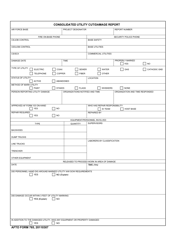

This version of the form is not currently in use and is provided for reference only. Download this version of

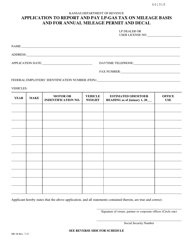

Form MF-90C

for the current year.

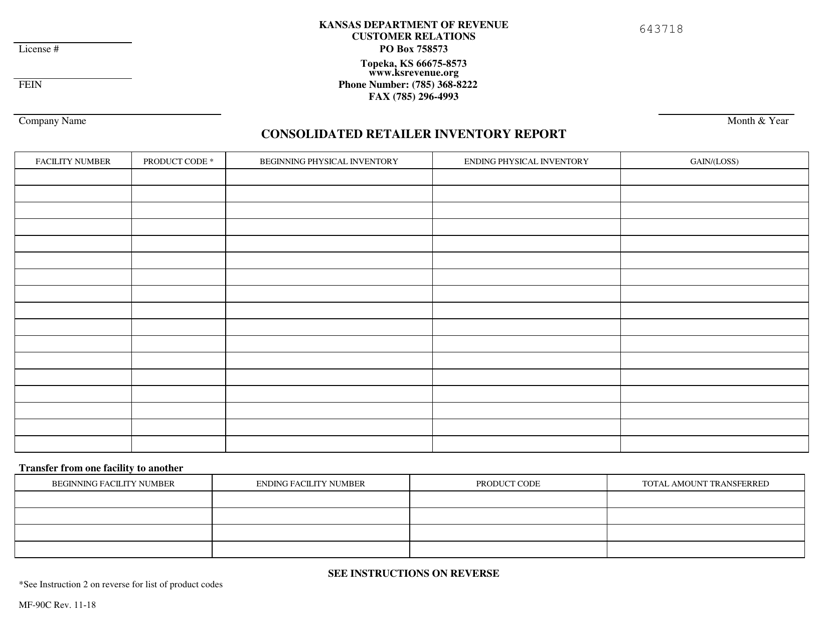

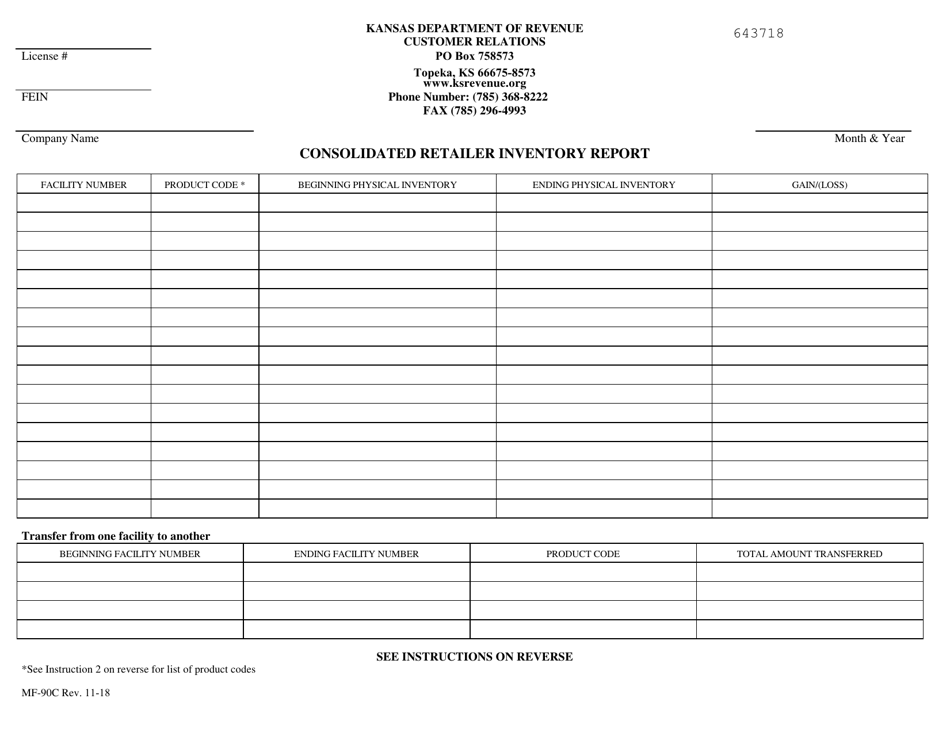

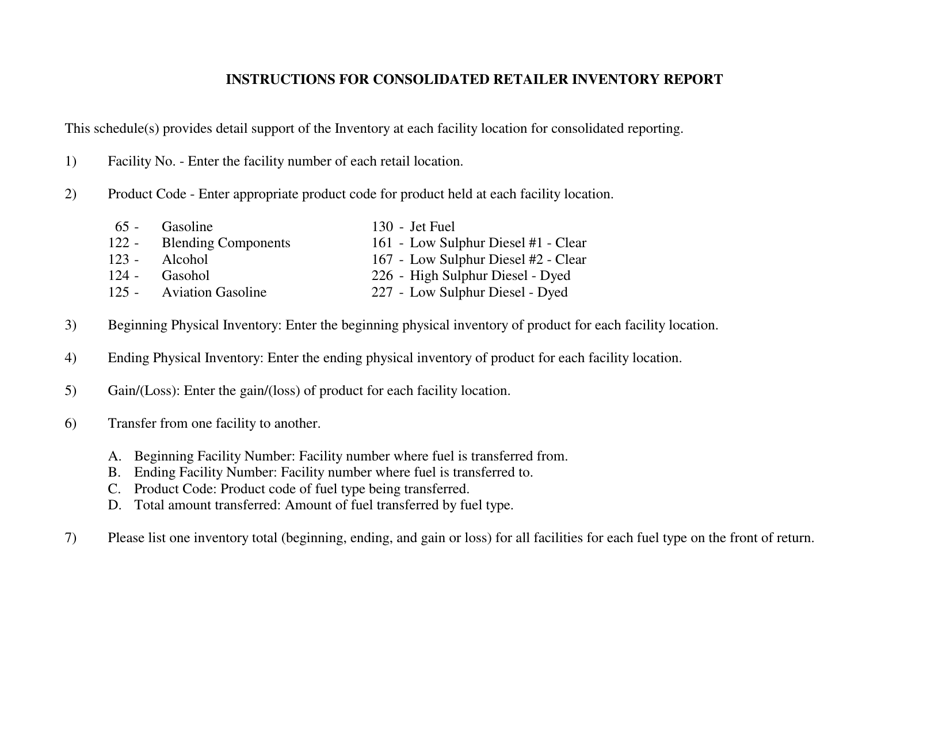

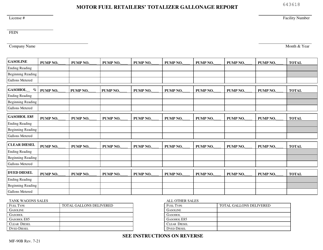

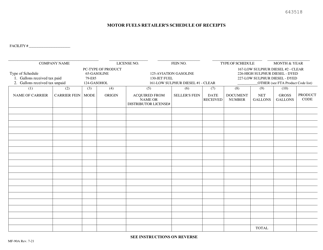

Form MF-90C Consolidated Retailer Inventory Report - Kansas

What Is Form MF-90C?

This is a legal form that was released by the Kansas Department of Revenue - a government authority operating within Kansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form MF-90C?

A: Form MF-90C is the Consolidated Retailer Inventory Report for the state of Kansas.

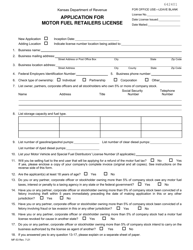

Q: Who needs to file Form MF-90C?

A: Retailers in Kansas need to file Form MF-90C.

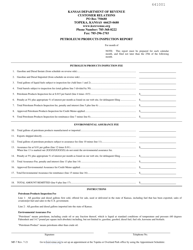

Q: What is the purpose of Form MF-90C?

A: The purpose of Form MF-90C is to report retailer inventory data to the state of Kansas.

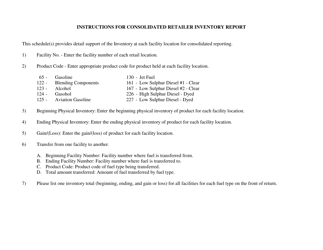

Q: What information is required on Form MF-90C?

A: Form MF-90C requires retailers to provide detailed information about their inventory, including the description, quantity, and value of each item.

Q: When is Form MF-90C due?

A: Form MF-90C is typically due on the 25th day of the month following the end of the reporting period.

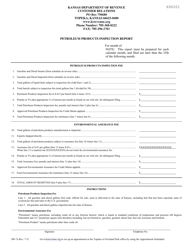

Q: How can Form MF-90C be filed?

A: Form MF-90C can be filed electronically or by mail.

Q: Are there any penalties for late or incorrect filing of Form MF-90C?

A: Yes, there are penalties for late or incorrect filing of Form MF-90C. It is important to file the form accurately and on time to avoid any penalties.

Q: Is there a fee to file Form MF-90C?

A: No, there is no fee to file Form MF-90C.

Q: What happens if I don't file Form MF-90C?

A: Failure to file Form MF-90C can result in penalties and potential legal consequences.

Q: What should I do if I have questions or need assistance with Form MF-90C?

A: If you have questions or need assistance with Form MF-90C, you should contact the Kansas Department of Revenue for guidance.

Form Details:

- Released on November 1, 2018;

- The latest edition provided by the Kansas Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MF-90C by clicking the link below or browse more documents and templates provided by the Kansas Department of Revenue.