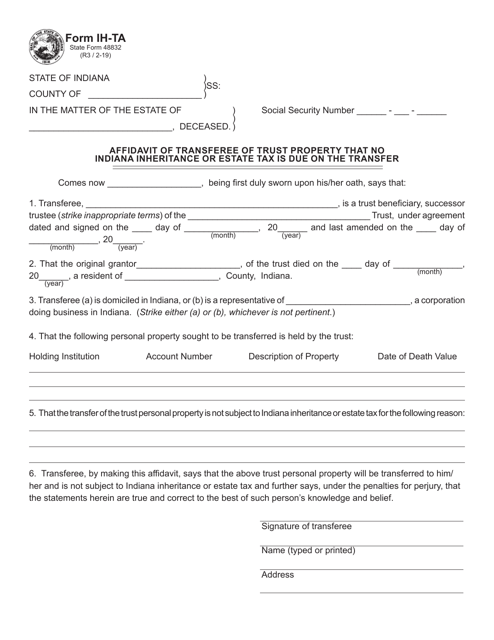

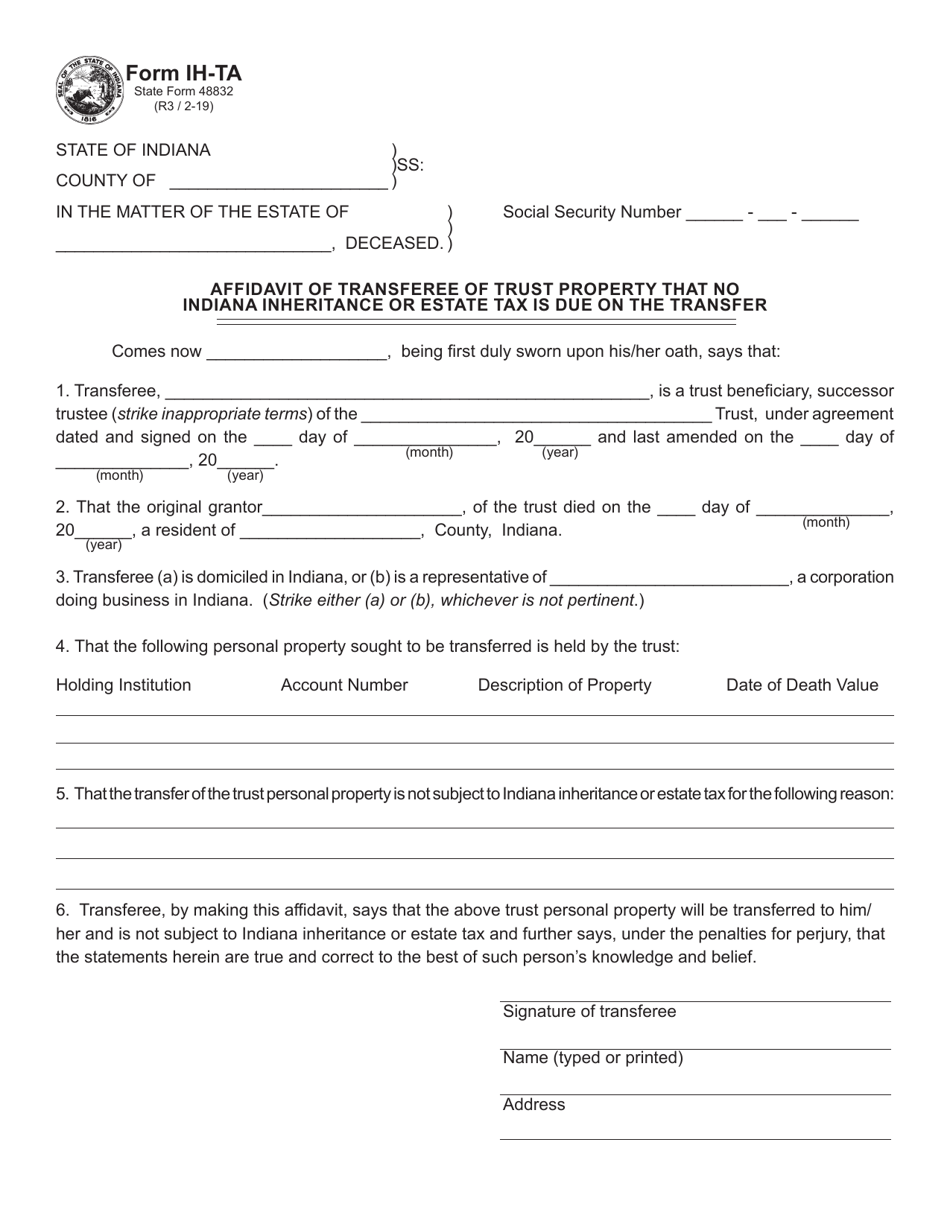

Form IH-TA (State Form 48832) Affidavit of Transferee of Trust Property That No Indiana Inheritance or Estate Tax Is Due on the Transfer - Indiana

What Is Form IH-TA (State Form 48832)?

