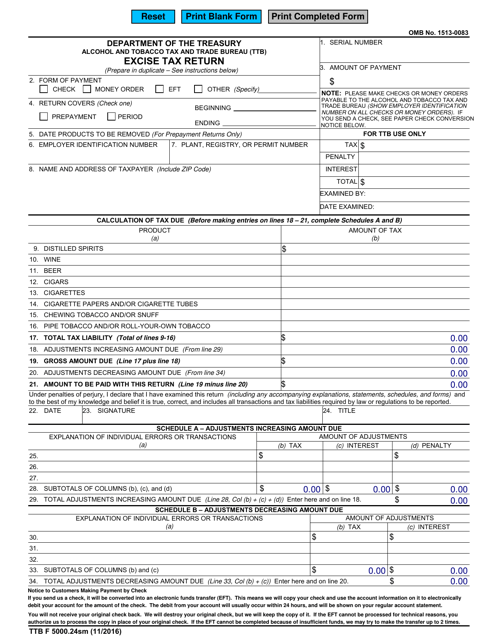

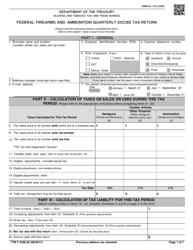

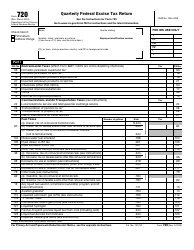

TTB Form 5000.24SM Excise Tax Return

What Is TTB Form 5000.24SM?

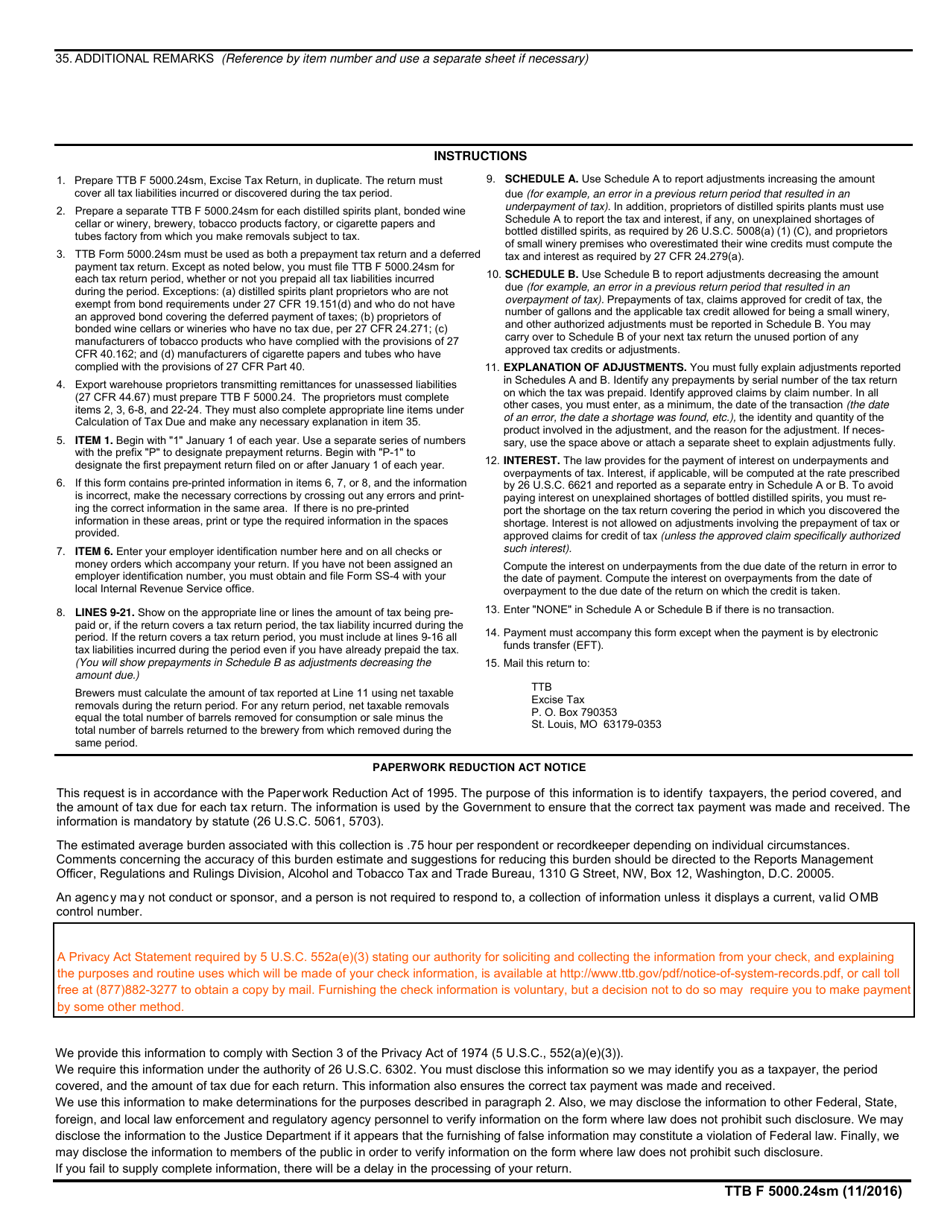

This is a legal form that was released by the U.S. Department of the Treasury - Alcohol and Tobacco Tax and Trade Bureau on November 1, 2016 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is TTB Form 5000.24SM?

