This version of the form is not currently in use and is provided for reference only. Download this version of

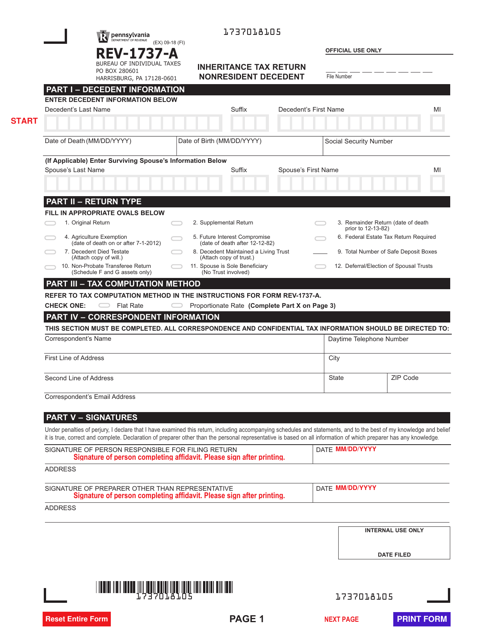

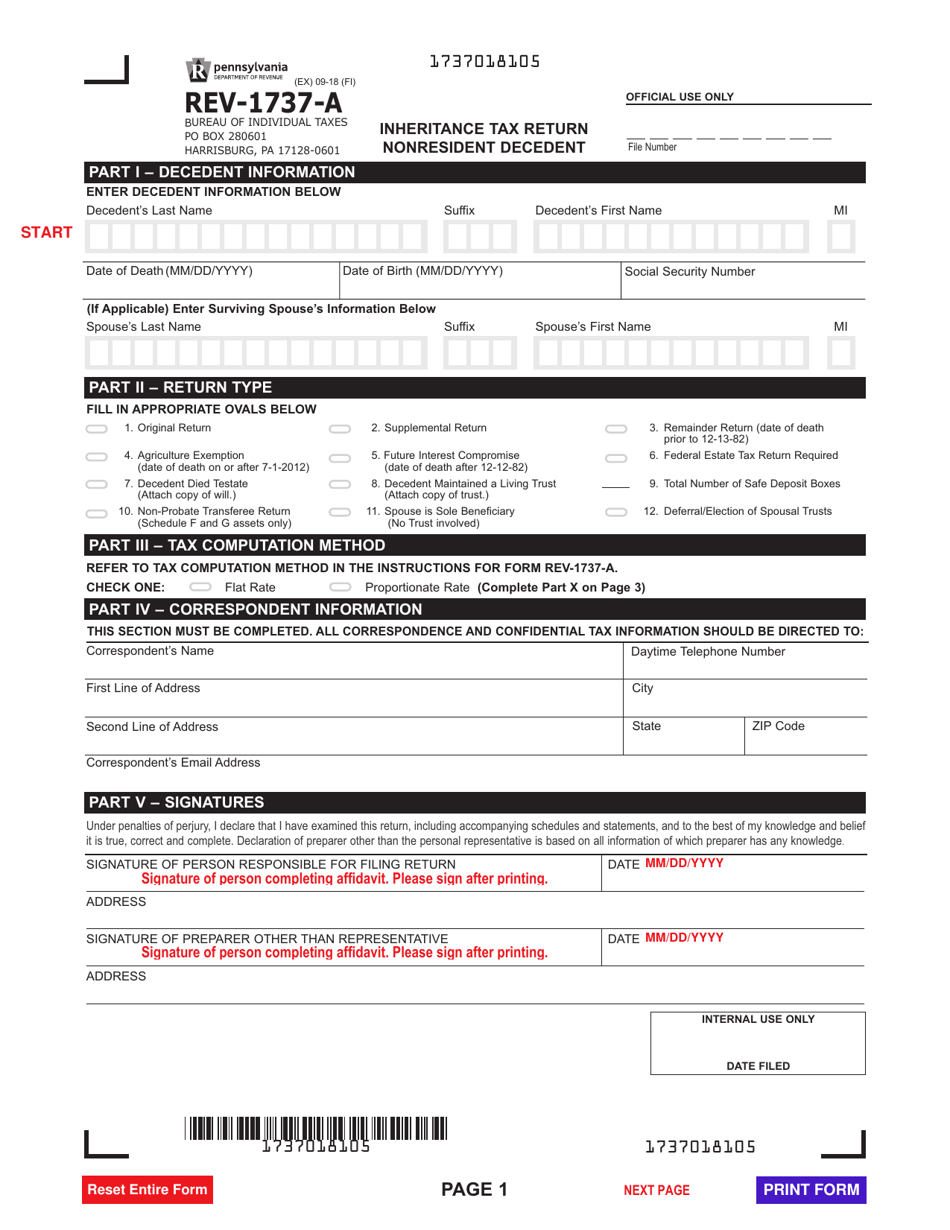

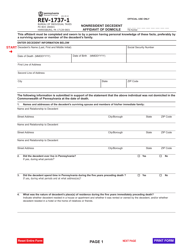

Form REV-1737-A

for the current year.