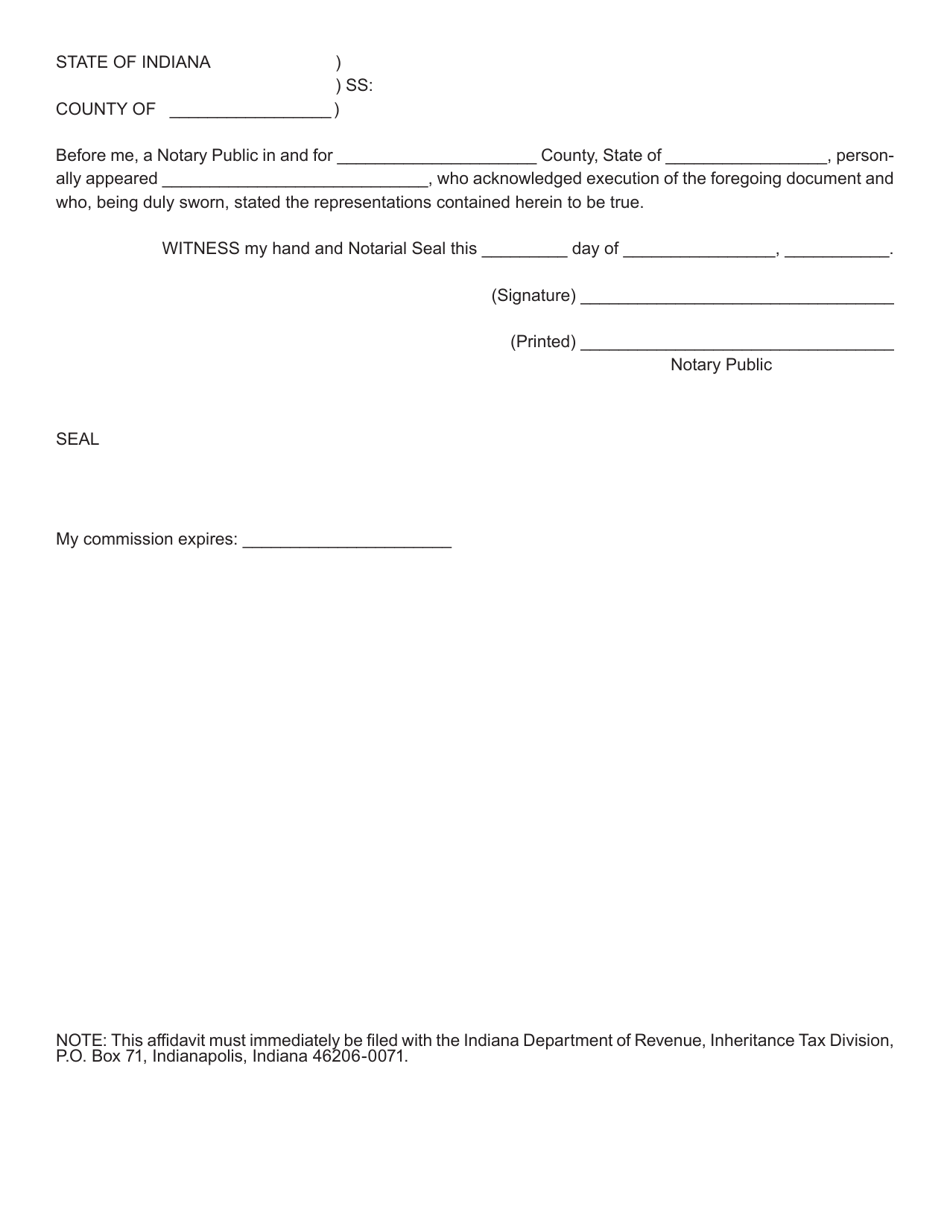

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IH-TA?

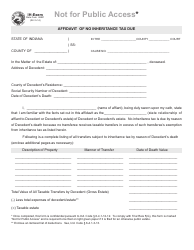

A: Form IH-TA is the Affidavit of Transferee of Trust Property That No Indiana Inheritance or Estate Tax Is Due on the Transfer.

Q: What is the purpose of Form IH-TA?

A: The purpose of Form IH-TA is to declare that no Indiana inheritance or estate tax is due on the transfer of trust property.

Q: Who needs to complete Form IH-TA?

A: The transferee of trust property in Indiana needs to complete Form IH-TA.

Q: Do I need to submit Form IH-TA with any other forms?

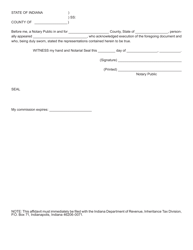

A: Form IH-TA should be submitted along with the relevant trust documents and any other required tax forms.

Q: Is there a deadline to submit Form IH-TA?

A: Form IH-TA should be filed within 9 months from the decedent's date of death or within 90 days after receiving notice of the transfer, whichever is later.

Q: Are there any fees associated with filing Form IH-TA?

A: There are no fees for filing Form IH-TA.

Q: What happens after I submit Form IH-TA?

A: After submitting Form IH-TA, the Indiana Department of Revenue will review the information provided and determine if any inheritance or estate tax is due.

Form Details:

- Released on February 1, 2019;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IH-TA (State Form 48832) by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.