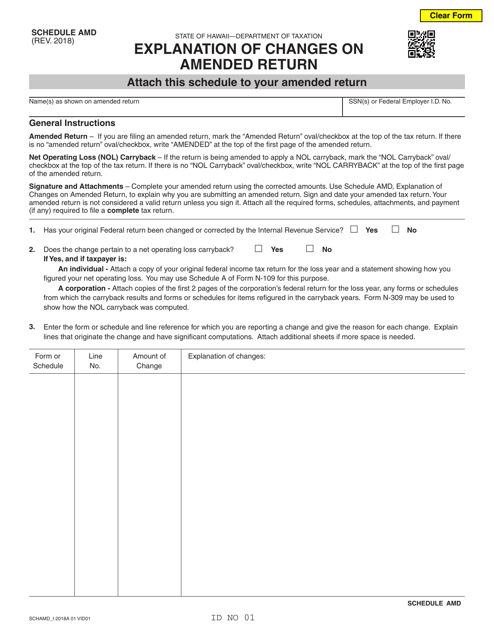

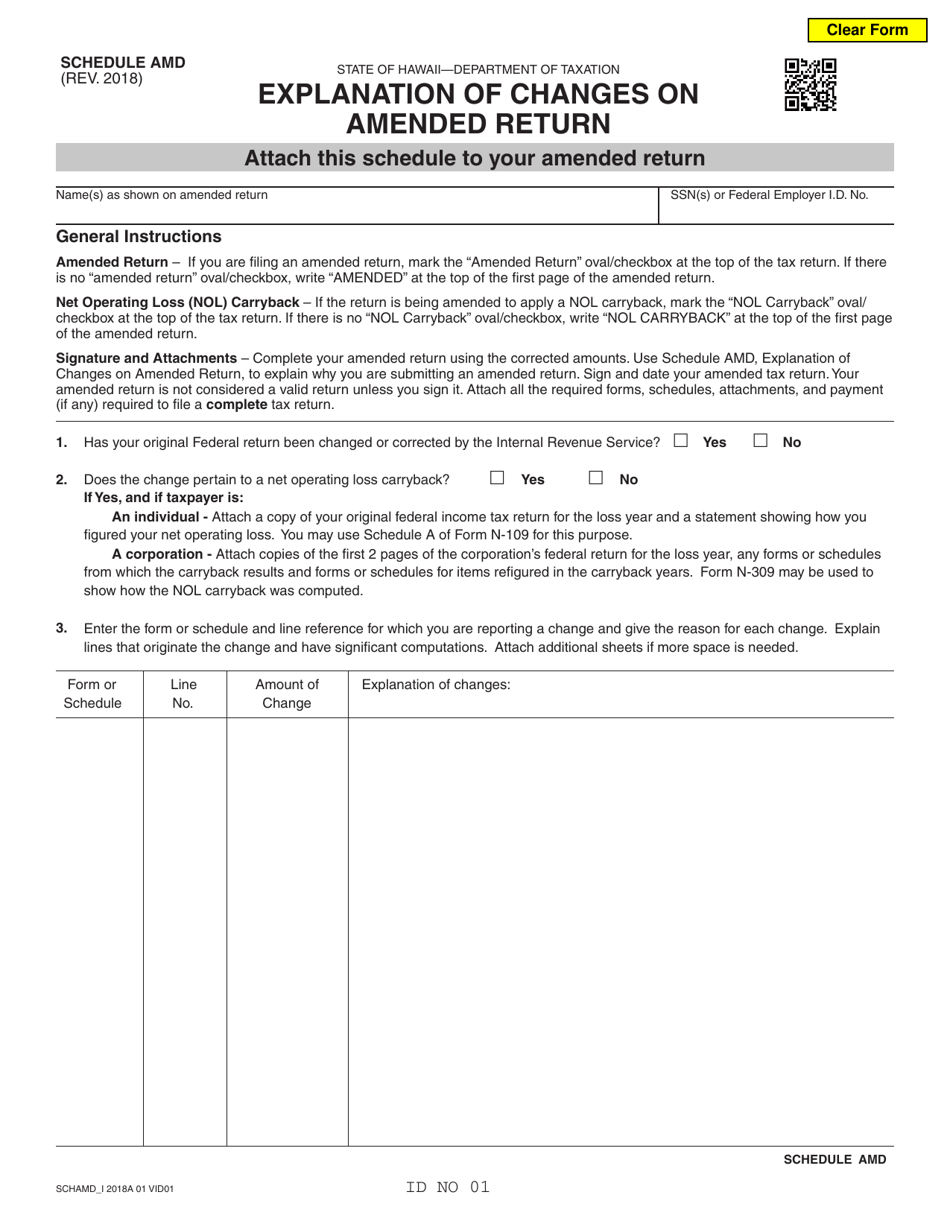

Schedule AMD Explanation of Changes on Amended Return - Hawaii

What Is Schedule AMD?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is an amended return?

