This version of the form is not currently in use and is provided for reference only. Download this version of

Schedule D-1

for the current year.

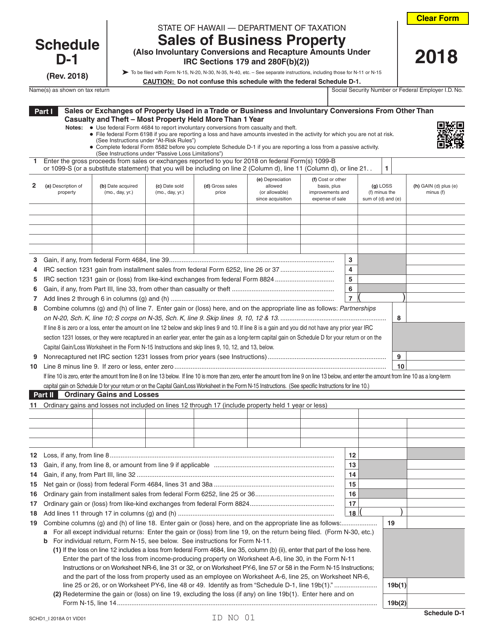

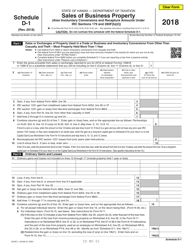

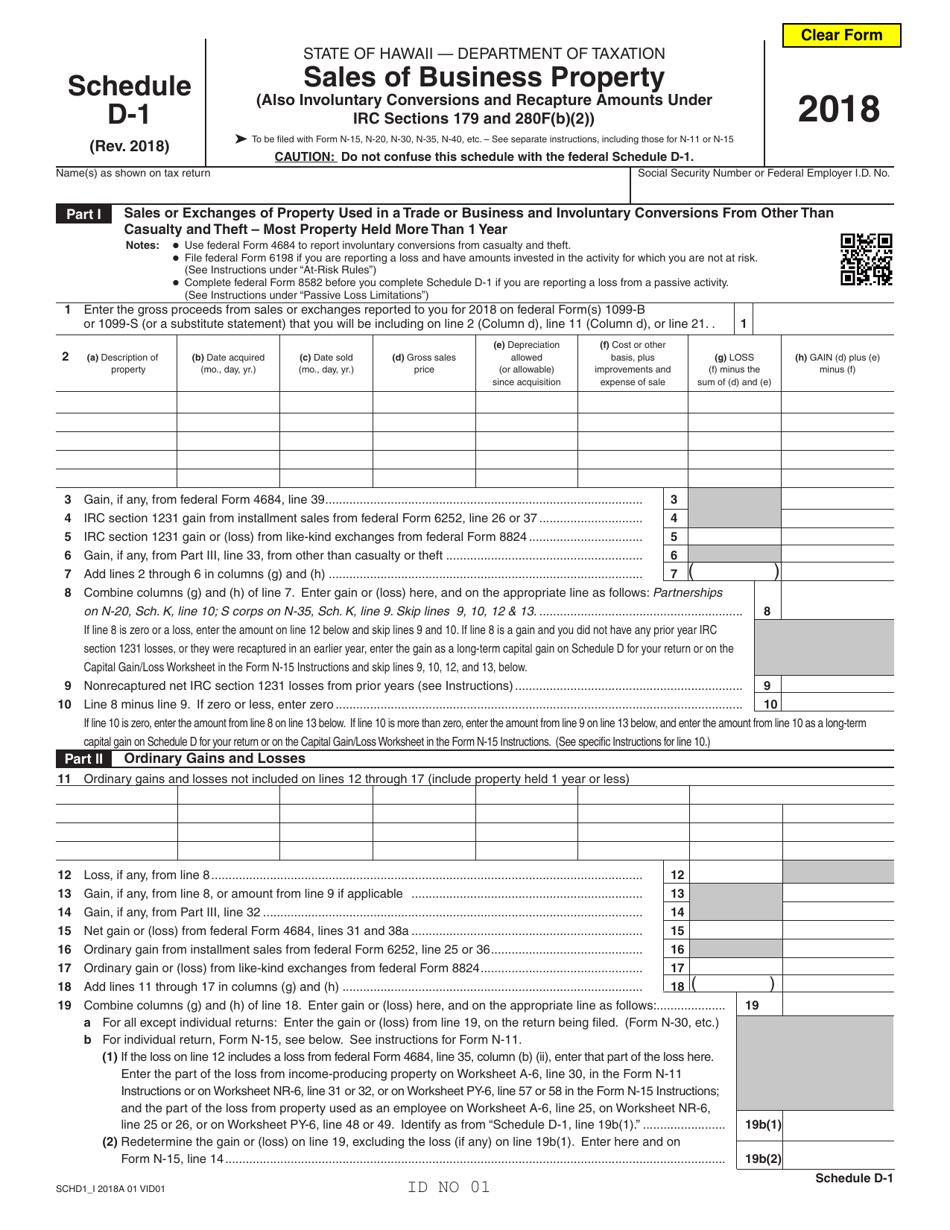

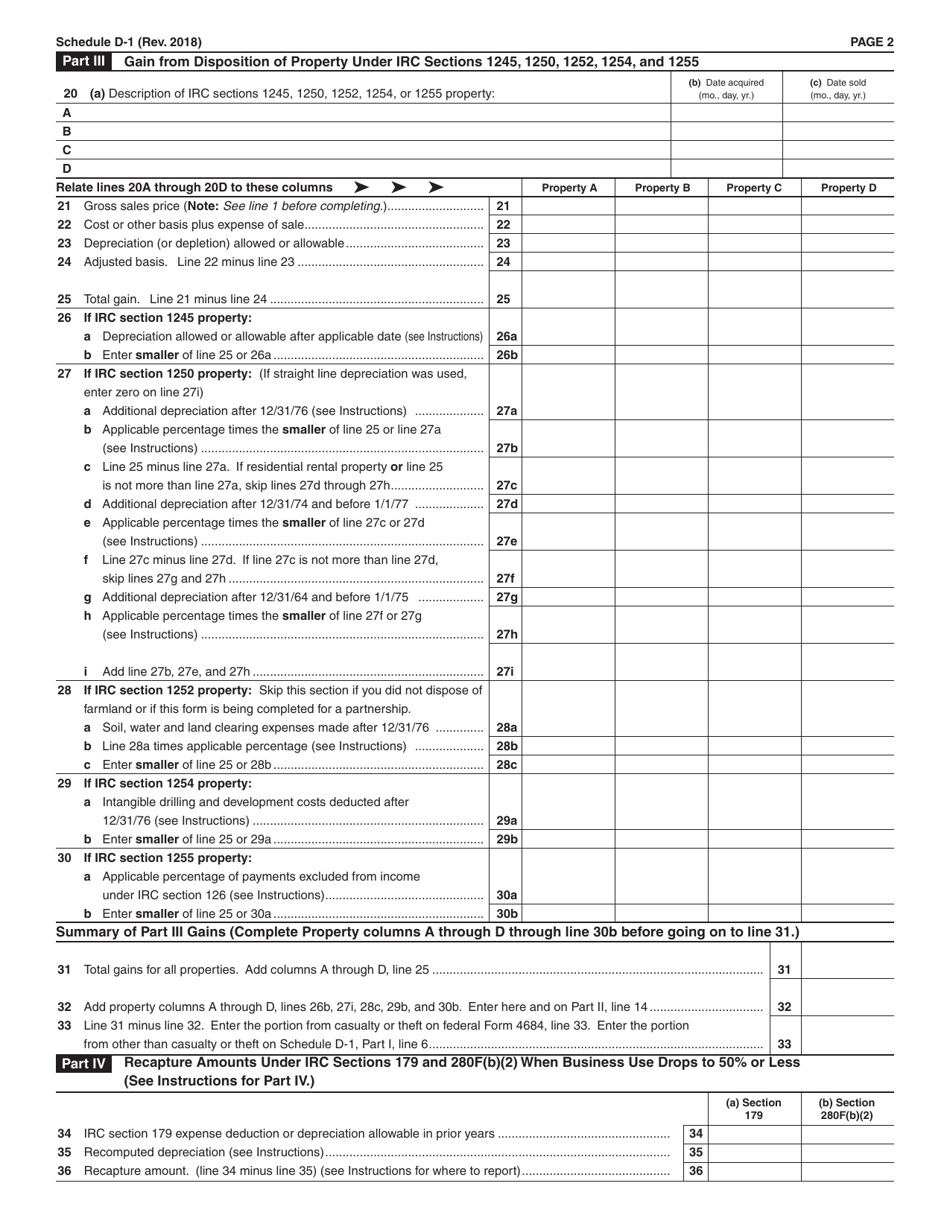

Schedule D-1 Sales of Business Property - Hawaii

What Is Schedule D-1?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Schedule D-1?

A: Schedule D-1 is a form used to report the sales of business property in Hawaii.

Q: Who needs to file Schedule D-1?

A: Individuals and businesses who have sold business property in Hawaii need to file Schedule D-1.

Q: What information is required on Schedule D-1?

A: Schedule D-1 requires information about the property sold, the selling price, and any gain or loss realized.

Q: When is Schedule D-1 due?

A: Schedule D-1 is due on the same date as your Hawaii individual income tax return, which is typically April 20th.

Form Details:

- Released on January 1, 2018;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Schedule D-1 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.