This version of the form is not currently in use and is provided for reference only. Download this version of

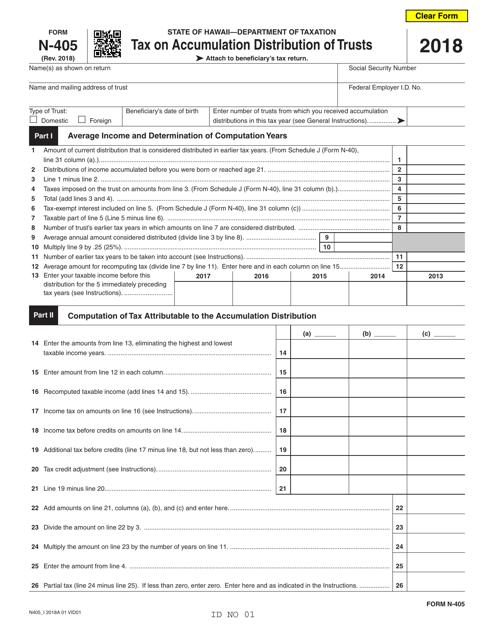

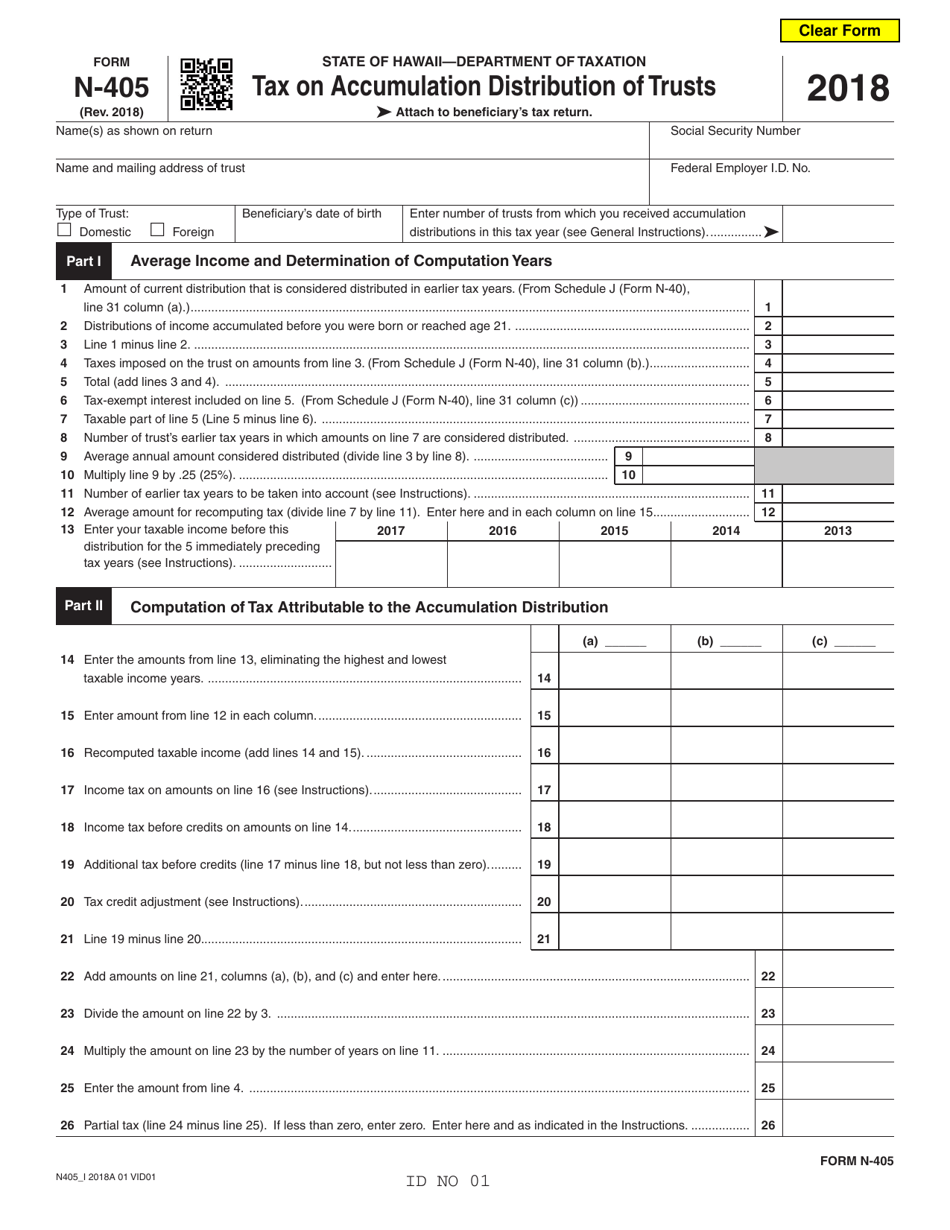

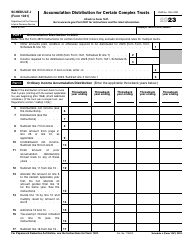

Form N-405

for the current year.

