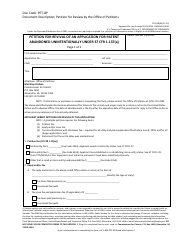

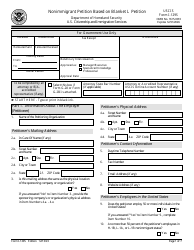

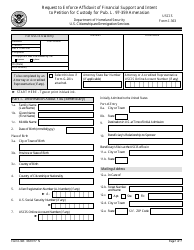

T.C. Form 2 Petition (Simplified Form)

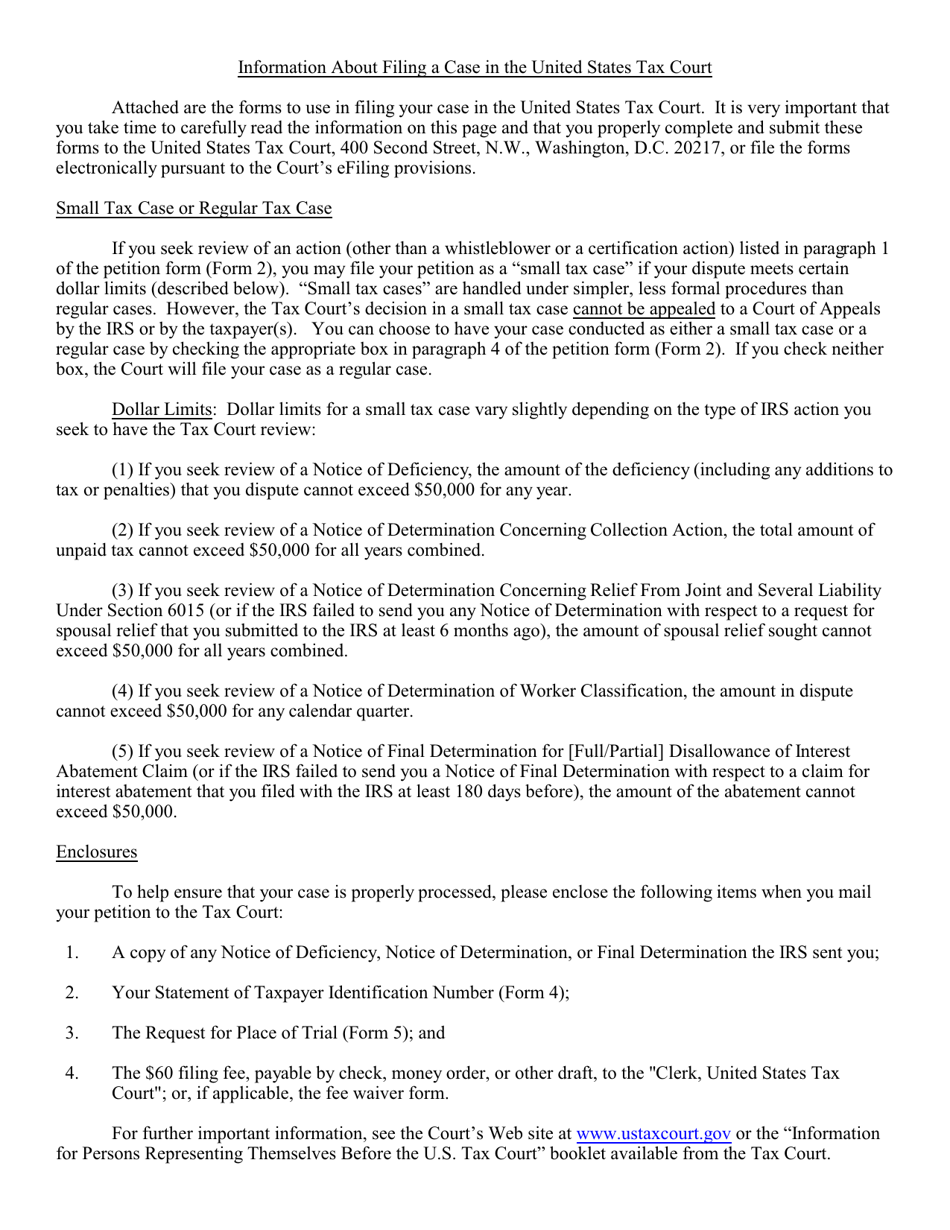

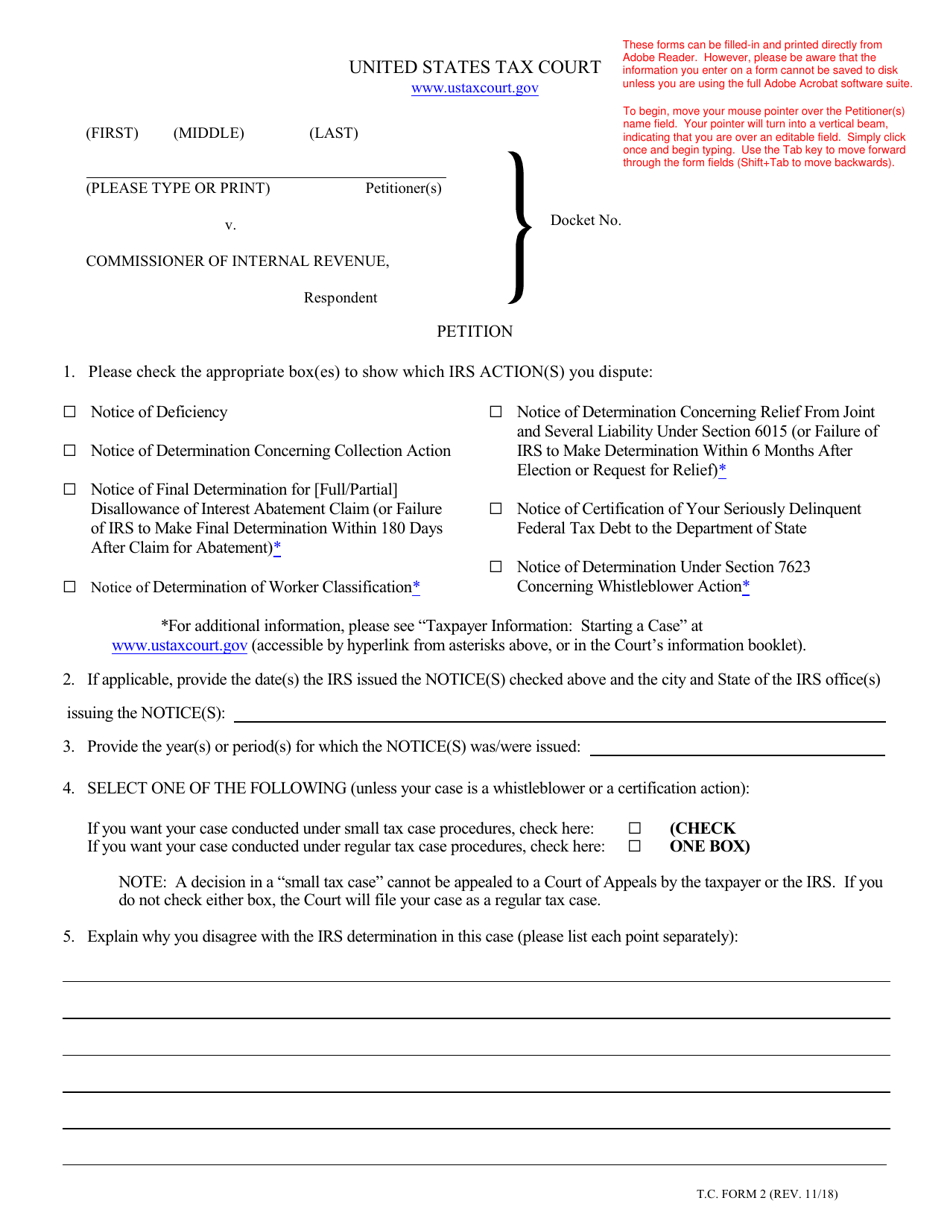

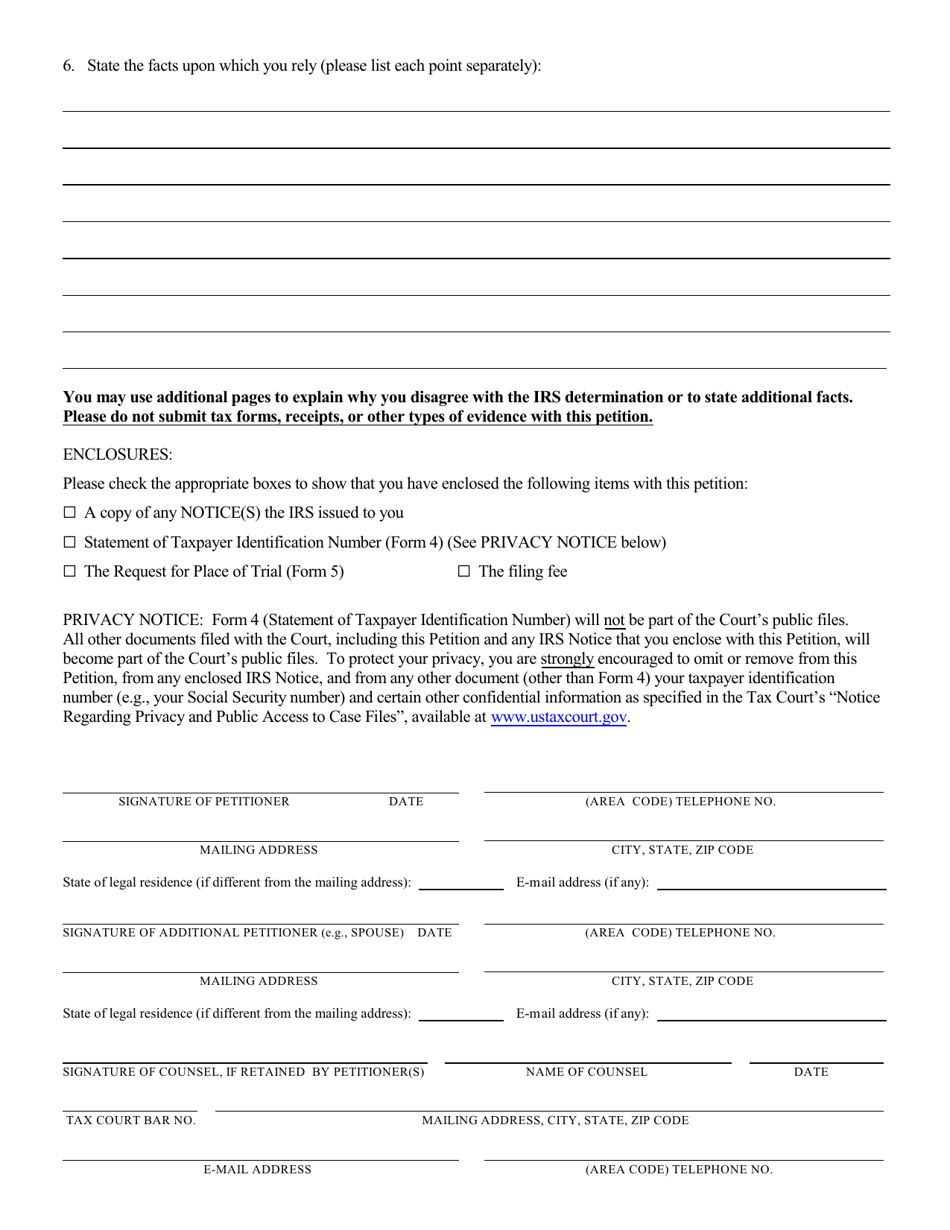

What Is T.C. Form 2?

This is a legal form that was released by the United States Tax Court on November 1, 2018 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

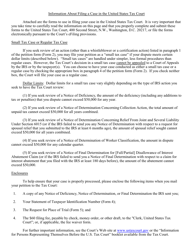

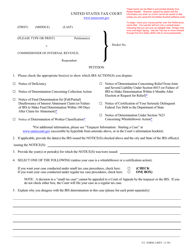

Q: What is a T.C. Form 2 Petition?

A: A T.C. Form 2 Petition is a simplified form used for filing a petition in court.

Q: How do I use the T.C. Form 2 Petition?

A: You can use the T.C. Form 2 Petition by filling out the required information and submitting it to the appropriate court.

Q: What can I file a petition for using the T.C. Form 2?

