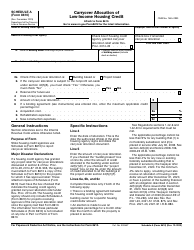

This version of the form is not currently in use and is provided for reference only. Download this version of

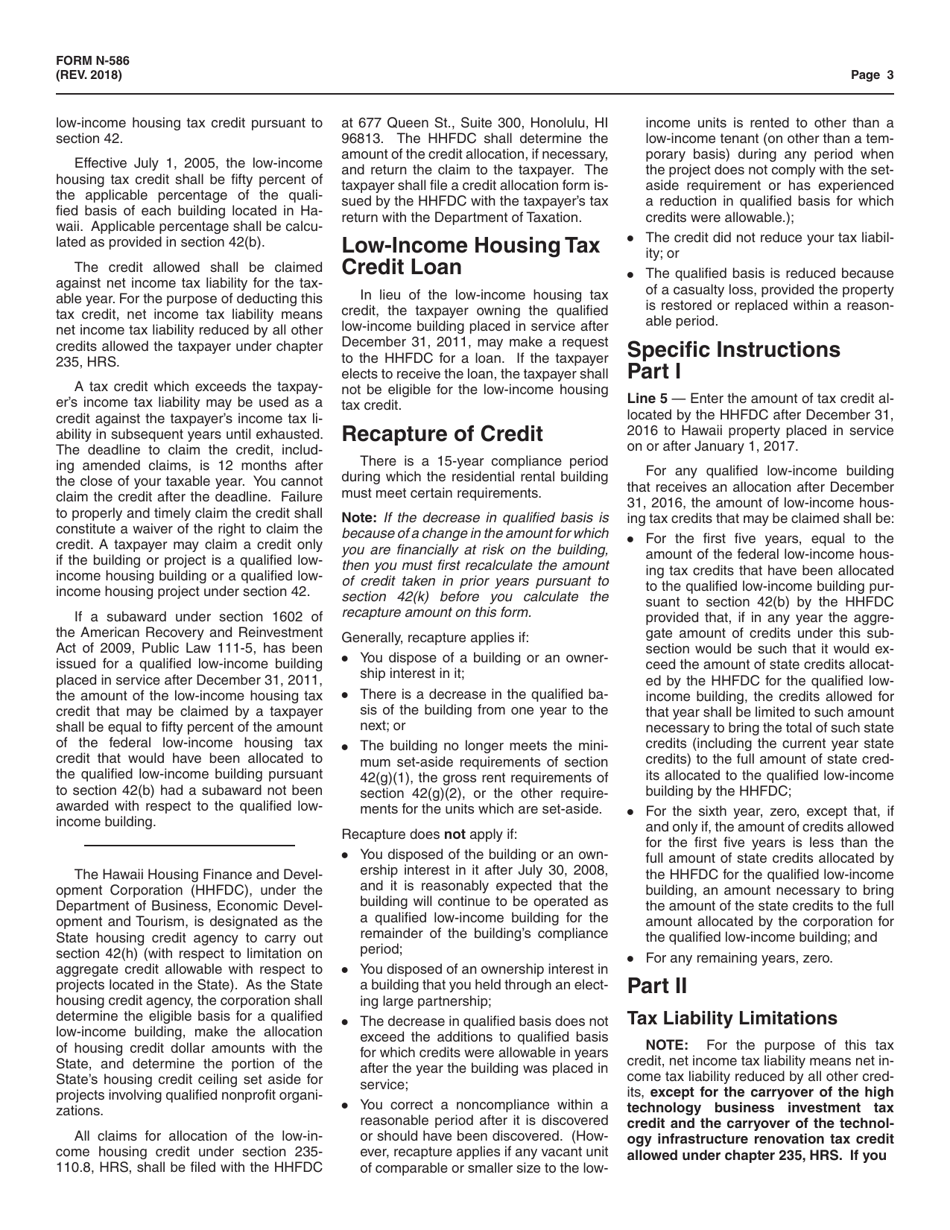

Form N-586

for the current year.

