This version of the form is not currently in use and is provided for reference only. Download this version of

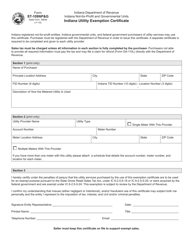

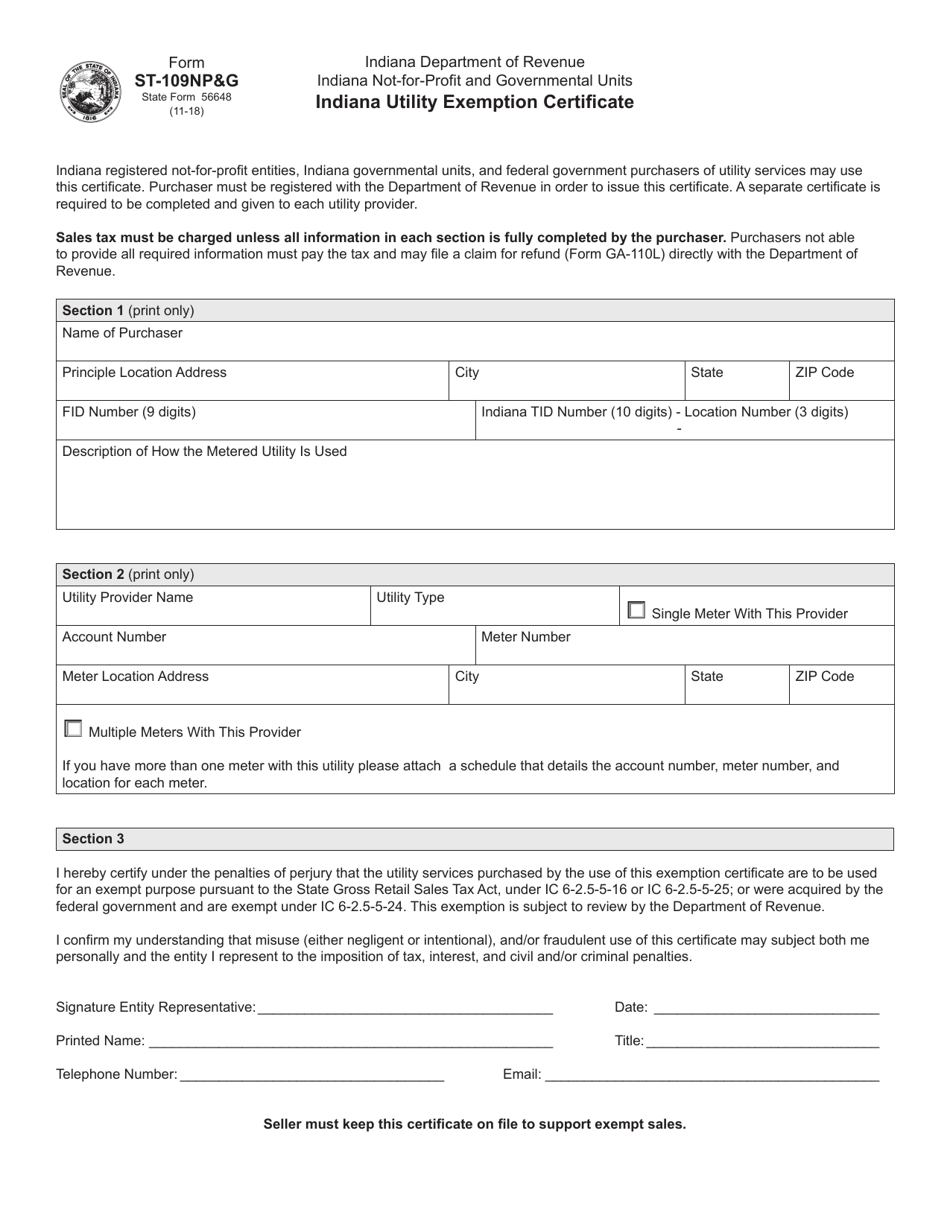

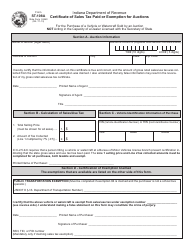

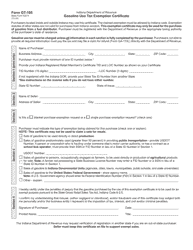

Form ST-109NP&G (State Form 56648)

for the current year.

Form ST-109NP&G (State Form 56648) Indiana Utility Exemption Certificate - Indiana

What Is Form ST-109NP&G (State Form 56648)?

