This version of the form is not currently in use and is provided for reference only. Download this version of

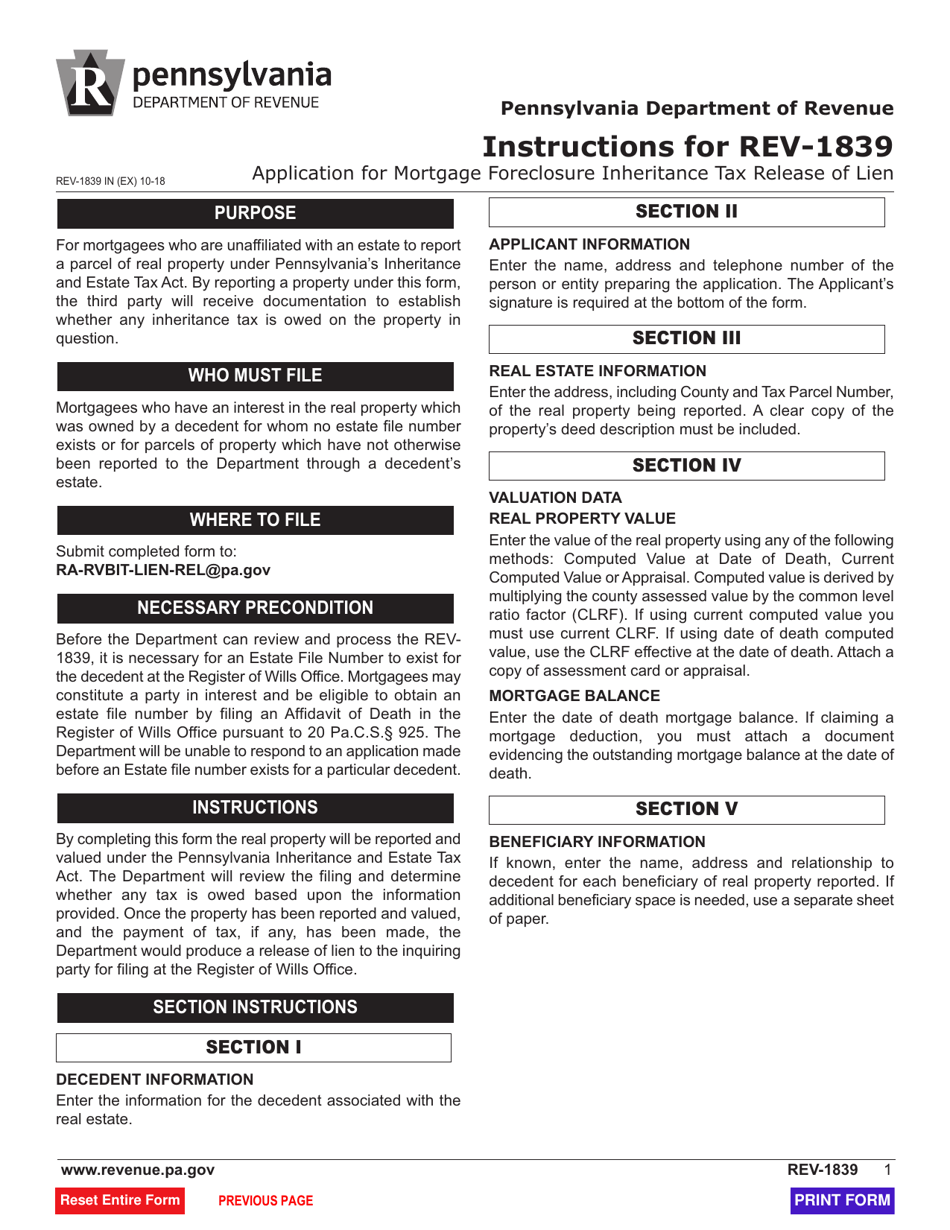

Form REV-1839

for the current year.

