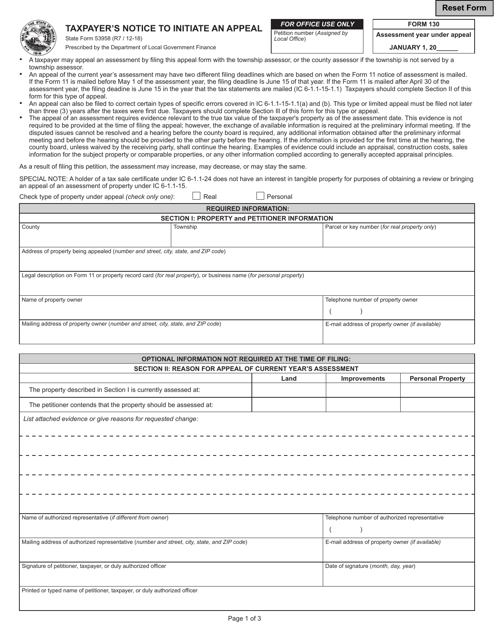

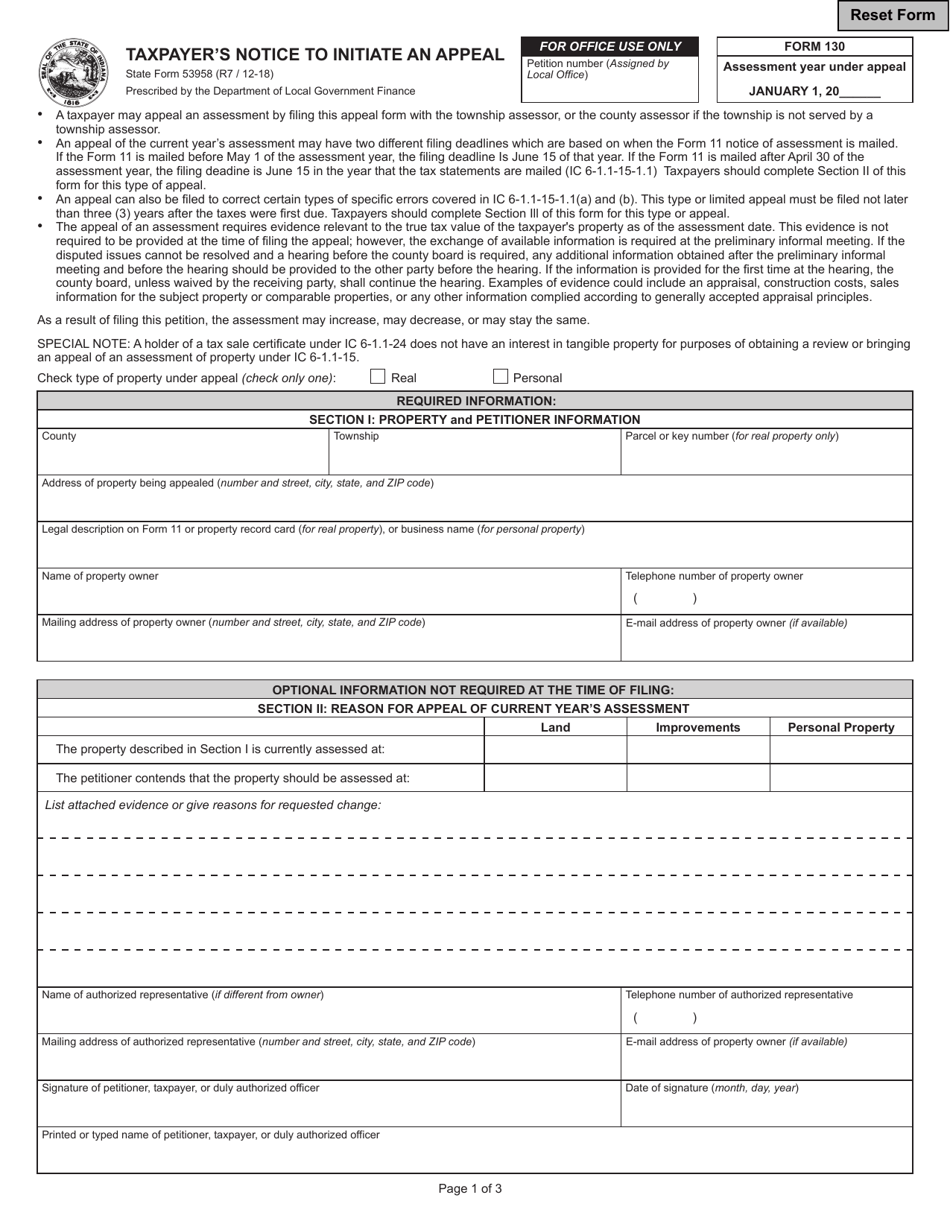

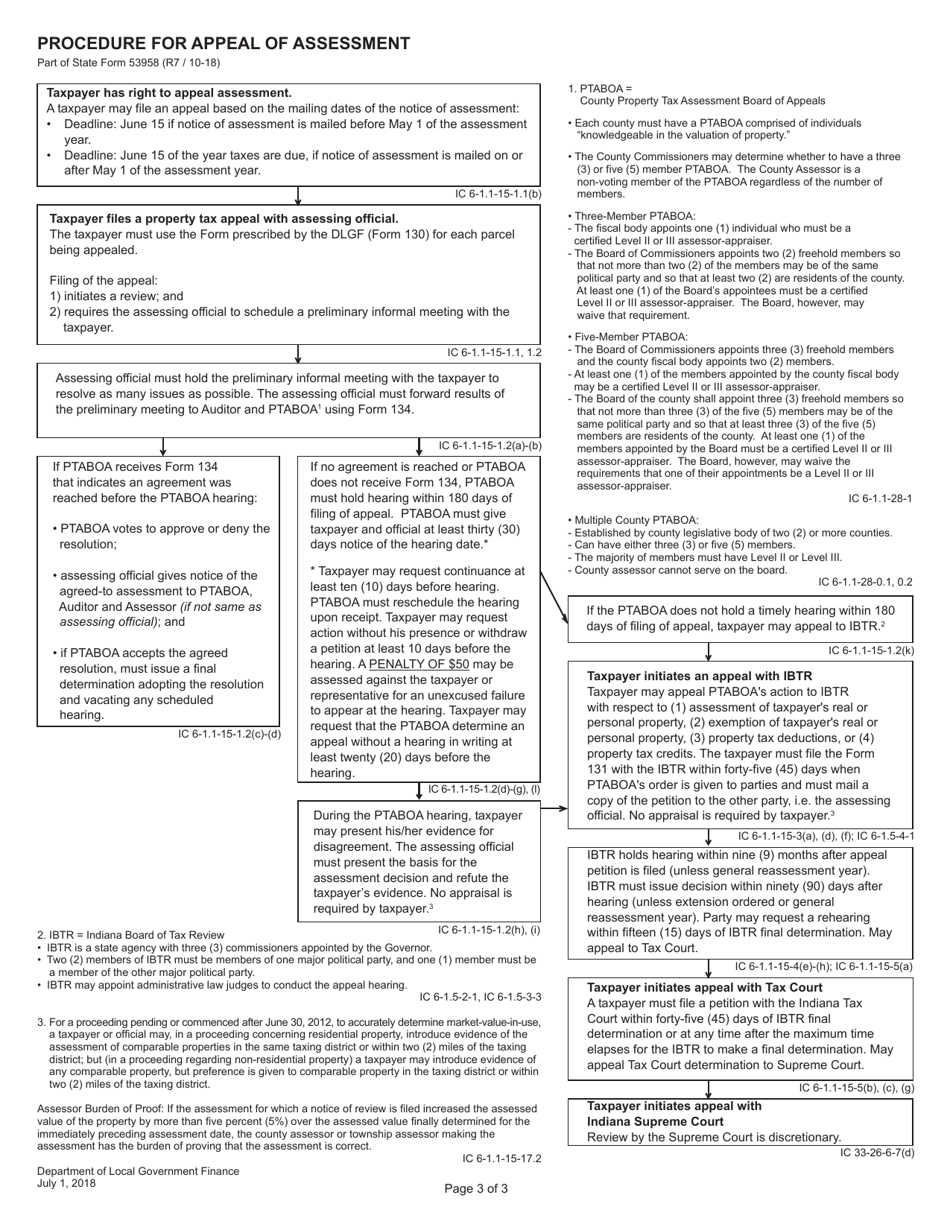

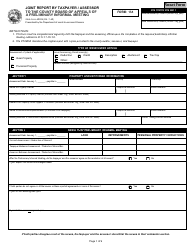

Form 130 (State Form 53958) Taxpayer's Notice to Initiate an Appeal - Indiana

What Is Form 130 (State Form 53958)?

This is a legal form that was released by the Indiana Department of Local Government Finance - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 130?

A: Form 130 is the Taxpayer's Notice to Initiate an Appeal in Indiana.

