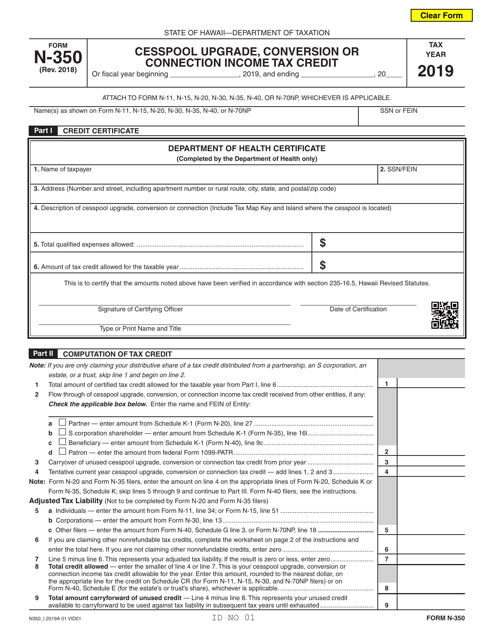

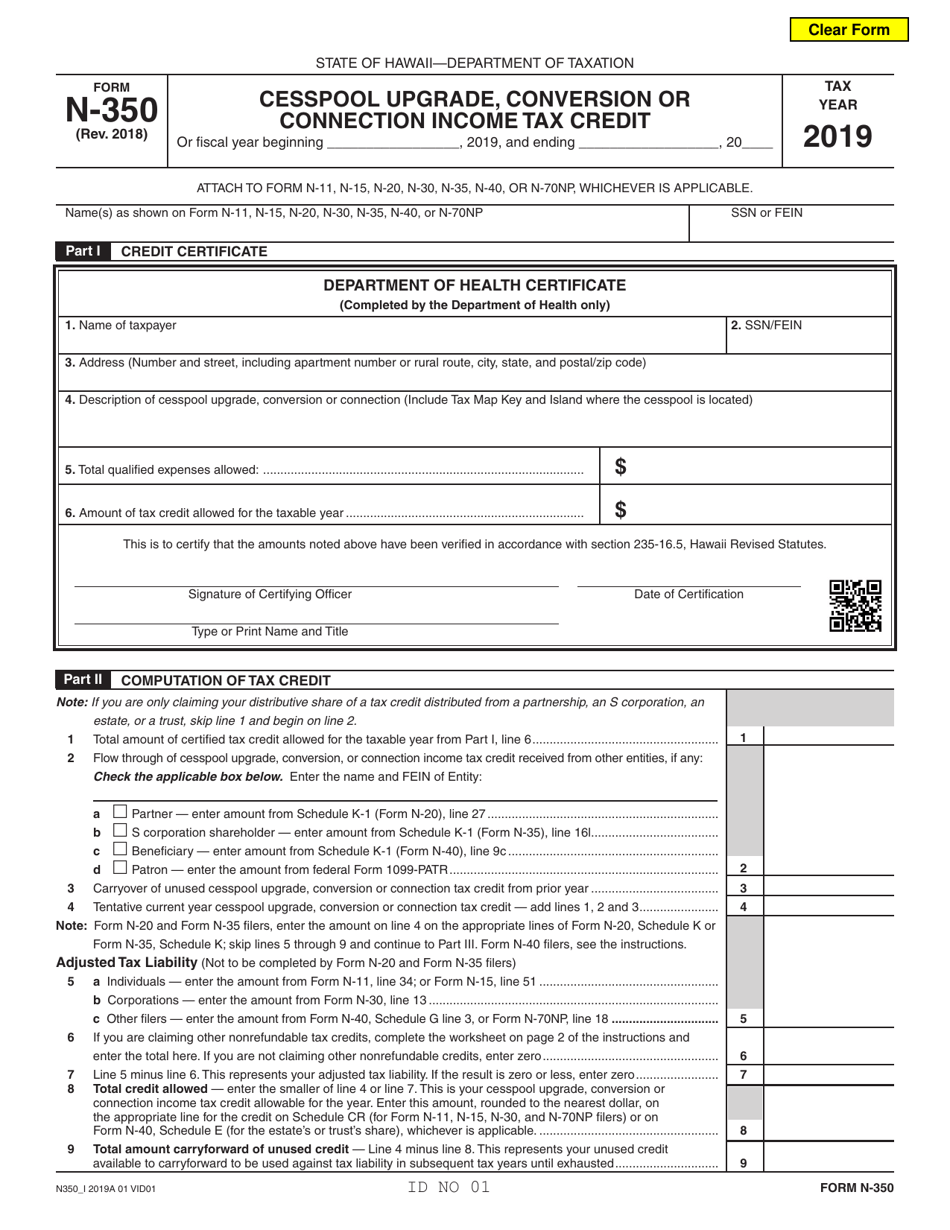

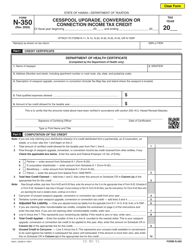

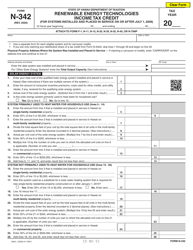

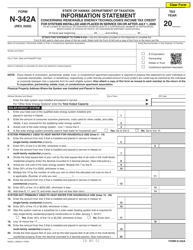

Form 350 Cesspool Upgrade, Conversion or Connection Income Tax Credit - Hawaii

What Is Form 350?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 350 Cesspool Upgrade, Conversion or Connection Income Tax Credit?

A: Form 350 is a tax credit offered by the state of Hawaii for upgrading, converting, or connecting cesspools.

Q: Who is eligible for the Form 350 Cesspool Upgrade, Conversion or Connection Income Tax Credit?

A: Hawaii residents who upgrade, convert, or connect cesspools may be eligible for this tax credit.

Q: What is the purpose of the tax credit?

A: The tax credit is intended to incentivize residents to phase out cesspools and upgrade to more environmentally friendly wastewater systems.

Q: How much is the tax credit?

A: The amount of the tax credit depends on the cost of the cesspool upgrade, conversion, or connection, up to a maximum of $10,000.

Q: How do I claim the tax credit?

A: To claim the tax credit, you need to complete and submit Form 350 when filing your Hawaii income tax return.

Q: Are there any restrictions or limitations for the tax credit?

A: Yes, there are certain restrictions and limitations, such as the requirement that the upgrade, conversion, or connection must be completed by a licensed contractor.

Form Details:

- Released on January 1, 2018;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 350 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.