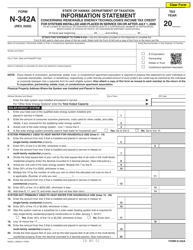

This version of the form is not currently in use and is provided for reference only. Download this version of

Form N-358

for the current year.

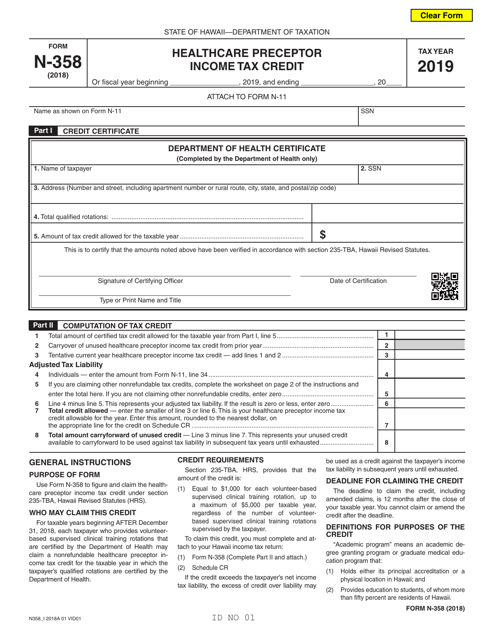

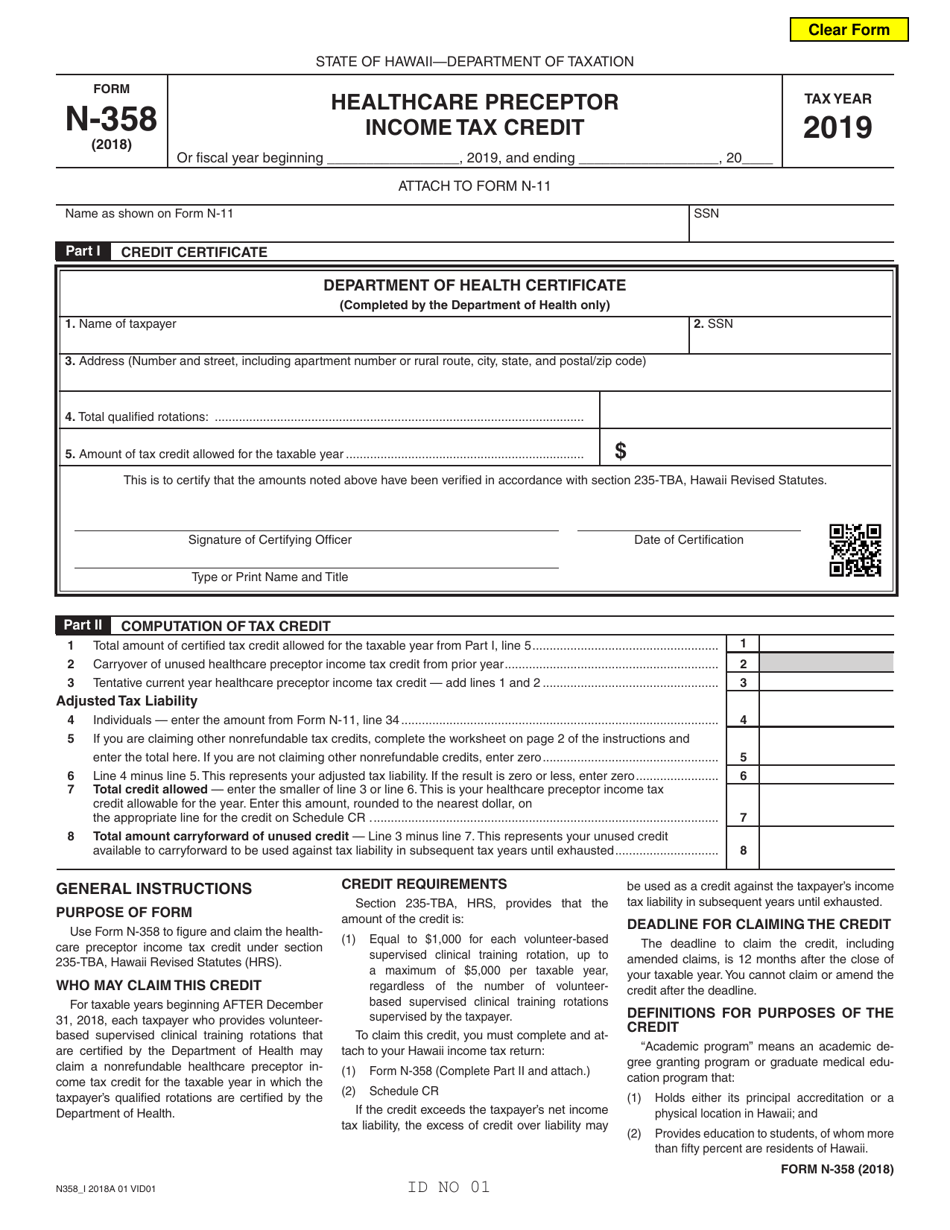

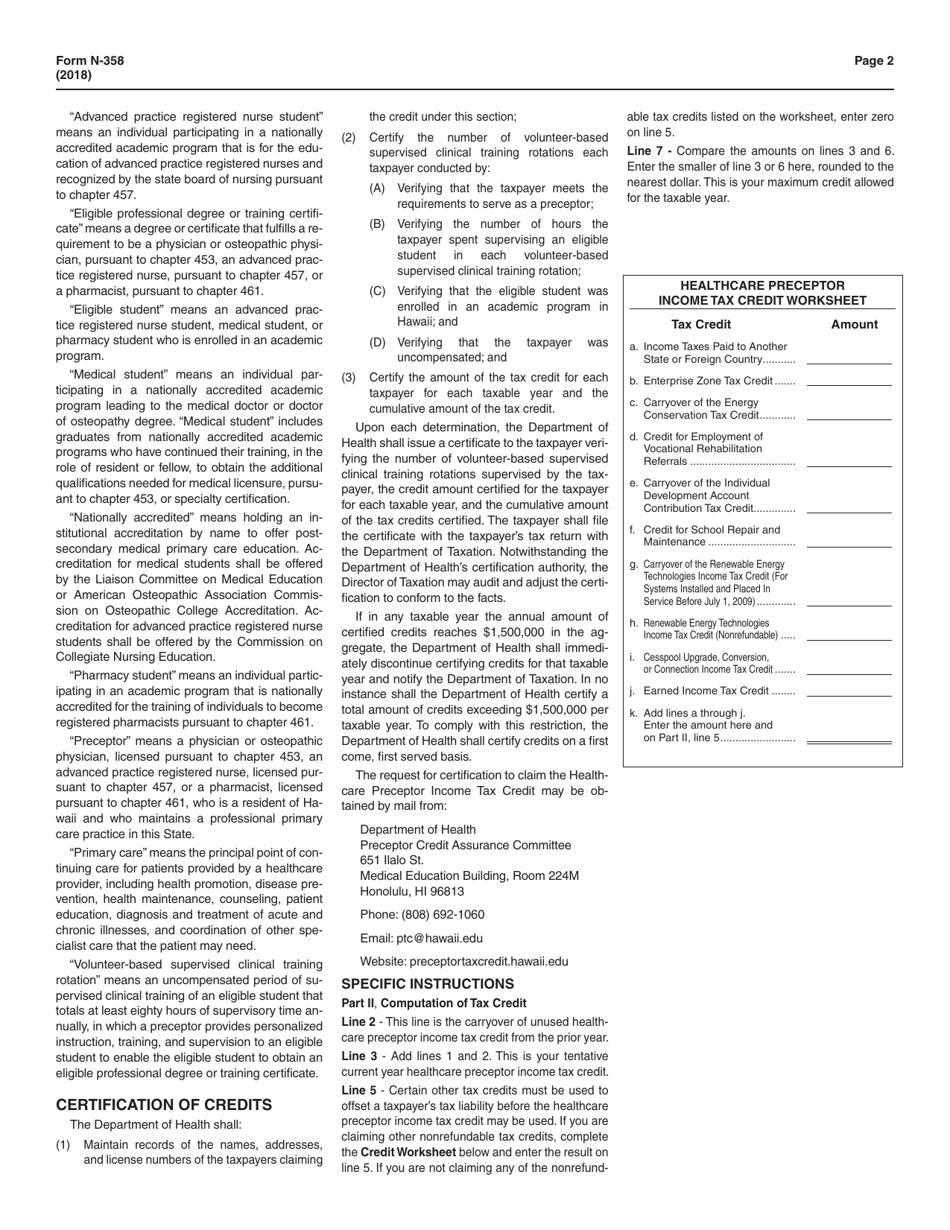

Form N-358 Healthcare Preceptor Income Tax Credit - Hawaii

What Is Form N-358?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form N-358?

A: Form N-358 is a tax form used in Hawaii to claim the Healthcare Preceptor Income Tax Credit.

Q: What is the Healthcare Preceptor Income Tax Credit in Hawaii?

A: The Healthcare Preceptor Income Tax Credit in Hawaii is a credit that allows healthcare preceptors to reduce their state income tax liability.

Q: Who is eligible for the Healthcare Preceptor Income Tax Credit?

A: Healthcare preceptors in Hawaii who meet certain criteria are eligible for the Healthcare Preceptor Income Tax Credit.

Q: What is a healthcare preceptor?

A: A healthcare preceptor is an individual who provides training or supervision to health profession students or residents in a clinical setting.

Q: How do I claim the Healthcare Preceptor Income Tax Credit in Hawaii?

A: To claim the Healthcare Preceptor Income Tax Credit in Hawaii, you need to file Form N-358 and meet the eligibility requirements.

Q: What are the eligibility requirements for the Healthcare Preceptor Income Tax Credit?

A: Eligibility requirements for the Healthcare Preceptor Income Tax Credit in Hawaii include being a healthcare preceptor, meeting certain minimum hours of training or supervision, and being licensed or certified in the relevant profession.

Q: Are there any deadlines for filing Form N-358?

A: Yes, there are specific deadlines for filing Form N-358. It is important to check the official instructions or contact the Hawaii Department of Taxation for the current year's deadline.

Form Details:

- Released on January 1, 2018;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form N-358 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.