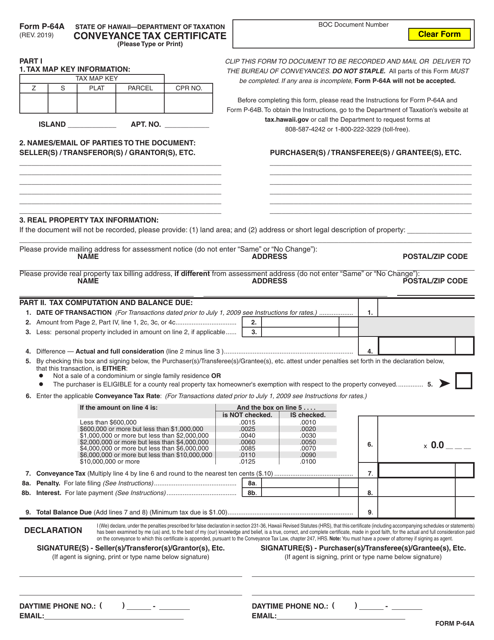

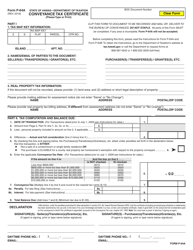

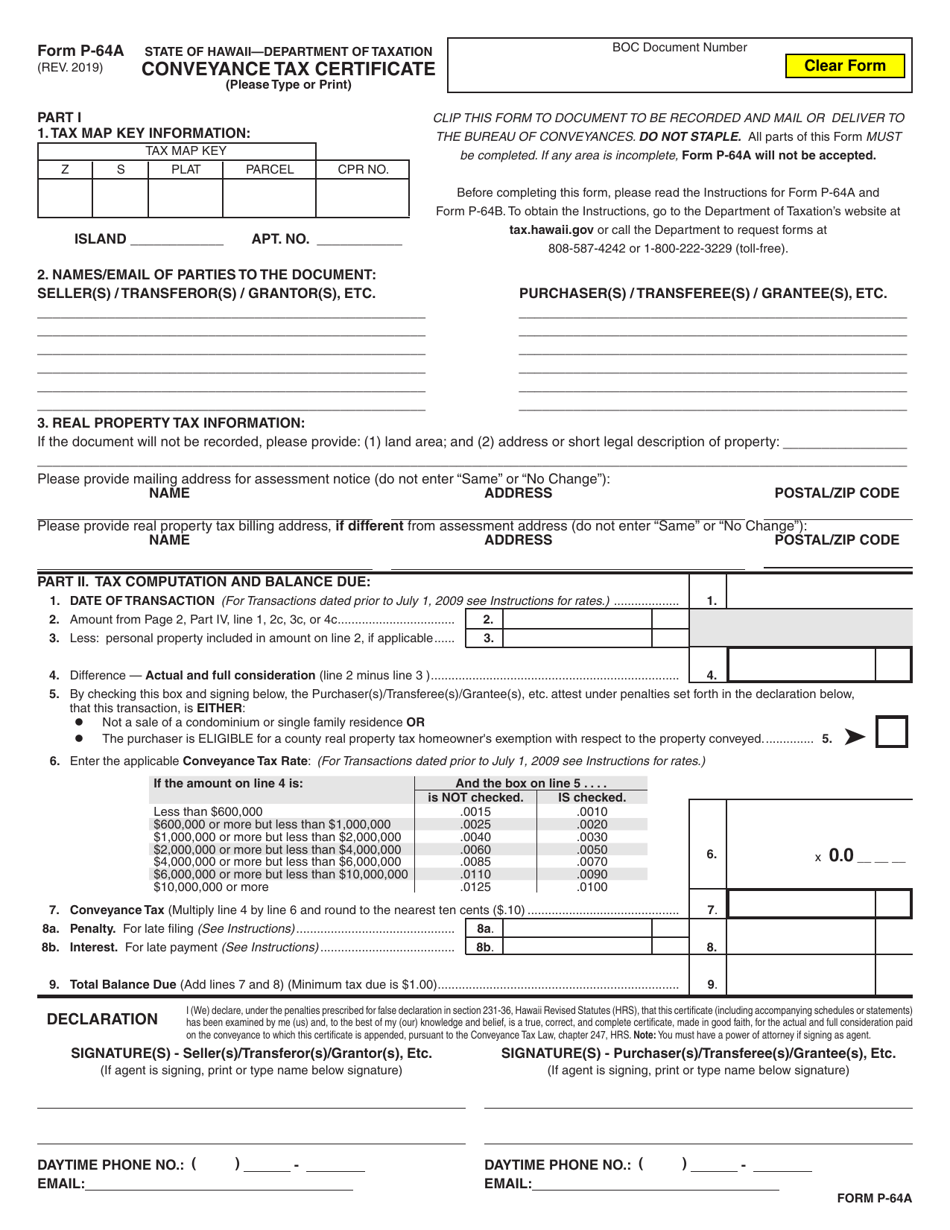

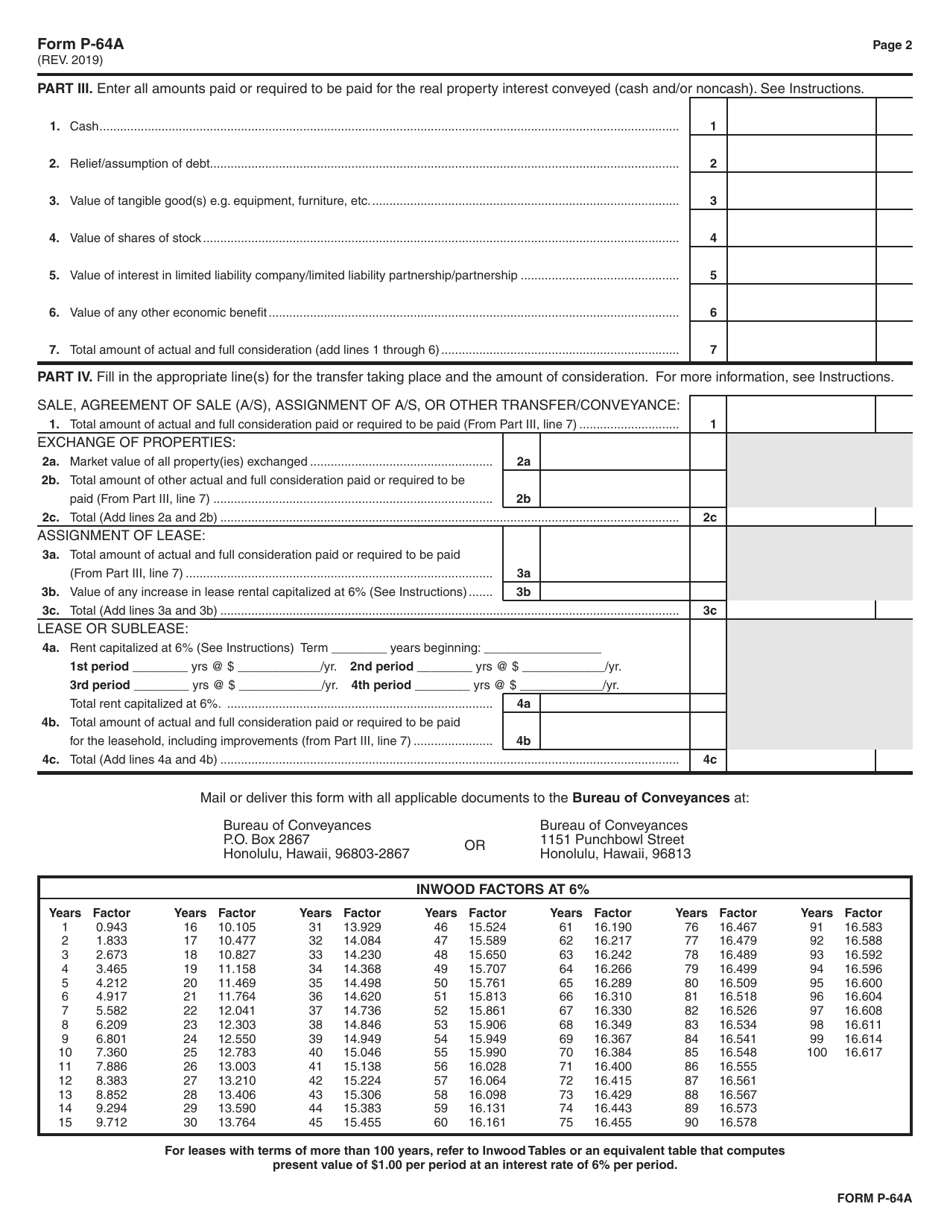

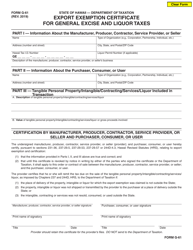

Form P-64A Conveyance Tax Certificate - Hawaii

What Is Form P-64A?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form P-64A?

A: Form P-64A is the Conveyance Tax Certificate used in Hawaii.

Q: What is the purpose of Form P-64A?

A: Form P-64A is used to report and pay conveyance taxes in Hawaii.

Q: Who needs to file Form P-64A?

A: Anyone involved in a real estate transaction in Hawaii, such as buyers, sellers, and transferees, needs to file Form P-64A.

Q: When do I need to file Form P-64A?

A: Form P-64A must be filed within 10 days after the conveyance of real property in Hawaii.

Q: What information is required on Form P-64A?

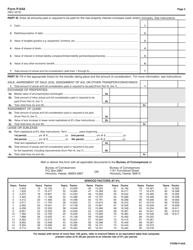

A: Form P-64A requires information about the property, the buyers and sellers, and the terms of the transaction.

Q: Are there any exemptions or deductions available on Form P-64A?

A: Yes, there are certain exemptions and deductions available on Form P-64A for certain types of transactions.

Q: What happens if I don't file Form P-64A or pay the conveyance taxes?

A: Failure to file Form P-64A or pay the conveyance taxes can result in penalties and interest being assessed by the Hawaii Department of Taxation.

Form Details:

- Released on January 1, 2019;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form P-64A by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.