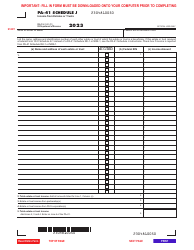

This version of the form is not currently in use and is provided for reference only. Download this version of

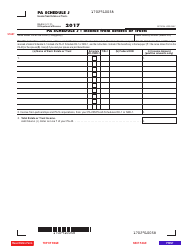

Form REV-414 (F)

for the current year.

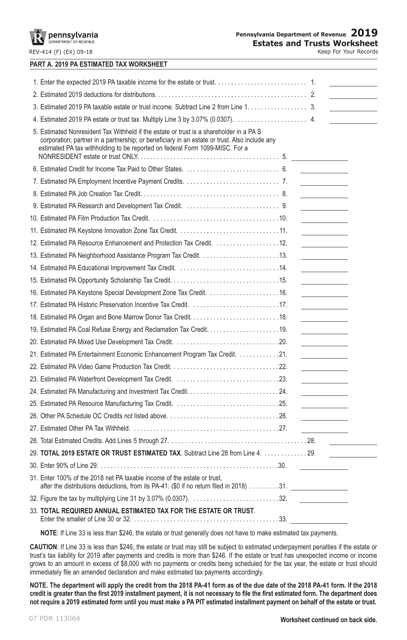

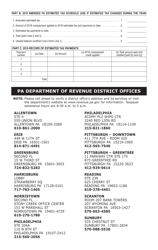

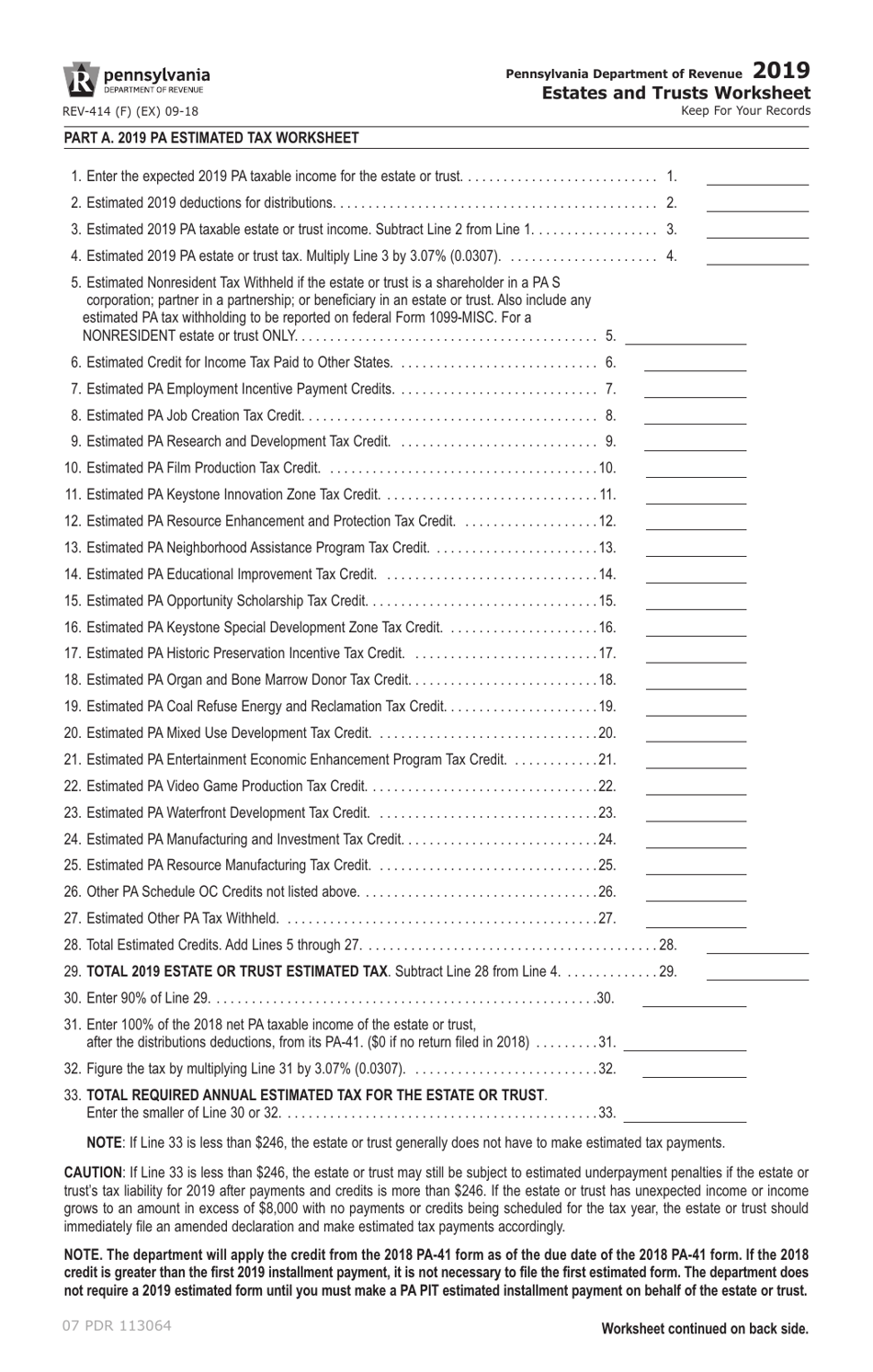

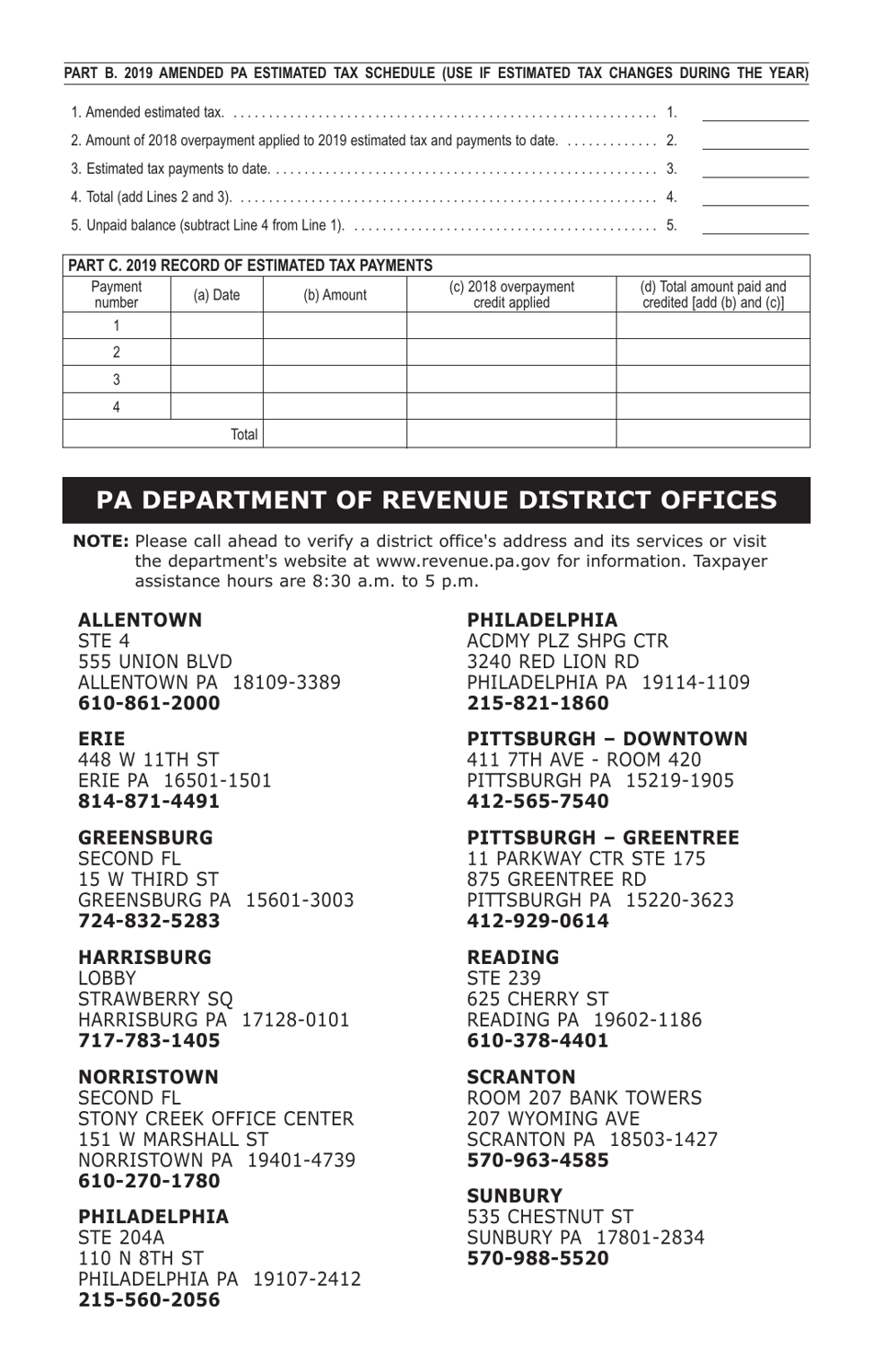

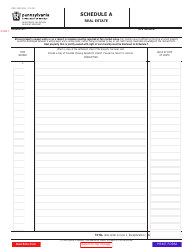

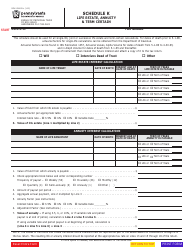

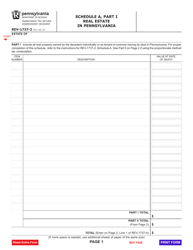

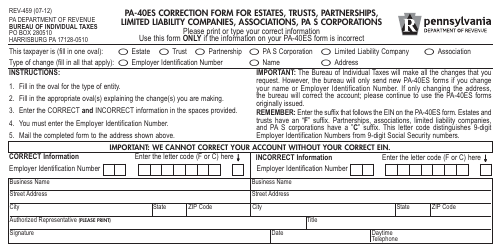

Form REV-414 (F) Estates and Trusts Worksheet - Pennsylvania

What Is Form REV-414 (F)?

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form REV-414 (F)?

A: Form REV-414 (F) is the Estates and Trusts Worksheet for the state of Pennsylvania.

Q: Who needs to file Form REV-414 (F)?

A: Individuals who have an estate or trust in Pennsylvania need to file Form REV-414 (F).

Q: What is the purpose of Form REV-414 (F)?

A: Form REV-414 (F) is used to calculate the Pennsylvania taxable income for estates and trusts.

Q: What information do I need to complete Form REV-414 (F)?

A: You will need information about the estate or trust's income, deductions, and credits to complete Form REV-414 (F).

Q: When is Form REV-414 (F) due?

A: Form REV-414 (F) is due on or before April 15th of each year.

Q: Are there any filing requirements for estates or trusts in Pennsylvania?

A: Yes, estates or trusts that have gross income of $2,500 or more are required to file a Pennsylvania tax return using Form REV-414 (F).

Q: Can I e-file Form REV-414 (F)?

A: No, currently electronic filing is not available for Form REV-414 (F). It must be filed by mail.

Form Details:

- Released on September 1, 2018;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form REV-414 (F) by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.