This version of the form is not currently in use and is provided for reference only. Download this version of

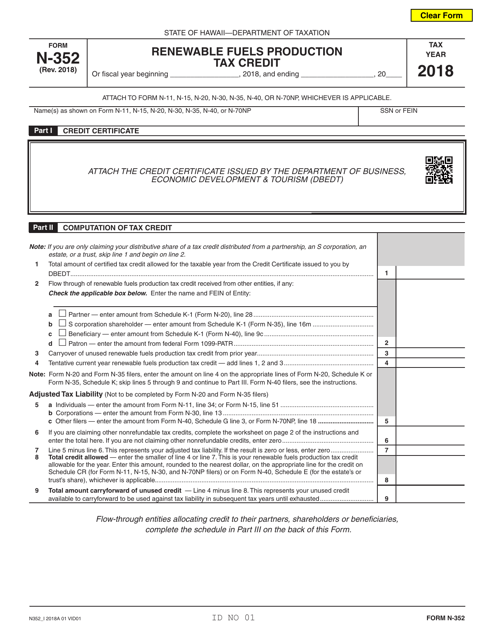

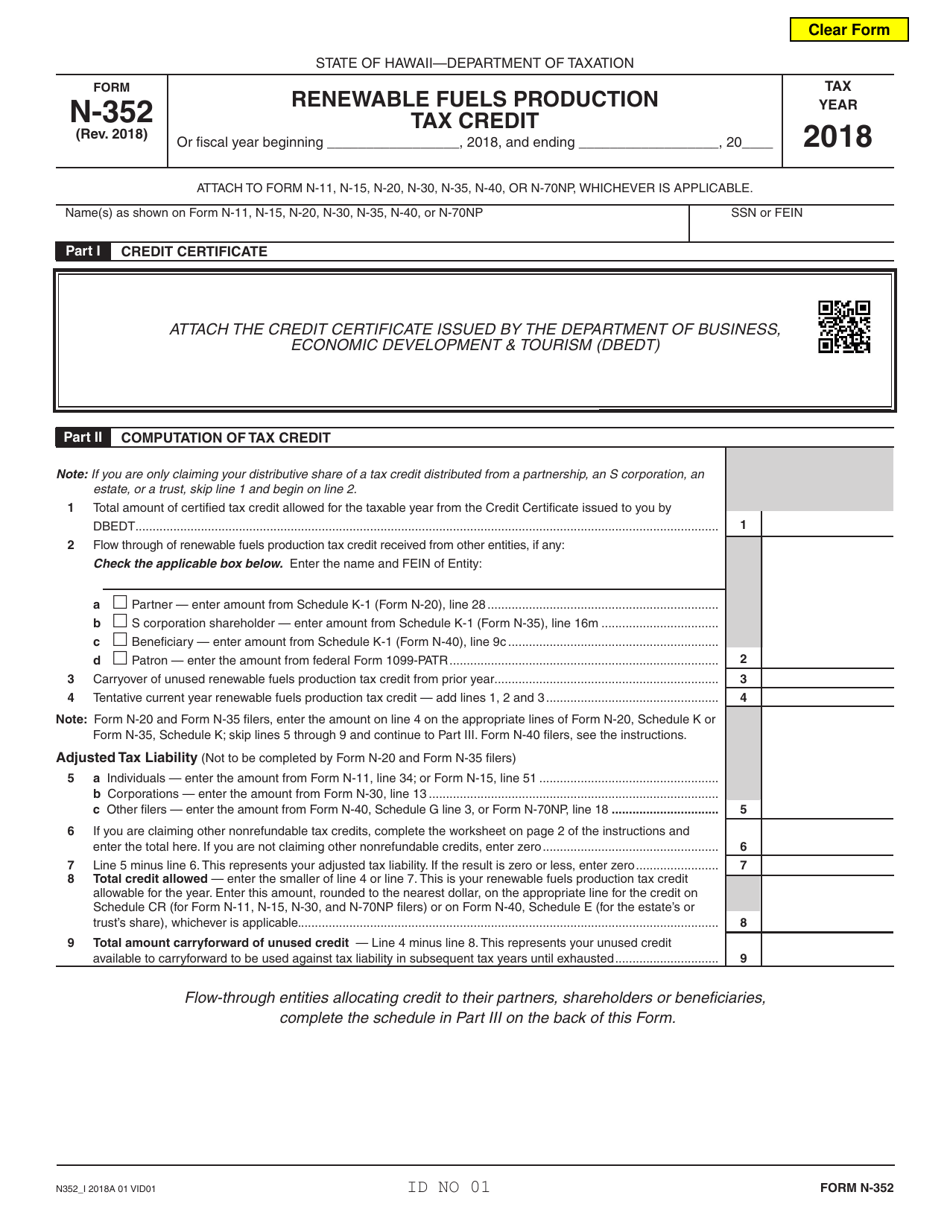

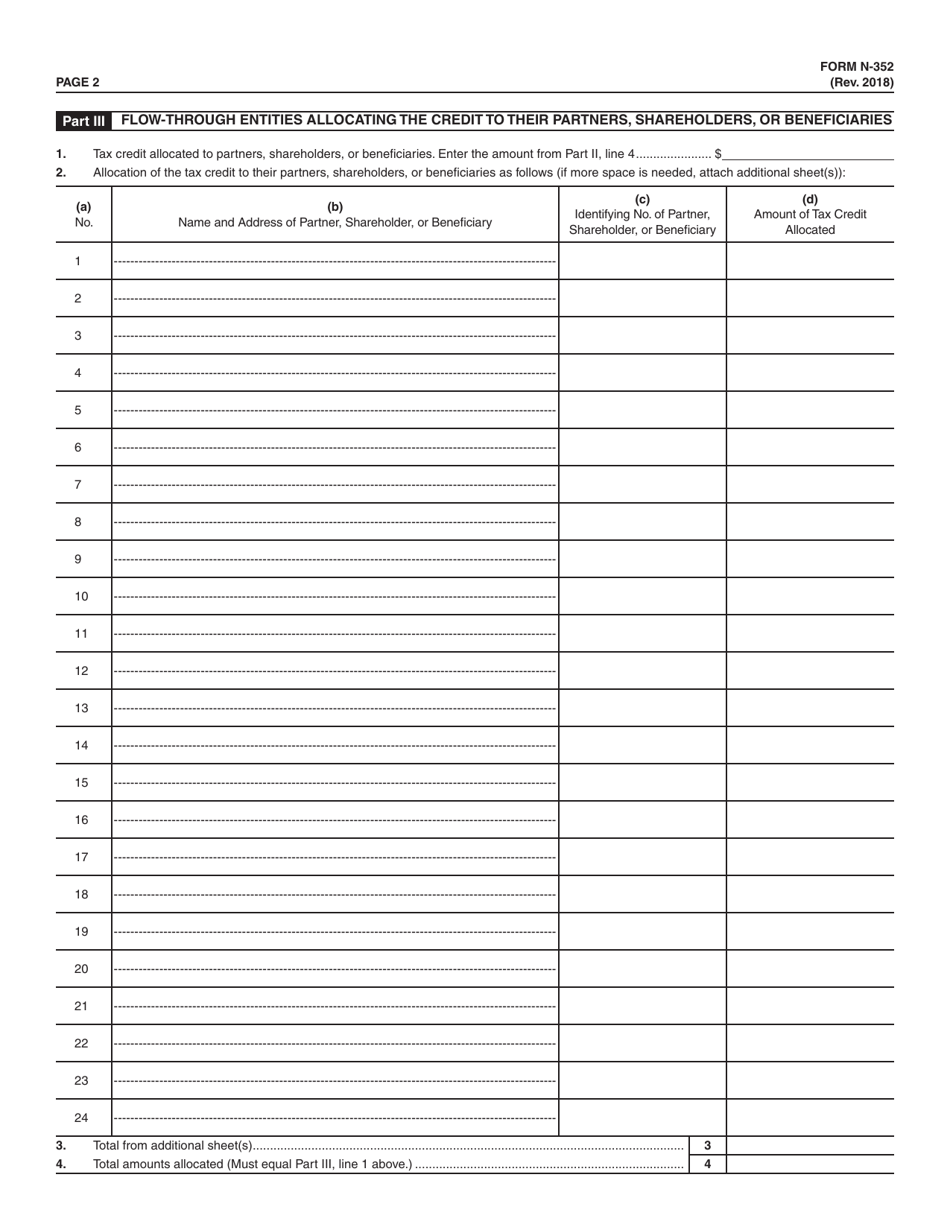

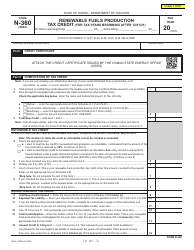

Form N-352

for the current year.

Form N-352 Renewable Fuels Production Tax Credit - Hawaii

What Is Form N-352?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form N-352?

A: Form N-352 is a tax form used in Hawaii to claim the Renewable Fuels Production Tax Credit.

Q: What is the Renewable Fuels Production Tax Credit?

A: The Renewable Fuels Production Tax Credit is a tax credit available to individuals and businesses in Hawaii who produce renewable fuels.

Q: Who can use Form N-352?

A: Individuals and businesses in Hawaii who produce renewable fuels can use Form N-352 to claim the tax credit.

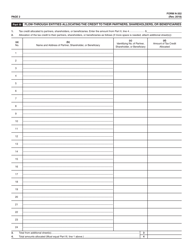

Q: What information is required on Form N-352?

A: Form N-352 requires information about the type and quantity of renewable fuel produced, as well as other details about the production process.

Q: How do I file Form N-352?

A: Form N-352 can be filed electronically or by mail with the Hawaii Department of Taxation.

Q: Is there a deadline for filing Form N-352?

A: Yes, Form N-352 must be filed by the due date of the taxpayer's Hawaii income tax return.

Form Details:

- Released on January 1, 2018;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form N-352 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.