This version of the form is not currently in use and is provided for reference only. Download this version of

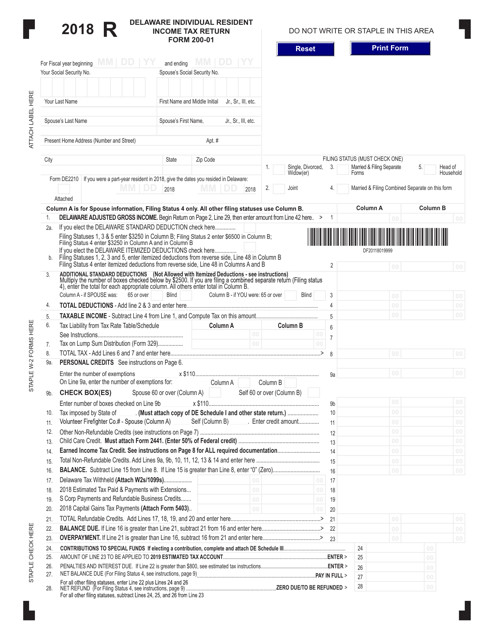

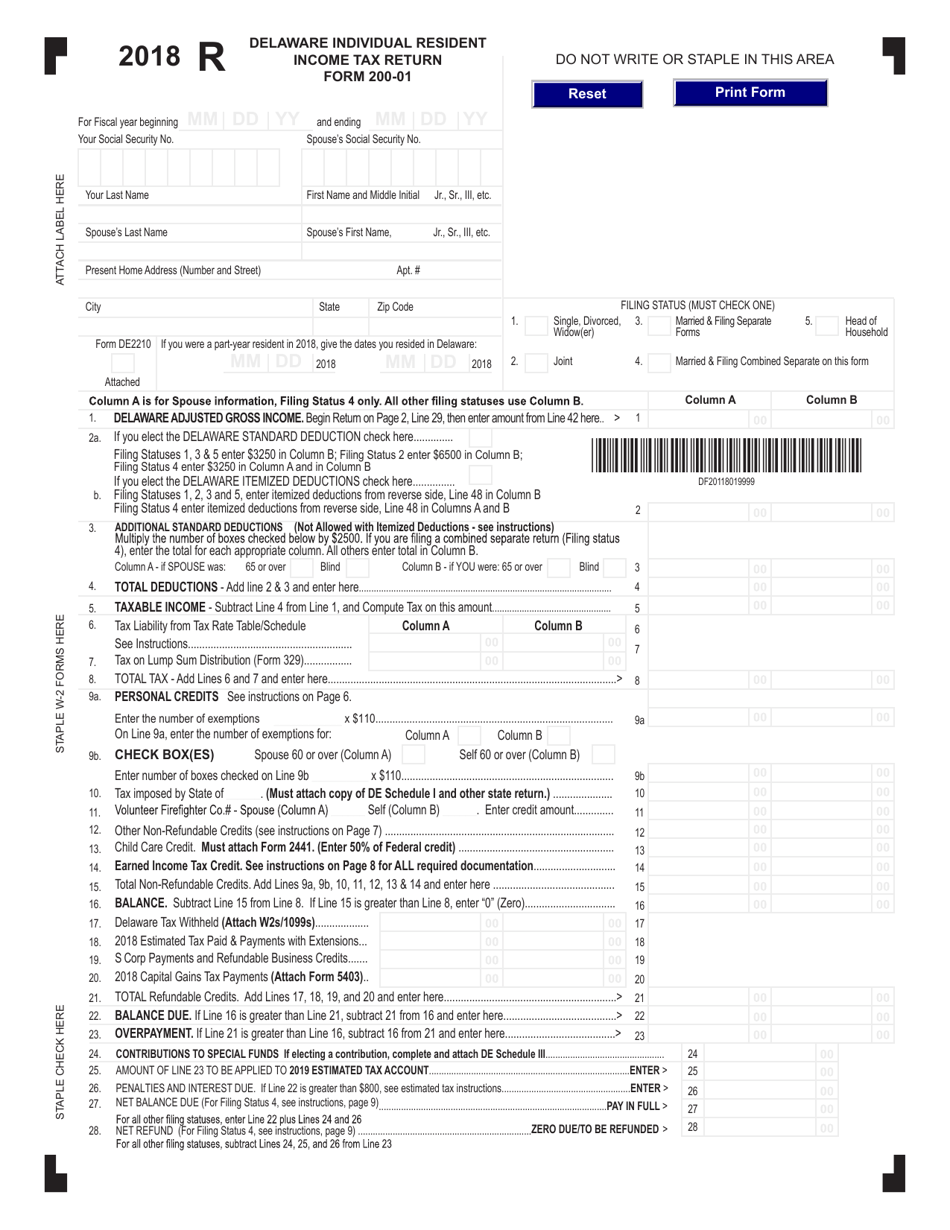

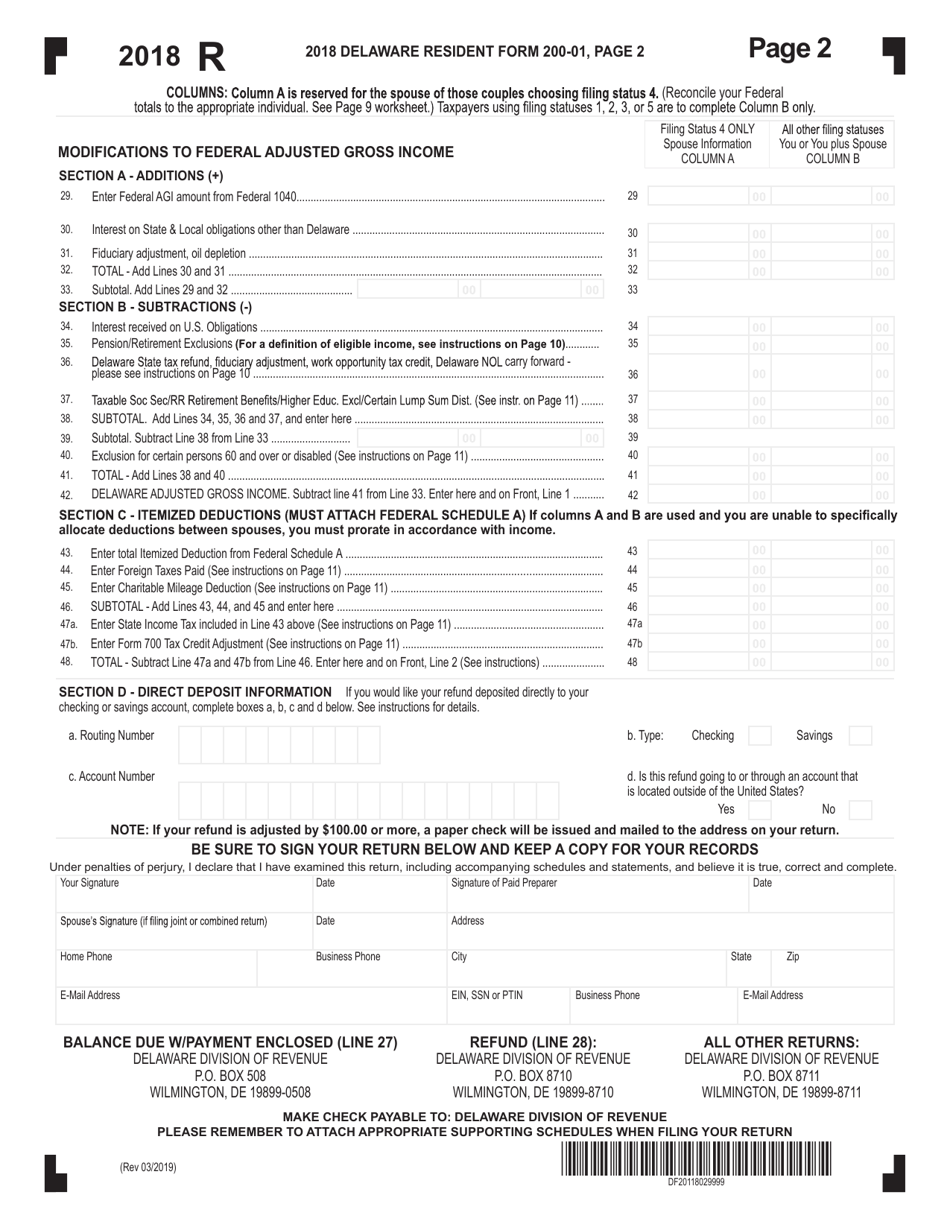

Form 200-01

for the current year.

Form 200-01 Individual Resident Income Tax Return - Delaware

What Is Form 200-01?

This is a legal form that was released by the Delaware Department of Finance - Division of Revenue - a government authority operating within Delaware. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 200-01?

A: Form 200-01 is the Individual Resident Income Tax Return for Delaware.

Q: Who needs to file Form 200-01?

A: Delaware residents who have earned income during the tax year are required to file Form 200-01.

Q: What is the purpose of Form 200-01?

A: Form 200-01 is used to report and calculate the amount of income tax owed by Delaware residents.

Q: When is the deadline for filing Form 200-01?

A: The deadline for filing Form 200-01 is April 30th of each year.

Q: Can I file Form 200-01 electronically?

A: Yes, Delaware residents have the option to file their Form 200-01 electronically.

Q: Do I need to include any supporting documents with Form 200-01?

A: Generally, you are not required to attach any supporting documents with Form 200-01. However, it is important to keep them for your records.

Q: What should I do if I cannot pay the full amount of tax owed?

A: If you are unable to pay the full amount of tax owed, you can reach out to the Delaware Division of Revenue to discuss payment options.

Q: What happens if I file Form 200-01 late?

A: If you file Form 200-01 after the deadline, you may be subject to penalties and interest on any unpaid tax amount.

Q: Can I amend my Form 200-01 if I make a mistake?

A: Yes, you can amend your Form 200-01 if you discover an error or omission after filing. You will need to file an amended return using Form 200-01X.

Form Details:

- Released on March 1, 2019;

- The latest edition provided by the Delaware Department of Finance - Division of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 200-01 by clicking the link below or browse more documents and templates provided by the Delaware Department of Finance - Division of Revenue.