A: You can file a petition for various purposes, such as child custody, child support, divorce, or other family law matters.

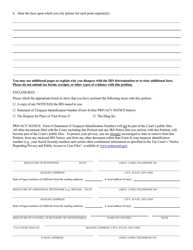

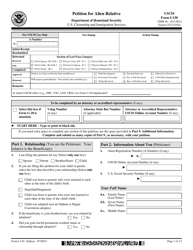

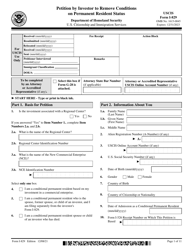

Q: What information do I need to provide on the T.C. Form 2?

A: You will need to provide your personal information, details about your case, and the relief you are seeking in your petition.

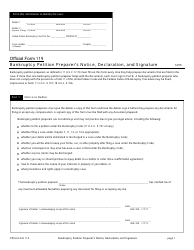

Q: Can I get legal assistance with filling out the T.C. Form 2?

A: Yes, you can seek legal assistance from a lawyer or legal aid organization to help you fill out the T.C. Form 2 Petition.

Q: Are there any fees associated with filing the T.C. Form 2 Petition?

A: There may be filing fees associated with the T.C. Form 2 Petition, which can vary depending on the court and the type of case you are filing.

Q: What should I do after filing the T.C. Form 2 Petition?

A: After filing the T.C. Form 2 Petition, you should follow the instructions given by the court and attend any scheduled hearings or proceedings related to your case.

Q: Can I modify the T.C. Form 2 Petition after filing?

A: In some cases, you may be able to modify the T.C. Form 2 Petition after filing by requesting an amendment from the court.

Q: What happens after the court receives my T.C. Form 2 Petition?

A: After the court receives your T.C. Form 2 Petition, it will review your petition and may schedule a hearing or ask for additional information if necessary.

Form Details:

- Released on November 1, 2018;

- The latest available edition released by the United States Tax Court;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of T.C. Form 2 by clicking the link below or browse more documents and templates provided by the United States Tax Court.