This version of the form is not currently in use and is provided for reference only. Download this version of

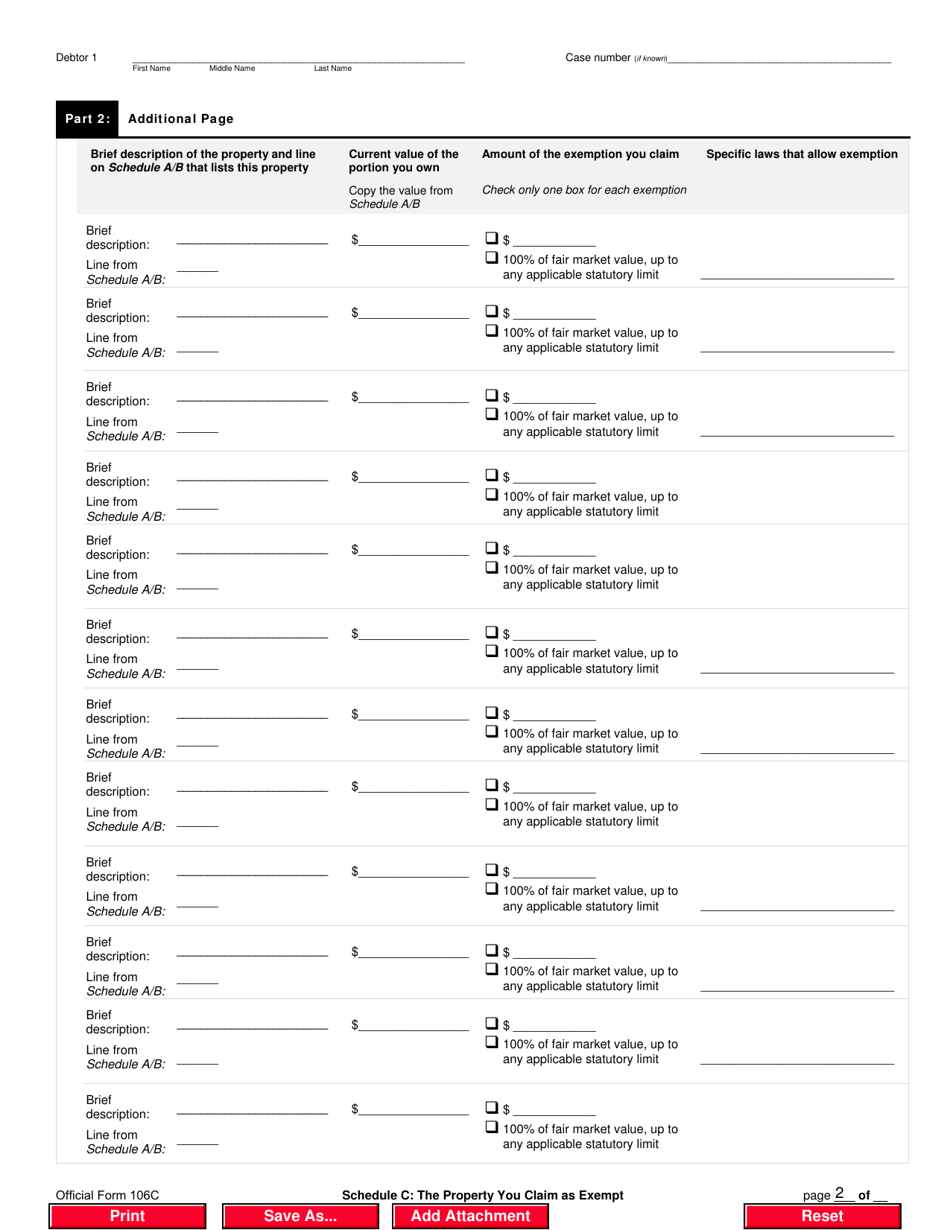

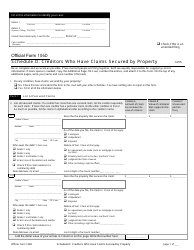

Official Form 106C Schedule C

for the current year.

