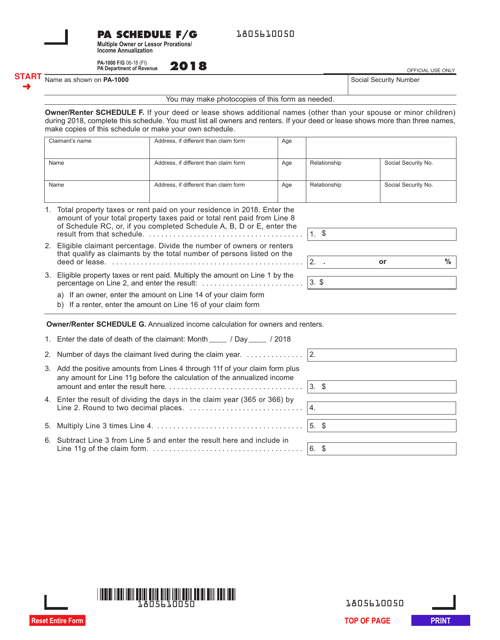

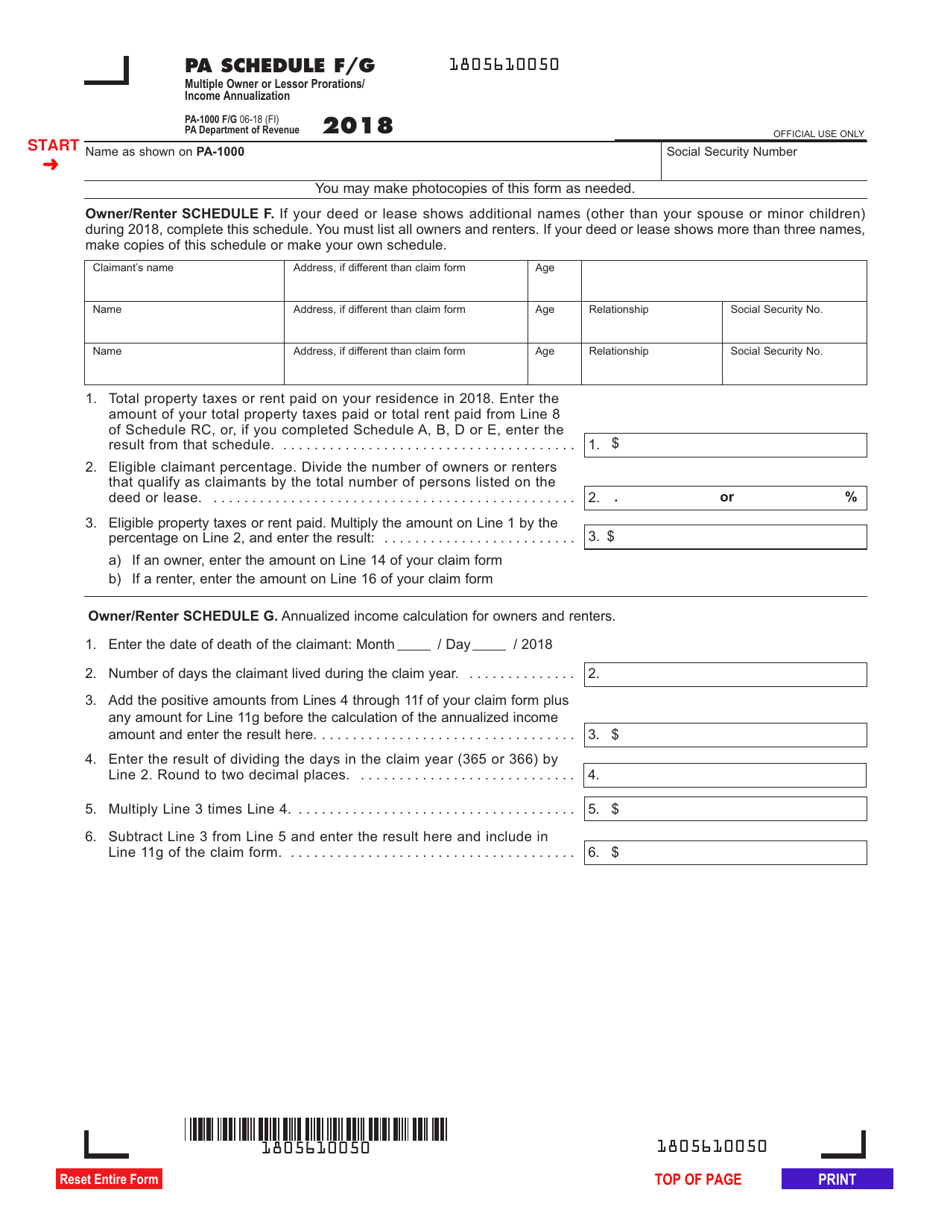

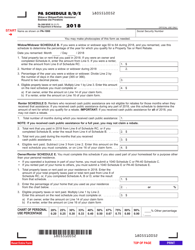

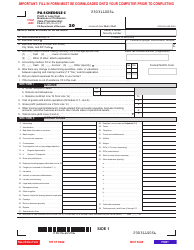

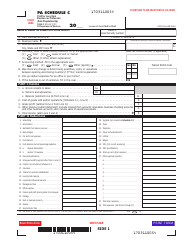

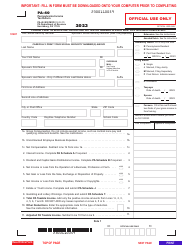

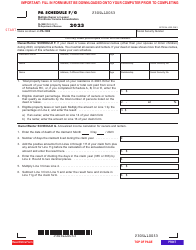

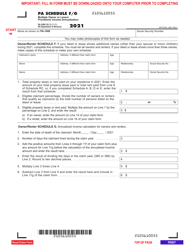

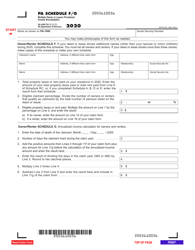

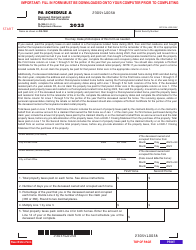

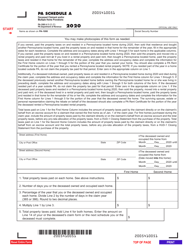

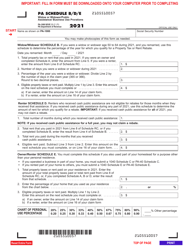

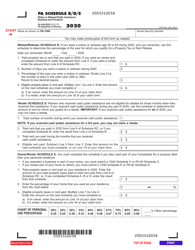

Form PA-1000 F / G Pa Schedule F / G - Multiple Owner or Lessor Prorations / Income Annualization - Pennsylvania

What Is Form PA-1000 F/G?

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PA-1000 F/G?

A: Form PA-1000 F/G is used for Multiple Owner or Lessor Prorations/Income Annualization in Pennsylvania.

Q: What is the purpose of Schedule F/G?

A: Schedule F/G is used to calculate prorated shares of property taxes and income for multiple owners or lessors.

Q: What are multiple owner or lessor prorations?

A: Multiple owner or lessor prorations are calculations to determine the proportionate share of property taxes and income for each owner or lessor.

Q: What is income annualization?

A: Income annualization is the process of determining the annual income by adjusting for partial-year income.

Q: When is Form PA-1000 F/G required?

A: Form PA-1000 F/G is required when there are multiple owners or lessors of a property for proration of taxes and income.

Q: Who can use Form PA-1000 F/G?

A: Form PA-1000 F/G can be used by individuals, partnerships, corporations, and other entities with multiple owners or lessors.

Form Details:

- Released on June 1, 2018;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PA-1000 F/G by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.