This version of the form is not currently in use and is provided for reference only. Download this version of

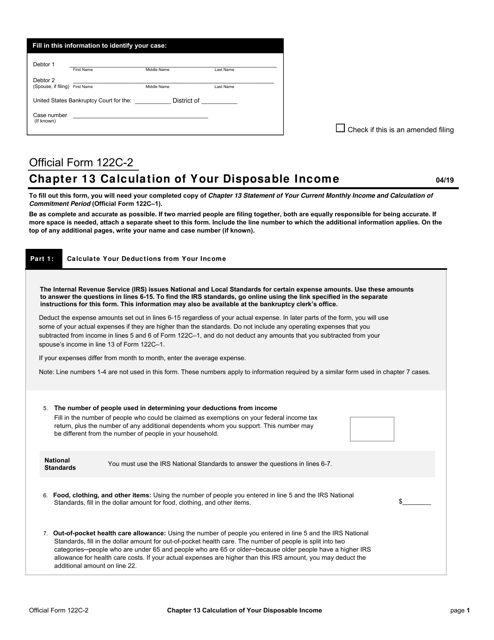

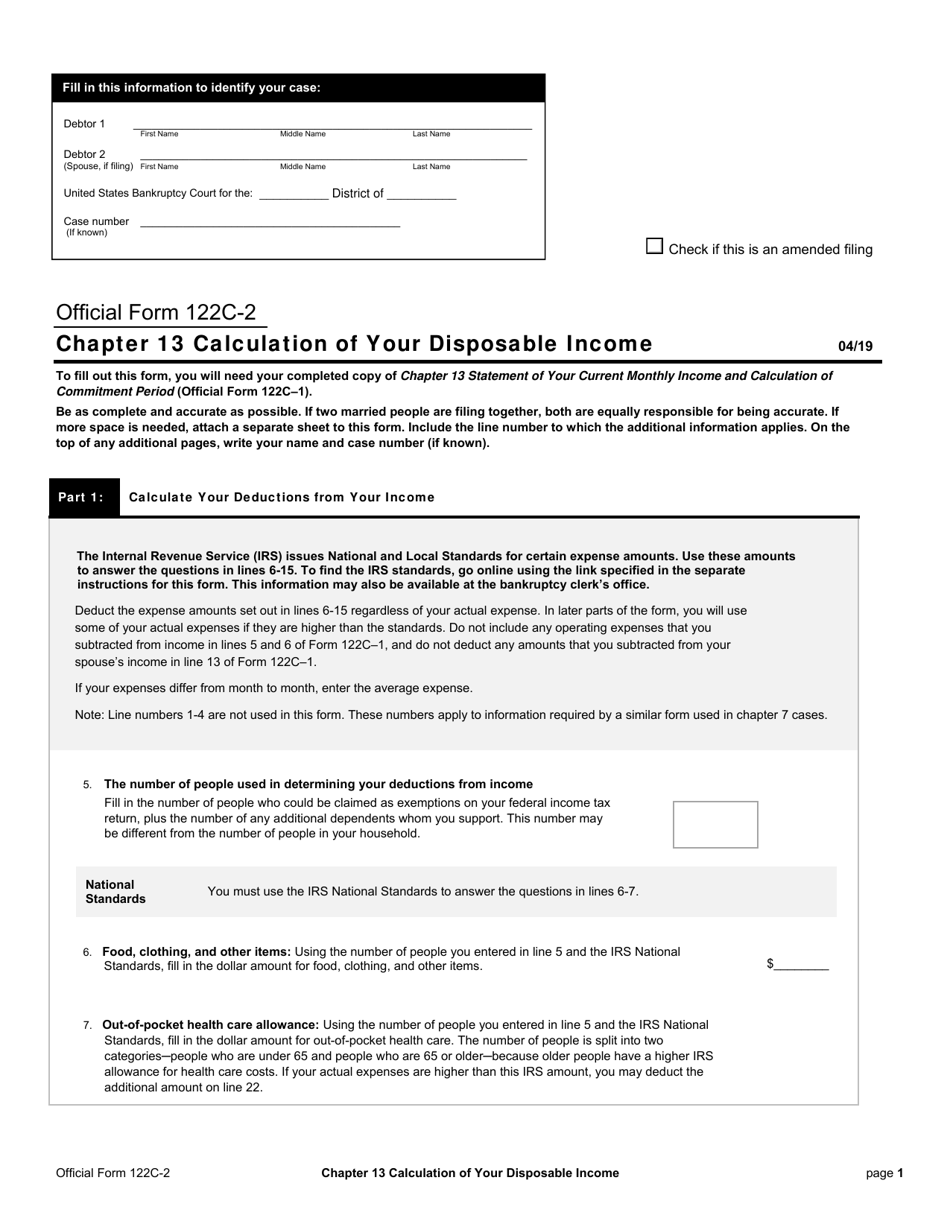

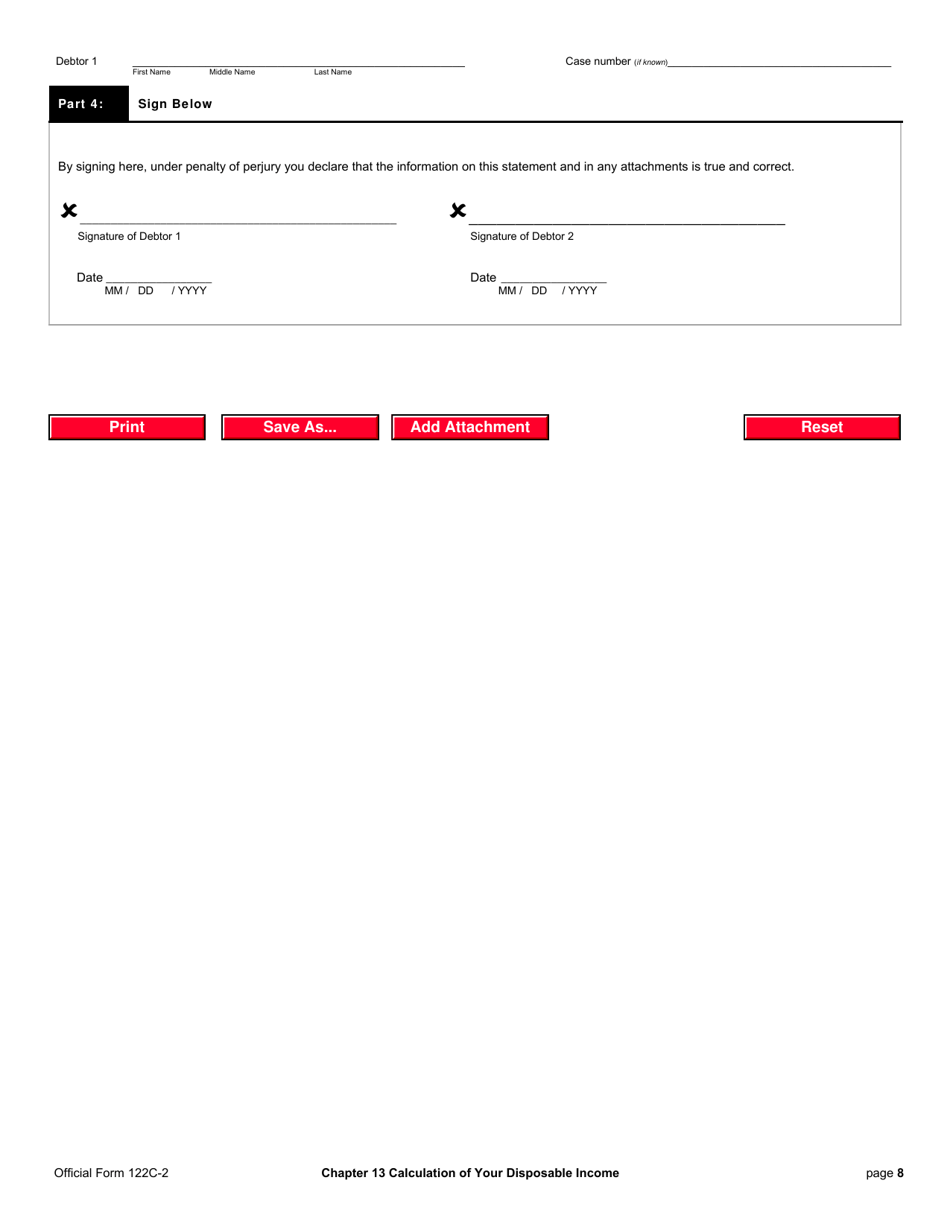

Official Form 122C-2

for the current year.

