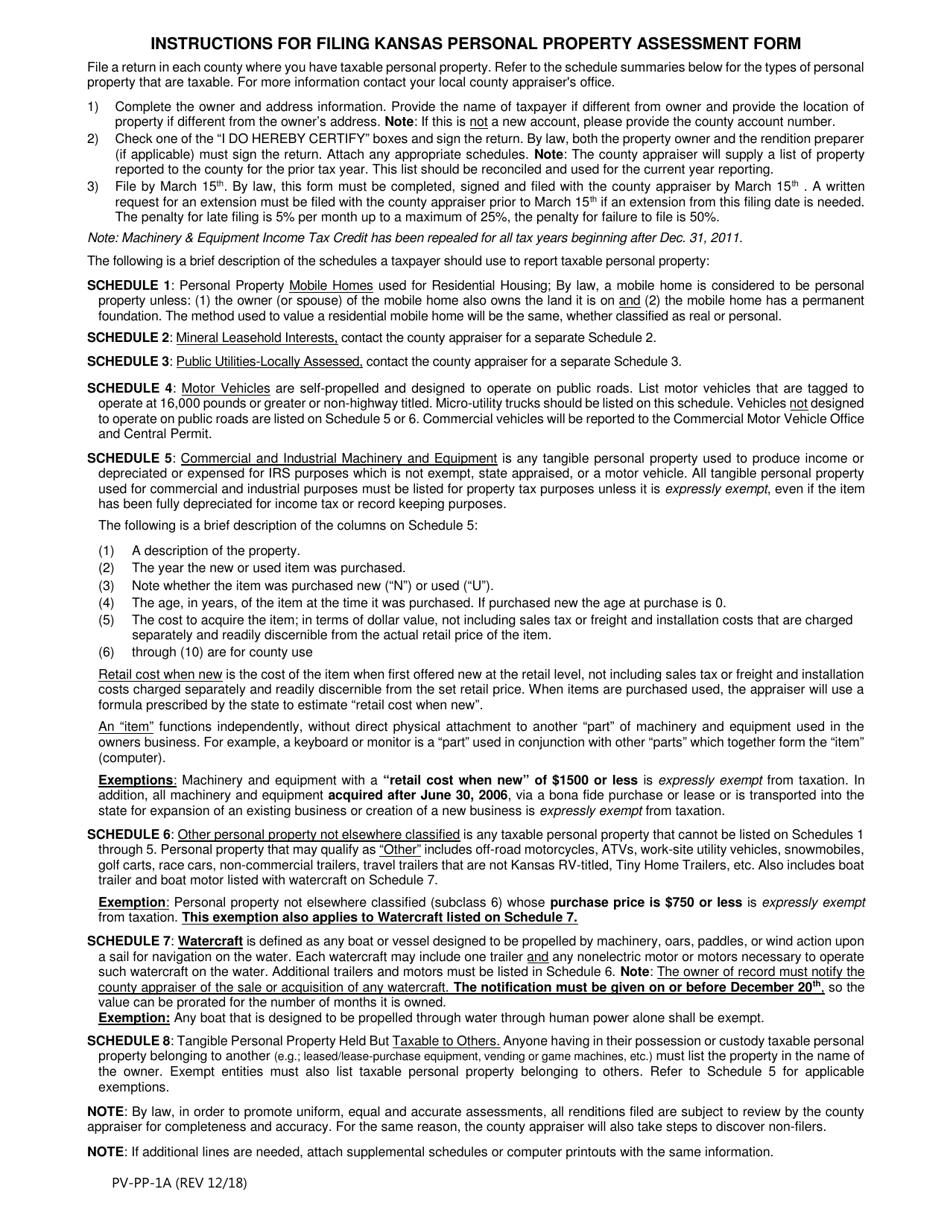

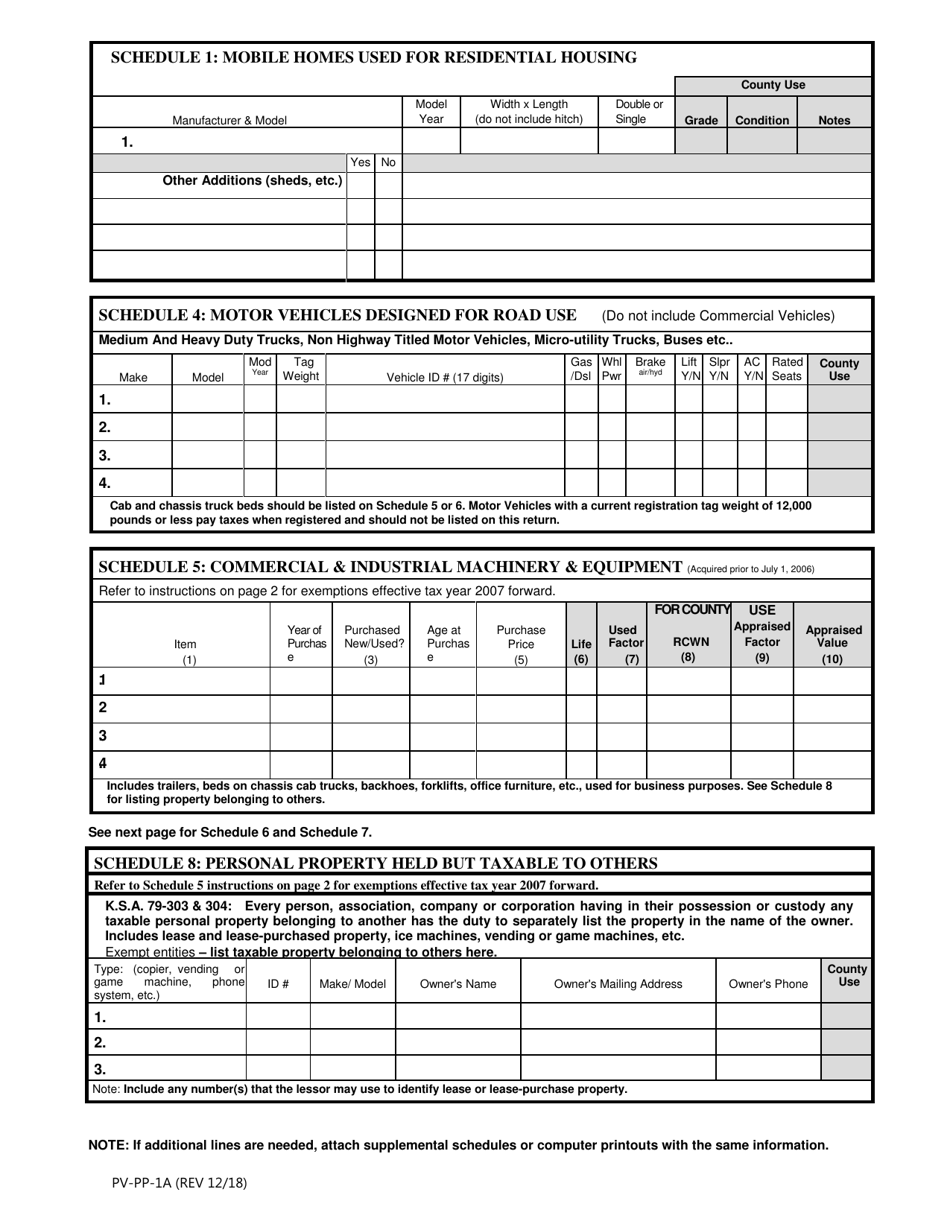

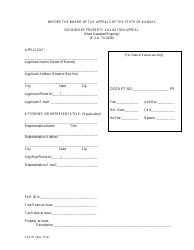

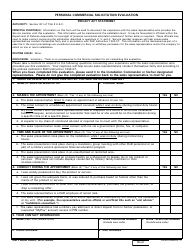

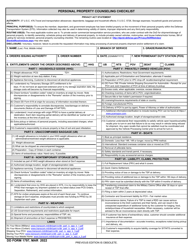

Form PV-PP-1A Personal Property Assessment Form - Kansas

What Is Form PV-PP-1A?

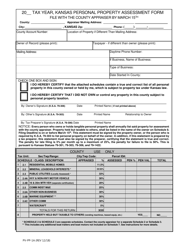

This is a legal form that was released by the Kansas Department of Revenue - a government authority operating within Kansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the PV-PP-1A form?

A: The PV-PP-1A form is the Personal Property Assessment Form used in Kansas.

Q: What is the purpose of the PV-PP-1A form?

A: The PV-PP-1A form is used to assess personal property for tax purposes in Kansas.

Q: Who needs to fill out the PV-PP-1A form?

A: Anyone who owns taxable personal property in Kansas needs to fill out the PV-PP-1A form.

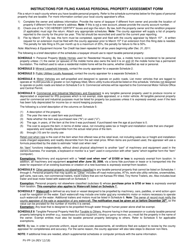

Q: What type of personal property should be reported on the PV-PP-1A form?

A: All taxable personal property, including vehicles, machinery, equipment, and furniture, should be reported on the PV-PP-1A form.

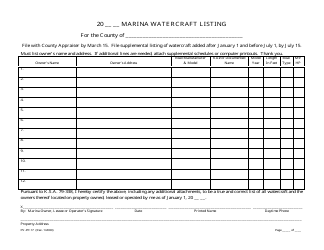

Q: When is the PV-PP-1A form due?

A: The PV-PP-1A form is typically due on March 15th of each year.

Q: What happens if I don't fill out the PV-PP-1A form?

A: Failure to complete the PV-PP-1A form may result in penalties or fines.

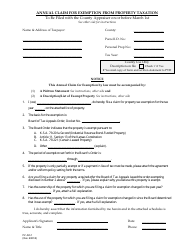

Q: Are there any exemptions or deductions available on the PV-PP-1A form?

A: Yes, there are certain exemptions and deductions available for eligible property owners. Consult the instructions provided with the form for more information.

Q: What should I do if I have questions about the PV-PP-1A form?

A: If you have questions or need assistance with the PV-PP-1A form, contact your local county appraiser's office for guidance.

Form Details:

- Released on December 1, 2018;

- The latest edition provided by the Kansas Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PV-PP-1A by clicking the link below or browse more documents and templates provided by the Kansas Department of Revenue.