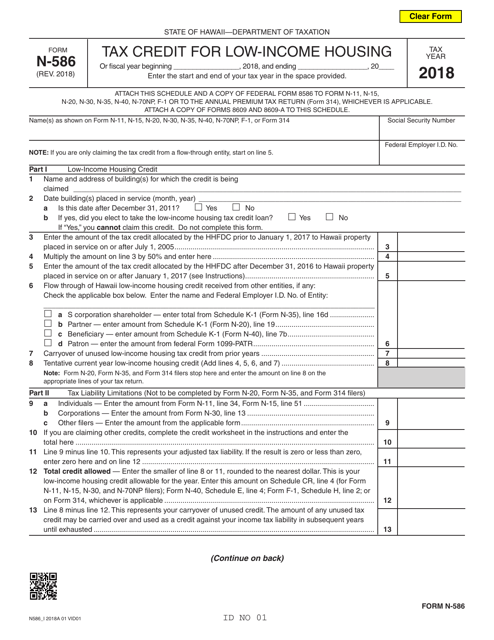

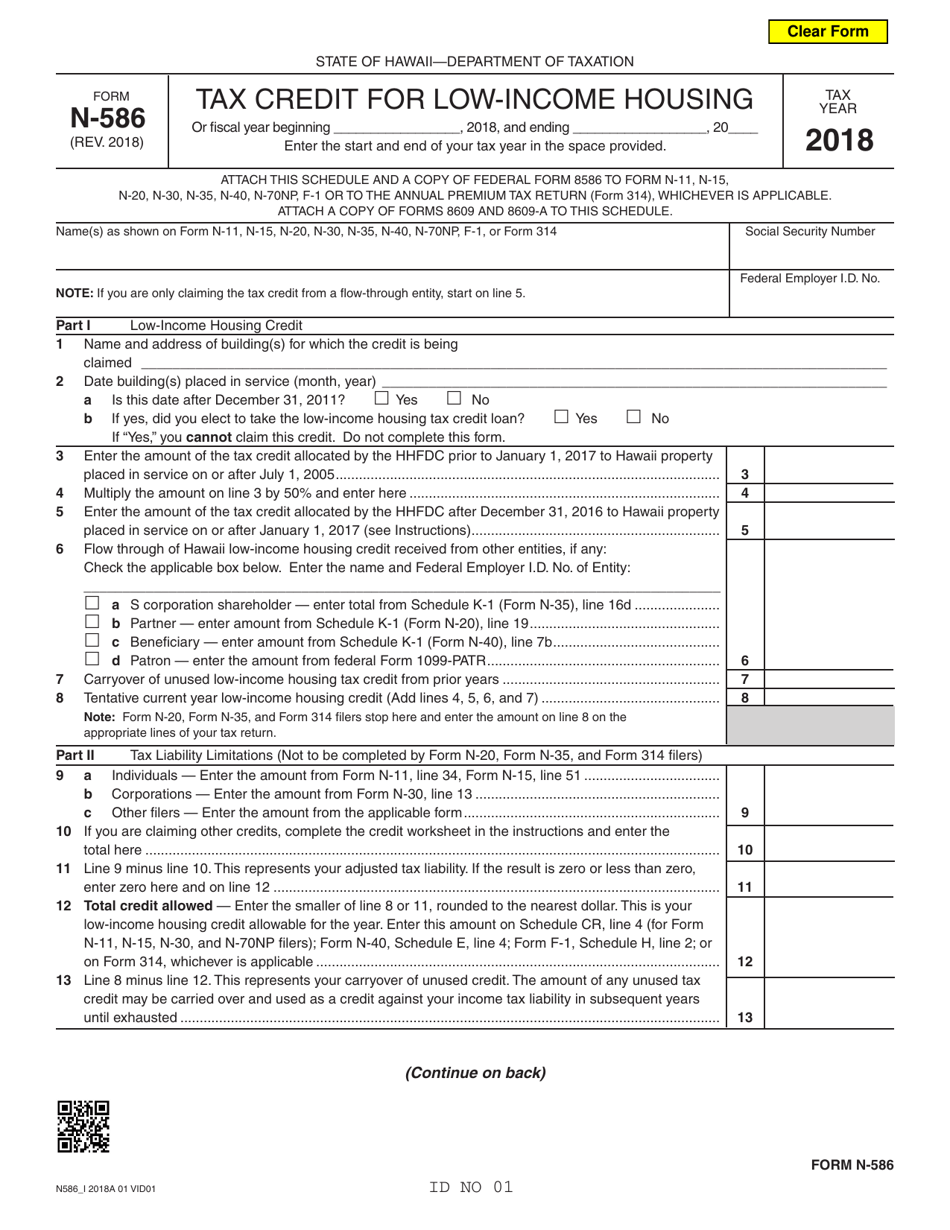

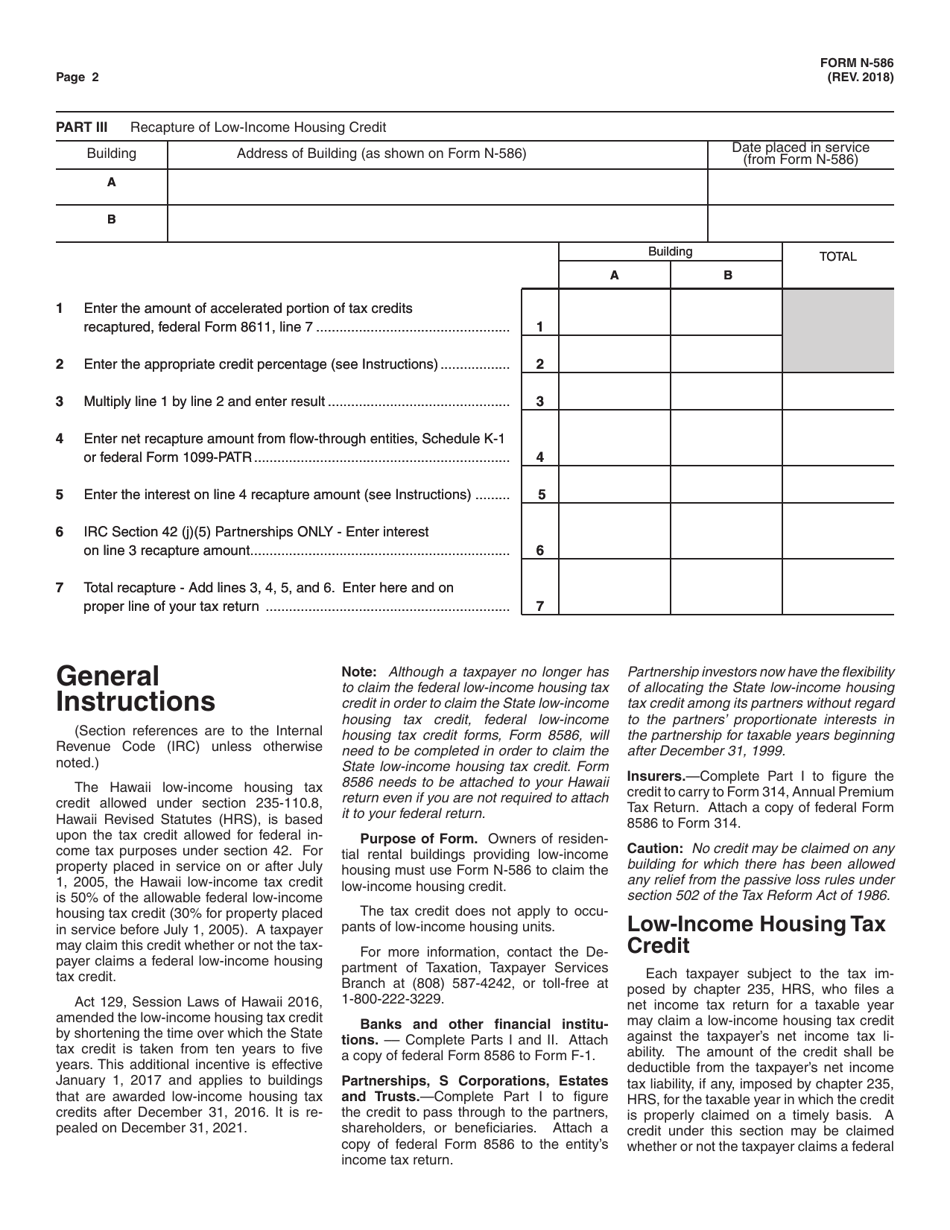

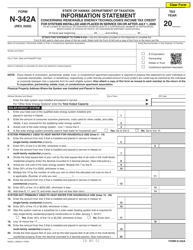

Form N-586 Tax Credit for Low-Income Housing - Hawaii

What Is Form N-586?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form N-586?

A: Form N-586 is a tax form specifically for claiming a tax credit for low-income housing in Hawaii.

Q: Who can use Form N-586?

A: Form N-586 can be used by individuals or businesses that own or have invested in low-income housing projects in Hawaii.

Q: What is the purpose of Form N-586?

A: The purpose of Form N-586 is to claim a tax credit for providing affordable housing to low-income individuals and families in Hawaii.

