This version of the form is not currently in use and is provided for reference only. Download this version of

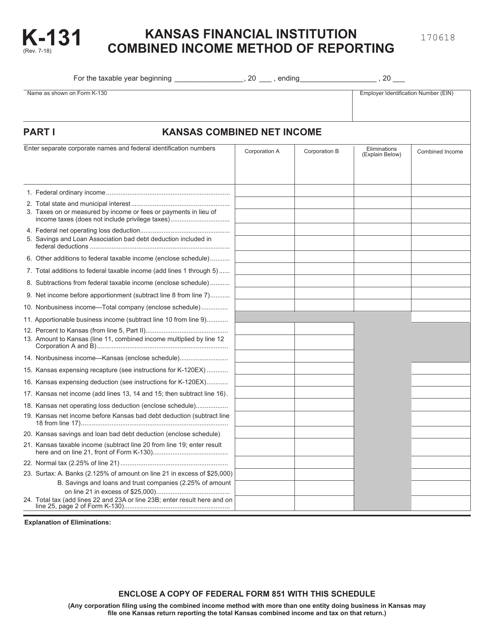

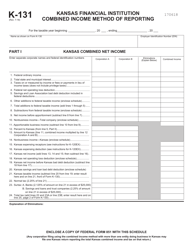

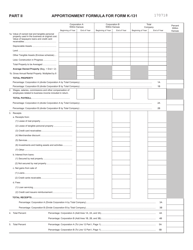

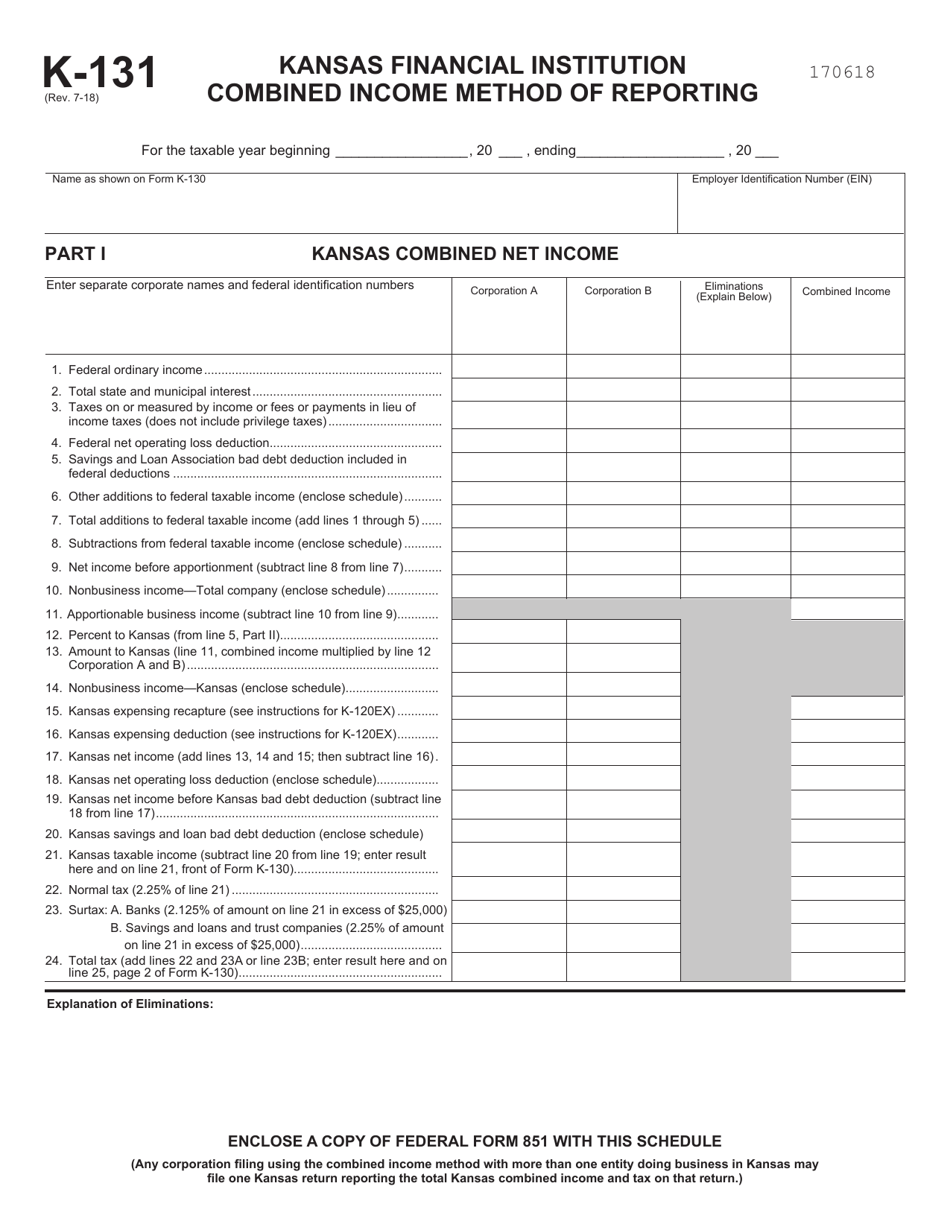

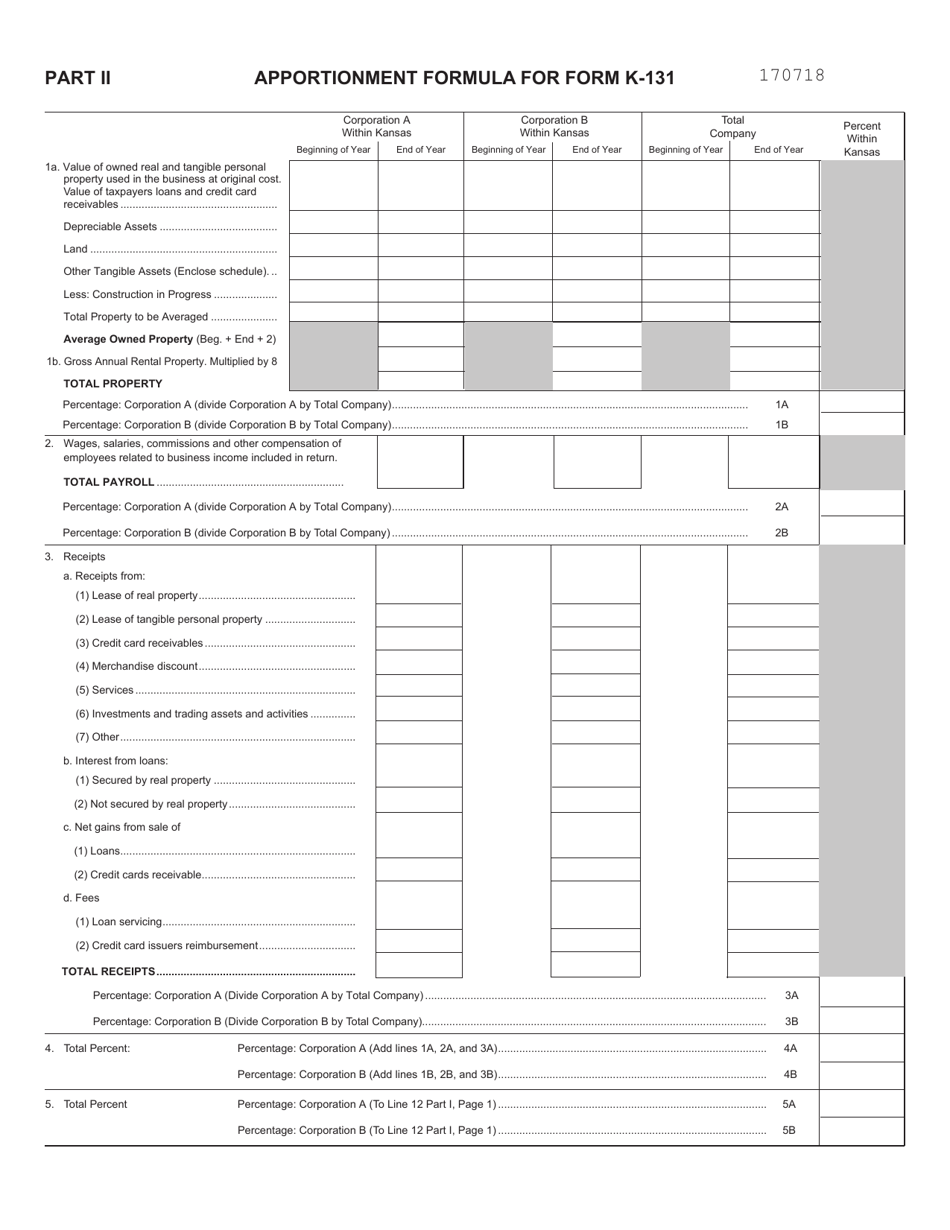

Form K-131

for the current year.

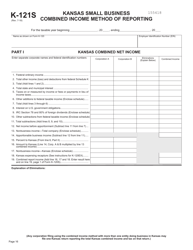

Form K-131 Kansas Financial Institution Combined Income Method of Reporting - Kansas

What Is Form K-131?

This is a legal form that was released by the Kansas Department of Revenue - a government authority operating within Kansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form K-131?

A: Form K-131 is a form used by financial institutions in Kansas to report their income using the combined income method.

Q: Who needs to file Form K-131?

A: Financial institutions in Kansas are required to file Form K-131 if they use the combined income method of reporting.

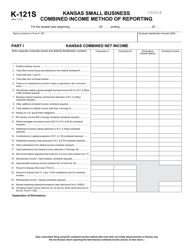

Q: What is the combined income method of reporting?

A: The combined income method of reporting is a method used by financial institutions to calculate and report their income based on a combination of different factors, such as interest income, dividend income, and service charges.

Q: When is Form K-131 due?

A: Form K-131 is due on or before the 15th day of the fourth month following the close of the financial institution's tax year.

Q: Are there any penalties for late filing of Form K-131?

A: Yes, financial institutions may incur penalties for late filing of Form K-131. It is important to file the form by the due date to avoid any penalties or late fees.

Q: What should I do if I have questions about Form K-131?

A: If you have any questions or need assistance with Form K-131, you can contact the Kansas Department of Revenue directly for guidance.

Q: Is there a fee for filing Form K-131?

A: There is no fee for filing Form K-131. However, financial institutions may be subject to other taxes or fees based on their income and operations.

Form Details:

- Released on July 1, 2018;

- The latest edition provided by the Kansas Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form K-131 by clicking the link below or browse more documents and templates provided by the Kansas Department of Revenue.