This version of the form is not currently in use and is provided for reference only. Download this version of

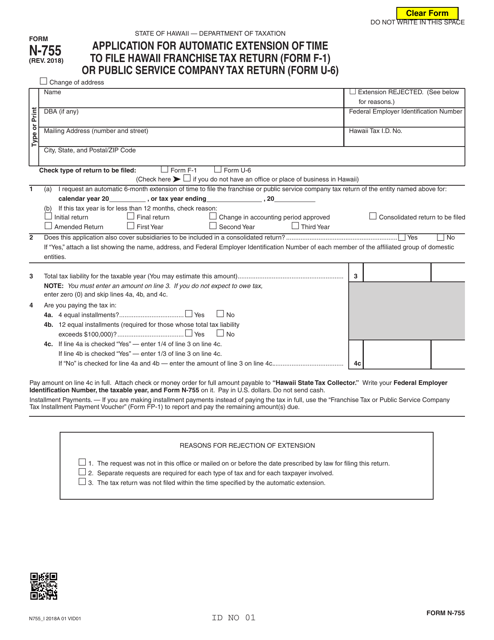

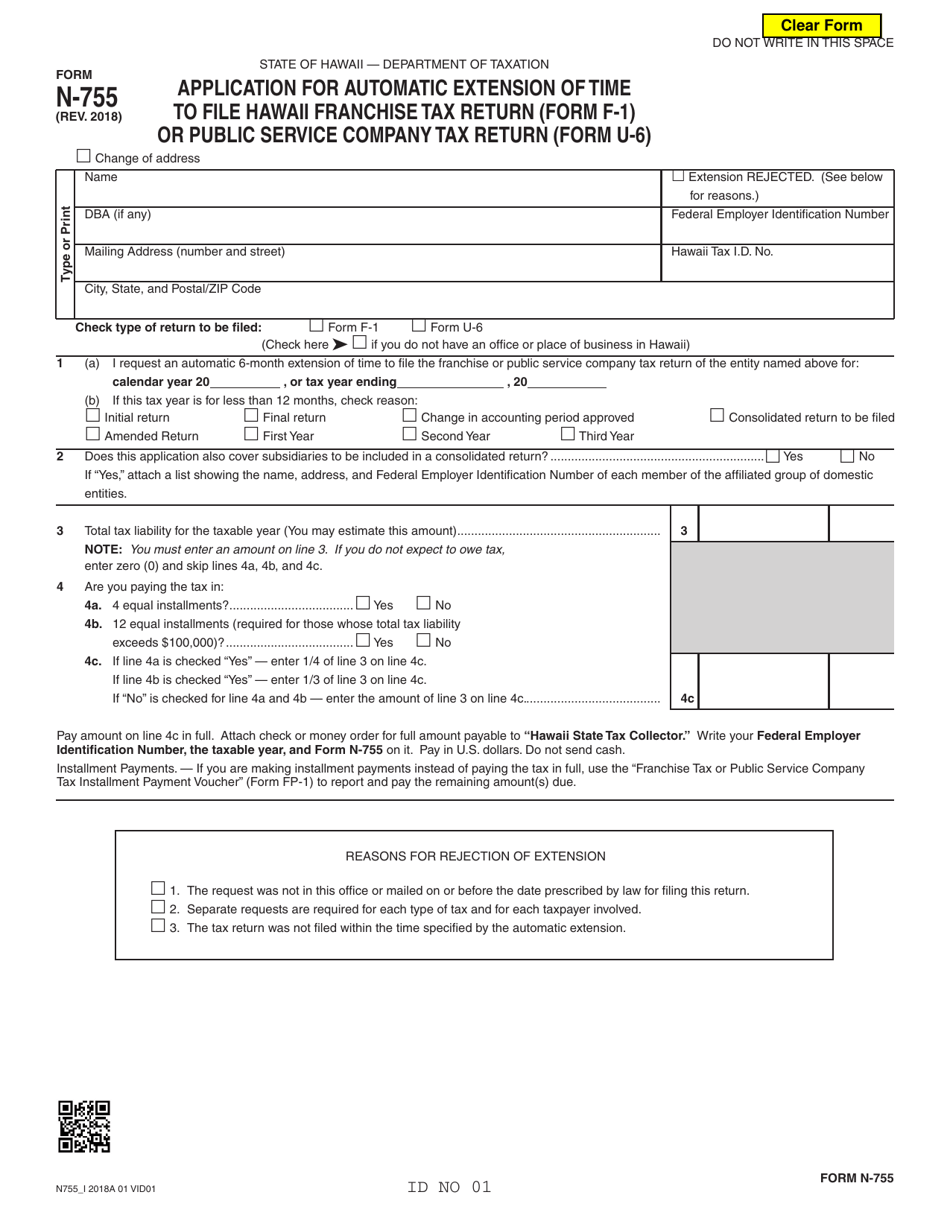

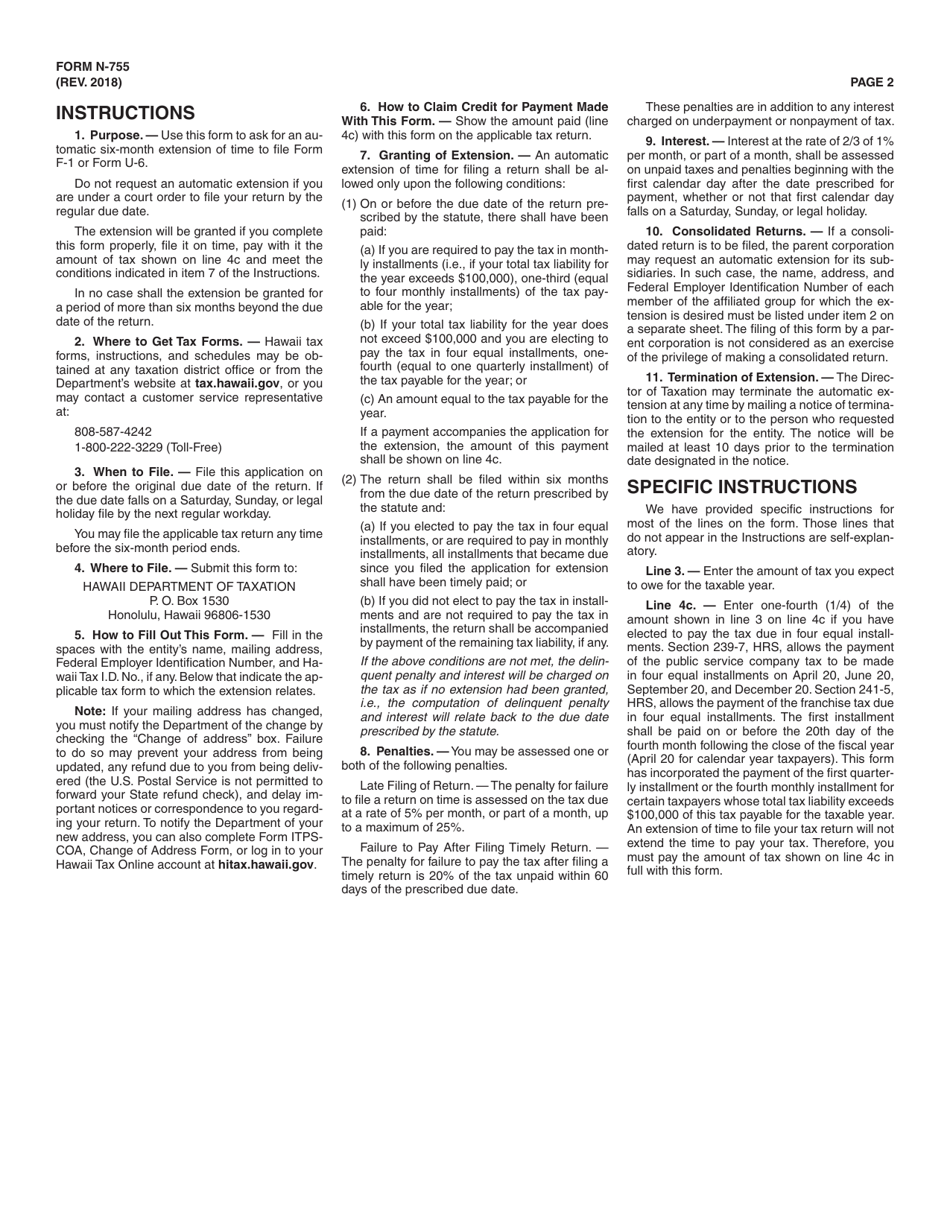

Form N-755

for the current year.

Form N-755 Application for Automatic Extension of Time to File Hawaii Franchise Tax Return (Form F-1) or Public Service Company Tax Return (Form U-6) - Hawaii

What Is Form N-755?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form N-755?

A: Form N-755 is the application for automatic extension of time to file the Hawaii Franchise Tax Return (Form F-1) or Public Service Company Tax Return (Form U-6).

Q: When is Form N-755 used?

A: Form N-755 is used when individuals or companies need additional time to file their Hawaii Franchise Tax Return (Form F-1) or Public Service Company Tax Return (Form U-6).

Q: How do I apply for an extension using Form N-755?

A: To apply for an extension, you need to complete and file Form N-755 with the Hawaii Department of Taxation.

Q: What is the deadline for filing Form N-755?

A: The deadline for filing Form N-755 is the same as the deadline for filing the Hawaii Franchise Tax Return (Form F-1) or Public Service Company Tax Return (Form U-6), typically on or before the 20th day of the fourth month.

Q: How long is the extension granted by Form N-755?

A: Form N-755 grants an automatic extension of time for filing your Hawaii Franchise Tax Return (Form F-1) or Public Service Company Tax Return (Form U-6) for an additional six months.

Form Details:

- Released on January 1, 2018;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form N-755 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.