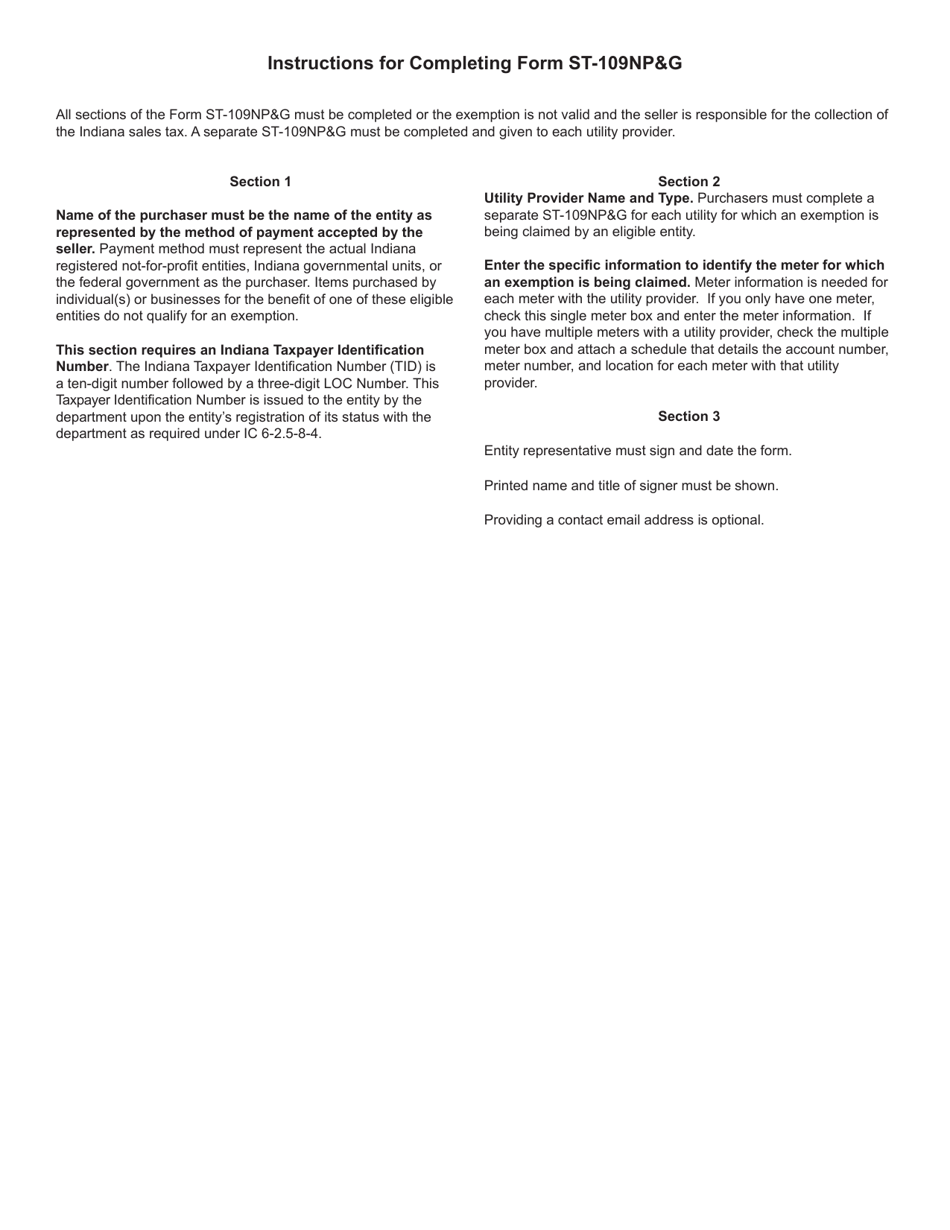

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

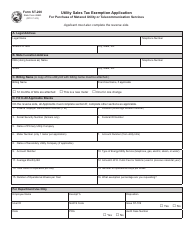

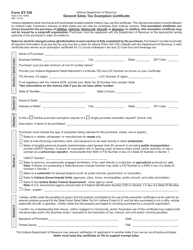

Q: What is Form ST-109NP&G?

A: Form ST-109NP&G is the Indiana Utility Exemption Certificate.

Q: What is the purpose of Form ST-109NP&G?

A: The purpose of Form ST-109NP&G is to claim an exemption from paying certain utility taxes in Indiana.

Q: Who should use Form ST-109NP&G?

A: Form ST-109NP&G should be used by qualifying organizations or individuals who meet the requirements for a utility tax exemption in Indiana.

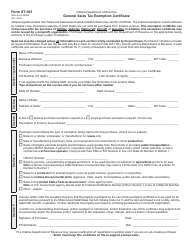

Q: Are there any deadlines for filing Form ST-109NP&G?

A: Yes, Form ST-109NP&G must be filed with the Indiana Department of Revenue on or before the due date of the utility tax return.

Q: What documentation is required to support the exemption claimed on Form ST-109NP&G?

A: Supporting documentation, such as the utility bill or contract, may be required to verify the exemption claimed on Form ST-109NP&G.

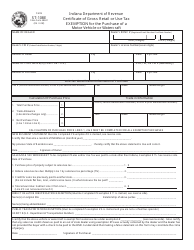

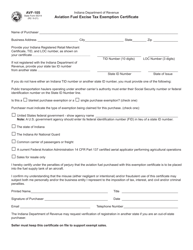

Form Details:

- Released on November 1, 2018;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ST-109NP&G (State Form 56648) by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.