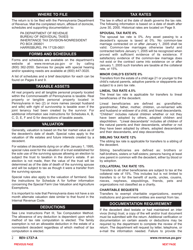

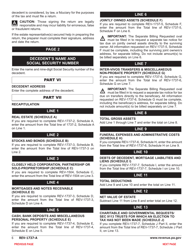

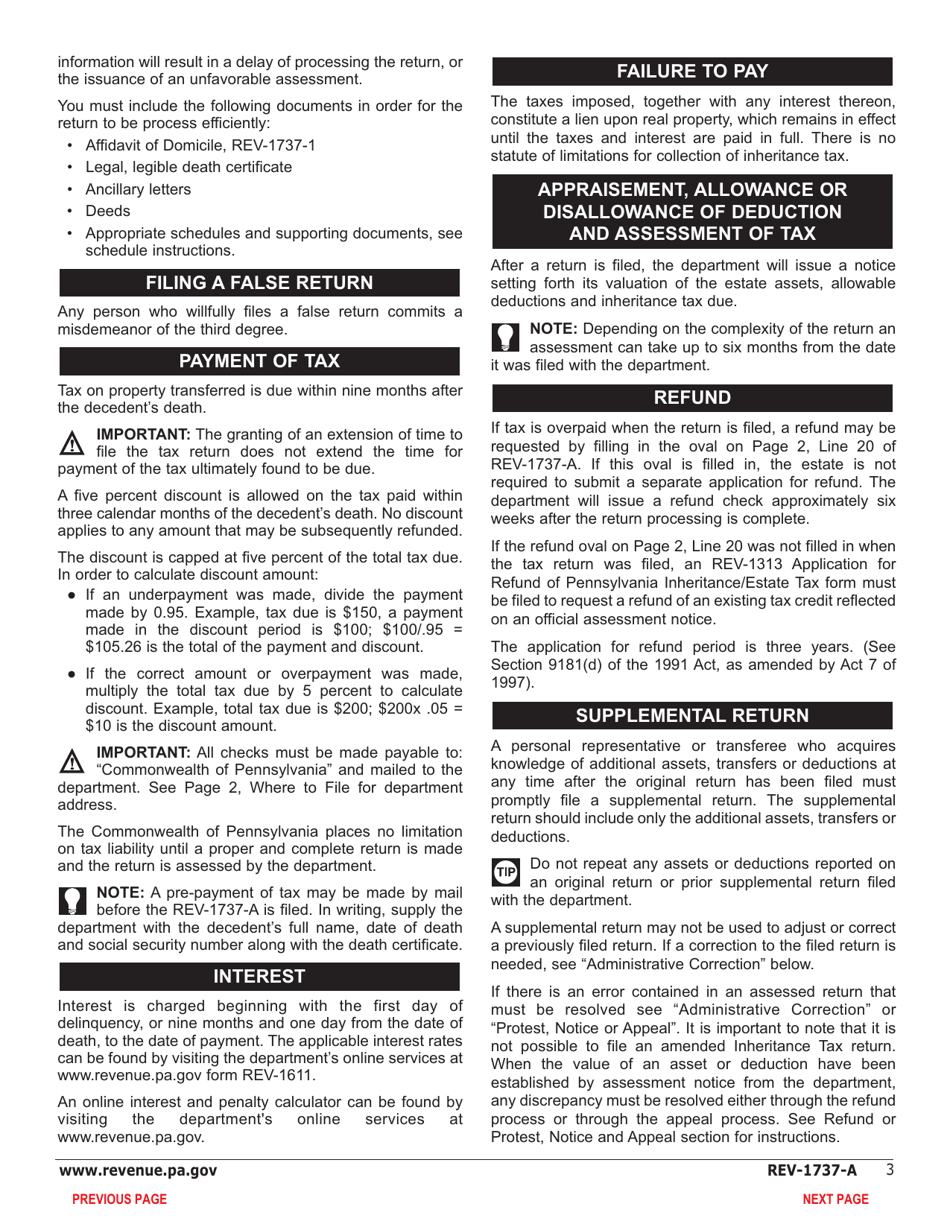

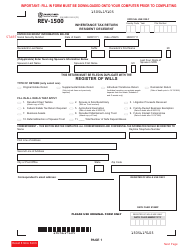

Form REV-1737-A Inheritance Tax Return - Nonresident Decedent - Pennsylvania

What Is Form REV-1737-A?

