This version of the form is not currently in use and is provided for reference only. Download this version of

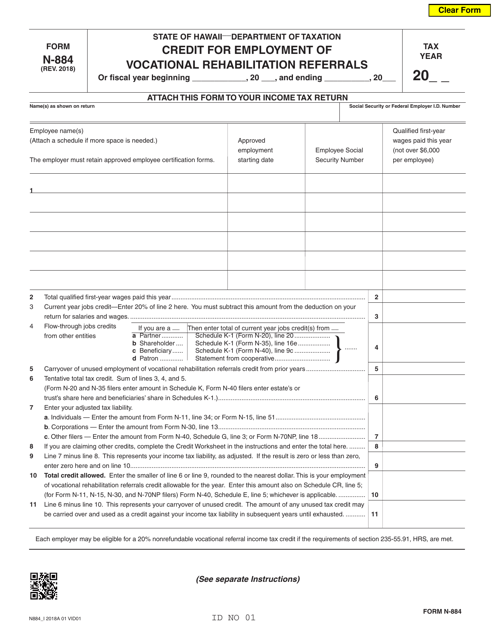

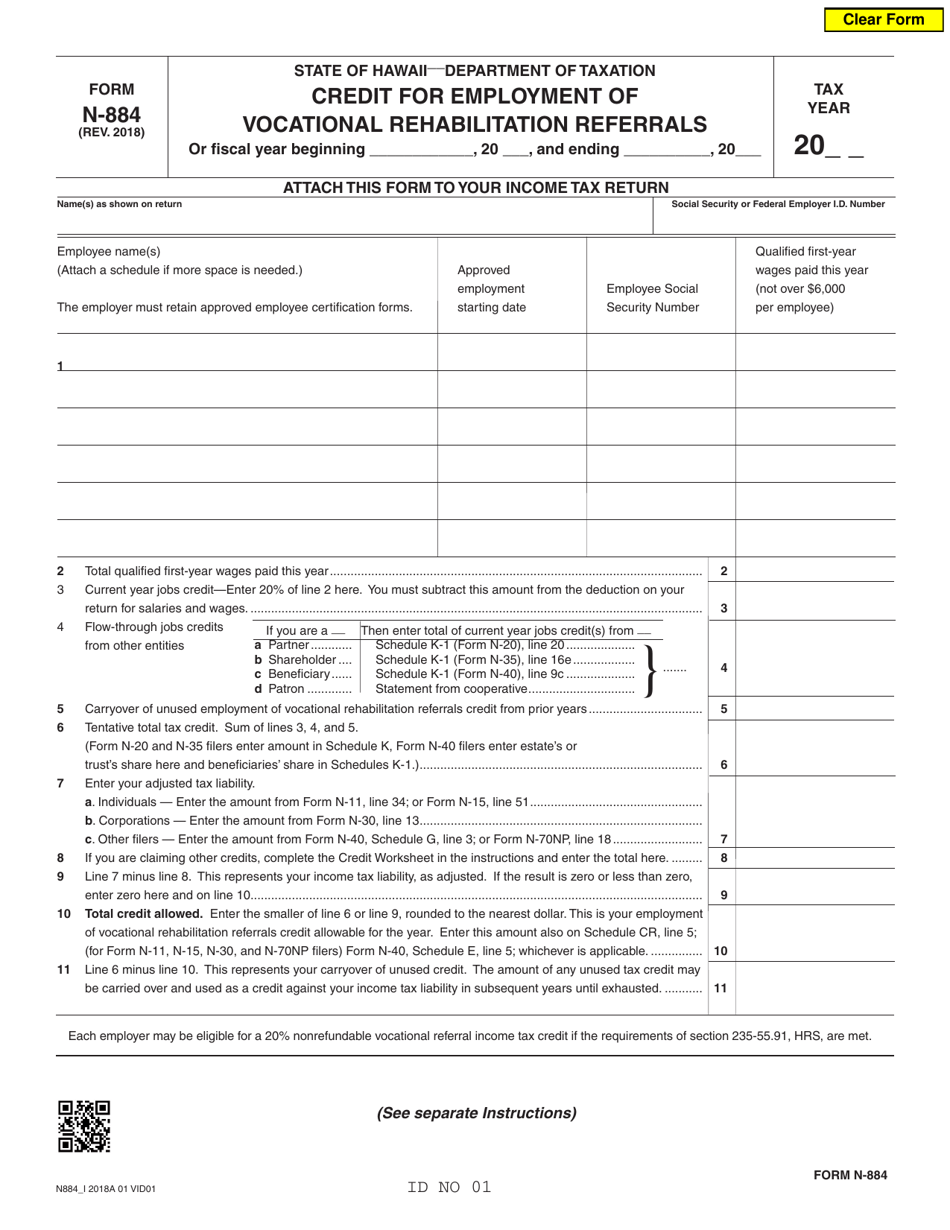

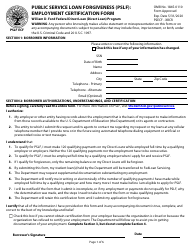

Form N-884

for the current year.

Form N-884 Credit for Employment of Vocational Rehabilitation Referrals - Hawaii

What Is Form N-884?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form N-884?

A: Form N-884 is a tax form used to claim the Credit for Employment of Vocational Rehabilitation Referrals.

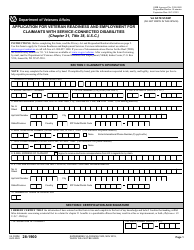

Q: Who is eligible to use Form N-884?

A: Employers in Hawaii who hire individuals referred by vocational rehabilitation agencies may be eligible to use Form N-884.

Q: What is the purpose of the Credit for Employment of Vocational Rehabilitation Referrals?

A: The purpose of this credit is to encourage employers to hire individuals with disabilities who have been referred by vocational rehabilitation agencies.

Q: How much is the credit?

A: The credit amount varies and is based on the wages paid to qualifying employees.

Q: How do I claim the credit?

A: To claim the credit, employers must complete Form N-884 and attach it to their Hawaii tax return.

Q: Is there a deadline to file Form N-884?

A: Yes, Form N-884 must be filed by the due date of your Hawaii tax return.

Q: Are there any restrictions or limitations for claiming the credit?

A: Yes, there are certain eligibility requirements and limitations for claiming the credit. It is recommended to review the instructions for Form N-884 for more details.

Q: Can I claim this credit if I hire individuals with disabilities from sources other than vocational rehabilitation agencies?

A: No, the credit is specifically for employers who hire individuals referred by vocational rehabilitation agencies.

Form Details:

- Released on January 1, 2018;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form N-884 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.