This version of the form is not currently in use and is provided for reference only. Download this version of

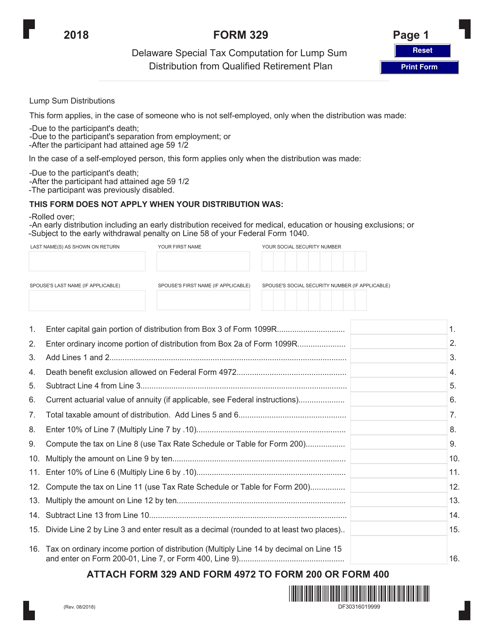

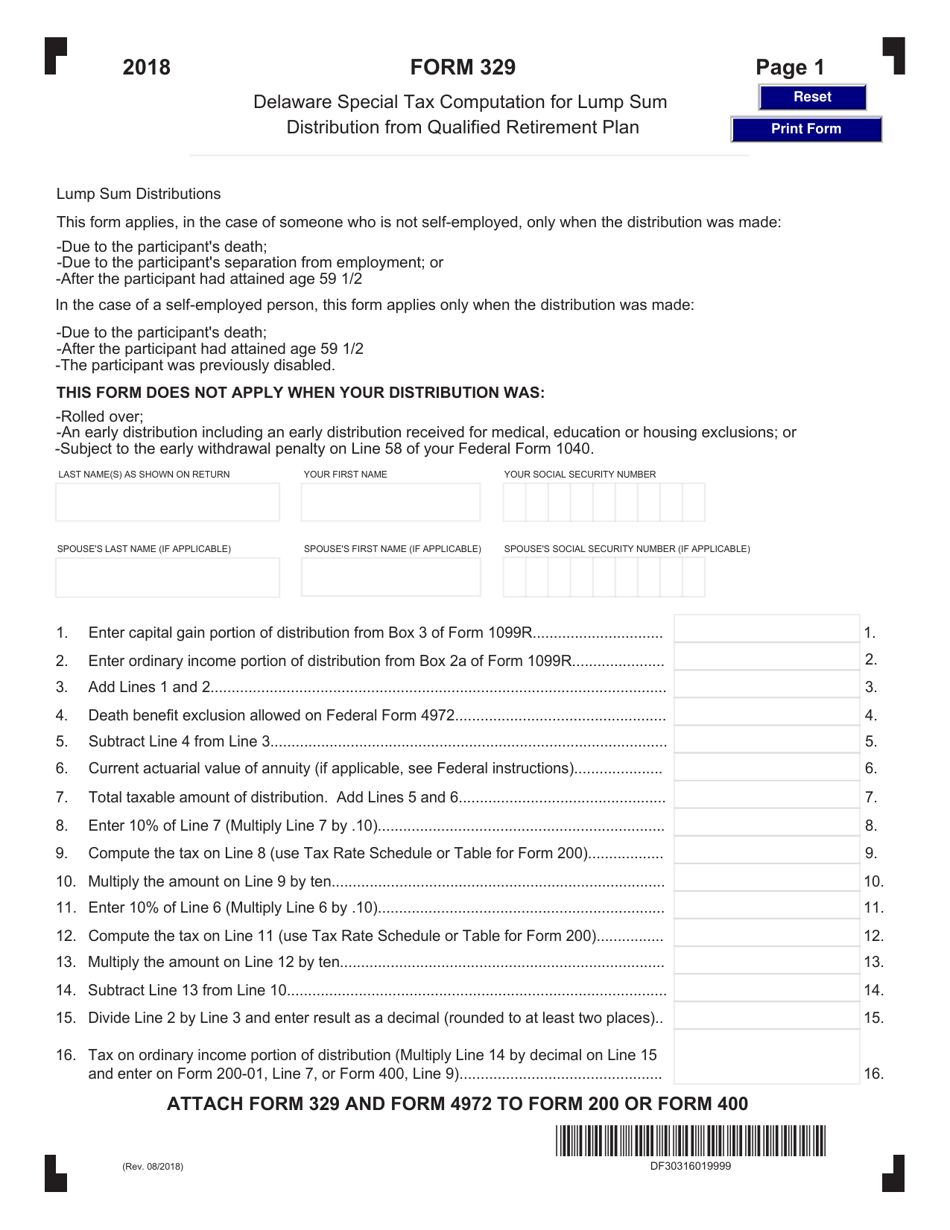

Form 329

for the current year.

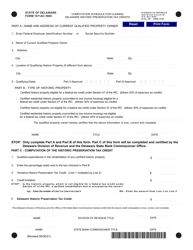

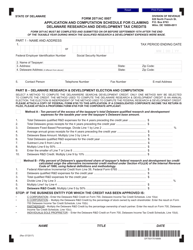

Form 329 Special Tax Computation for Lump Sum Distribution From Qualified Retirement Plan - Delaware

What Is Form 329?

This is a legal form that was released by the Delaware Department of Finance - Division of Revenue - a government authority operating within Delaware. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 329?

A: Form 329 is a tax form used for calculating the special tax computation for lump sum distributions from a qualified retirement plan in Delaware.

Q: Who needs to file Form 329?

A: Any individual who received a lump sum distribution from a qualified retirement plan in Delaware needs to file Form 329.

Q: What is a lump sum distribution?

A: A lump sum distribution is a one-time payment or withdrawal made from a qualified retirement plan.

Q: What is a qualified retirement plan?

A: A qualified retirement plan is a retirement savings plan that meets specific IRS requirements and provides tax advantages, such as a 401(k) or an IRA.

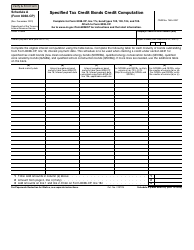

Q: What does Form 329 help calculate?

A: Form 329 helps calculate the special tax computation for the lump sum distribution, taking into account any rollovers or transfers.

Q: Are there any deadlines for filing Form 329?

A: Yes, Form 329 must be filed within 30 days of receiving the lump sum distribution.

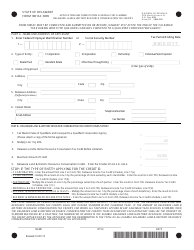

Q: Do I need to include any supporting documents with Form 329?

A: Yes, you need to attach a statement from the payer of the distribution that provides specific information about the distribution.

Q: Are there any penalties for not filing Form 329?

A: Yes, failure to file Form 329 or filing it late may result in penalties and interest charges.

Q: Can I e-file Form 329?

A: No, Form 329 must be filed by mail or hand-delivered to the Delaware Division of Revenue.

Form Details:

- Released on August 1, 2018;

- The latest edition provided by the Delaware Department of Finance - Division of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 329 by clicking the link below or browse more documents and templates provided by the Delaware Department of Finance - Division of Revenue.