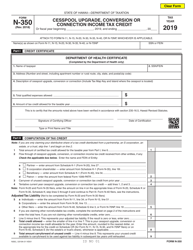

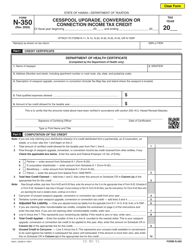

This version of the form is not currently in use and is provided for reference only. Download this version of

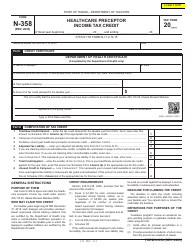

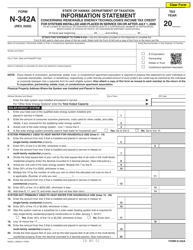

Form N-342

for the current year.

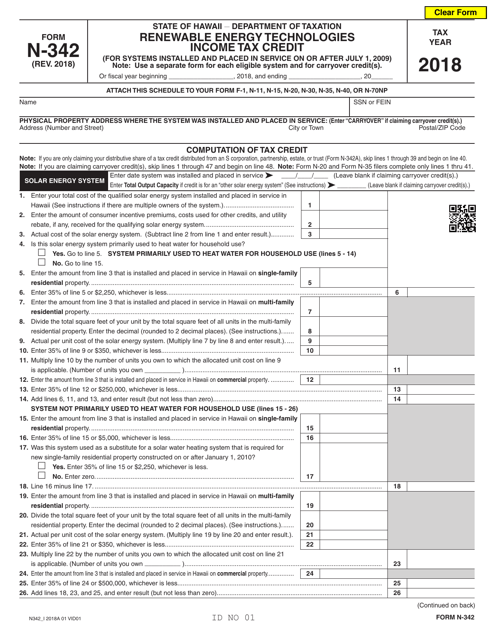

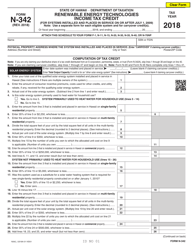

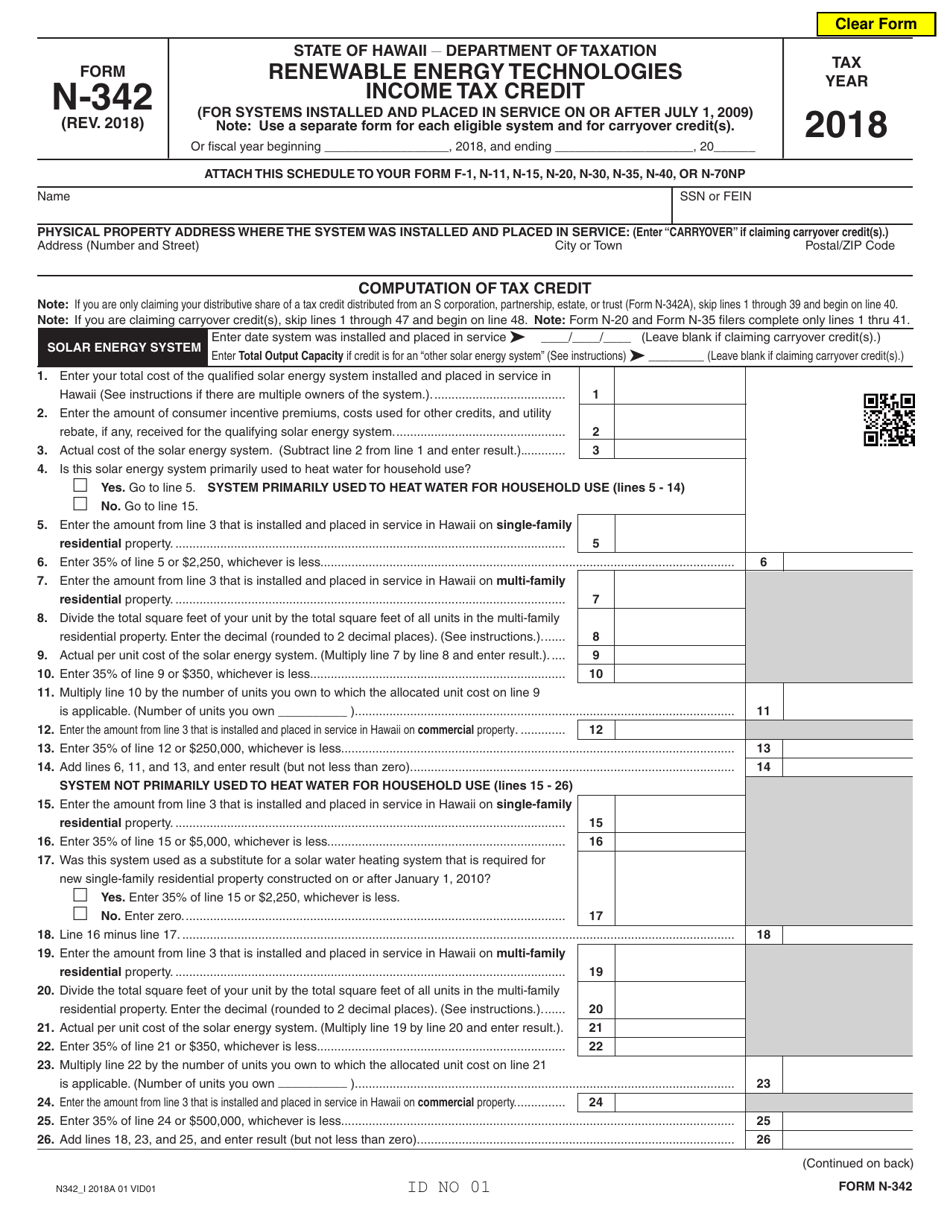

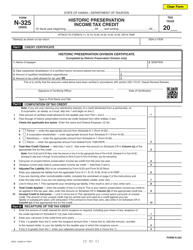

Form N-342 Renewable Energy Technologies Income Tax Credit - Hawaii

What Is Form N-342?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form N-342?

A: Form N-342 is a tax form used by residents of Hawaii to claim the Renewable Energy Technologies Income Tax Credit.

Q: What is the Renewable Energy Technologies Income Tax Credit?

A: The Renewable Energy Technologies Income Tax Credit is a tax credit offered by the state of Hawaii to encourage the use of renewable energy technologies.

Q: Who is eligible for the tax credit?

A: Hawaii residents who have installed qualified renewable energy technologies in their homes or businesses are eligible for the tax credit.

Q: What are qualified renewable energy technologies?

A: Qualified renewable energy technologies include solar water heating systems, photovoltaic systems, wind-powered energy systems, and more.

Q: How much is the tax credit?

A: The amount of the tax credit depends on the type of renewable energy technology installed and the capacity of the system. It can range from a few thousand dollars to tens of thousands of dollars.

Q: How to claim the tax credit?

A: To claim the tax credit, you need to complete Form N-342 and submit it with your Hawaii state tax return.

Q: Are there any deadlines for claiming the tax credit?

A: Yes, the tax credit must be claimed within one year after the renewable energy technology is placed into service.

Q: Are there any other requirements?

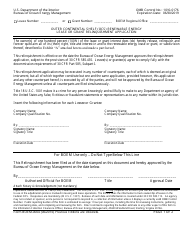

A: Yes, there are additional requirements such as obtaining a certification from the Hawaii Department of Business, Economic Development, and Tourism.

Form Details:

- Released on January 1, 2018;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form N-342 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.