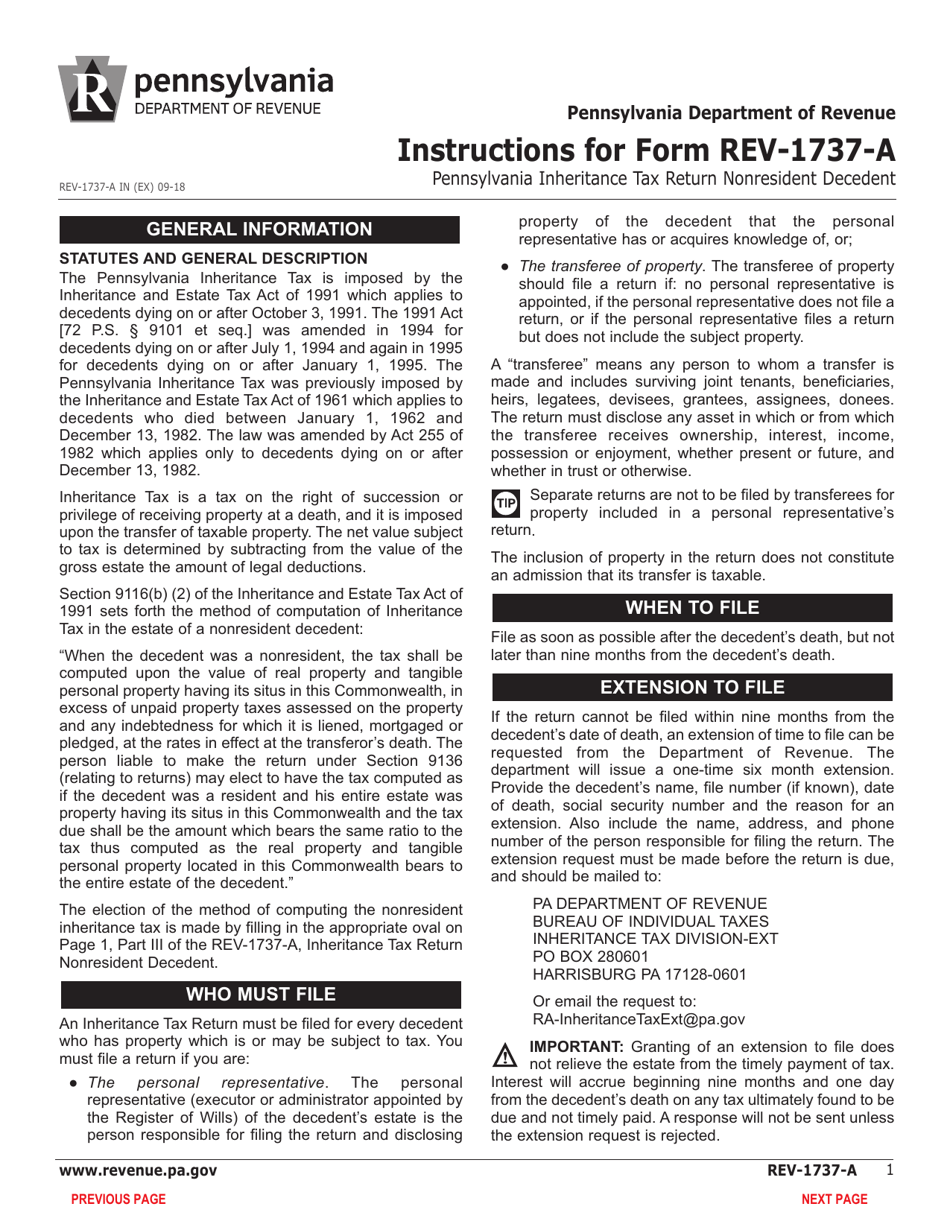

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form REV-1737-A?

A: Form REV-1737-A is the Inheritance Tax Return specifically designed for nonresident decedents in Pennsylvania.

Q: Who needs to file Form REV-1737-A?

A: Any nonresident decedent who owned property in Pennsylvania or had tangible personal property in Pennsylvania at the time of their death needs to file Form REV-1737-A.

Q: What is the purpose of Form REV-1737-A?

A: The purpose of Form REV-1737-A is to calculate and report any inheritance tax owed by the nonresident decedent's estate to the state of Pennsylvania.

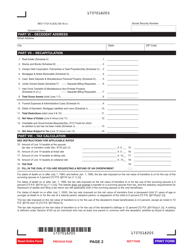

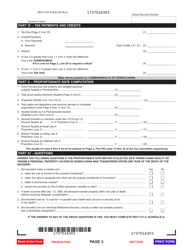

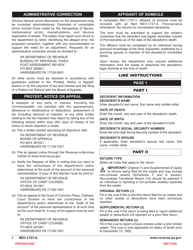

Q: What information is required on Form REV-1737-A?

A: Form REV-1737-A requires various information including the decedent's personal details, details of the estate, and information on the beneficiaries.

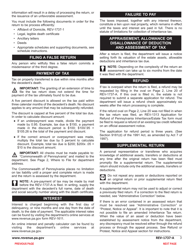

Q: When is the deadline to file Form REV-1737-A?

A: Form REV-1737-A must be filed within nine months from the date of the nonresident decedent's death.

Q: Is there any inheritance tax on nonresident decedents in Pennsylvania?

A: Yes, Pennsylvania imposes an inheritance tax on property inherited by nonresident decedents.

