This version of the form is not currently in use and is provided for reference only. Download this version of

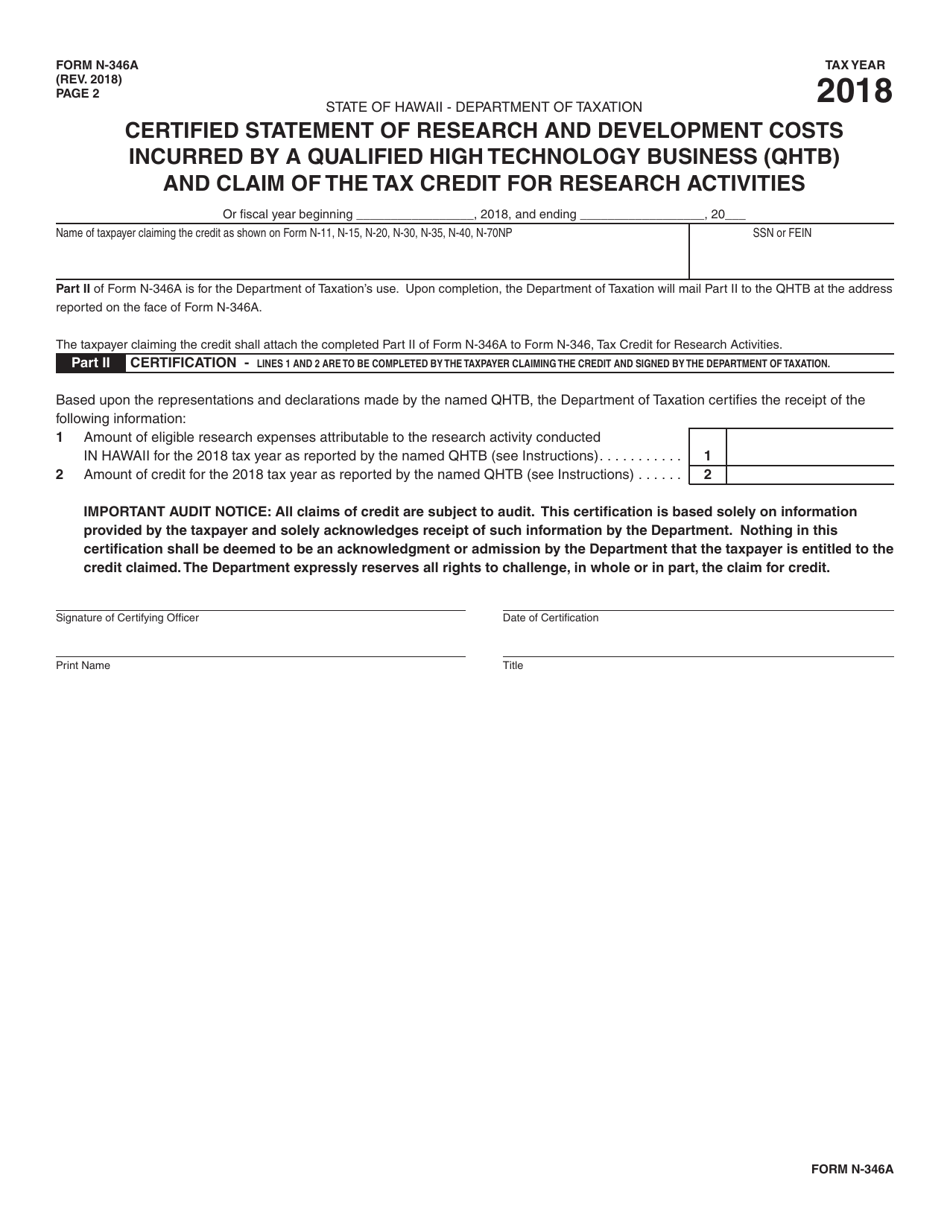

Form N-346A

for the current year.