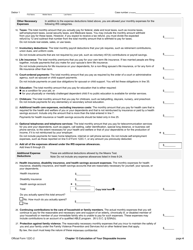

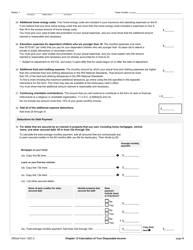

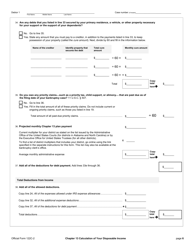

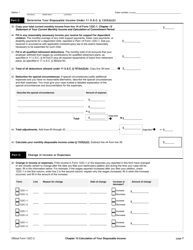

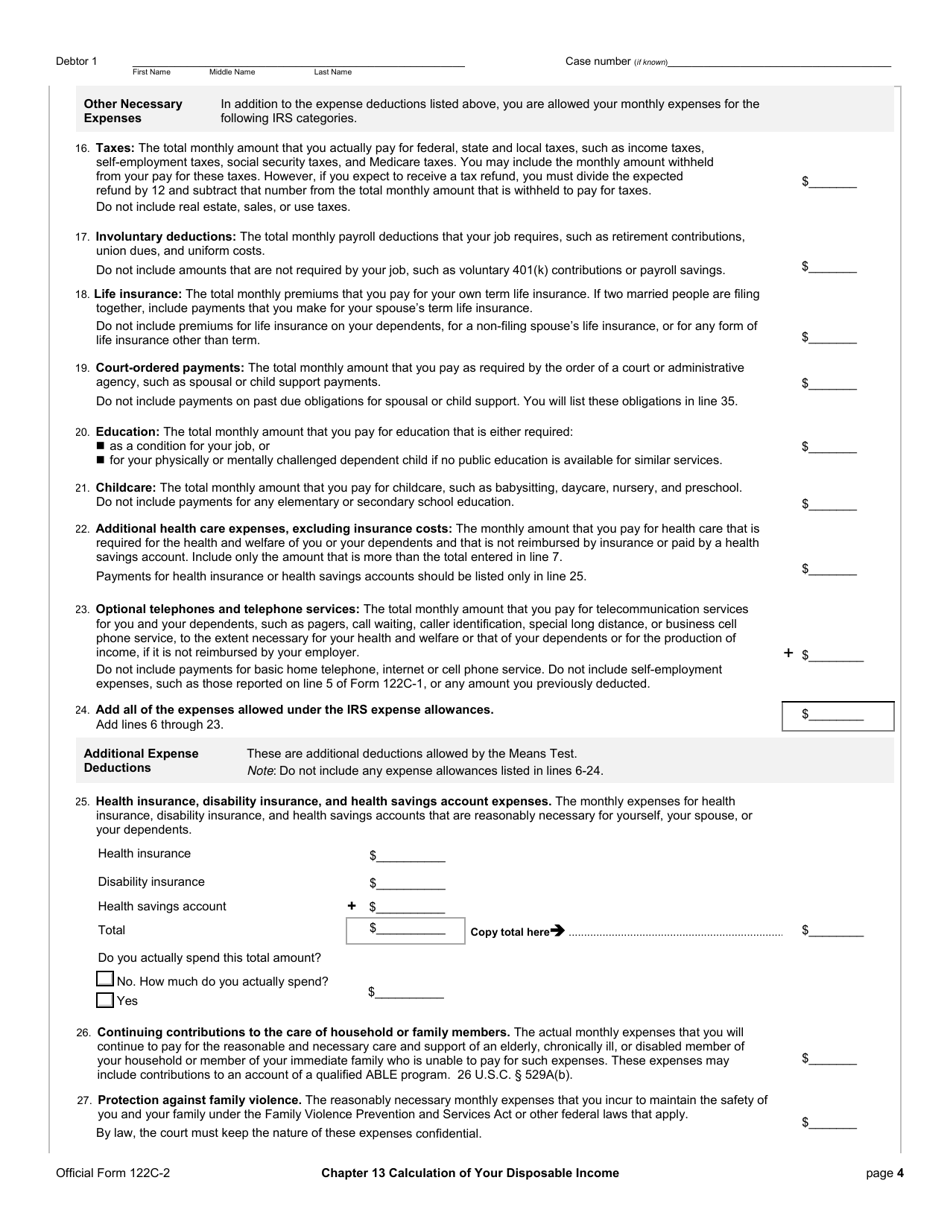

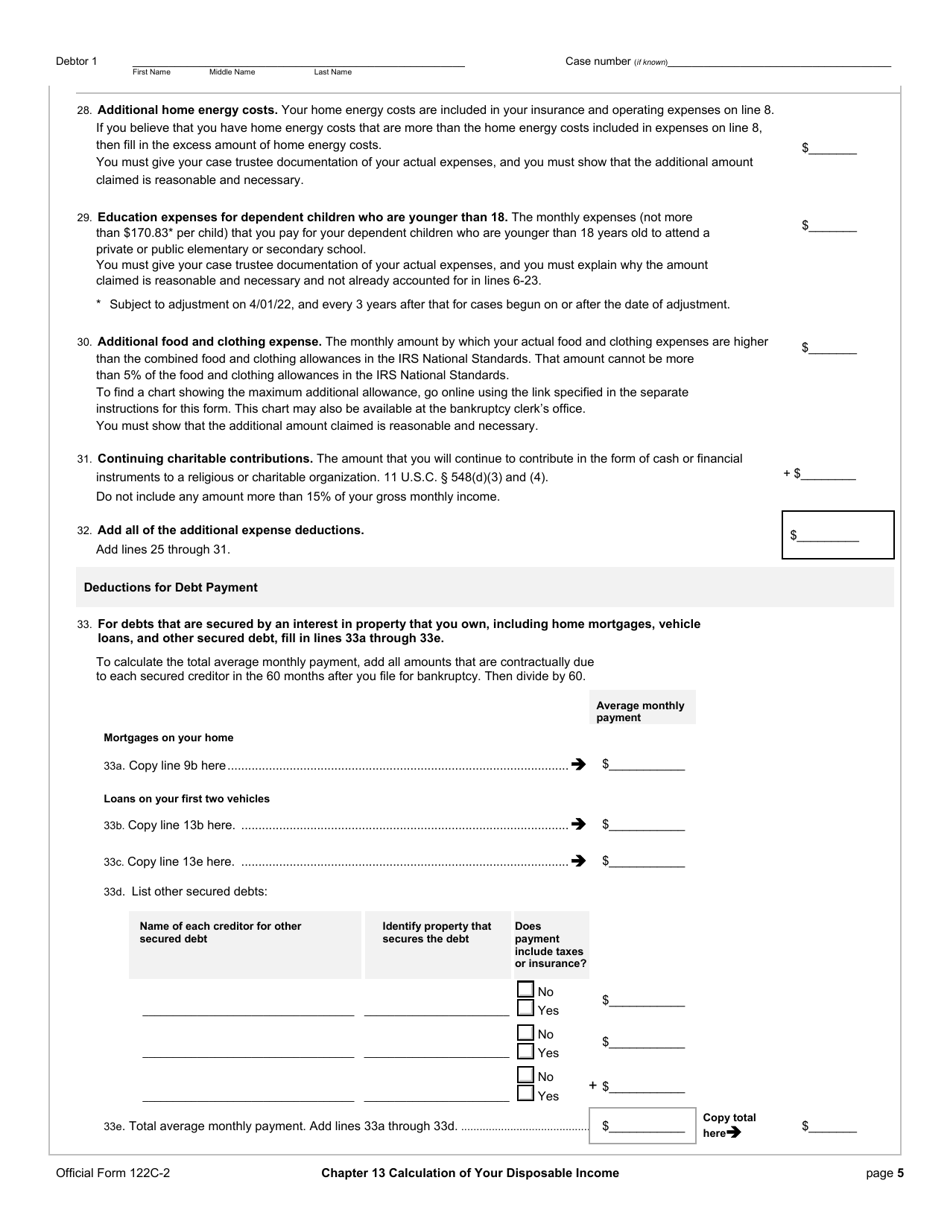

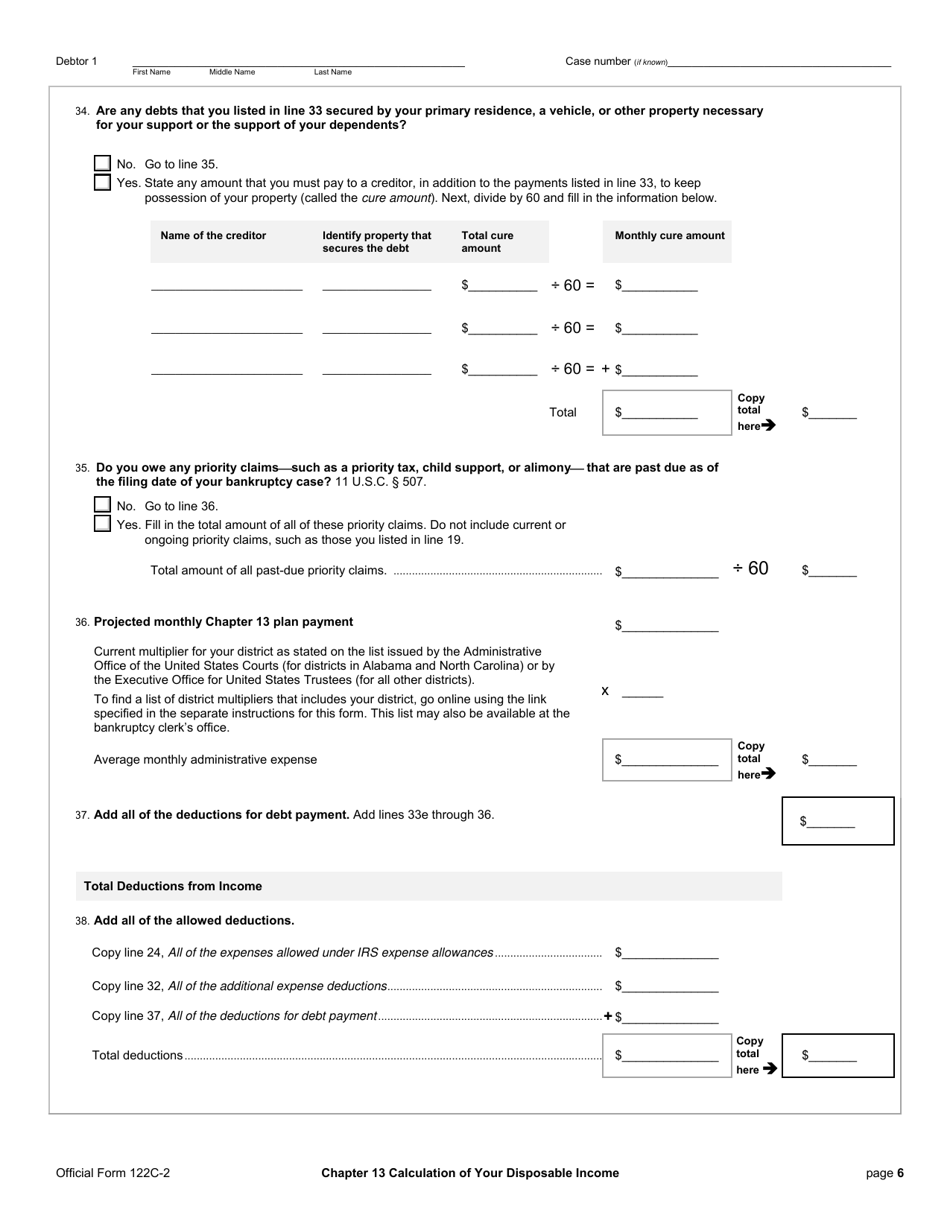

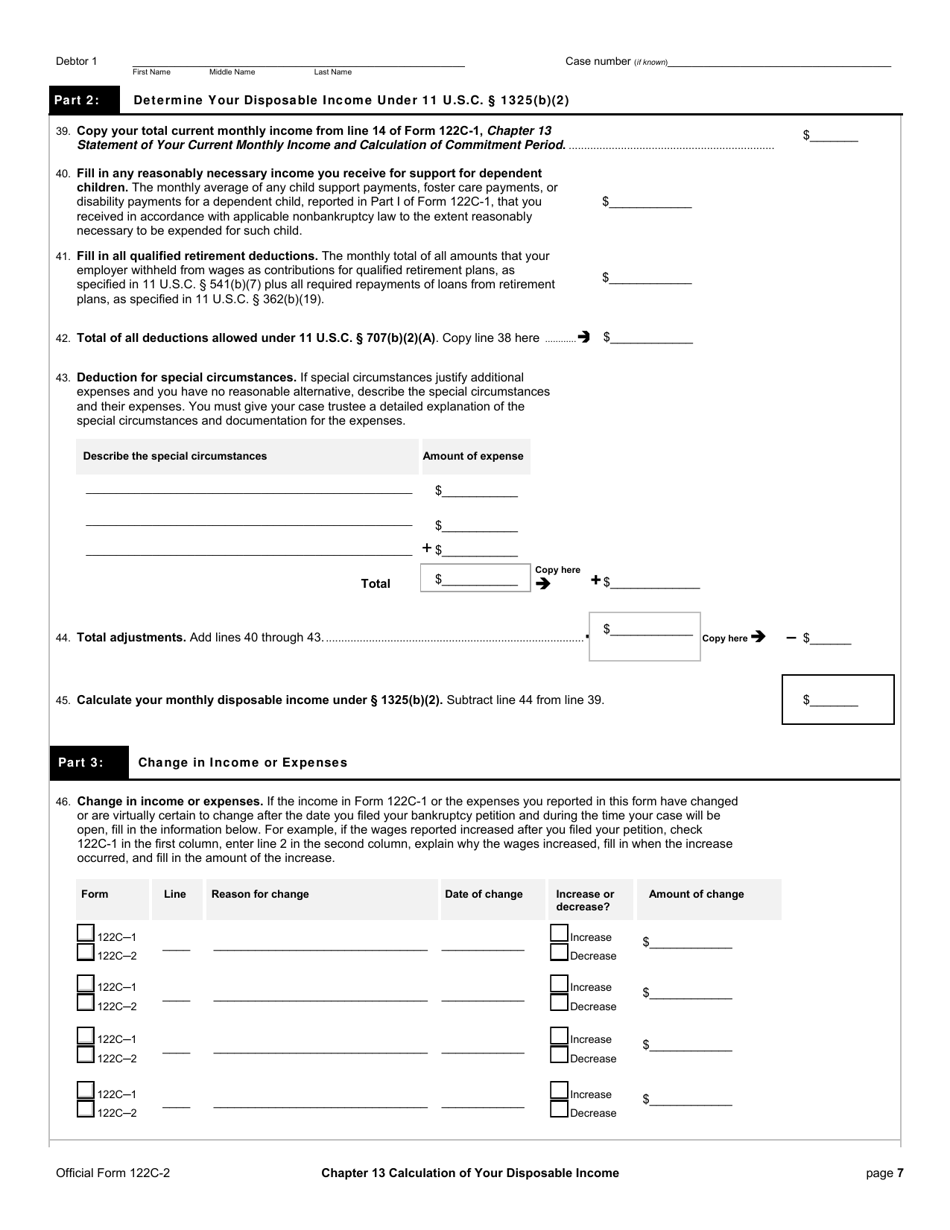

Official Form 122C-2 Chapter 13 Calculation of Your Disposable Income

What Is Official Form 122C-2?

This is a legal form that was released by the United States Bankruptcy Court on April 1, 2019 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Official Form 122C-2?

A: Official Form 122C-2 is a form used in Chapter 13 bankruptcy cases to calculate the debtor's disposable income.

Q: What is Chapter 13 bankruptcy?

A: Chapter 13 bankruptcy is a type of bankruptcy that allows individuals to create a repayment plan to pay off their debts over a period of three to five years.

Q: What is disposable income?

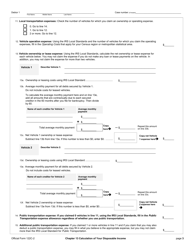

A: Disposable income is the amount of money that a debtor has available to pay towards their debts after deducting necessary expenses.

Q: Why is it important to calculate disposable income in Chapter 13 bankruptcy?

A: Calculating disposable income helps determine the amount that the debtor can afford to repay to their creditors under the Chapter 13 repayment plan.

