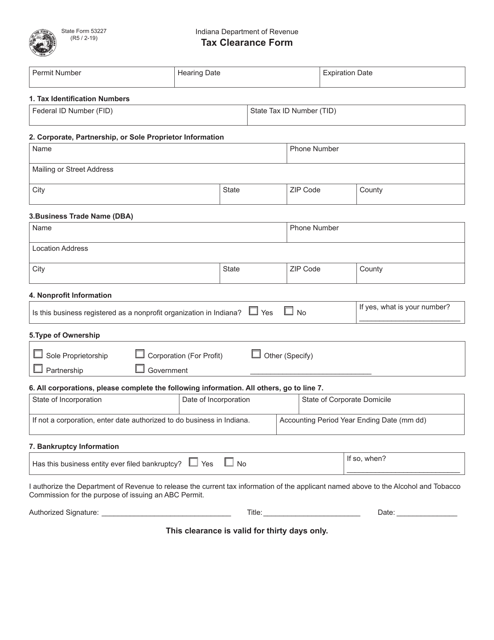

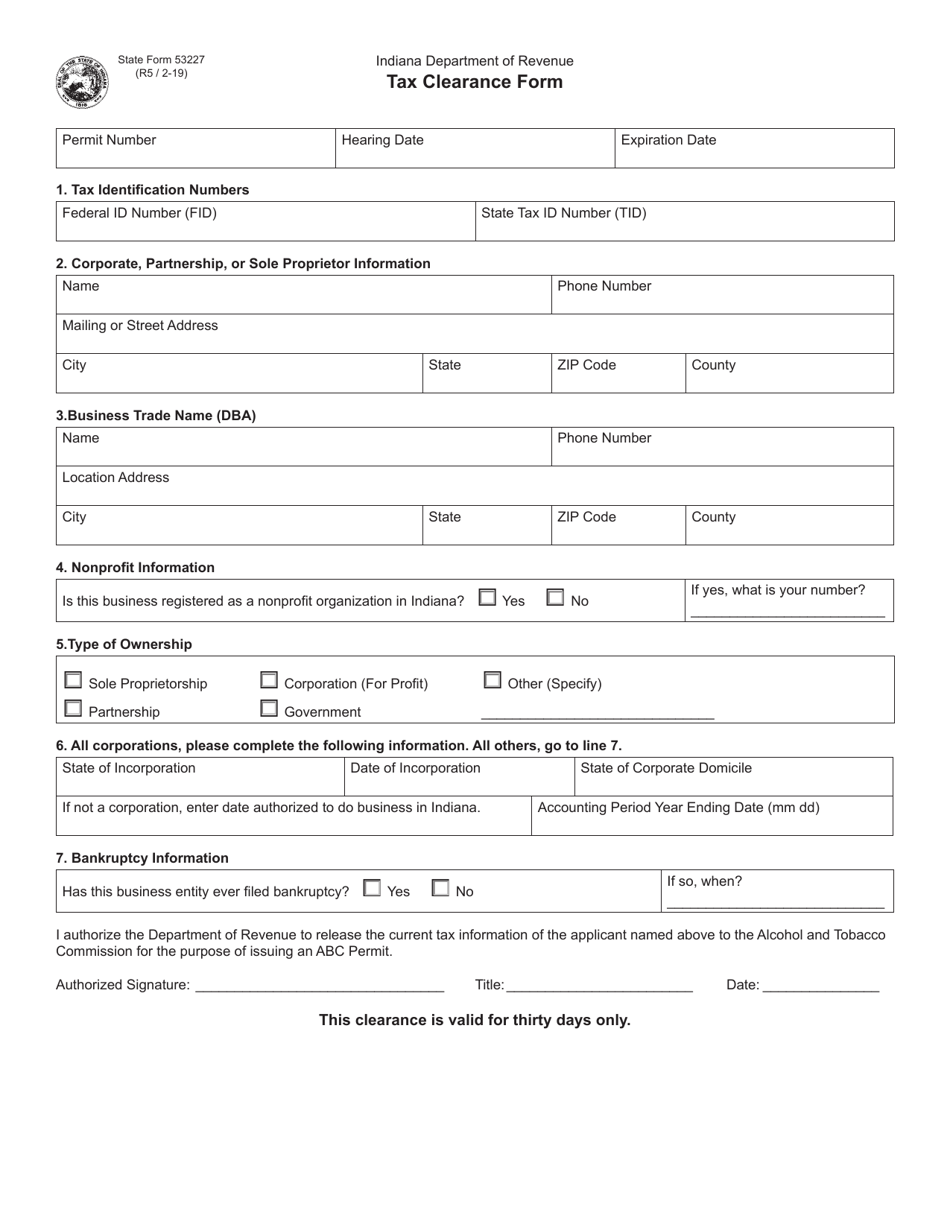

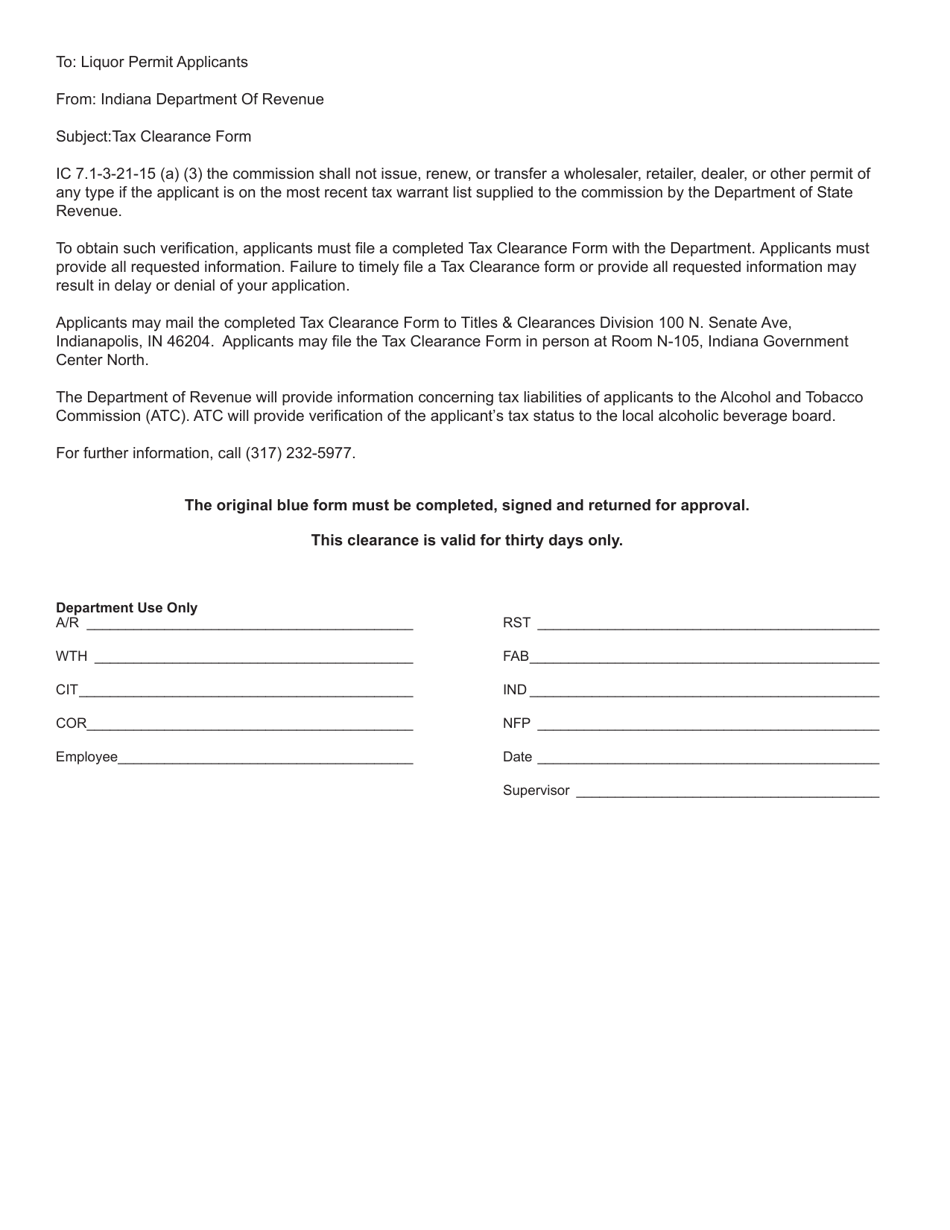

State Form 53227 Tax Clearance Form - Indiana

What Is State Form 53227?

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 53227?

A: Form 53227 is the Tax Clearance Form for the state of Indiana.

Q: What is the purpose of Form 53227?

A: The purpose of Form 53227 is to obtain tax clearance from the state of Indiana.

Q: Who needs to fill out Form 53227?

A: Anyone who wants to obtain tax clearance from the state of Indiana needs to fill out Form 53227.

Q: Are there any fees associated with submitting Form 53227?

A: No, there are no fees associated with submitting Form 53227.

Q: What information is required on Form 53227?

A: Form 53227 requires information such as the taxpayer's name, address, tax identification number, and other relevant tax details.

Q: How should I submit Form 53227?

A: Form 53227 can be submitted electronically or by mail to the Indiana Department of Revenue.

Q: What happens after I submit Form 53227?

A: After submitting Form 53227, the Indiana Department of Revenue will review the form and issue a tax clearance certificate if everything is in order.

Q: How long does it take to receive a tax clearance certificate?

A: The processing time for a tax clearance certificate can vary, but it typically takes a few weeks to receive a response from the Indiana Department of Revenue.

Q: What is the importance of obtaining a tax clearance certificate?

A: Obtaining a tax clearance certificate is necessary for certain business transactions or to demonstrate compliance with Indiana tax laws.

Form Details:

- Released on February 1, 2019;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of State Form 53227 by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.