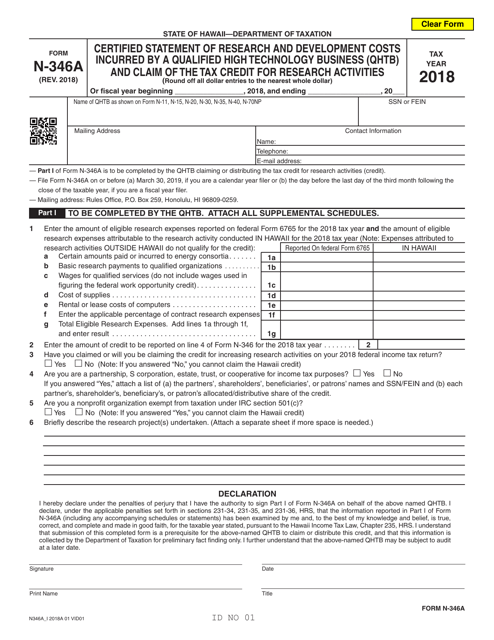

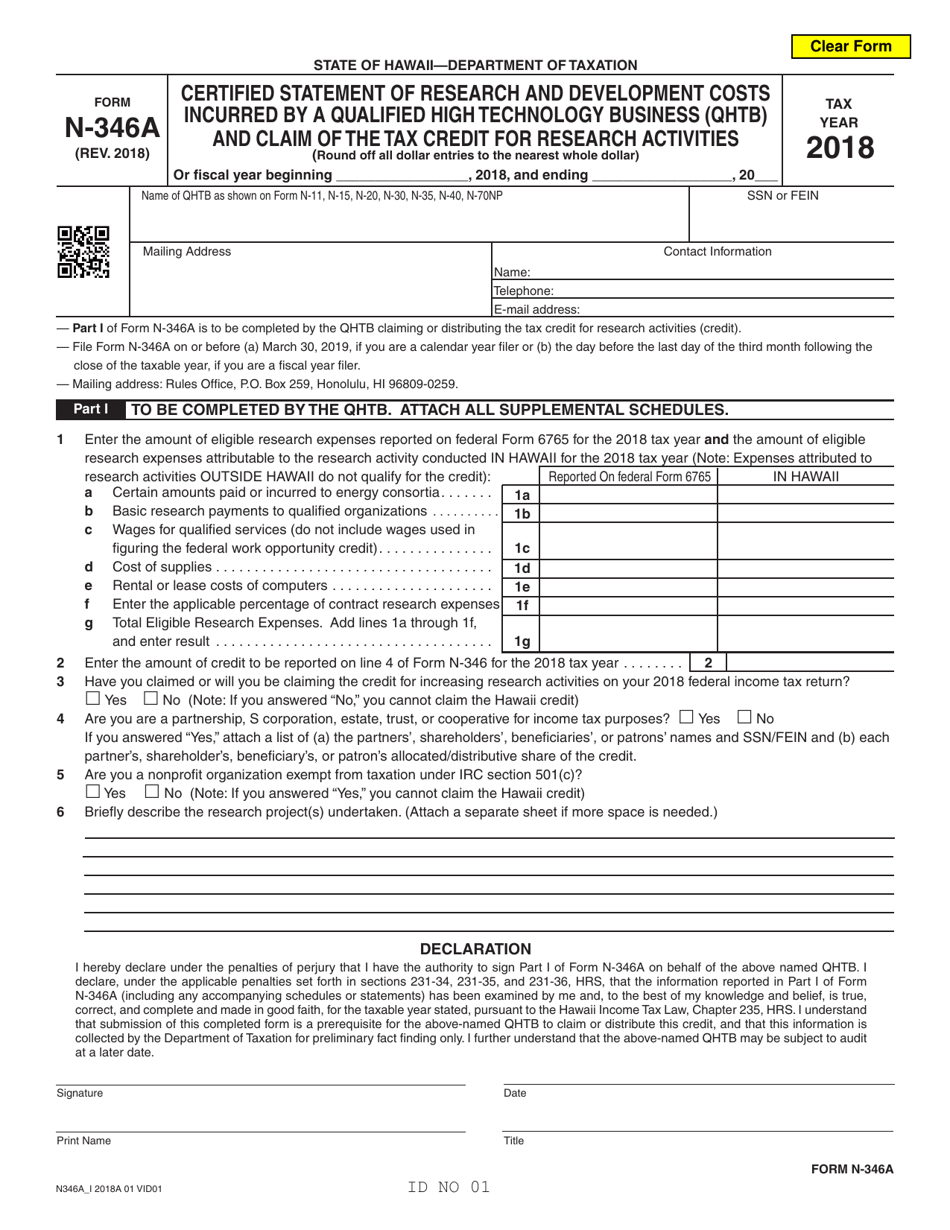

Form N-346A Certified Statement of Research and Development Costs Incurred by a Qualified High Technology Business (Qhtb) and Claim of the Tax Credit for Research Activities - Hawaii

What Is Form N-346A?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form N-346A?

A: Form N-346A is a form used in Hawaii to report research and developmentcosts incurred by a Qualified High Technology Business (QHTB) and claim the tax credit for research activities.

Q: What is a Qualified High Technology Business (QHTB)?

A: A Qualified High Technology Business (QHTB) is a business that meets certain criteria defined by the state of Hawaii, including being engaged in qualified research activities and having a substantial number of employees engaged in those activities.

Q: What is the tax credit for research activities?

A: The tax credit for research activities is a credit that can be claimed by a Qualified High Technology Business (QHTB) in Hawaii for eligible research and development expenses.

Q: What expenses can be included in the tax credit for research activities?

A: Eligible expenses for the tax credit for research activities in Hawaii may include wages, supplies, and contractual expenses related to qualified research activities.

Q: How is Form N-346A used?

A: Form N-346A is used by a Qualified High Technology Business (QHTB) in Hawaii to report and claim the tax credit for research activities. The form must be filed with the Hawaii Department of Taxation.

Q: Are there any specific requirements for claiming the tax credit for research activities in Hawaii?

A: Yes, there are specific criteria that must be met to claim the tax credit for research activities in Hawaii, including being certified as a Qualified High Technology Business (QHTB) and meeting certain research and development expenditure requirements.

Form Details:

- Released on January 1, 2018;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form N-346A by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.