This version of the form is not currently in use and is provided for reference only. Download this version of

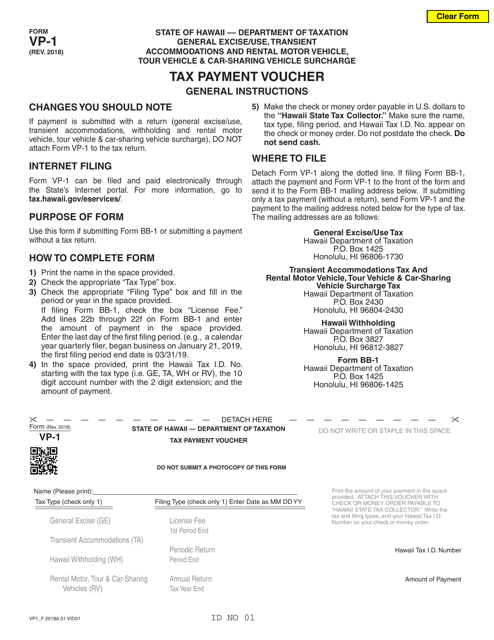

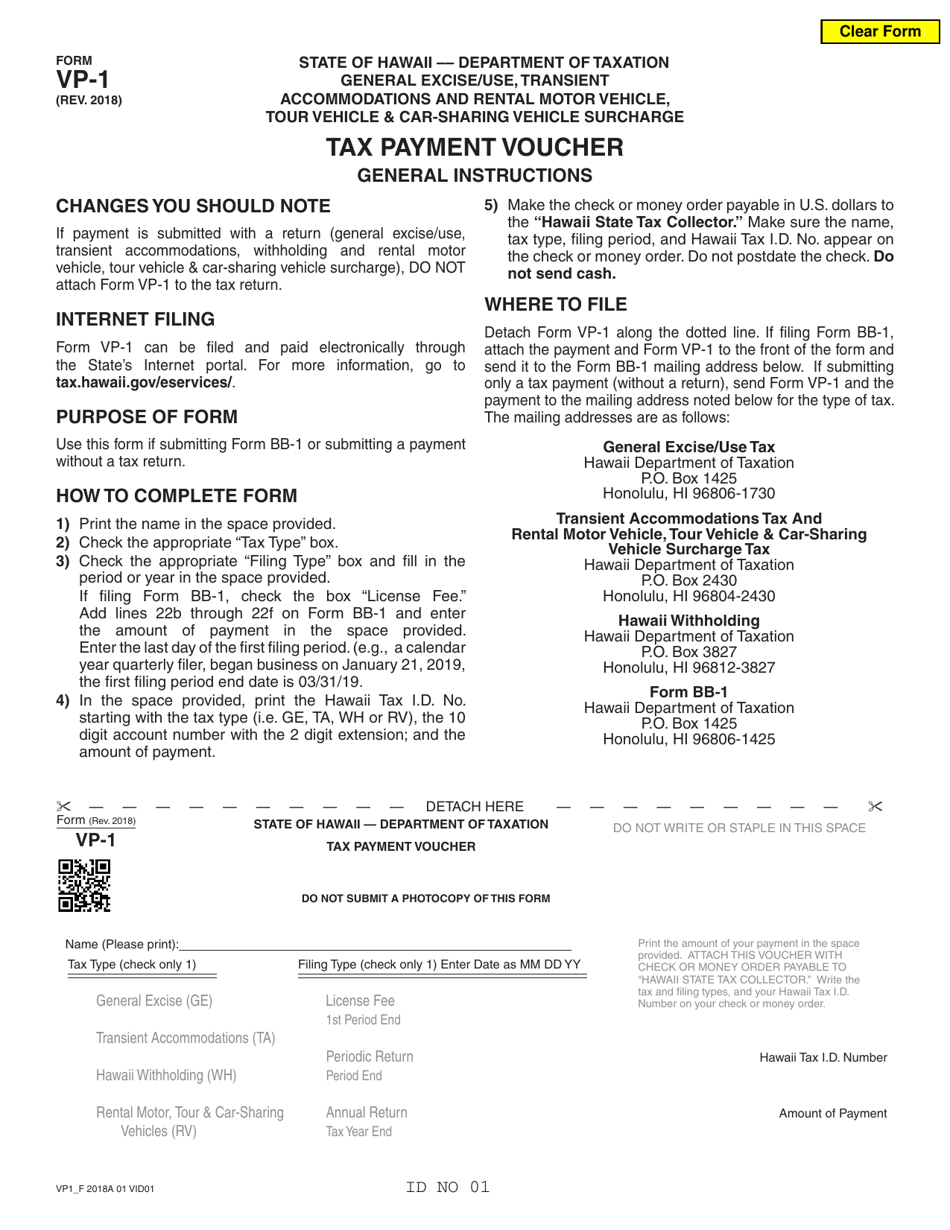

Form VP-1

for the current year.

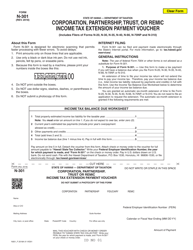

Form VP-1 Tax Payment Voucher - Hawaii

What Is Form VP-1?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form VP-1?

A: The Form VP-1 is a Tax Payment Voucher.

Q: What is the purpose of the Form VP-1?

A: The purpose of the Form VP-1 is to remit tax payments to the state of Hawaii.

Q: Who needs to file the Form VP-1?

A: Individuals or businesses that owe taxes to the state of Hawaii need to file the Form VP-1.

Q: When is the deadline to file the Form VP-1?

A: The Form VP-1 must be filed and payment must be submitted by the due date for the specific tax period.

Form Details:

- Released on January 1, 2018;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form VP-1 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.