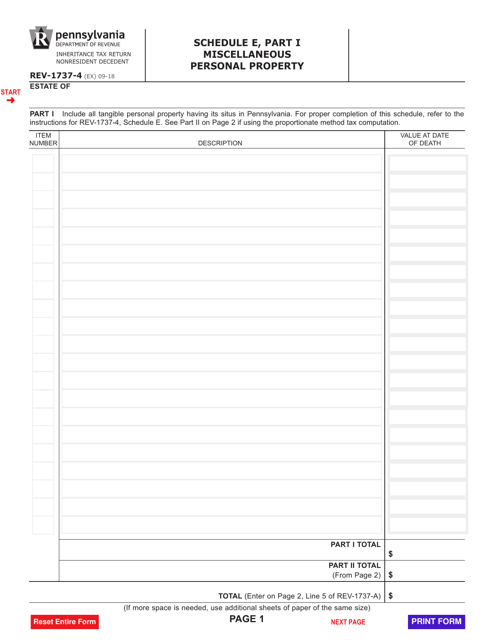

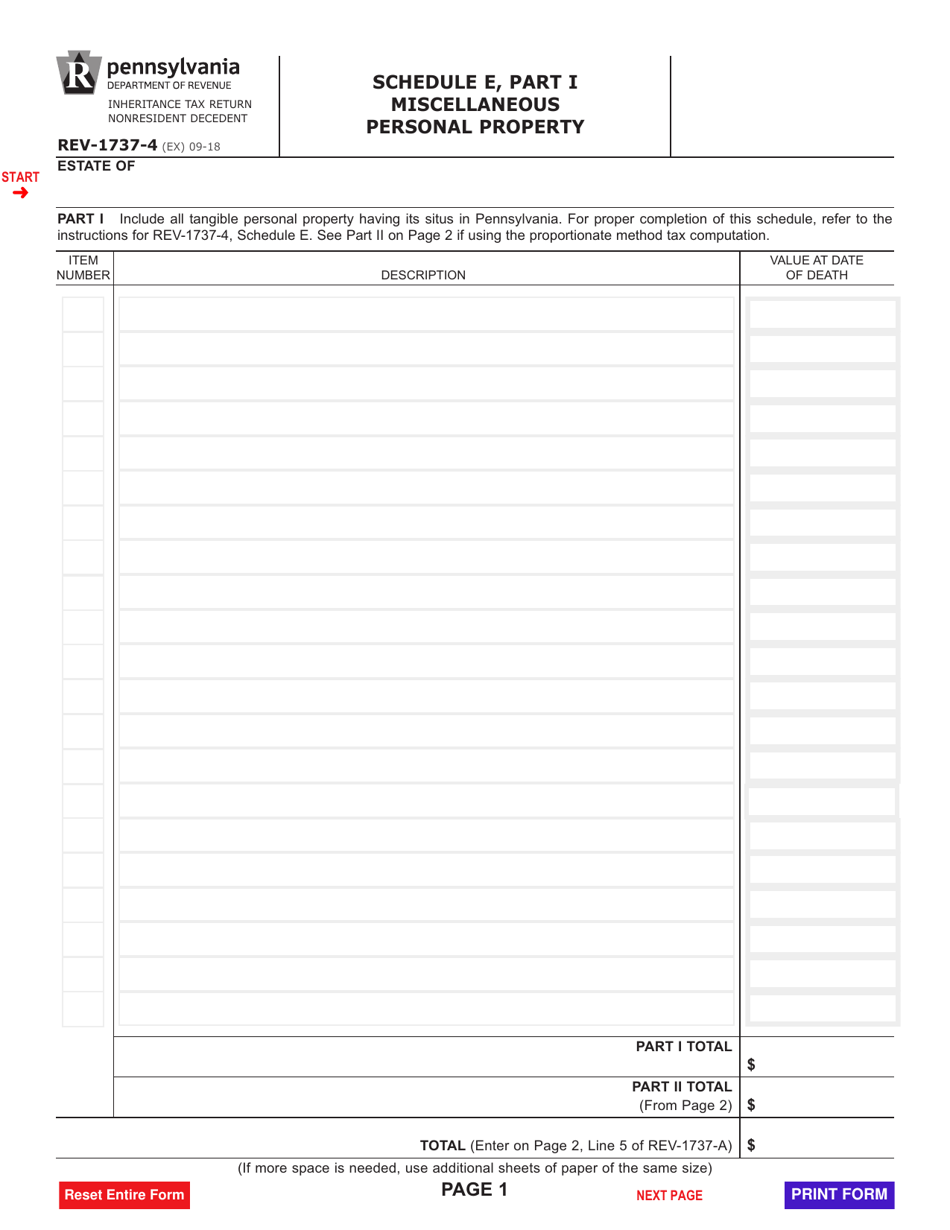

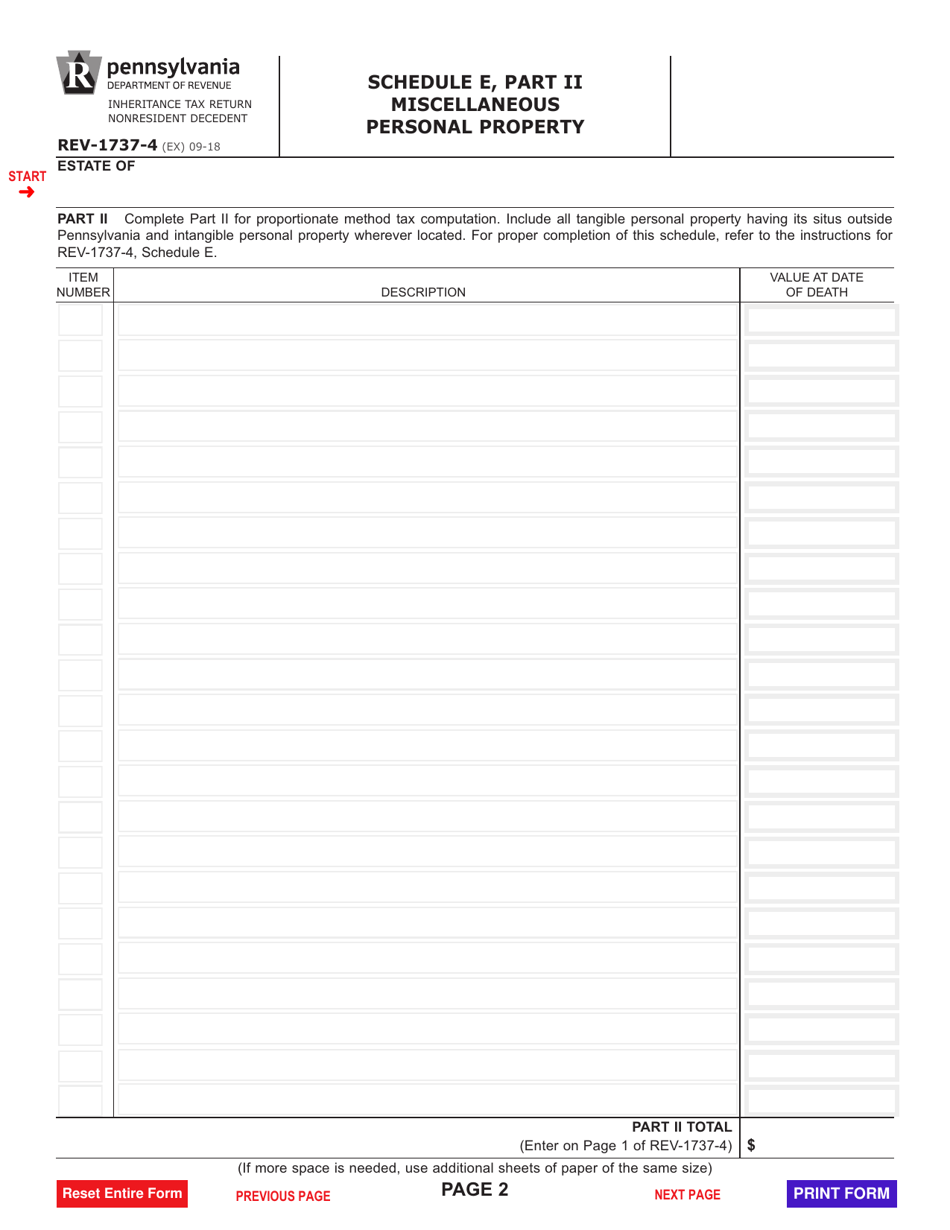

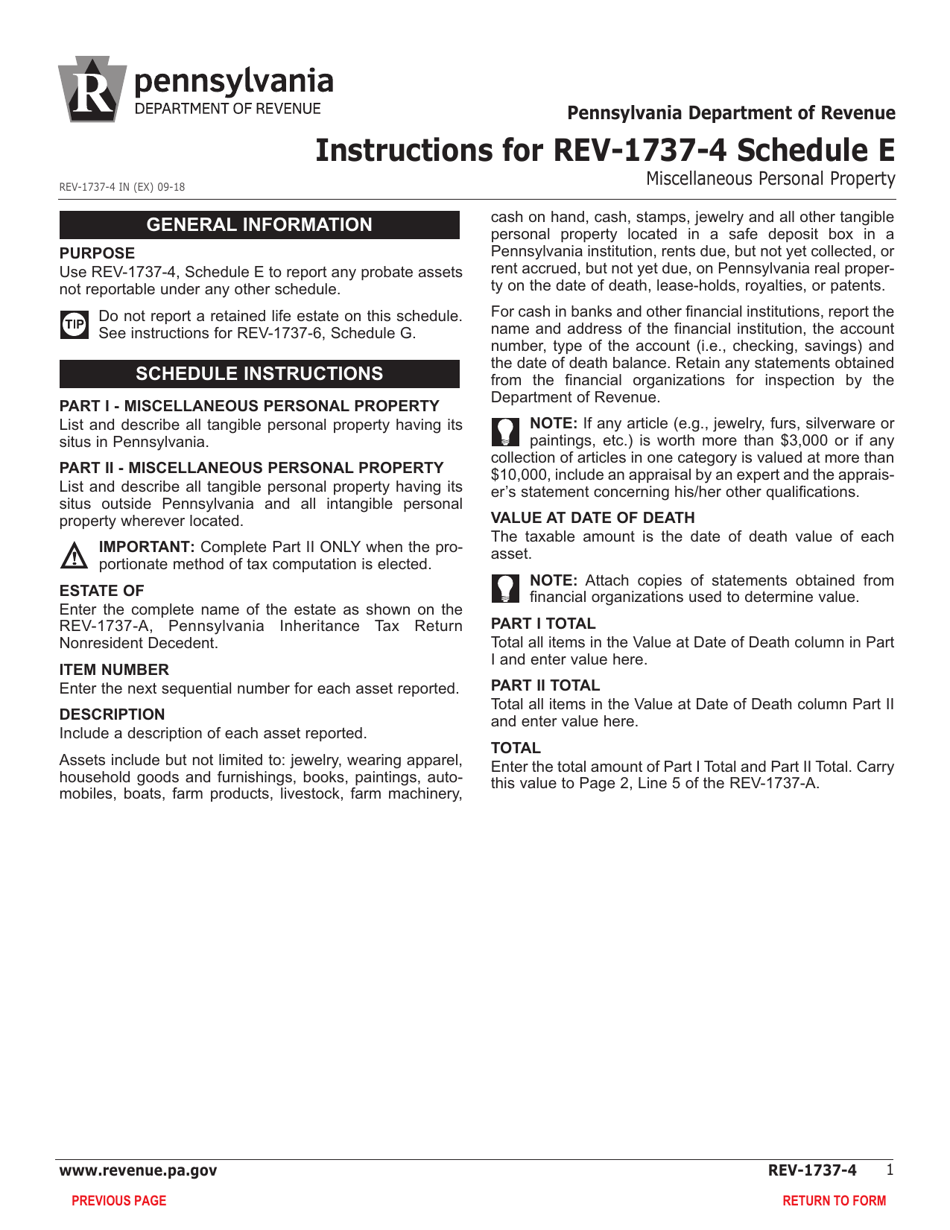

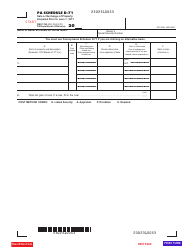

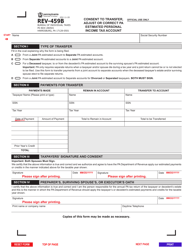

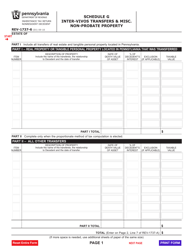

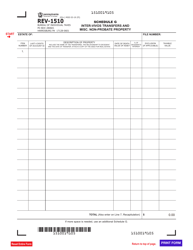

Form REV-1737-4 Schedule E Miscellaneous Personal Property - Pennsylvania

What Is Form REV-1737-4 Schedule E?

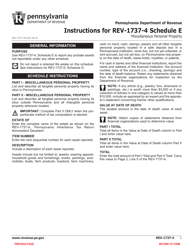

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form REV-1737-4?

A: Form REV-1737-4 is a schedule used for reporting miscellaneous personal property in Pennsylvania.

Q: What does Schedule E refer to on Form REV-1737-4?

A: Schedule E on Form REV-1737-4 is used for reporting miscellaneous personal property.

