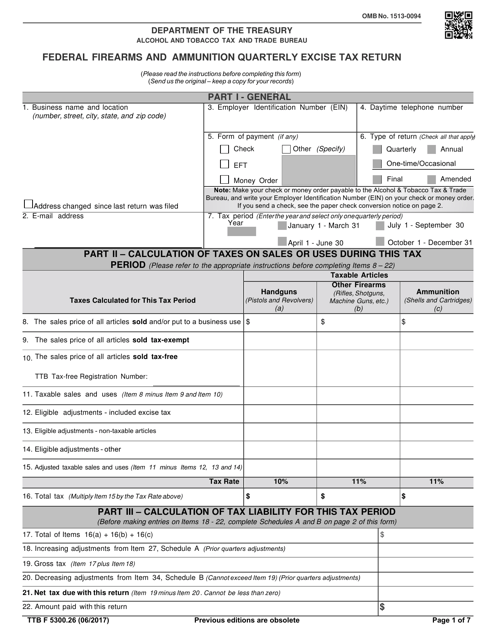

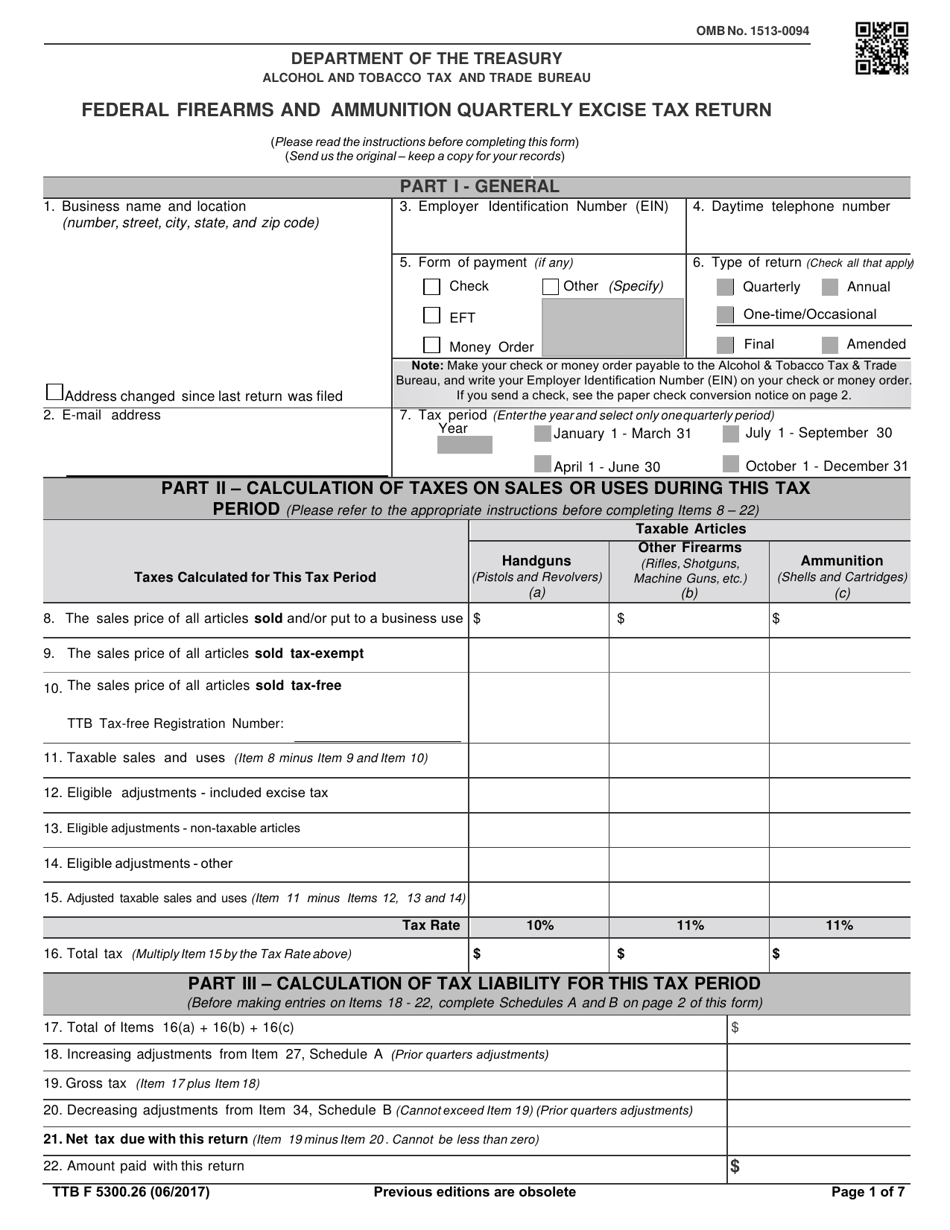

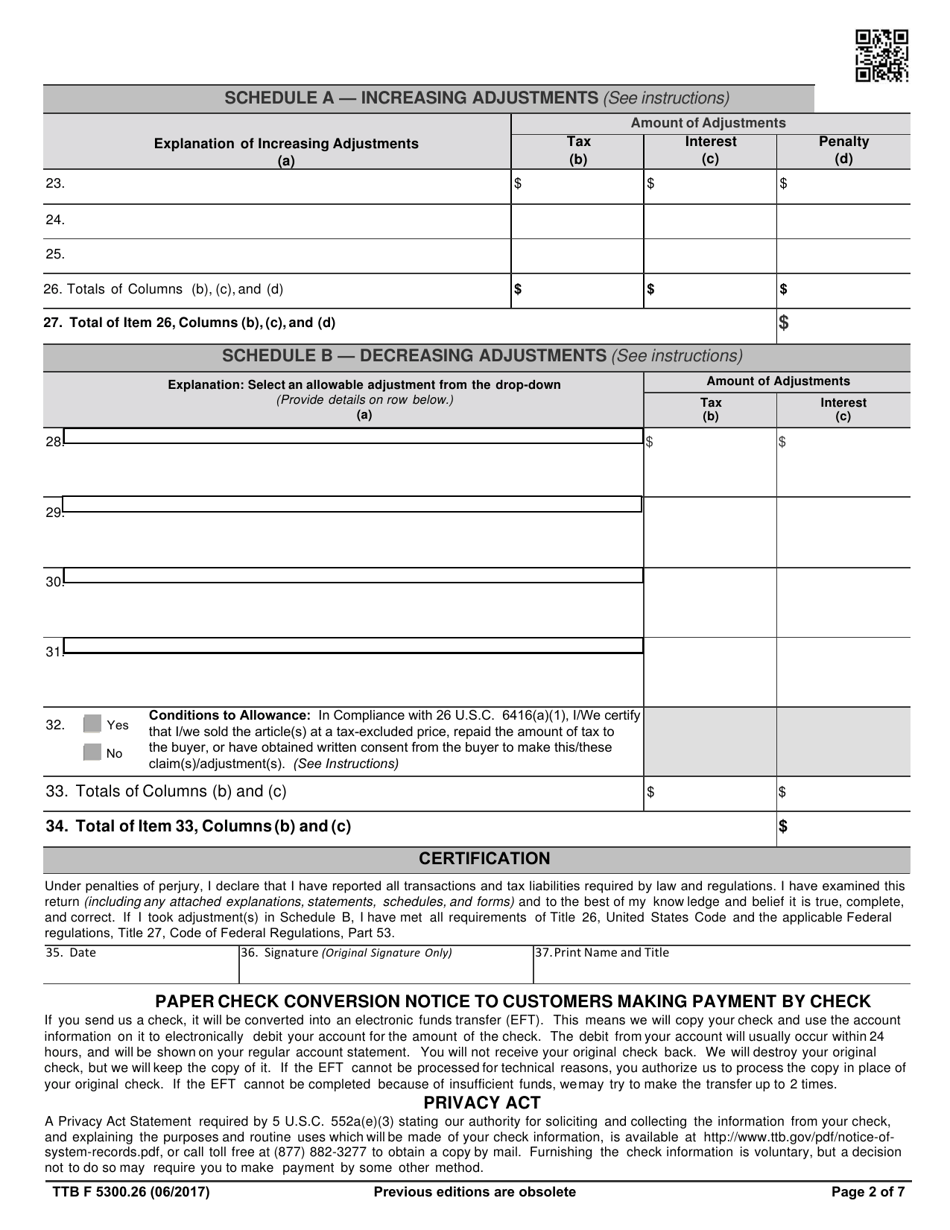

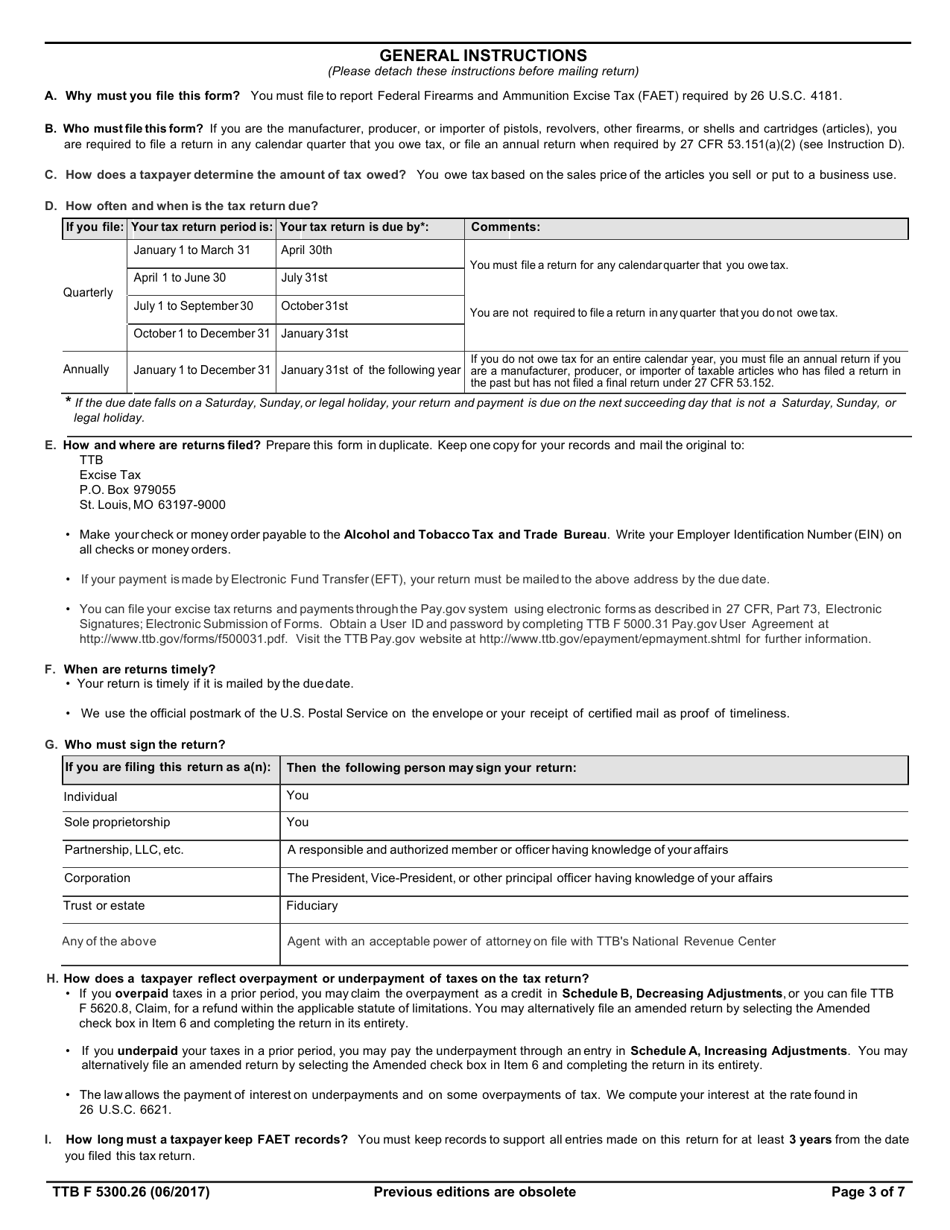

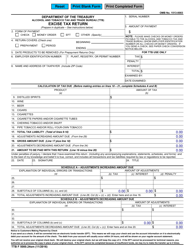

TTB Form 5300.26 Federal Firearms and Ammunition Quarterly Excise Tax Return

What Is TTB Form 5300.26?

This is a legal form that was released by the U.S. Department of the Treasury - Alcohol and Tobacco Tax and Trade Bureau on June 1, 2017 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is TTB Form 5300.26?

A: TTB Form 5300.26 is the Federal Firearms and Ammunition Quarterly Excise Tax Return.

Q: Who needs to file TTB Form 5300.26?

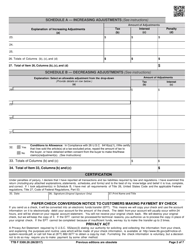

A: Anyone engaged in the business of manufacturing, importing, or selling firearms and ammunition needs to file TTB Form 5300.26.

Q: What is the purpose of TTB Form 5300.26?