A: An amended return is a tax return that you file to make corrections or update information on a tax return you previously filed.

Q: Why would I need to file an amended return?

A: You may need to file an amended return if you made an error on your original return, if you received new information that changes your tax liability, or if you need to claim a refund or credit that you missed on your original return.

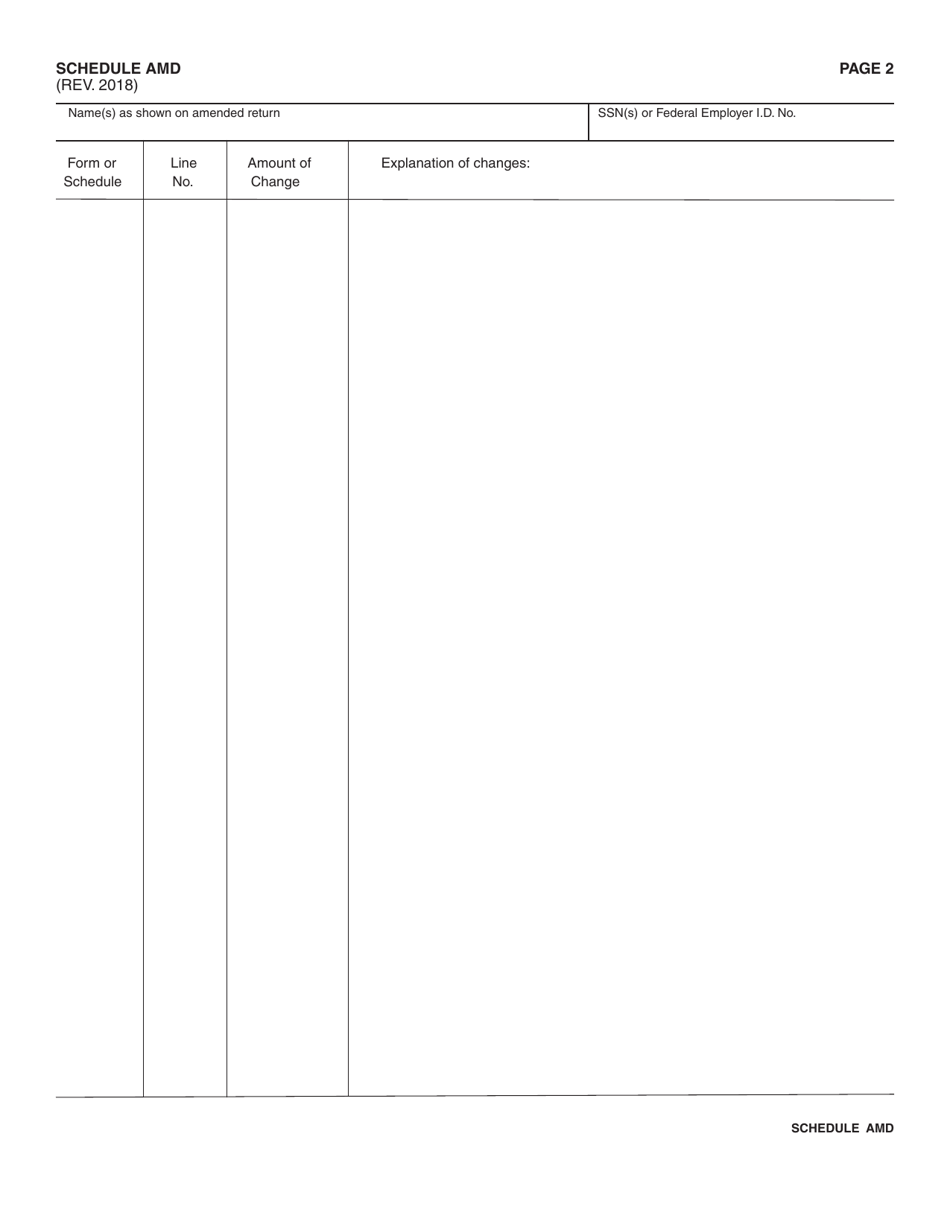

Q: What is Schedule AMD?

A: Schedule AMD is a form used to explain the changes made on your amended return. It provides details about the specific changes and the reasons for those changes.

Q: Do I need to file Schedule AMD for every amended return?

A: You only need to file Schedule AMD if there are changes made on your amended return that need explanation. If there are no changes that need explanation, you do not need to file Schedule AMD.

Q: How do I fill out Schedule AMD?

A: You will need to provide your personal information, such as your name and Social Security number, and then provide a clear and concise explanation of the changes made on your amended return.

Q: Can I e-file Schedule AMD?

A: No, you cannot e-file Schedule AMD. It must be filed by mail along with your amended return.

Form Details:

- Released on January 1, 2018;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Schedule AMD by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.