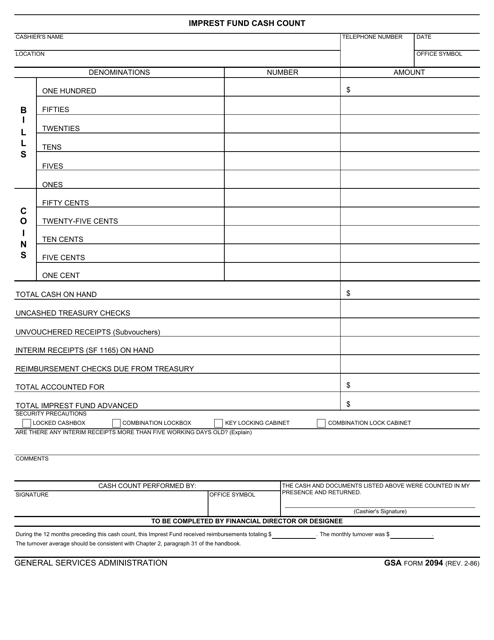

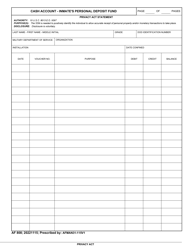

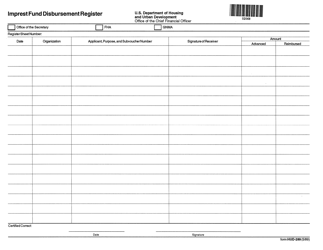

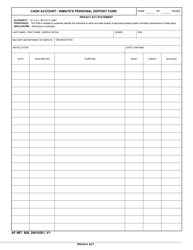

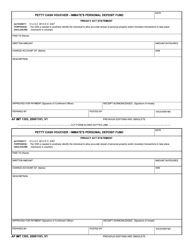

GSA Form 2094 Imprest Fund Cash Count

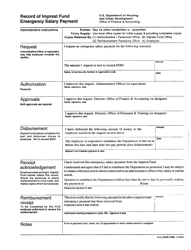

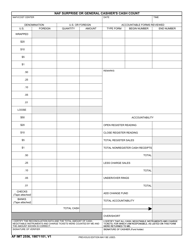

What Is GSA Form 2094?

This is a legal form that was released by the U.S. General Services Administration on February 1, 1986 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is GSA Form 2094?

A: GSA Form 2094 is a document used for the Imprest Fund Cash Count.

Q: What is an Imprest Fund?

A: An Imprest Fund is a fixed sum of money that is advanced to an individual for making small cash payments.

Q: What is a cash count?

A: A cash count is the process of physically counting the cash in an Imprest Fund to ensure its accuracy and completeness.

Q: Why is a cash count necessary?

A: A cash count is necessary to reconcile the cash balance with the records and detect any discrepancies or potential errors.

Q: What information is included in GSA Form 2094?

A: GSA Form 2094 includes details such as the date of the cash count, the starting cash balance, any cash additions or withdrawals, and the ending cash balance.

Q: Who is responsible for conducting the cash count?

A: The individual who has custody of the Imprest Fund is responsible for conducting the cash count.

Q: Are there any guidelines to follow for the cash count?

A: Yes, there are guidelines provided by the General Services Administration (GSA) for conducting the cash count correctly.

Q: What should be done if there are discrepancies in the cash count?

A: Any discrepancies identified during the cash count should be documented and reported to the appropriate authority for investigation and resolution.

Q: Is GSA Form 2094 mandatory for an Imprest Fund cash count?

A: Yes, GSA Form 2094 is mandatory and must be completed accurately and submitted as per the GSA guidelines.

Form Details:

- Released on February 1, 1986;

- The latest available edition released by the U.S. General Services Administration;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of GSA Form 2094 by clicking the link below or browse more documents and templates provided by the U.S. General Services Administration.