Q: What is the purpose of Form 130?

A: The purpose of Form 130 is to initiate an appeal for a taxpayer in Indiana.

Q: Do I need to fill out Form 130 if I want to appeal a tax decision in Indiana?

A: Yes, you need to fill out Form 130 in order to initiate an appeal for a tax decision in Indiana.

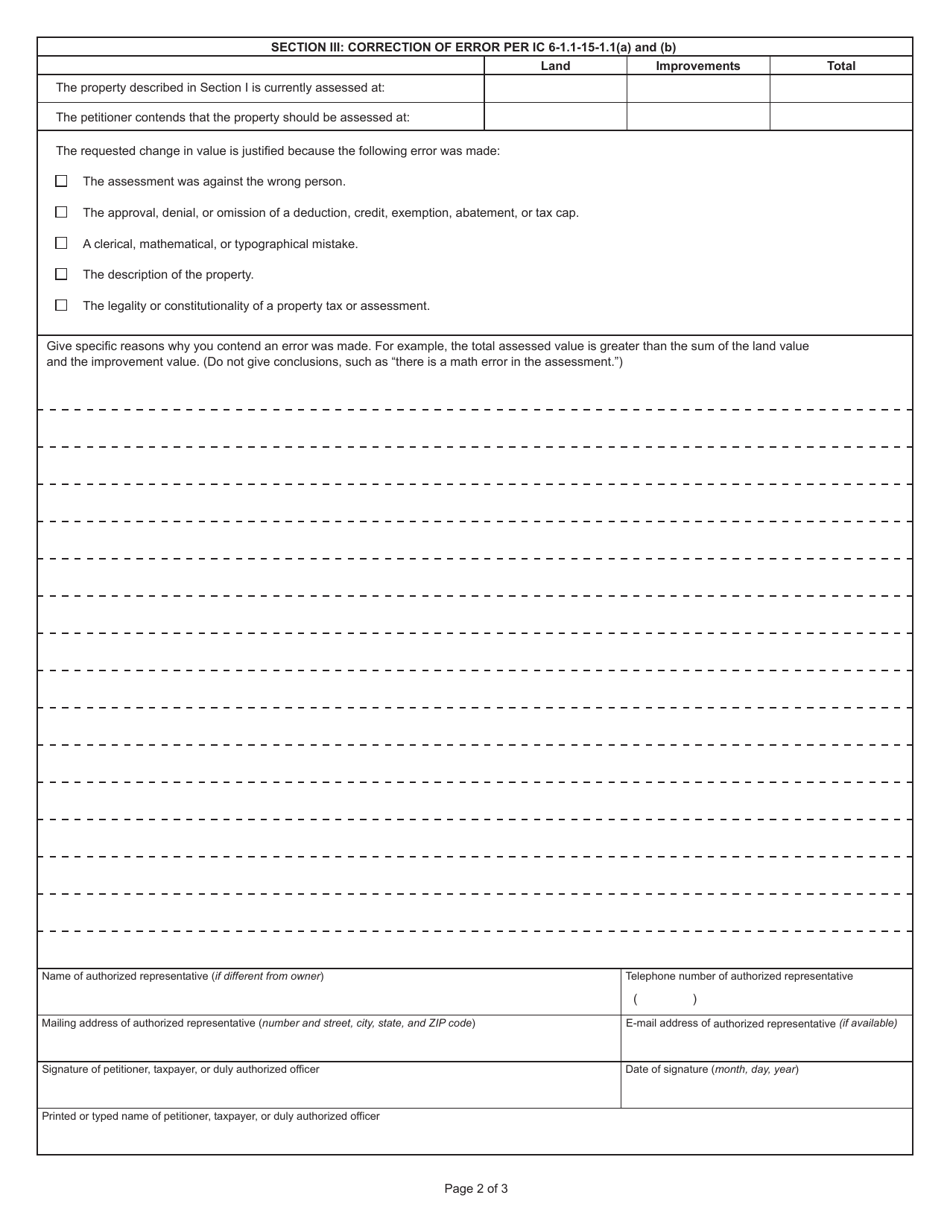

Q: What information is required on Form 130?

A: Form 130 requires information such as your name, contact information, tax identification number, a description of the tax decision being appealed, and the grounds for the appeal.

Form Details:

- Released on December 1, 2018;

- The latest edition provided by the Indiana Department of Local Government Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 130 (State Form 53958) by clicking the link below or browse more documents and templates provided by the Indiana Department of Local Government Finance.