A: TTB Form 5000.24SM is an Excise Tax Return form.

Q: Who needs to file TTB Form 5000.24SM?

A: Those who are required to pay excise taxes need to file this form.

Q: What are excise taxes?

A: Excise taxes are taxes levied on certain goods or activities, such as alcohol, tobacco, and gasoline.

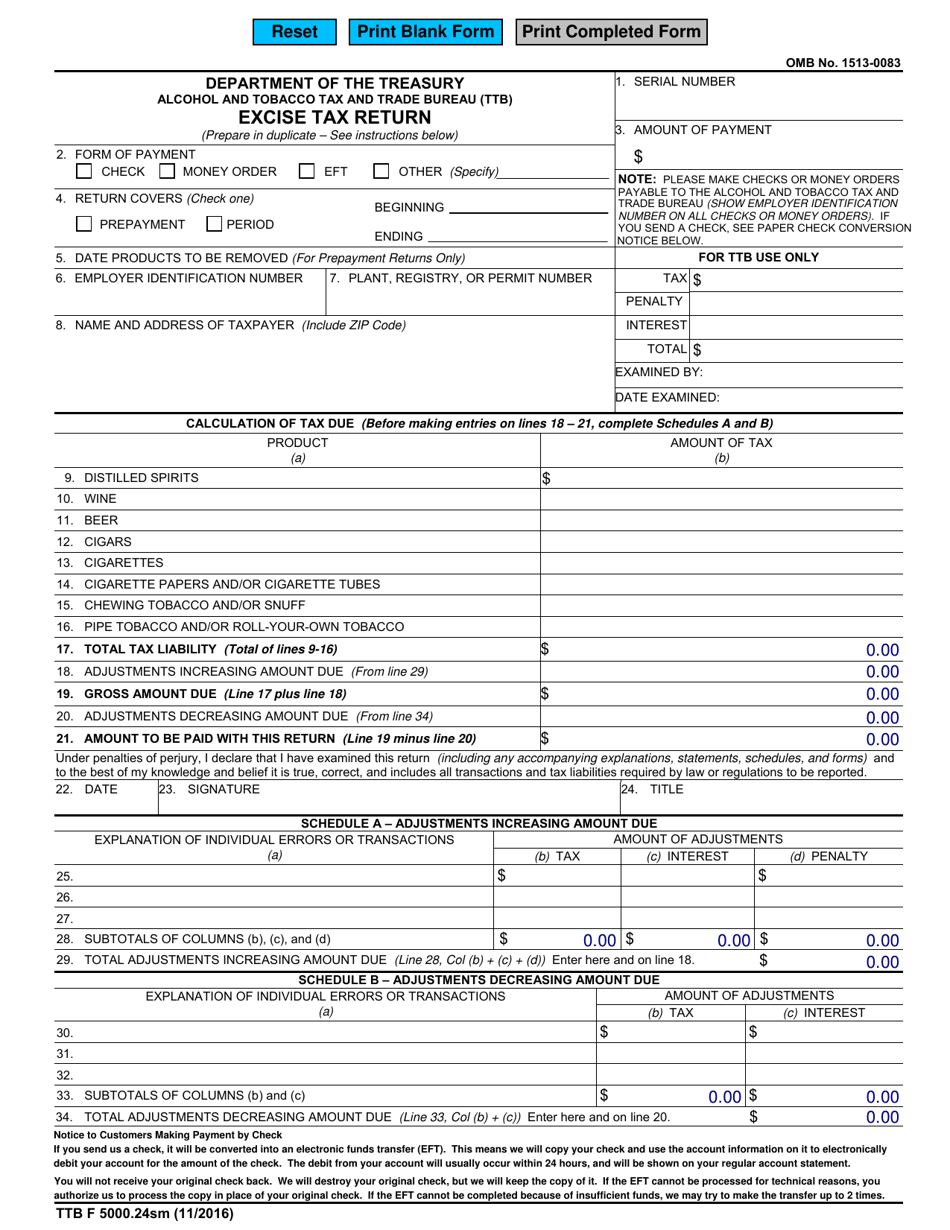

Q: What information is required on TTB Form 5000.24SM?

A: The form requires information about the taxpayer, the type and quantity of taxable products, and the calculation of the tax liability.

Q: When is TTB Form 5000.24SM due?

A: The due date for this form may vary depending on the specific requirements and deadlines set by the TTB. It is important to check the instructions or consult with the TTB for accurate filing deadlines.

Q: Are there any penalties for not filing TTB Form 5000.24SM?

A: Yes, there may be penalties for failing to file or file on time, such as late filing penalties or interest on unpaid taxes. It is important to comply with the filing requirements to avoid potential penalties.

Form Details:

- Released on November 1, 2016;

- The latest available edition released by the U.S. Department of the Treasury - Alcohol and Tobacco Tax and Trade Bureau;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of TTB Form 5000.24SM by clicking the link below or browse more documents and templates provided by the U.S. Department of the Treasury - Alcohol and Tobacco Tax and Trade Bureau.