This version of the form is not currently in use and is provided for reference only. Download this version of

Form ST-28H

for the current year.

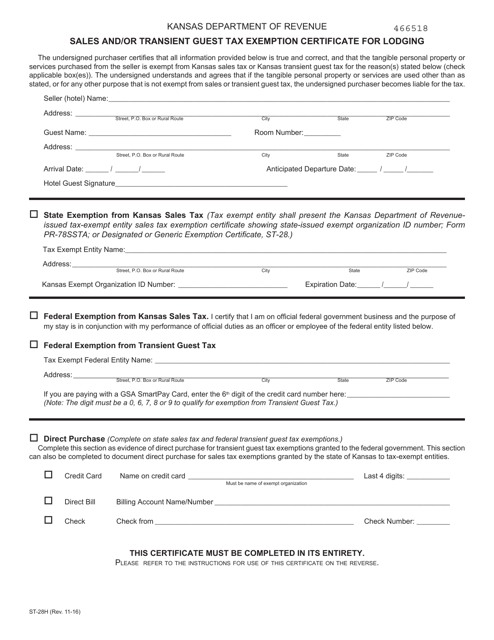

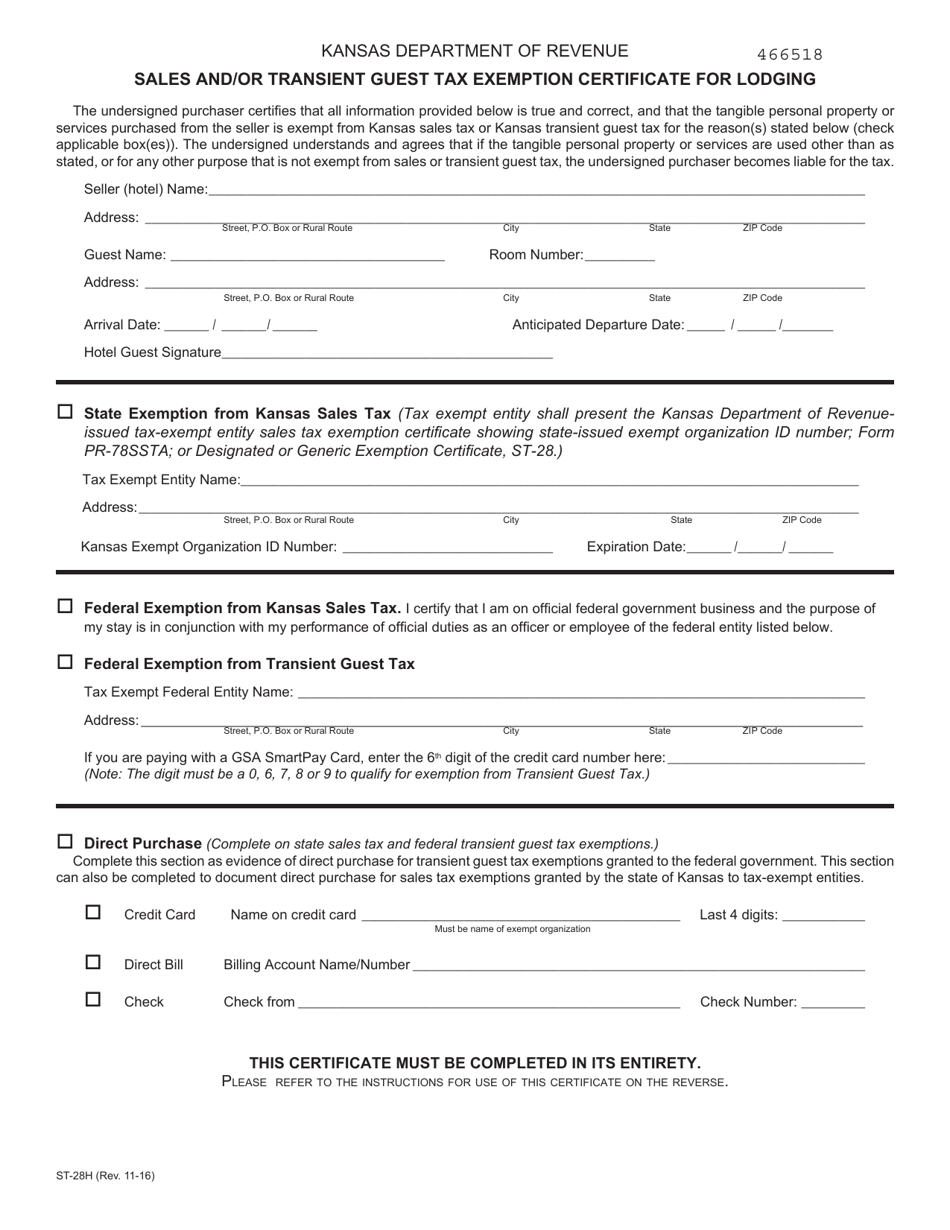

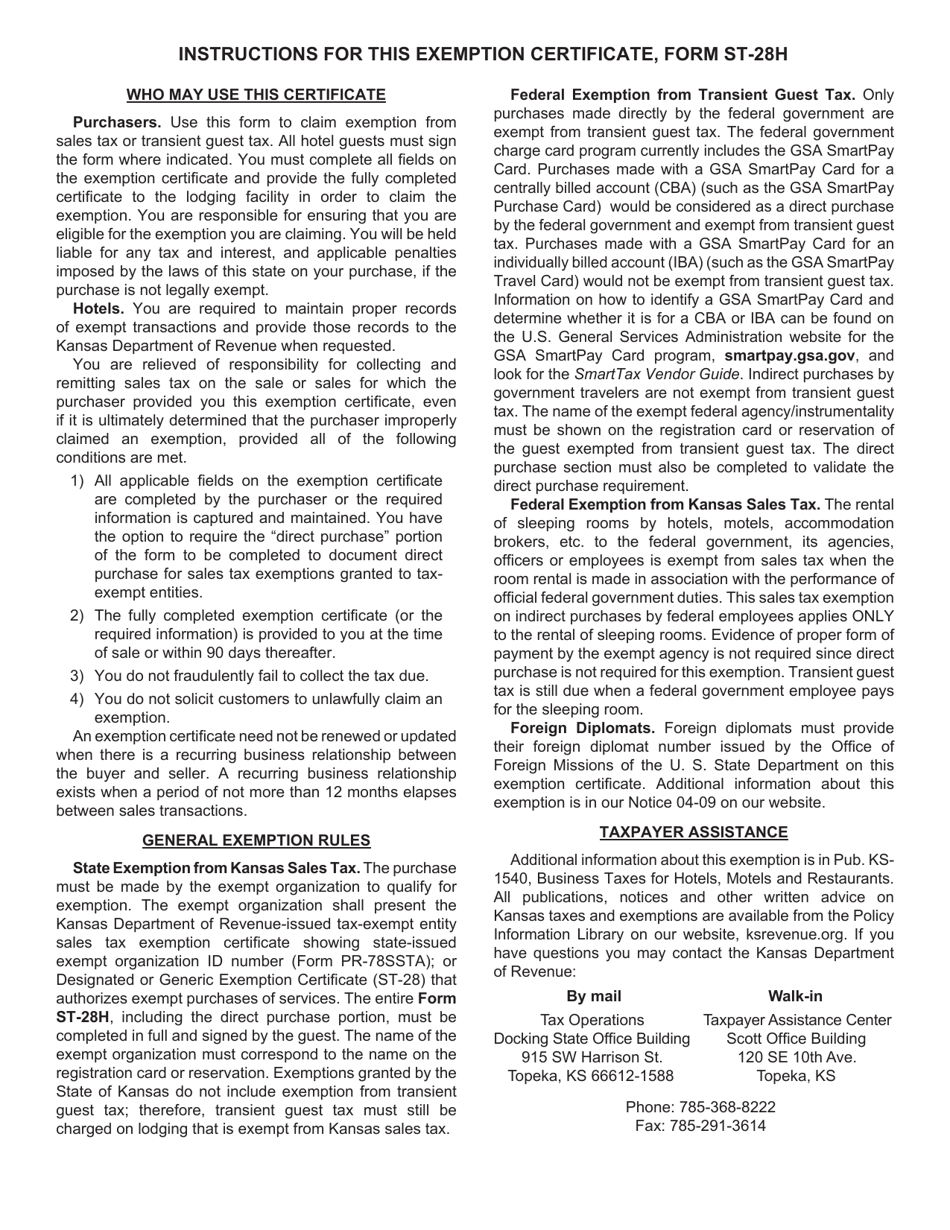

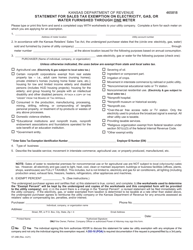

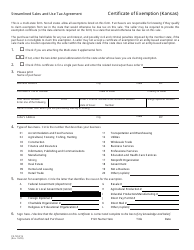

Form ST-28H Sales and / or Transient Guest Tax Exemption Certificate for Lodging - Kansas

What Is Form ST-28H?

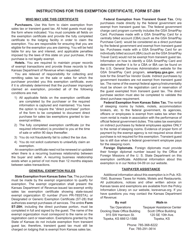

This is a legal form that was released by the Kansas Department of Revenue - a government authority operating within Kansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form ST-28H?

A: Form ST-28H is a Sales and/or Transient Guest Tax Exemption Certificate for Lodging.

Q: What is the purpose of Form ST-28H?

A: Form ST-28H is used to claim exemption from sales and/or transient guest tax on lodging in Kansas.

Q: Who should use Form ST-28H?

A: Anyone who is eligible for sales and/or transient guest tax exemption on lodging in Kansas should use Form ST-28H.

Q: What information is required on Form ST-28H?

A: Form ST-28H requires information such as the taxpayer's name, address, tax ID number, and the reason for claiming the exemption.

Q: When should Form ST-28H be submitted?

A: Form ST-28H should be submitted to the lodging establishment at the time of payment or check-in.

Q: Is there a fee for using Form ST-28H?

A: No, there is no fee for using Form ST-28H.

Q: How long is Form ST-28H valid?

A: Form ST-28H is valid for a period of one year from the date of issuance.

Q: What should I do if my Form ST-28H expires?

A: If your Form ST-28H expires, you will need to reapply and obtain a new certificate.

Q: Are there any penalties for misuse of Form ST-28H?

A: Yes, there are penalties for the misuse of Form ST-28H, including fines and possible criminal charges.

Form Details:

- Released on November 1, 2016;

- The latest edition provided by the Kansas Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ST-28H by clicking the link below or browse more documents and templates provided by the Kansas Department of Revenue.