This version of the form is not currently in use and is provided for reference only. Download this version of

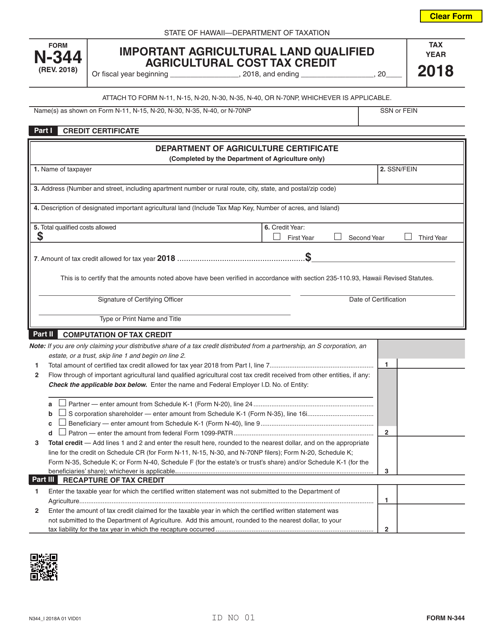

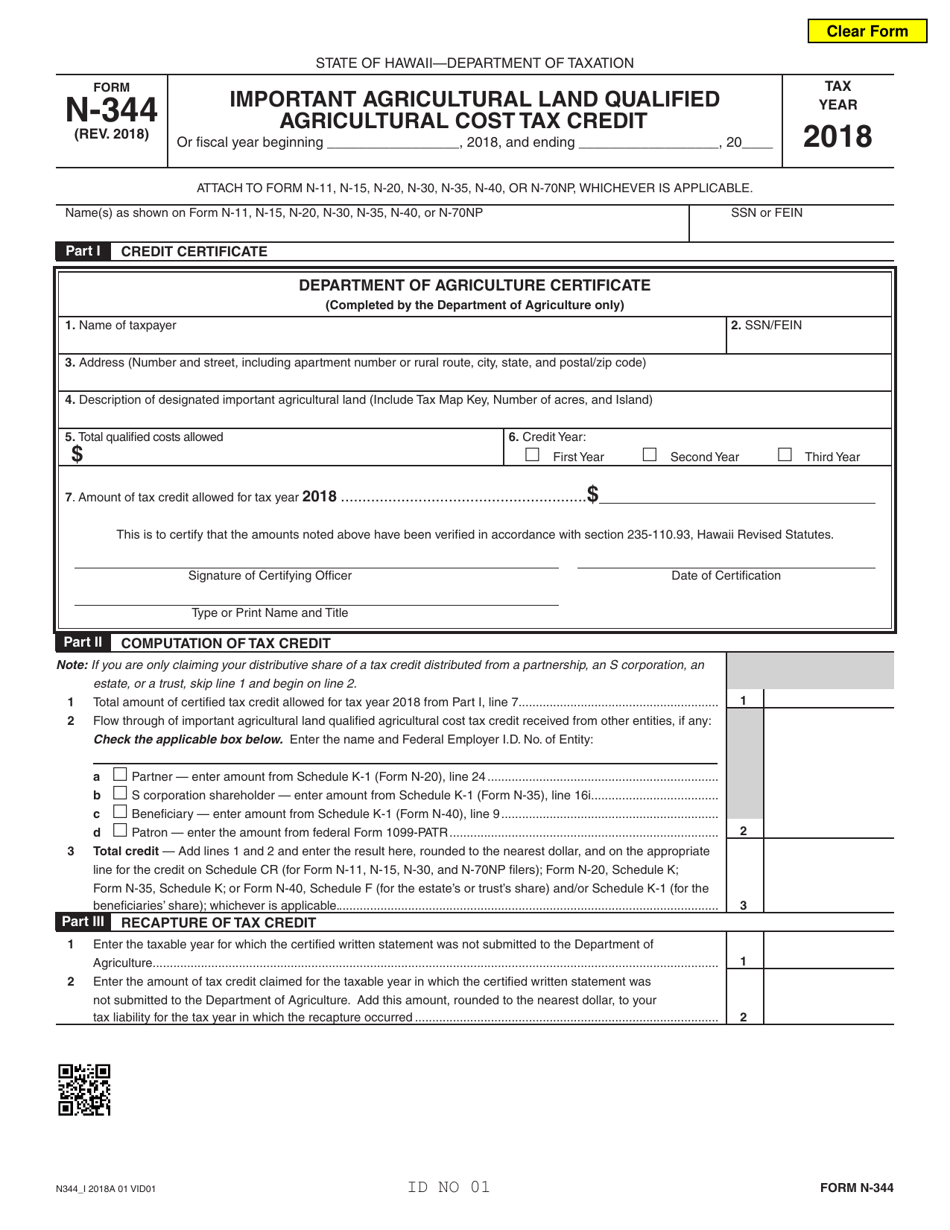

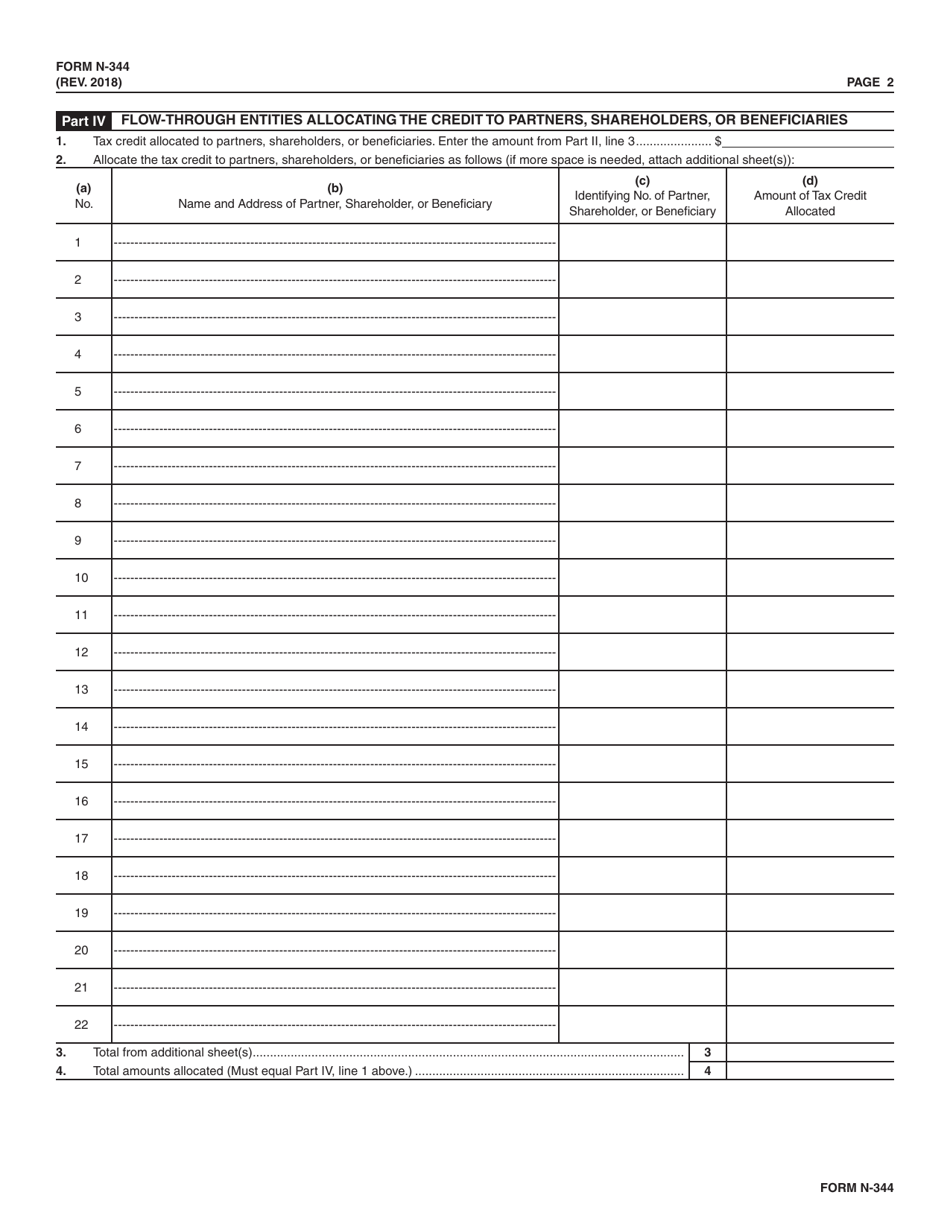

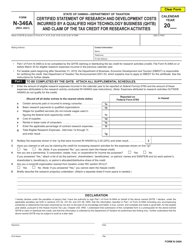

Form N-344

for the current year.

Form N-344 Important Agricultural Land Qualified Agricultural Cost Tax Credit - Hawaii

What Is Form N-344?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form N-344?

A: Form N-344 is a tax form used in the state of Hawaii to claim the Important Agricultural Land Qualified Agricultural Cost Tax Credit.

Q: What is the Important Agricultural Land Qualified Agricultural Cost Tax Credit?

A: The Important Agricultural Land Qualified Agricultural Cost Tax Credit is a tax credit offered in Hawaii to encourage the preservation and enhancement of important agricultural land.

Q: Who is eligible to claim this tax credit?

A: Agricultural landowners in Hawaii who meet certain criteria, such as having land designated as important agricultural land and incurring qualifying agricultural costs, may be eligible to claim this tax credit.

Q: What are qualifying agricultural costs?

A: Qualifying agricultural costs are expenses incurred by the landowner for the preservation, enhancement, or development of important agricultural land.

Q: How do I claim the tax credit?

A: To claim the tax credit, you need to complete and file Form N-344 with the Hawaii Department of Taxation.

Q: Is there a deadline for filing this form?

A: Yes, the deadline for filing Form N-344 is on or before the 20th day of the 4th month following the close of the taxable year.

Q: Can the tax credit be carried forward or backward?

A: No, the tax credit cannot be carried forward to future years or carried back to previous years.

Form Details:

- Released on January 1, 2018;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form N-344 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.