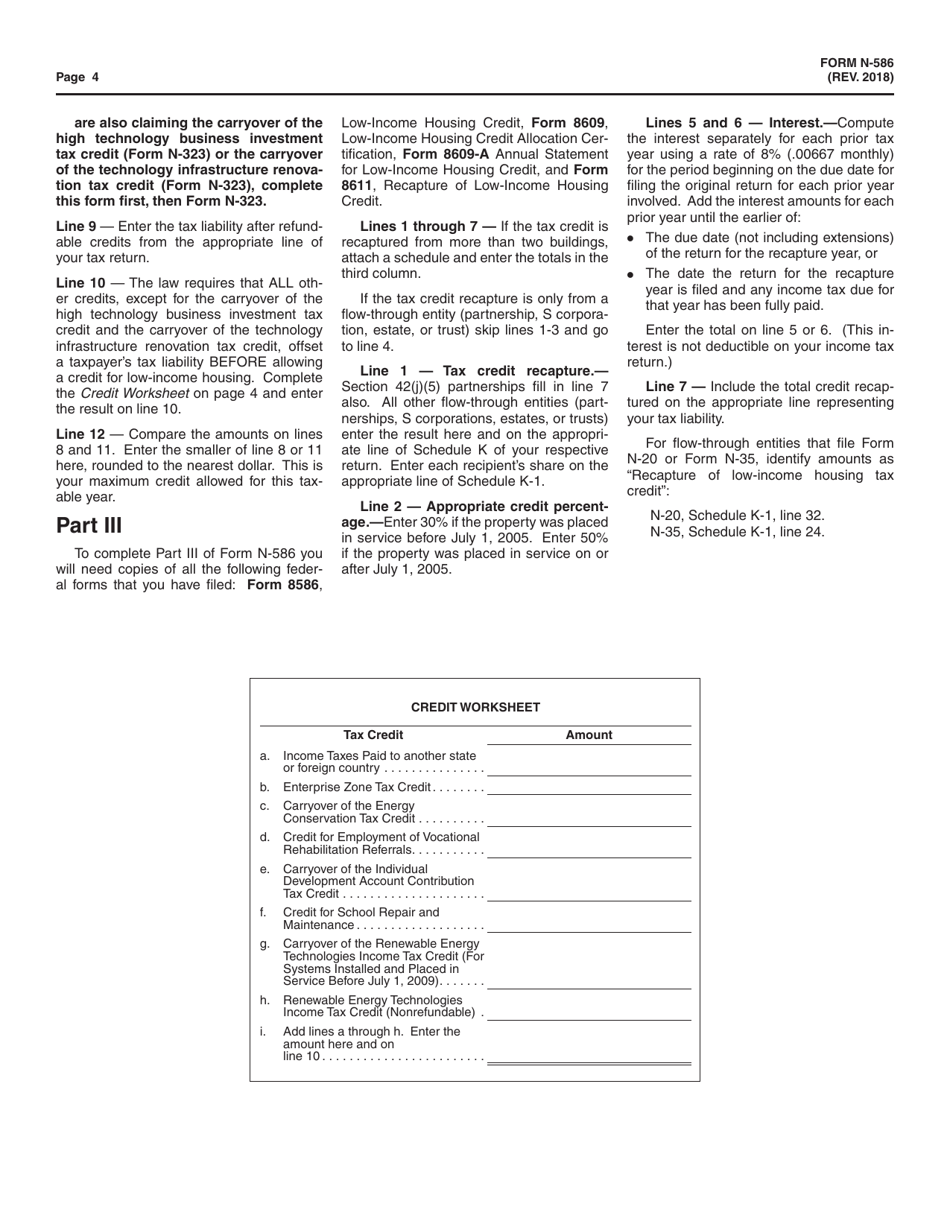

Q: What information is required on Form N-586?

A: Form N-586 requires information about the low-income housing project, including the number of units, income eligibility requirements, and the amount of credit being claimed.

Q: When is Form N-586 due?

A: Form N-586 is due on or before the 20th day of the 4th month following the close of the tax year.

Q: Are there any other requirements or restrictions for claiming the low-income housing tax credit in Hawaii?

A: Yes, there are additional requirements and restrictions outlined in the instructions for Form N-586. It is recommended to review the instructions or consult with a tax professional for more information.

Form Details:

- Released on January 1, 2018;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form N-586 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.