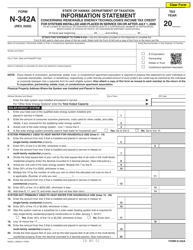

This version of the form is not currently in use and is provided for reference only. Download this version of

Form N-356

for the current year.

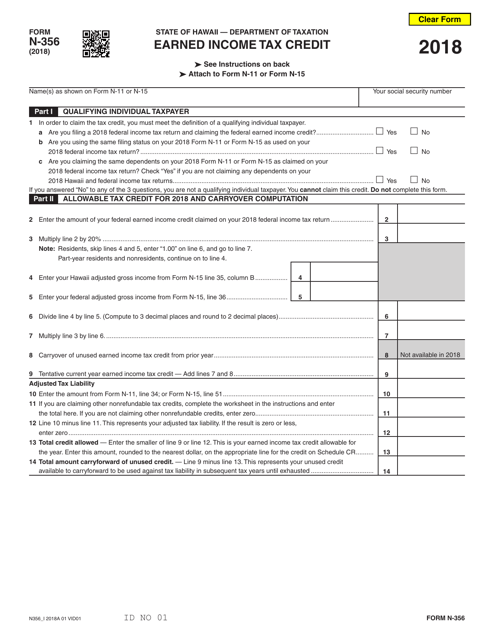

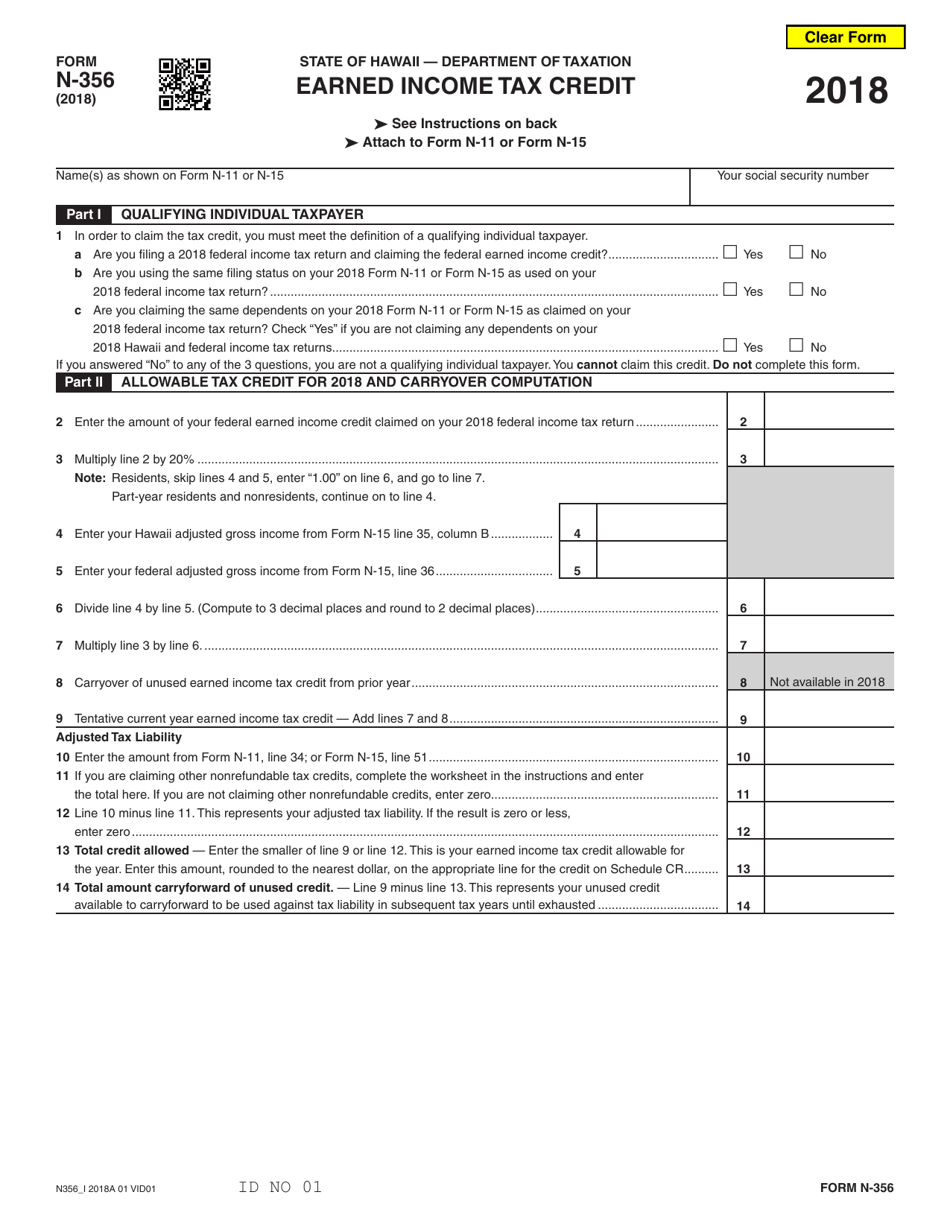

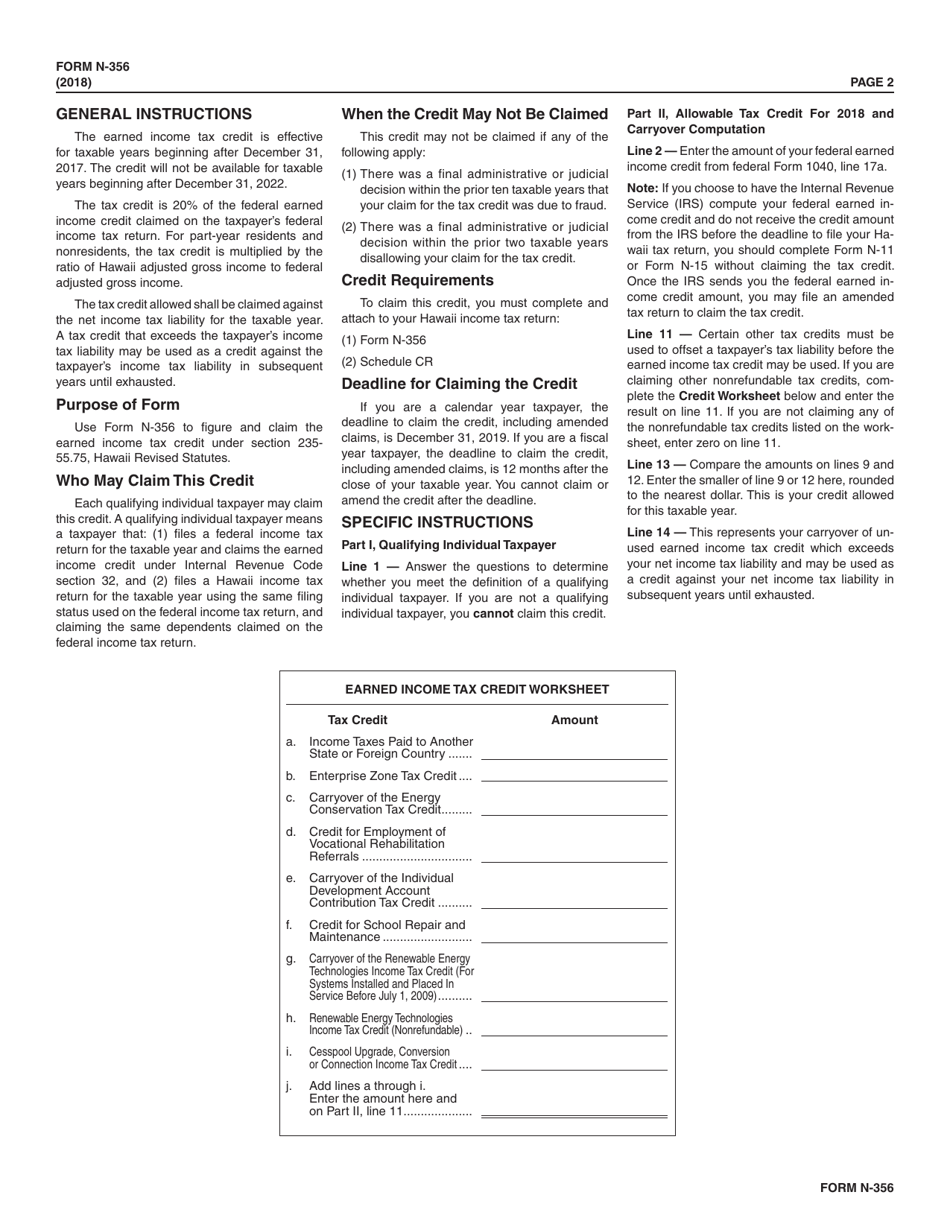

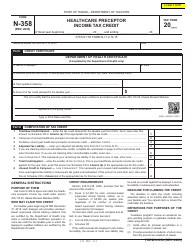

Form N-356 Earned Income Tax Credit - Hawaii

What Is Form N-356?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form N-356?

A: Form N-356 is the Earned Income Tax Credit form for the state of Hawaii.

Q: What is the Earned Income Tax Credit?

A: The Earned Income Tax Credit (EITC) is a benefit for working individuals and families with low to moderate income.

Q: Who is eligible for the EITC in Hawaii?

A: To be eligible for the EITC in Hawaii, you must meet certain income limits and have earned income from employment or self-employment.

Q: How do I claim the EITC in Hawaii?

A: To claim the EITC in Hawaii, you must file Form N-356 with your state tax return.

Q: What documents do I need to complete Form N-356?

A: You will need to gather your income statements, such as W-2 forms, and any other applicable tax documents to complete Form N-356.

Q: Is the EITC refundable?

A: Yes, the EITC is a refundable tax credit, which means that if the credit exceeds your tax liability, you can receive the excess amount as a refund.

Q: Are there any other requirements for claiming the EITC?

A: Yes, you must have a valid Social Security number for yourself, your spouse (if filing jointly), and any qualifying children.

Q: What is the maximum EITC amount in Hawaii?

A: The maximum EITC amount in Hawaii for tax year 2021 is $6,728.

Q: When is the deadline to file Form N-356 in Hawaii?

A: The deadline to file Form N-356 in Hawaii is typically April 20th, or the next business day if it falls on a weekend or holiday.

Form Details:

- Released on January 1, 2018;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form N-356 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.