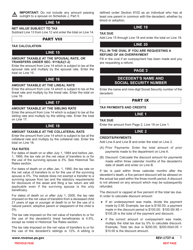

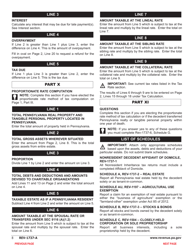

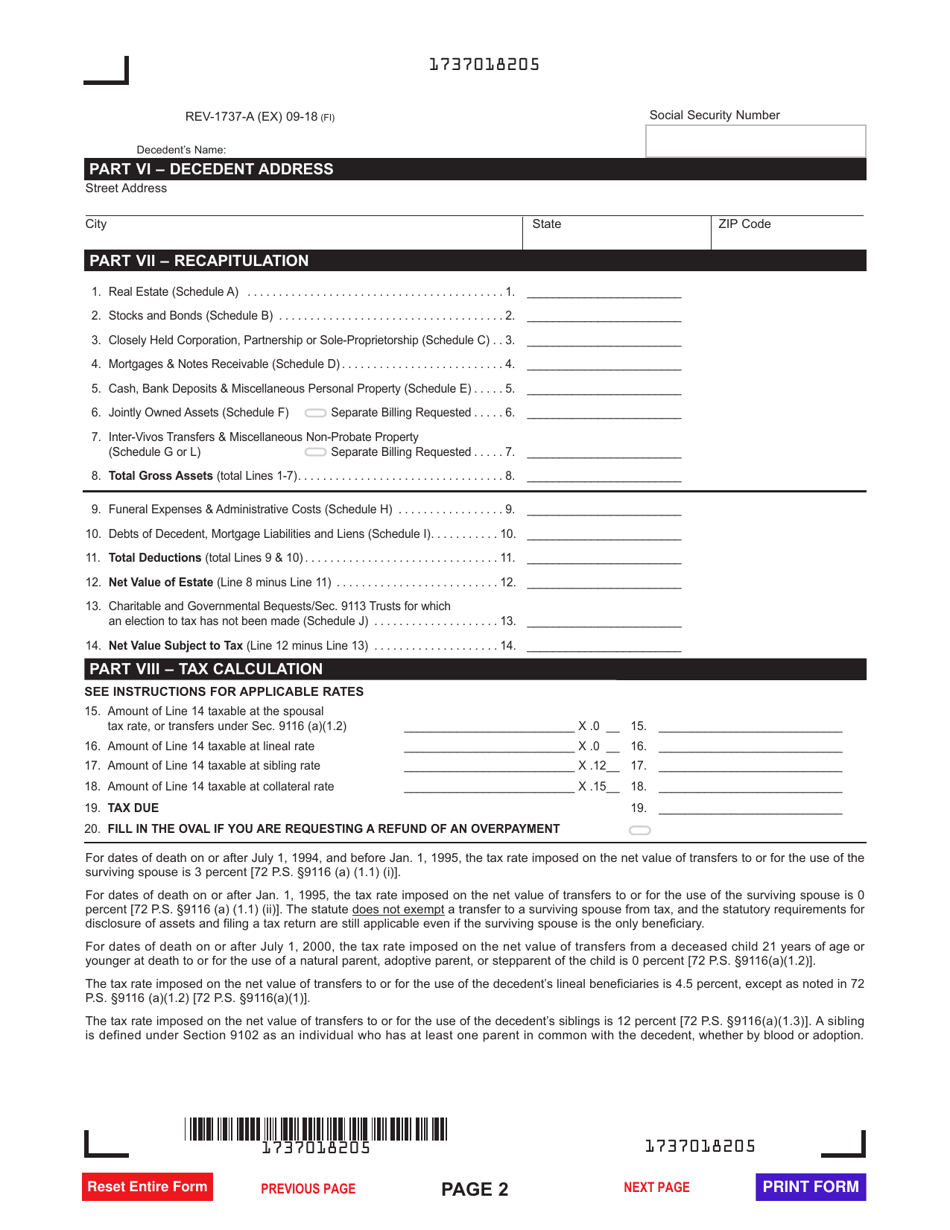

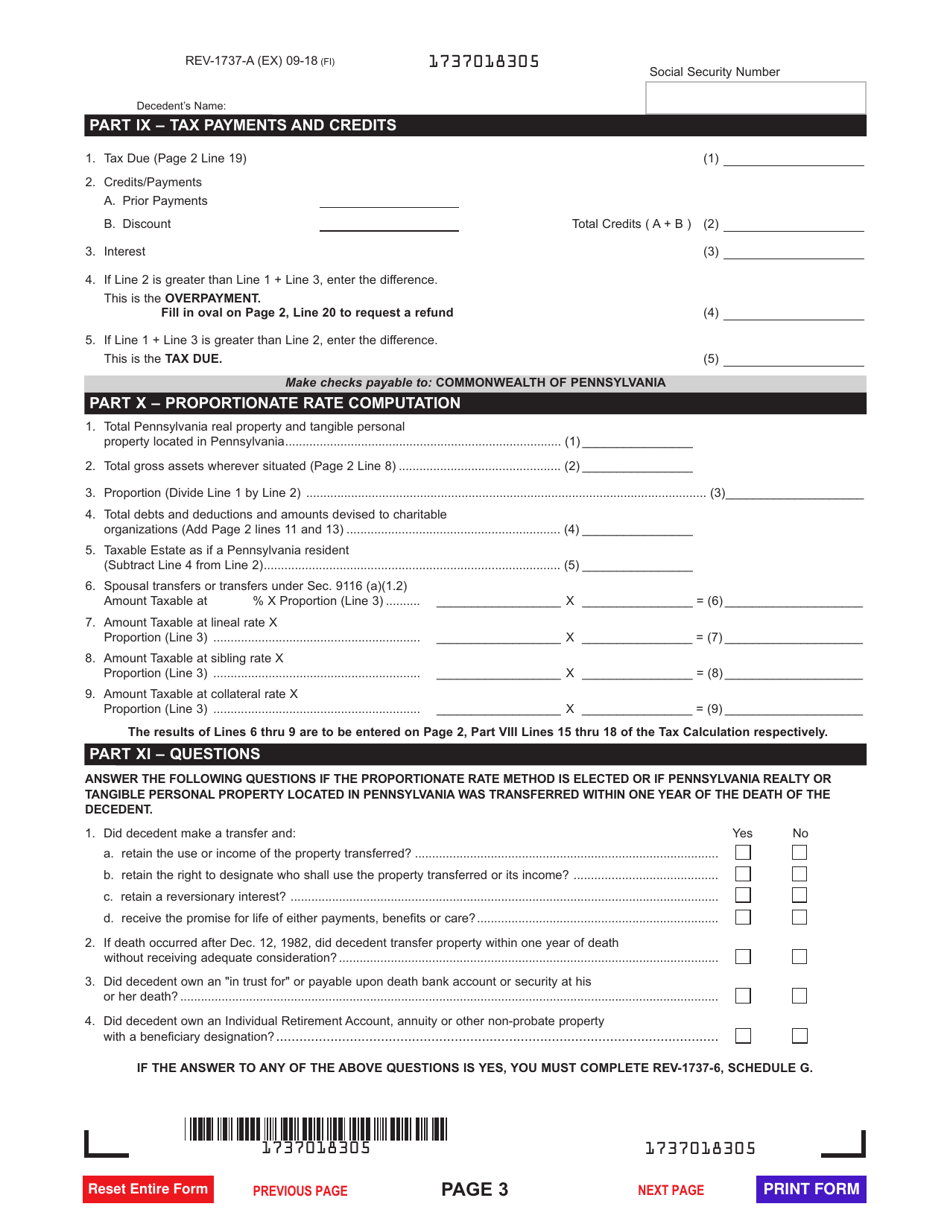

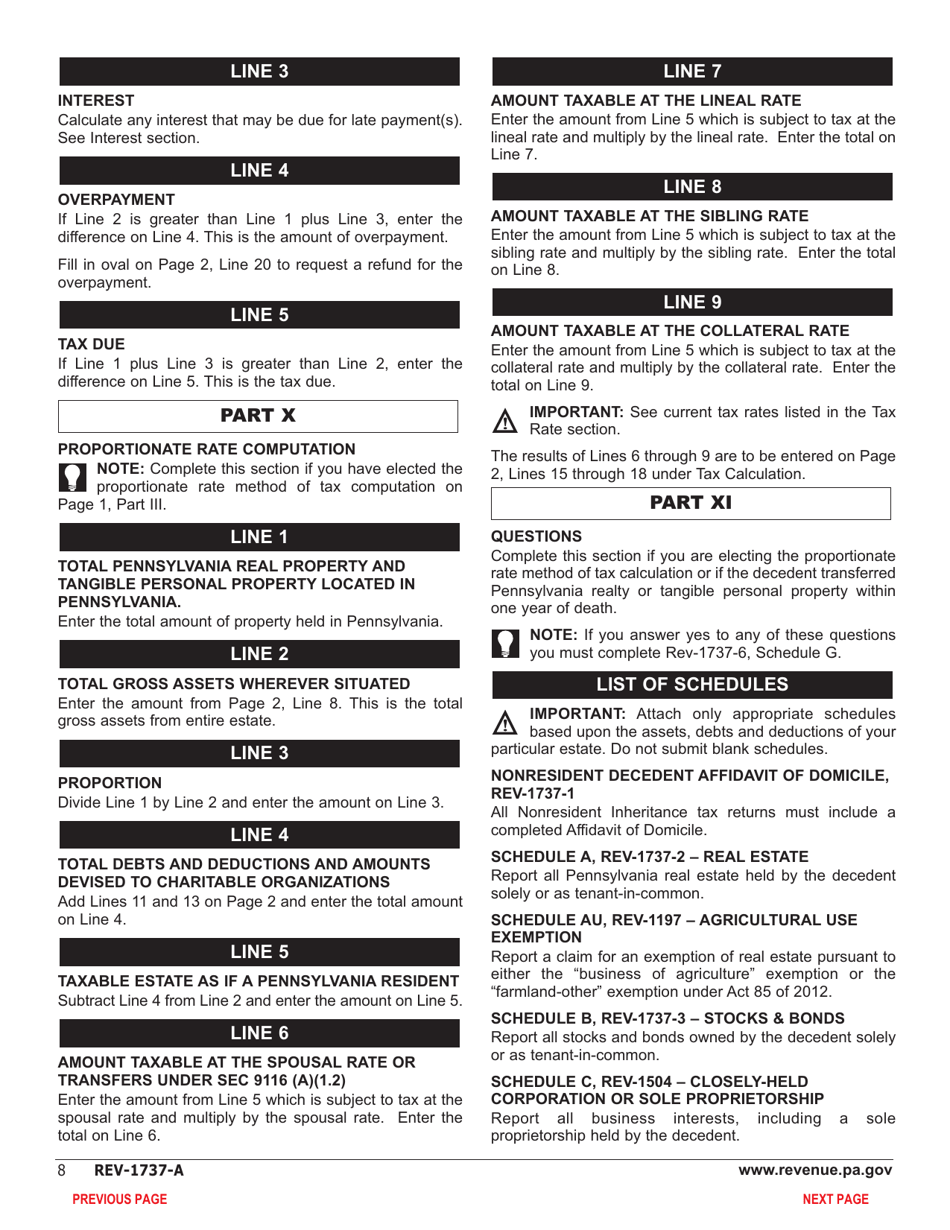

Q: How is the inheritance tax calculated in Pennsylvania?

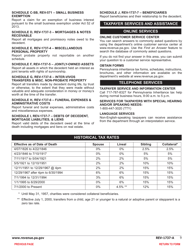

A: The inheritance tax rate in Pennsylvania depends on the relationship between the decedent and the beneficiary. The tax rates vary from 0% to 15%.

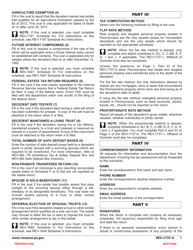

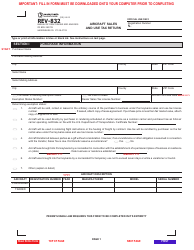

Form Details:

- Released on September 1, 2018;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form REV-1737-A by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.