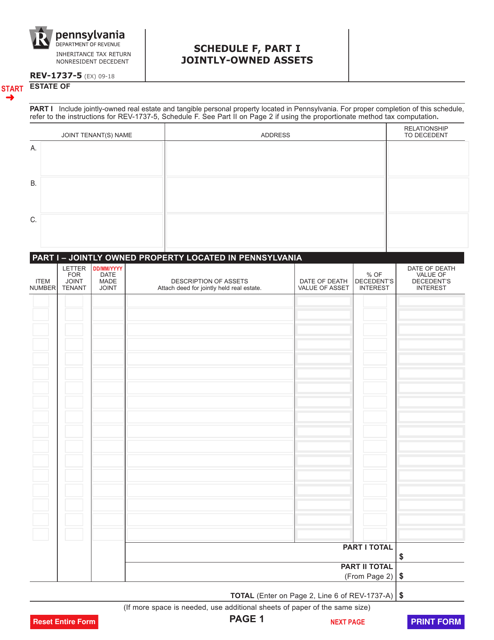

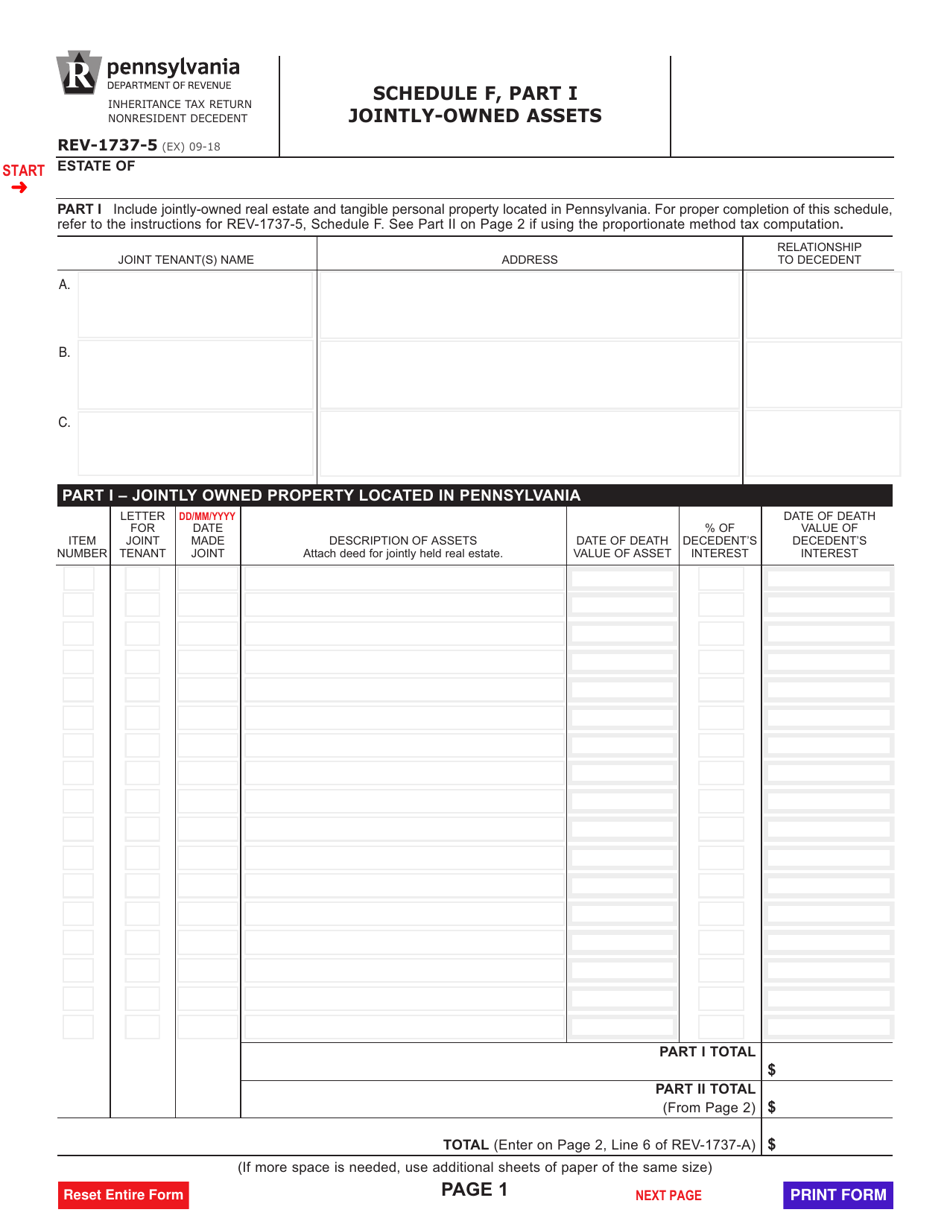

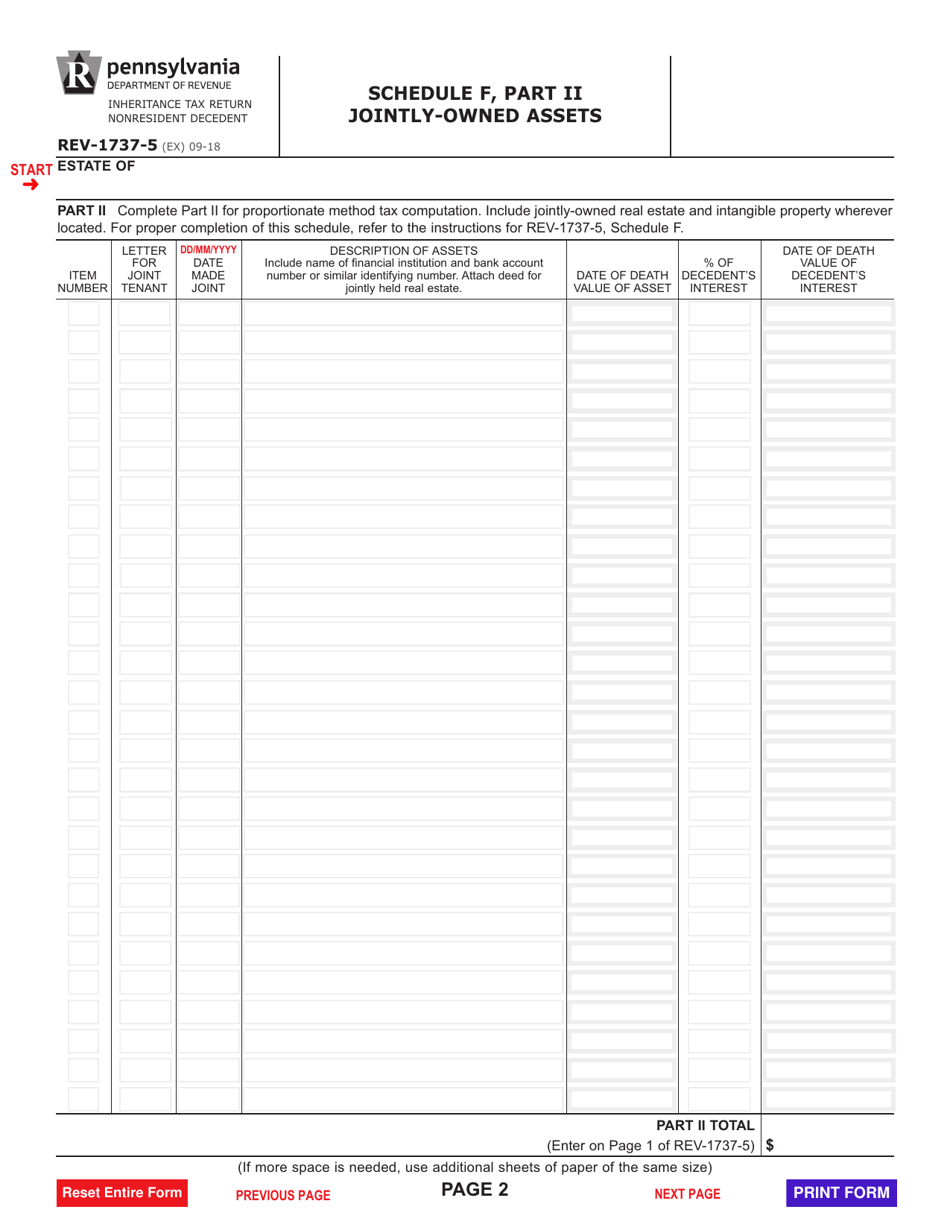

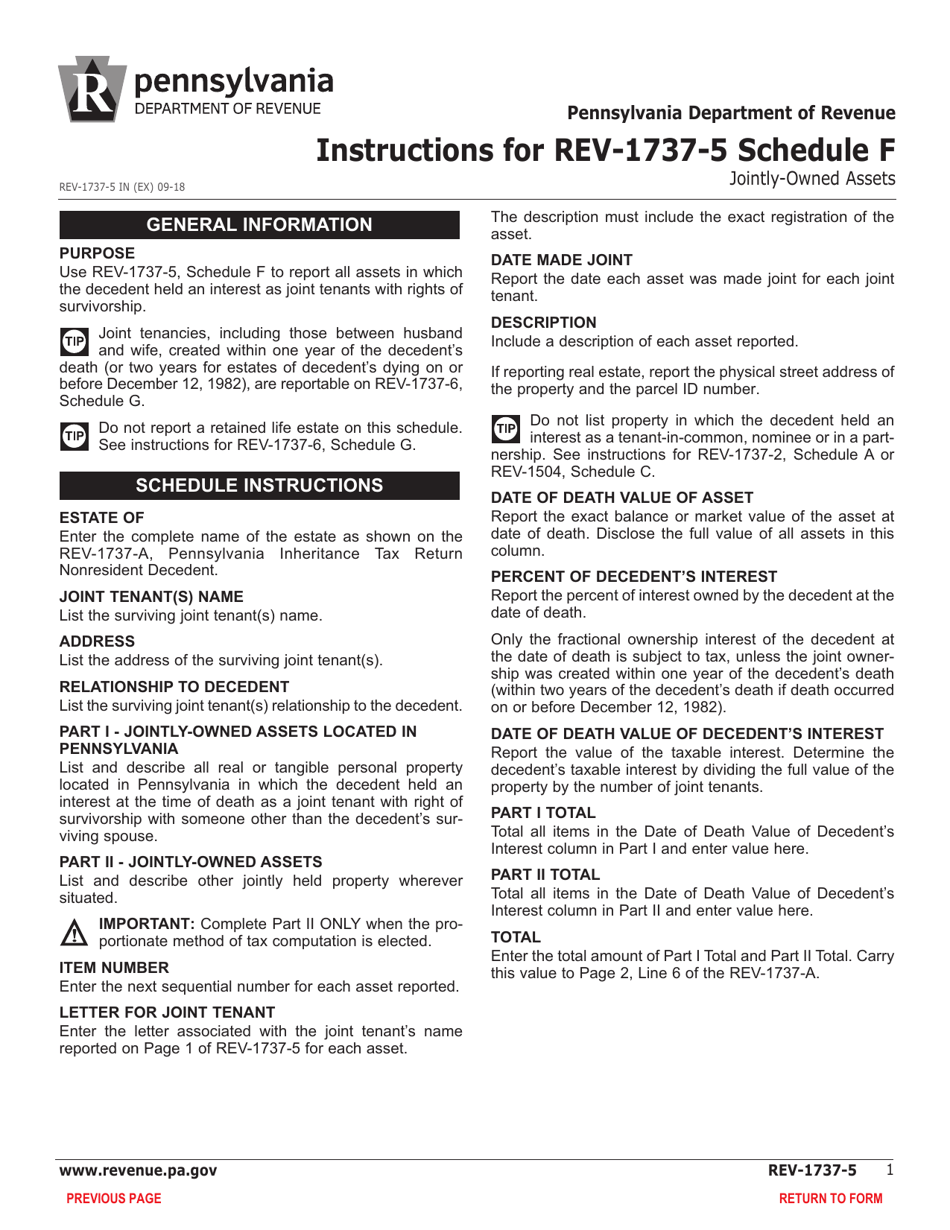

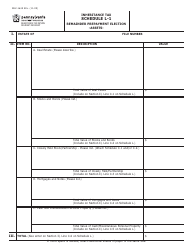

Form REV-1737-5 Schedule F Jointly-Owned Assets - Pennsylvania

What Is Form REV-1737-5 Schedule F?

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form REV-1737-5?

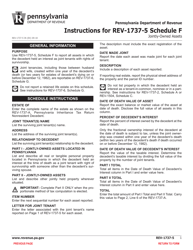

A: Form REV-1737-5 is a schedule used in Pennsylvania to report jointly-owned assets.

Q: What is the purpose of Schedule F?

A: The purpose of Schedule F is to disclose the details of jointly-owned assets.

Q: Who is required to file Schedule F?

A: Pennsylvania taxpayers who have jointly-owned assets are required to file Schedule F.

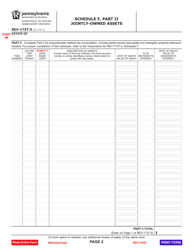

Q: What information is required in Schedule F?

A: Schedule F requires information about the jointly-owned assets, such as the type of asset, fair market value, and the percentage of ownership.

Q: When is the deadline to file Schedule F?

A: The deadline to file Schedule F is typically the same as the deadline for filing Pennsylvania individual income tax returns, which is April 15th.

Q: Are there any penalties for not filing Schedule F?

A: Failure to file Schedule F or providing false information may result in penalties and interest.

Q: Do I need to attach any documents to Schedule F?

A: You may need to attach supporting documents, such as deeds or titles, to validate the information provided in Schedule F.

Q: Can I amend Schedule F if I made a mistake?

A: Yes, you can file an amended Schedule F to correct any errors or update the information reported.

Form Details:

- Released on September 1, 2018;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form REV-1737-5 Schedule F by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.