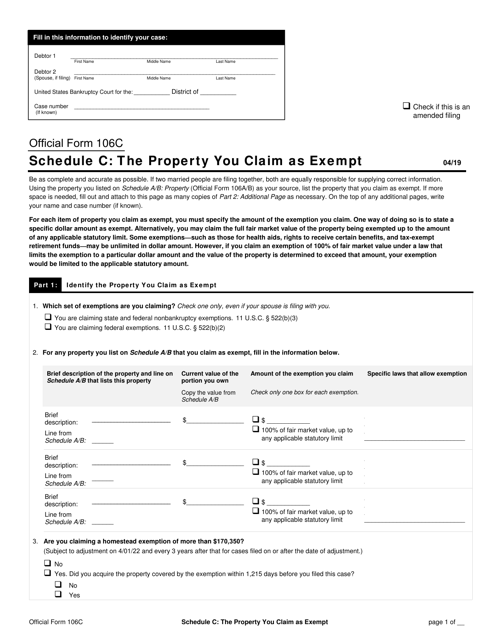

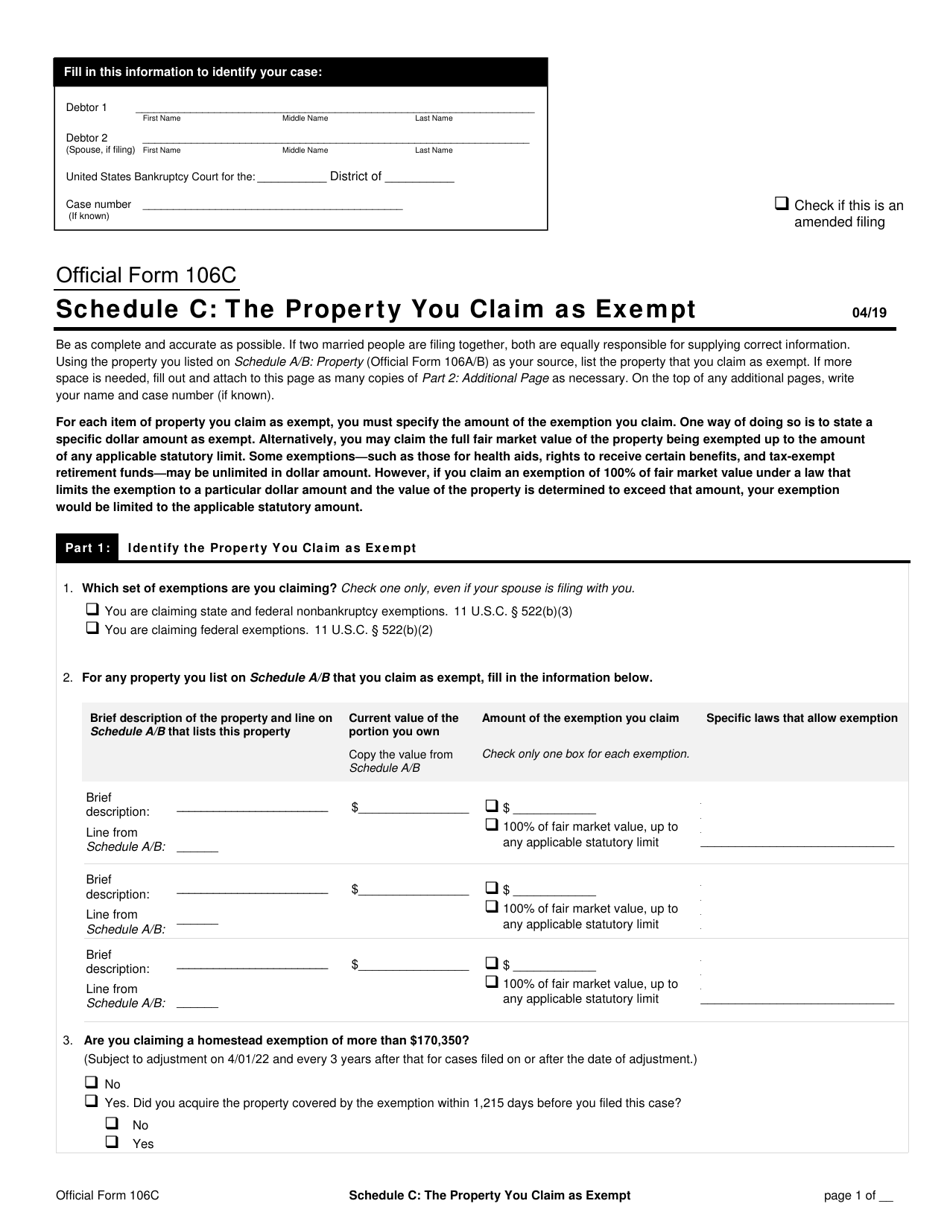

Official Form 106C Schedule C The Property Claimed as Exempt

What Is Official Form 106C Schedule C?

This is a legal form that was released by the United States Bankruptcy Court on April 1, 2019 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 106C?

A: Form 106C is a schedule used to report property that is claimed as exempt.

Q: What is Schedule C?

A: Schedule C is a part of Form 106C that specifically deals with exempt property.

Q: What does it mean to claim property as exempt?

A: Claiming property as exempt means that it cannot be seized or liquidated in order to satisfy certain debts or obligations.

Q: Why would someone claim property as exempt?

A: Someone may claim property as exempt to protect it from being taken away in certain legal or financial situations.

Q: What type of property can be claimed as exempt?

A: The type of property that can be claimed as exempt varies depending on federal and state laws, but common examples may include a primary residence, a vehicle, or certain personal belongings.

Q: Do I need to file Form 106C?

A: The filing of Form 106C is not required for everyone, but it may be necessary in certain circumstances. It is recommended to consult with a legal or tax professional to determine if this form should be filed.

Q: Is Form 106C the same as Schedule C for business income?

A: No, Form 106C is specifically for reporting property claimed as exempt, while Schedule C for business income is a different form.

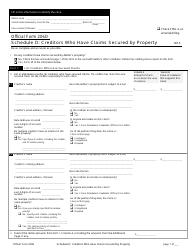

Q: What information is required on Schedule C?

A: Schedule C typically requires information such as a description of the property, its estimated value, and the applicable exemption law or provision.

Q: Can I claim multiple properties as exempt on Form 106C?

A: Yes, you can claim multiple properties as exempt on Form 106C, as long as they meet the criteria for exemption under the applicable laws.

Form Details:

- Released on April 1, 2019;

- The latest available edition released by the United States Bankruptcy Court;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Official Form 106C Schedule C by clicking the link below or browse more documents and templates provided by the United States Bankruptcy Court.