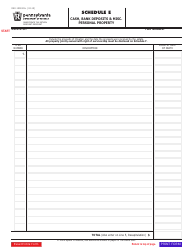

Q: What is miscellaneous personal property?

A: Miscellaneous personal property refers to items such as furniture, equipment, and other tangible assets that are not classified as real estate or vehicles.

Q: Who needs to file Schedule E?

A: Individuals, partnerships, corporations, and organizations who own taxable miscellaneous personal property in Pennsylvania need to file Schedule E.

Q: When is Form REV-1737-4 Schedule E due?

A: Form REV-1737-4 Schedule E is typically due on or before April 15th of each year.

Q: Are there any penalties for not filing Form REV-1737-4 Schedule E?

A: Yes, failure to file Form REV-1737-4 Schedule E or filing it late may result in penalties and interest.

Q: Can I e-file Form REV-1737-4 Schedule E?

A: No, as of now, electronic filing is not available for Form REV-1737-4 Schedule E.

Q: Is Schedule E required for all personal property?

A: No, Schedule E is specifically for reporting miscellaneous personal property. Other types of personal property may have different reporting requirements.

Q: What should I do if I no longer own any taxable personal property in Pennsylvania?

A: If you no longer own any taxable personal property in Pennsylvania, you should notify the Pennsylvania Department of Revenue in writing.

Q: Can I get an extension to file Form REV-1737-4 Schedule E?

A: Yes, extensions for filing Form REV-1737-4 Schedule E may be available upon request.

Q: Is there a fee for filing Form REV-1737-4 Schedule E?

A: There is no fee for filing Form REV-1737-4 Schedule E.

Q: Can I make changes to a filed Form REV-1737-4 Schedule E?

A: Yes, you can file an amended Form REV-1737-4 Schedule E to make changes or corrections.

Q: What should I do if I have questions or need assistance with Form REV-1737-4 Schedule E?

A: If you have questions or need assistance with Form REV-1737-4 Schedule E, you should contact the Pennsylvania Department of Revenue.

Q: Is Form REV-1737-4 Schedule E used for personal or business property?

A: Form REV-1737-4 Schedule E can be used for both personal and business property, as long as it falls under the category of miscellaneous personal property.

Form Details:

- Released on September 1, 2018;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form REV-1737-4 Schedule E by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.