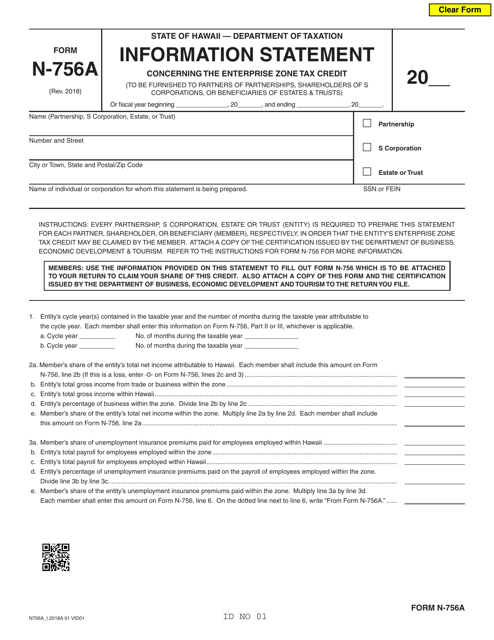

Form N-756A Information Statement Concerning the Enterprise Zone Tax Credit - Hawaii

What Is Form N-756A?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form N-756A?

A: Form N-756A is the Information Statement concerning the Enterprise ZoneTax Credit in Hawaii.

Q: Why is Form N-756A used?

A: Form N-756A is used to provide information about the Enterprise Zone Tax Credit in Hawaii.

Q: Who is eligible for the Enterprise Zone Tax Credit?

A: Certain businesses that operate within designated enterprise zones in Hawaii may be eligible for the tax credit.

Q: What information is required on Form N-756A?

A: Form N-756A requires information such as the taxpayer's name, address, contact information, and details about the business and the enterprise zone.

Form Details:

- Released on January 1, 2018;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form N-756A by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.