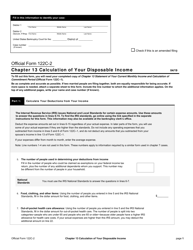

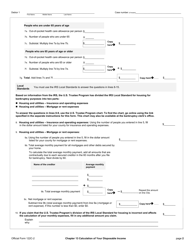

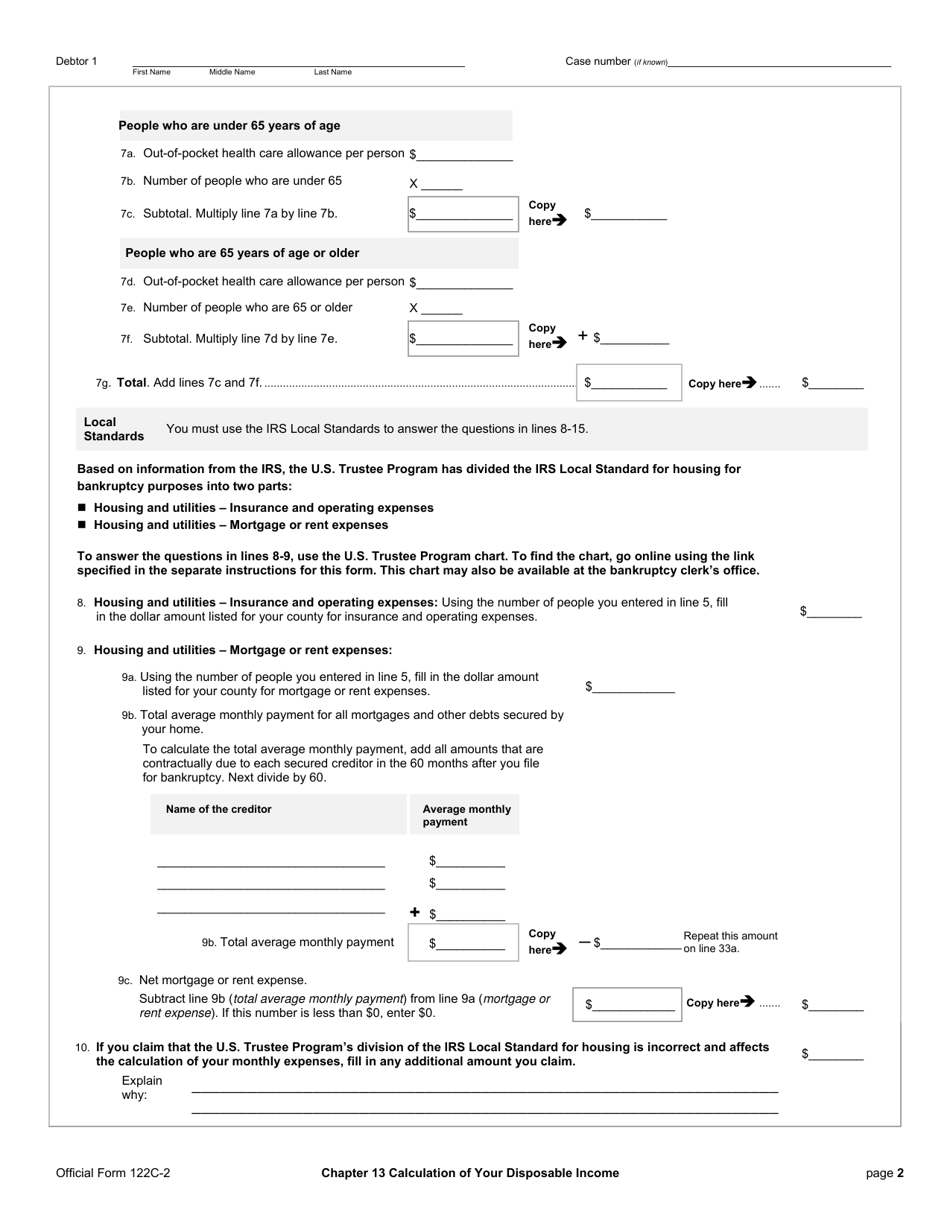

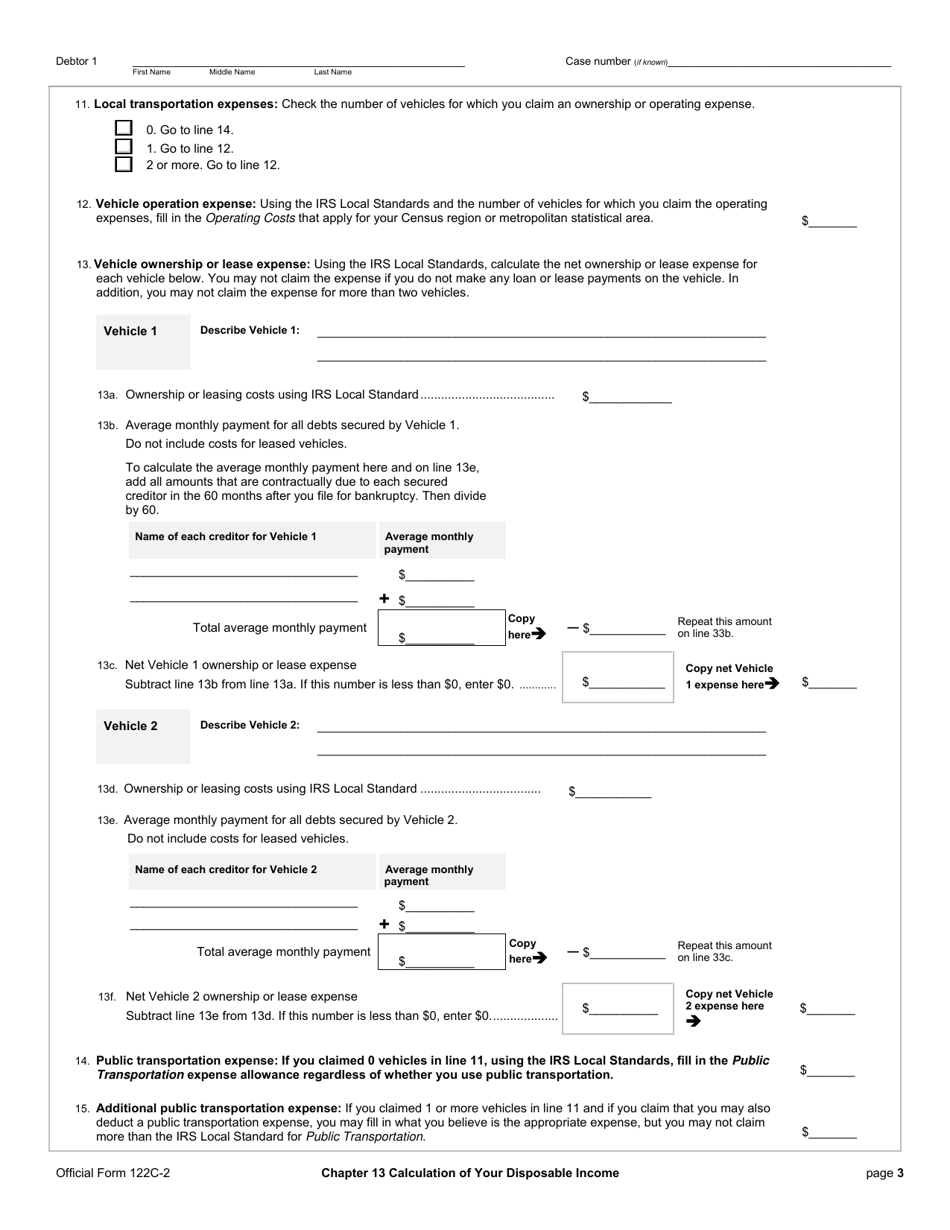

Q: What expenses are deducted when calculating disposable income?

A: When calculating disposable income, necessary expenses such as housing, utilities, transportation, and healthcare are deducted.

Q: What happens if the debtor's disposable income is not enough to cover the repayment plan?

A: If the debtor's disposable income is not enough to cover the repayment plan, the plan may need to be adjusted or the debtor may not qualify for Chapter 13 bankruptcy.

Q: Is Official Form 122C-2 specific to the United States or Canada?

A: Official Form 122C-2 is specific to the United States.

Q: Can Official Form 122C-2 be used for other types of bankruptcy cases?

A: No, Official Form 122C-2 is specifically used for Chapter 13 bankruptcy cases.

Form Details:

- Released on April 1, 2019;

- The latest available edition released by the United States Bankruptcy Court;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Official Form 122C-2 by clicking the link below or browse more documents and templates provided by the United States Bankruptcy Court.