This version of the form is not currently in use and is provided for reference only. Download this version of

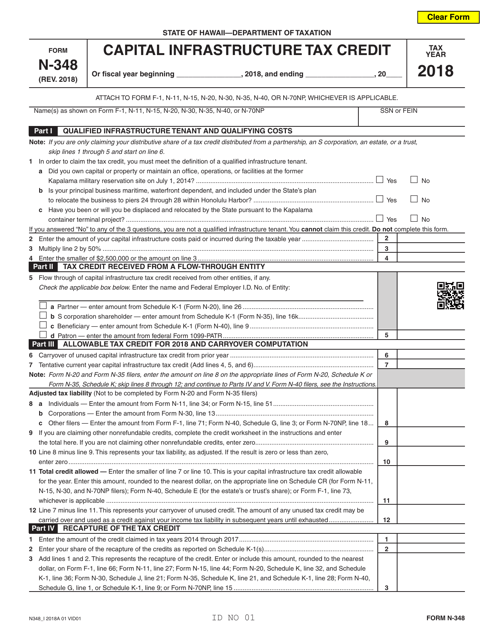

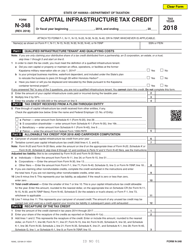

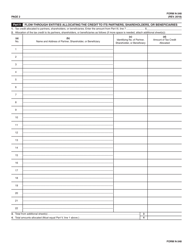

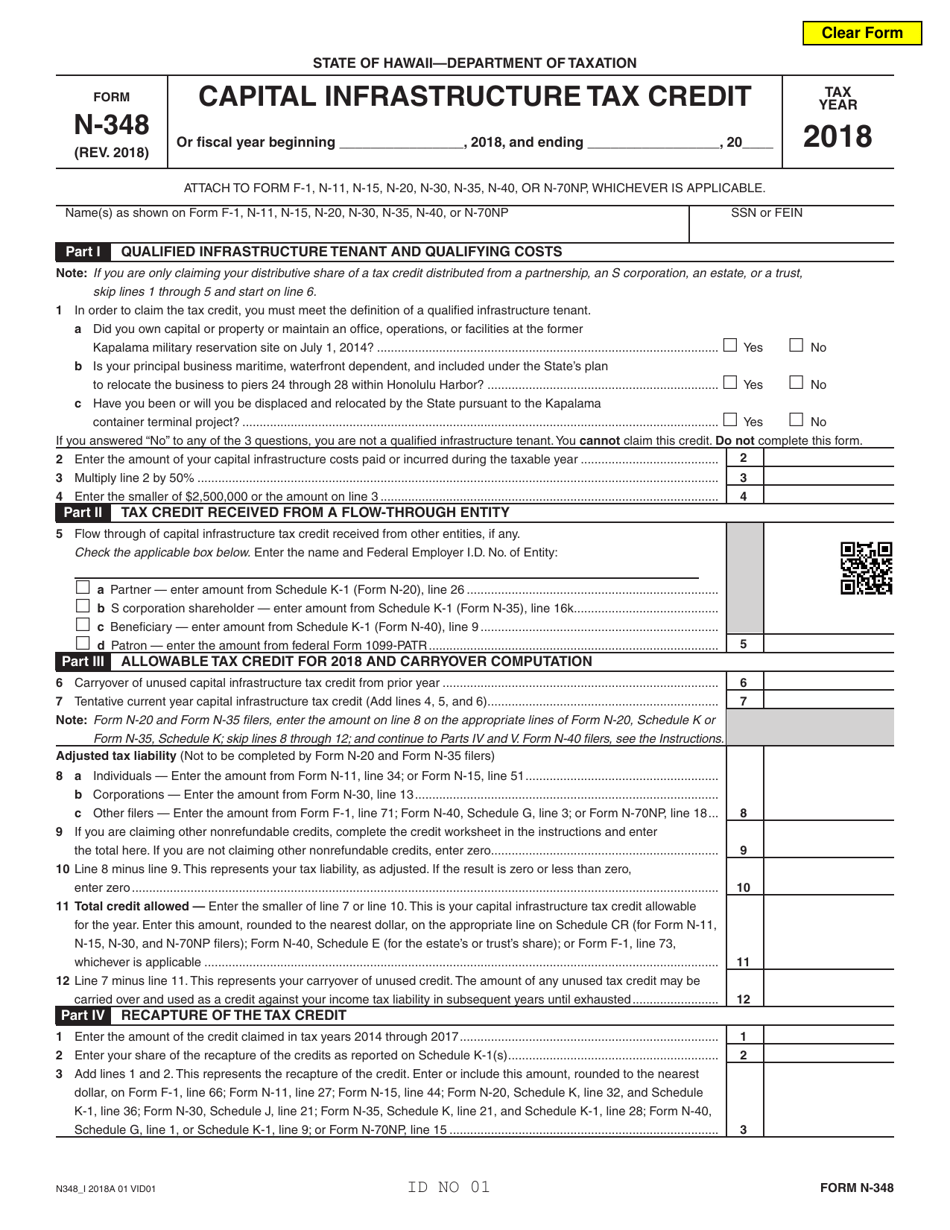

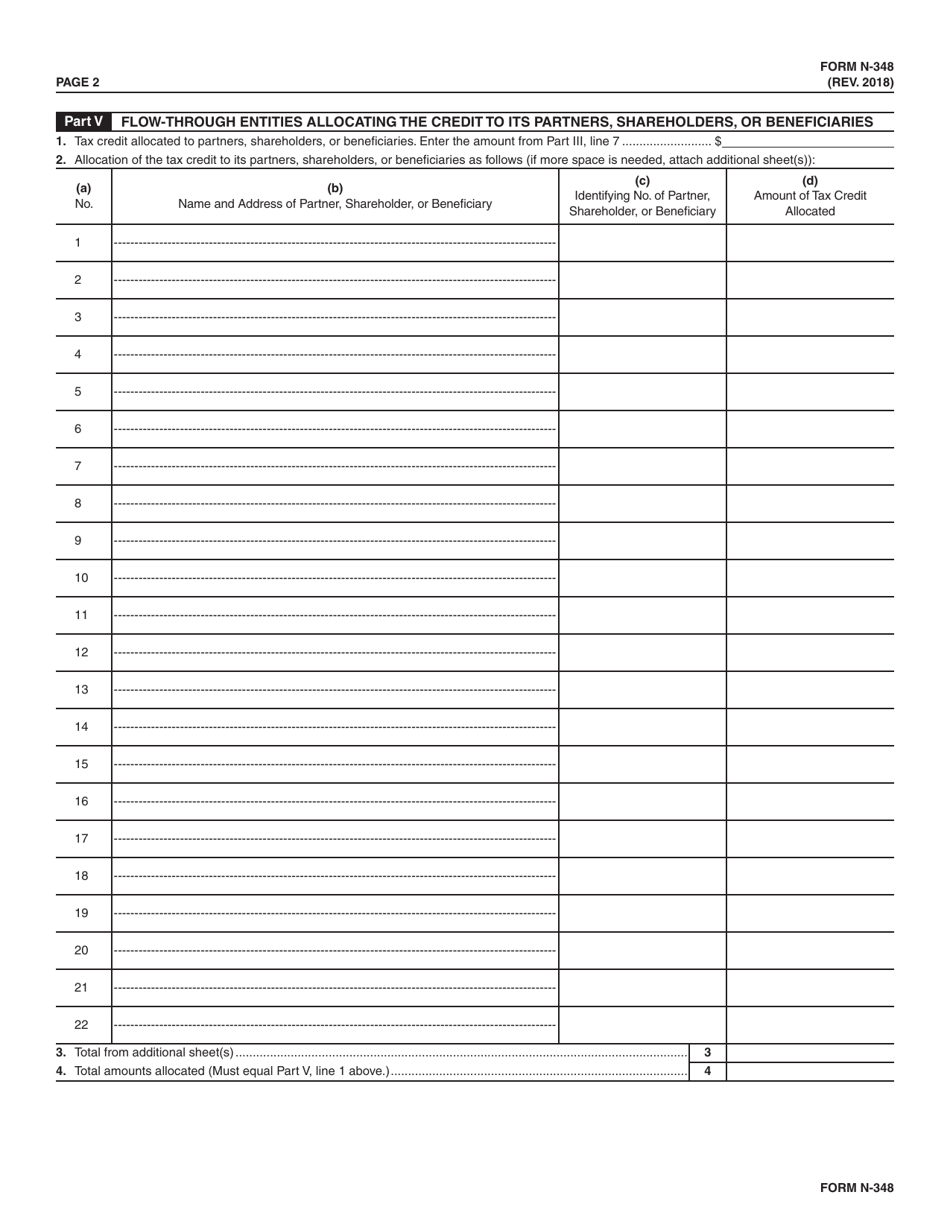

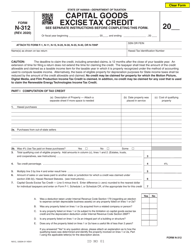

Form N-348

for the current year.

Form N-348 Capital Infrastructure Tax Credit - Hawaii

What Is Form N-348?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form N-348?

A: Form N-348 is the Capital Infrastructure Tax Credit form for the state of Hawaii.

Q: What is the Capital Infrastructure Tax Credit?

A: The Capital Infrastructure Tax Credit is a tax credit offered by the state of Hawaii to businesses that invest in capital infrastructure projects.

Q: Who is eligible for the Capital Infrastructure Tax Credit?

A: Businesses that make qualified investments in capital infrastructure projects in Hawaii are eligible for the tax credit.

Q: What kind of projects qualify for the Capital Infrastructure Tax Credit?

A: Projects that improve or expand the infrastructure in Hawaii, such as the construction, renovation, or installation of buildings, utilities, or transportation systems, may qualify for the tax credit.

Q: How much is the Capital Infrastructure Tax Credit?

A: The amount of the tax credit is determined based on the qualifying expenses and the total amount of credits allocated by the Hawaii Department of Business, Economic Development and Tourism.

Q: How do I claim the Capital Infrastructure Tax Credit?

A: To claim the tax credit, businesses must submit Form N-348 along with supporting documentation to the Hawaii Department of Business, Economic Development and Tourism.

Q: When is the deadline for filing Form N-348?

A: The deadline for filing Form N-348 is determined by the Hawaii Department of Business, Economic Development and Tourism and may vary each year.

Q: Are there any restrictions or limitations on the Capital Infrastructure Tax Credit?

A: Yes, there are certain restrictions and limitations on the tax credit. Businesses should consult with a tax professional or refer to the instructions provided with Form N-348 for specific details.

Q: Can individuals claim the Capital Infrastructure Tax Credit?

A: No, the Capital Infrastructure Tax Credit is available only to businesses that invest in capital infrastructure projects in Hawaii.

Form Details:

- Released on January 1, 2018;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form N-348 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.