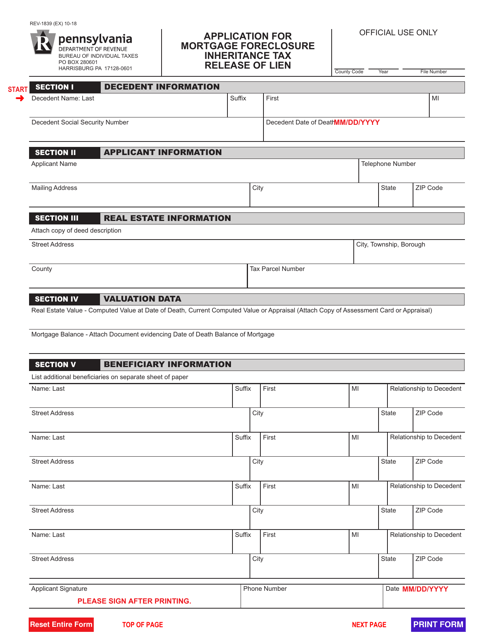

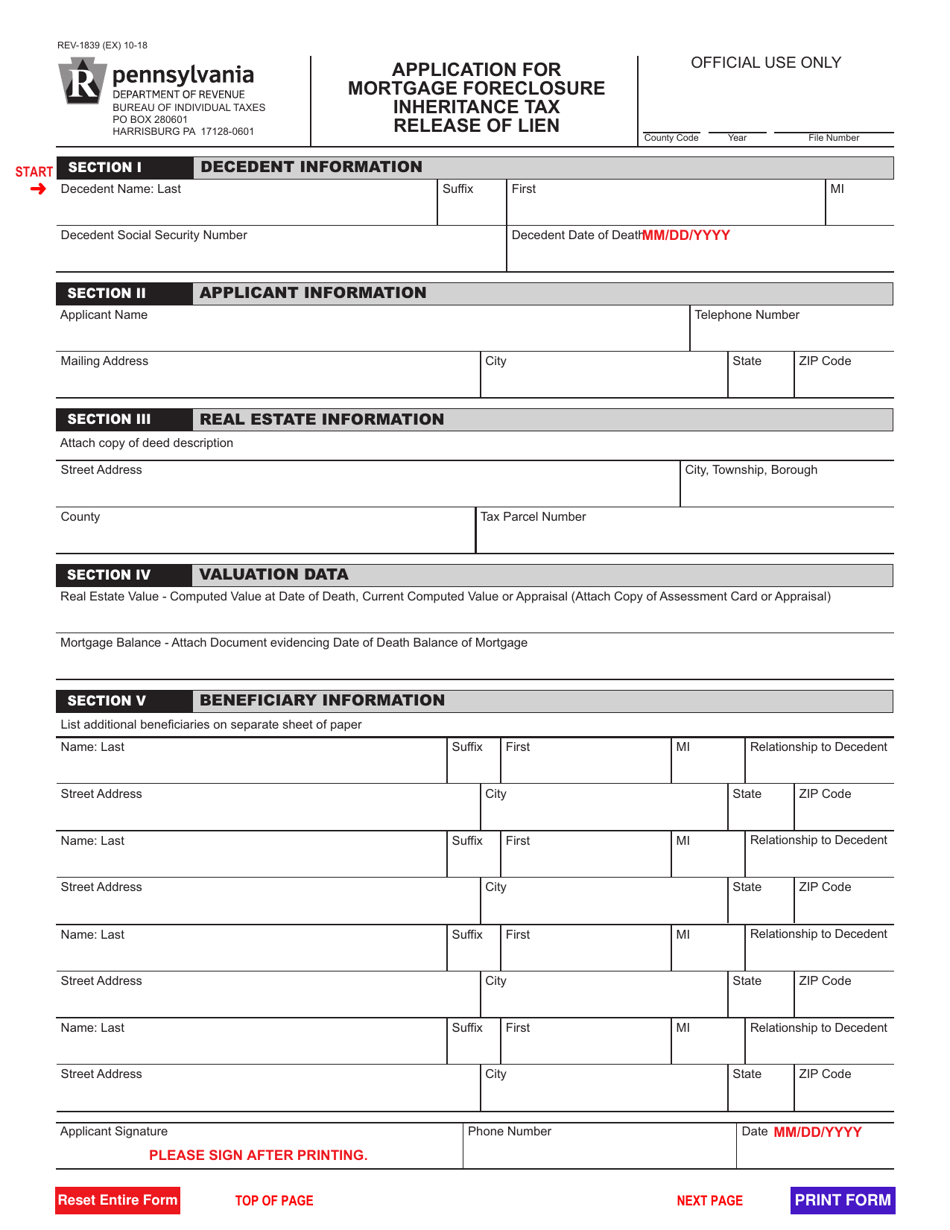

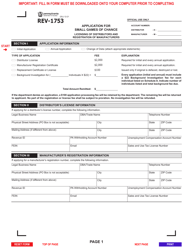

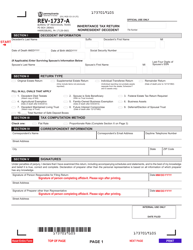

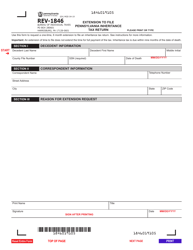

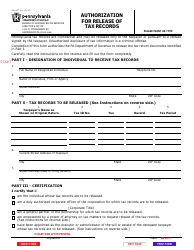

Form REV-1839 Application for Mortgage Foreclosure Inheritance Tax Release of Lien - Pennsylvania

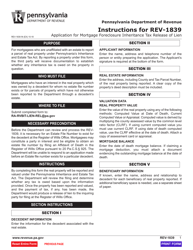

What Is Form REV-1839?

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form REV-1839?

A: Form REV-1839 is an application for Mortgage Foreclosure Inheritance Tax Release of Lien in Pennsylvania.

Q: What is the purpose of Form REV-1839?

A: The purpose of Form REV-1839 is to request the release of a lien on a property that was subject to mortgage foreclosure or inheritance tax.

Q: Who needs to fill out Form REV-1839?

A: Anyone who wants to release a lien on a property in Pennsylvania after a mortgage foreclosure or inheritance tax needs to fill out Form REV-1839.

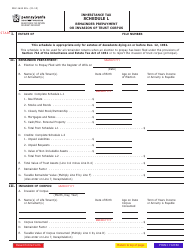

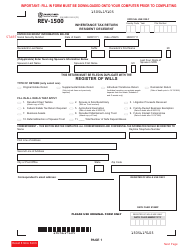

Q: What information is required on Form REV-1839?

A: Form REV-1839 requires information about the property, the lien holder, the foreclosure or inheritance tax case, and the applicant's contact information.

Q: Are there any fees associated with Form REV-1839?

A: There may be a recording fee associated with filing Form REV-1839, which varies depending on the county where the property is located.

Q: Is Form REV-1839 specific to Pennsylvania?

A: Yes, Form REV-1839 is specific to Pennsylvania and is used for releasing liens on properties in the state.

Q: Can I submit Form REV-1839 electronically?

A: No, Form REV-1839 must be submitted in paper form and cannot be submitted electronically.

Q: What is the processing time for Form REV-1839?

A: The processing time for Form REV-1839 varies depending on the county and workload of the Recorder of Deeds office.

Form Details:

- Released on October 1, 2018;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form REV-1839 by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.