Form N-405 Tax on Accumulation Distribution of Trusts - Hawaii

What Is Form N-405?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form N-405?

A: Form N-405 is the tax return form used for reporting the accumulation distribution of trusts in Hawaii.

Q: What is an accumulation distribution?

A: An accumulation distribution is the distribution of income that a trust has accumulated and not distributed to the beneficiaries.

Q: Who needs to file Form N-405?

A: Trusts in Hawaii that have made accumulation distributions during the tax year need to file Form N-405.

Q: When is Form N-405 due?

A: Form N-405 is due on the same date as the trust's income tax return, which is typically April 20th.

Q: What information do I need to complete Form N-405?

A: You will need to provide information such as the trust's name, address, and taxpayer identification number, as well as details of the accumulation distribution.

Q: Is there a penalty for filing Form N-405 late?

A: Yes, there may be penalties for filing Form N-405 late, so it is important to file it on time.

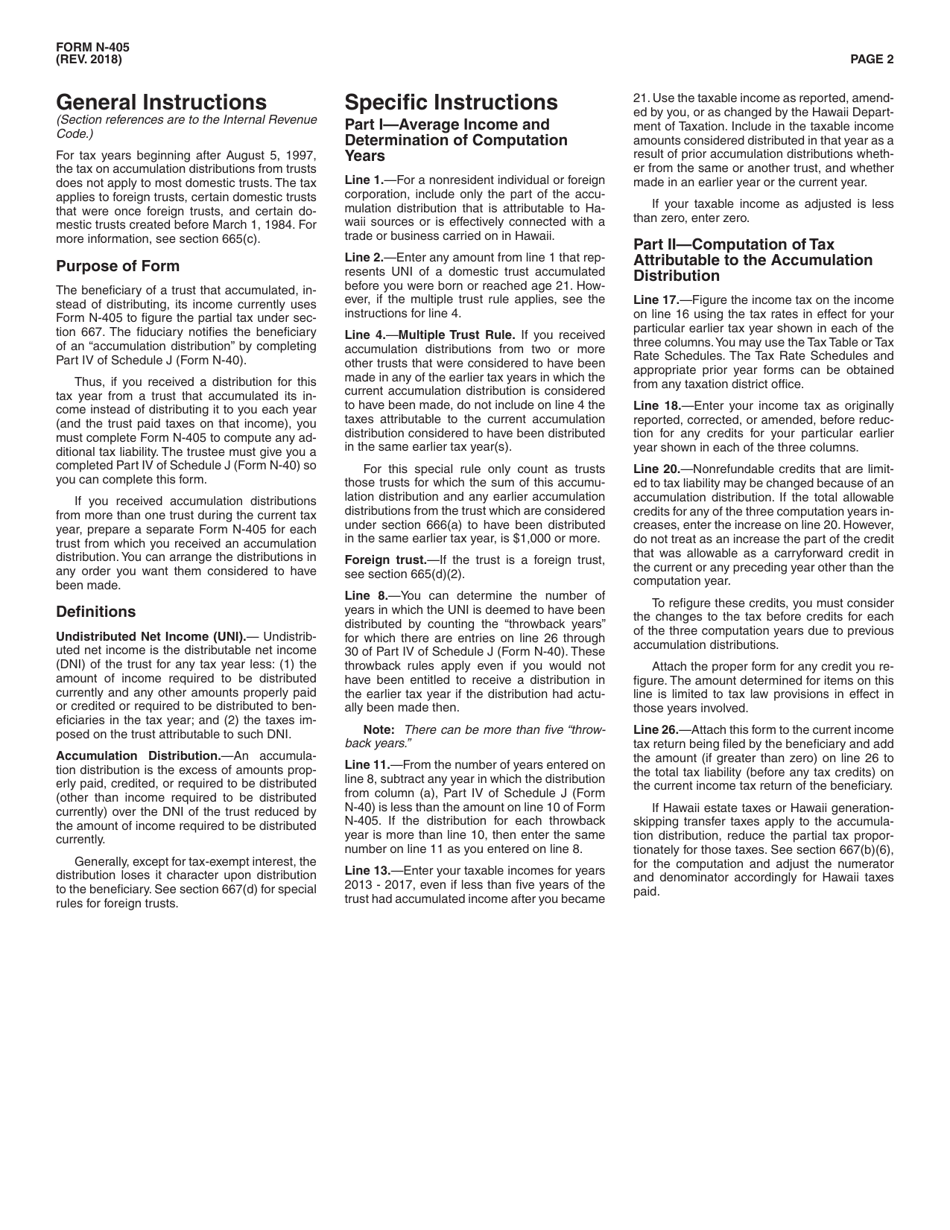

Q: Are there any special considerations for filling out Form N-405?

A: It is recommended to consult with a tax professional or refer to the instructions provided with the form for any specific considerations or guidance.

Q: What happens if I don't file Form N-405?

A: If you fail to file Form N-405 when required, you may be subject to penalties and interest on the unpaid tax amount.

Form Details:

- Released on January 1, 2018;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form N-405 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.