A: The purpose of this form is to report and pay excise taxes on firearms and ammunition.

Q: How often do you need to file TTB Form 5300.26?

A: TTB Form 5300.26 must be filed quarterly.

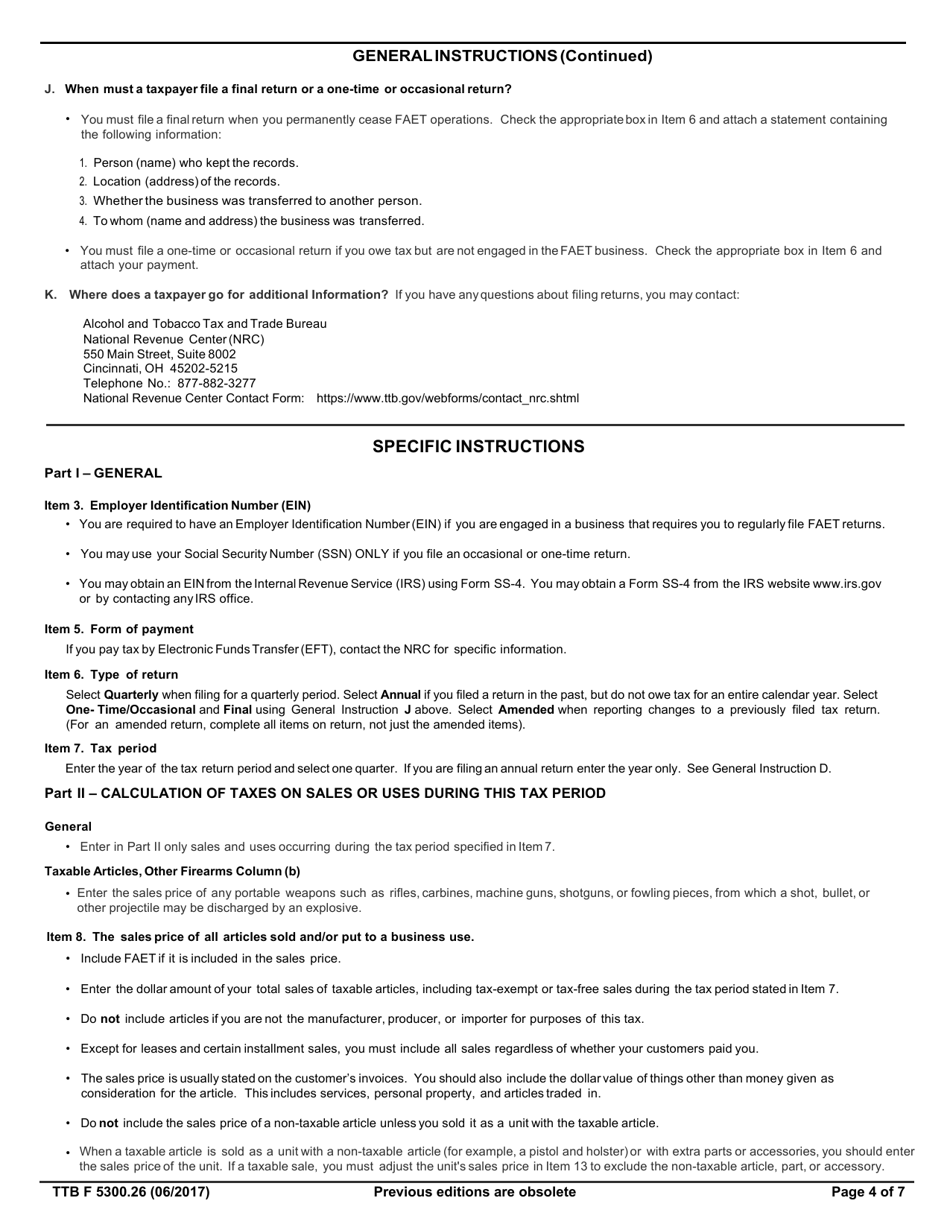

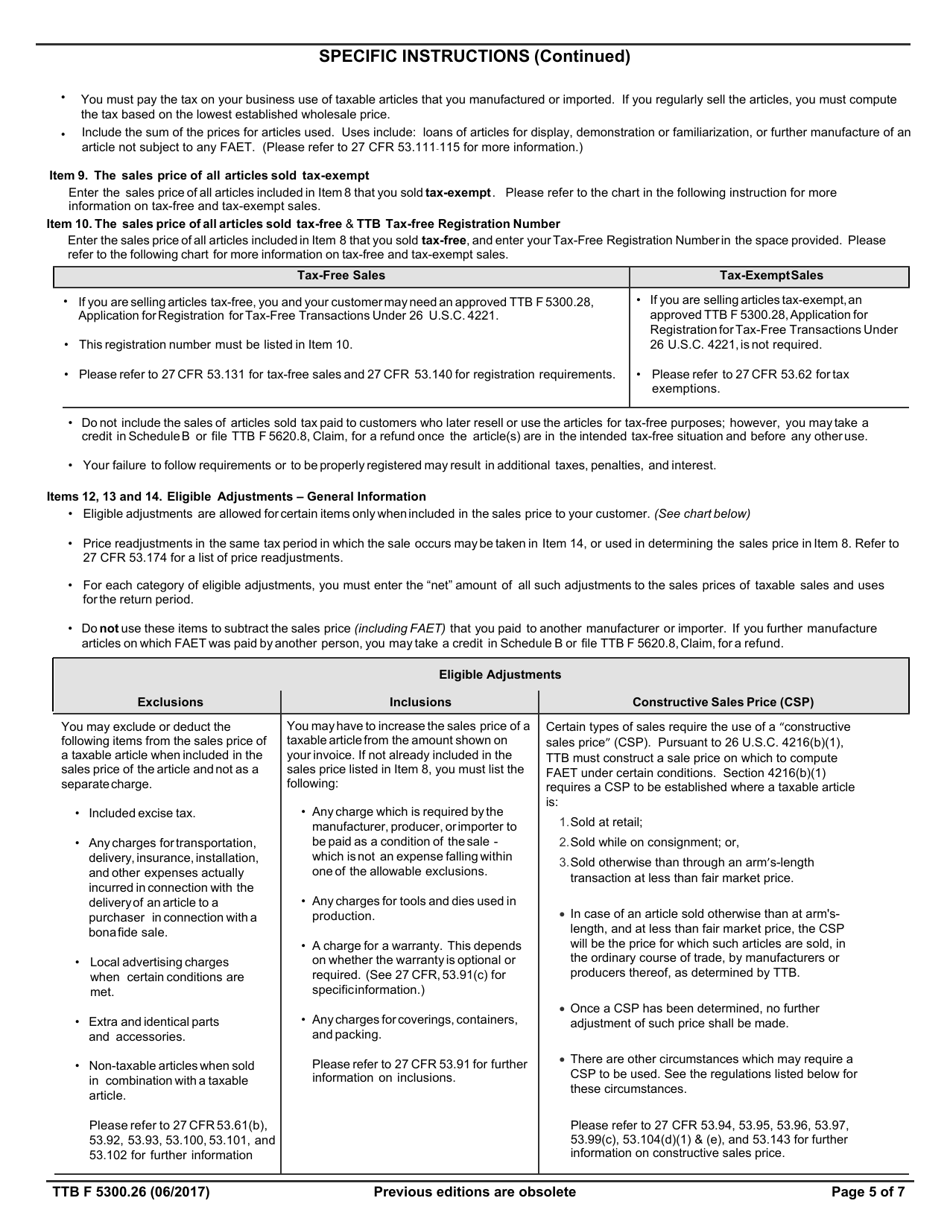

Q: What information is required on TTB Form 5300.26?

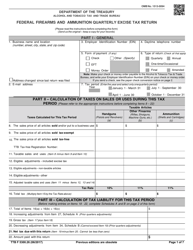

A: The form requires information about the type and quantity of firearms and ammunition sold, as well as the amount of excise taxes owed.

Q: Is there a deadline for filing TTB Form 5300.26?

A: Yes, TTB Form 5300.26 must be filed by the last day of the month following the end of each quarter.

Q: What happens if I don't file TTB Form 5300.26?

A: Failure to file TTB Form 5300.26 can result in penalties and interest charges.

Q: Can I file TTB Form 5300.26 electronically?

A: Yes, you can file TTB Form 5300.26 electronically through the TTB's e-file system.

Q: Is there a fee for filing TTB Form 5300.26?

A: No, there is no fee for filing TTB Form 5300.26.

Form Details:

- Released on June 1, 2017;

- The latest available edition released by the U.S. Department of the Treasury - Alcohol and Tobacco Tax and Trade Bureau;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of TTB Form 5300.26 by clicking the link below or browse more documents and templates provided by the U.S. Department of the Treasury - Alcohol and Tobacco Tax and Trade Bureau.