This version of the form is not currently in use and is provided for reference only. Download this version of

Form N-330

for the current year.

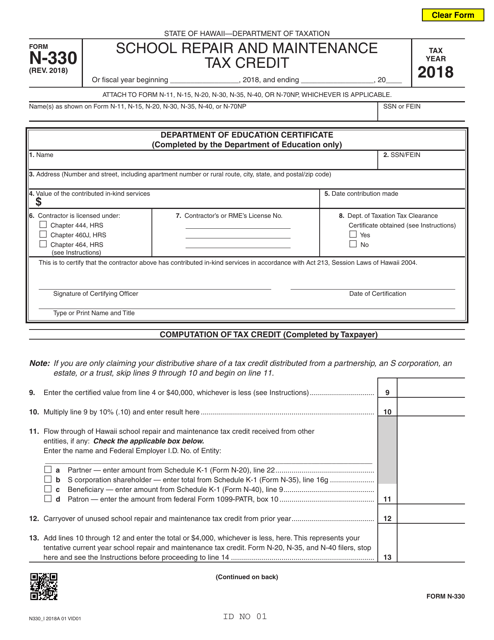

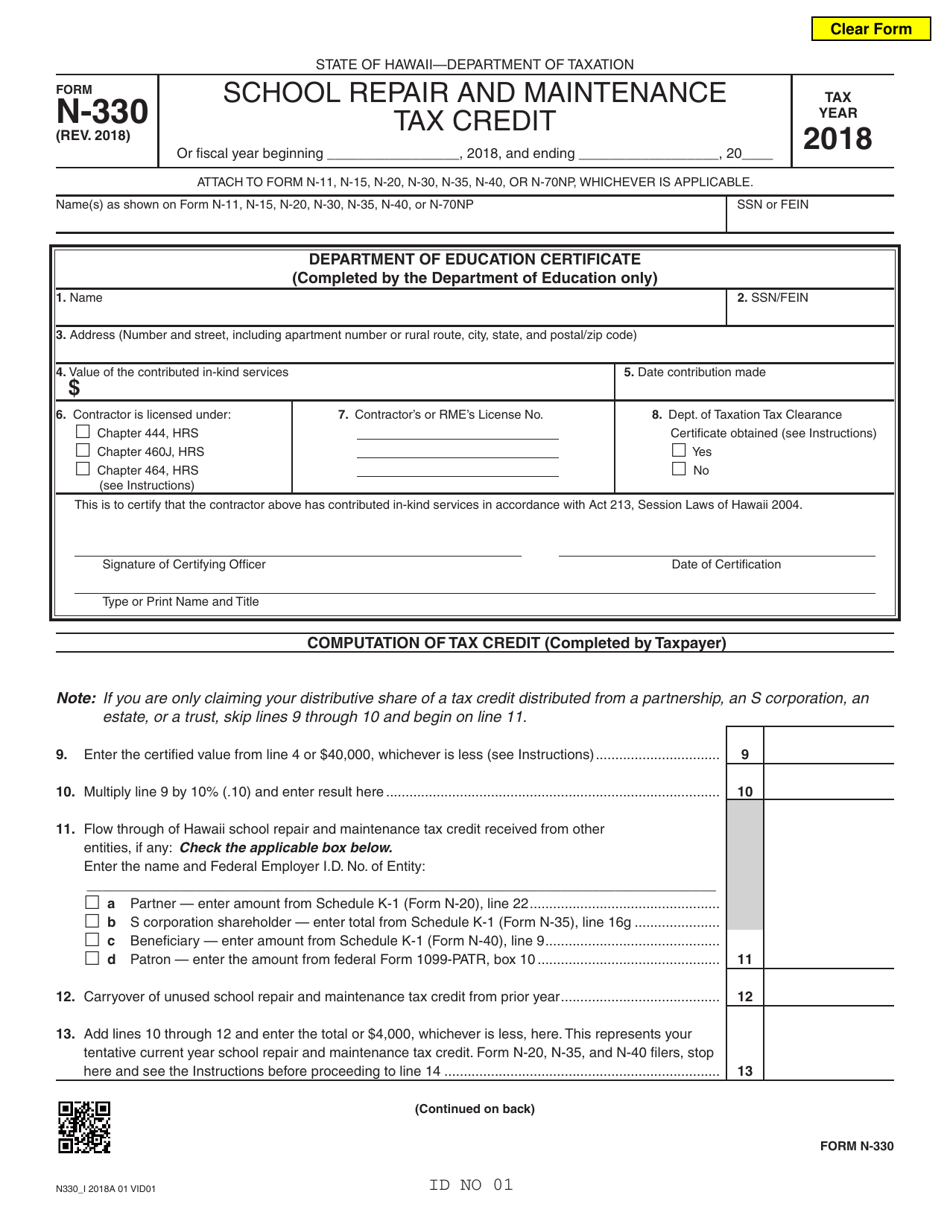

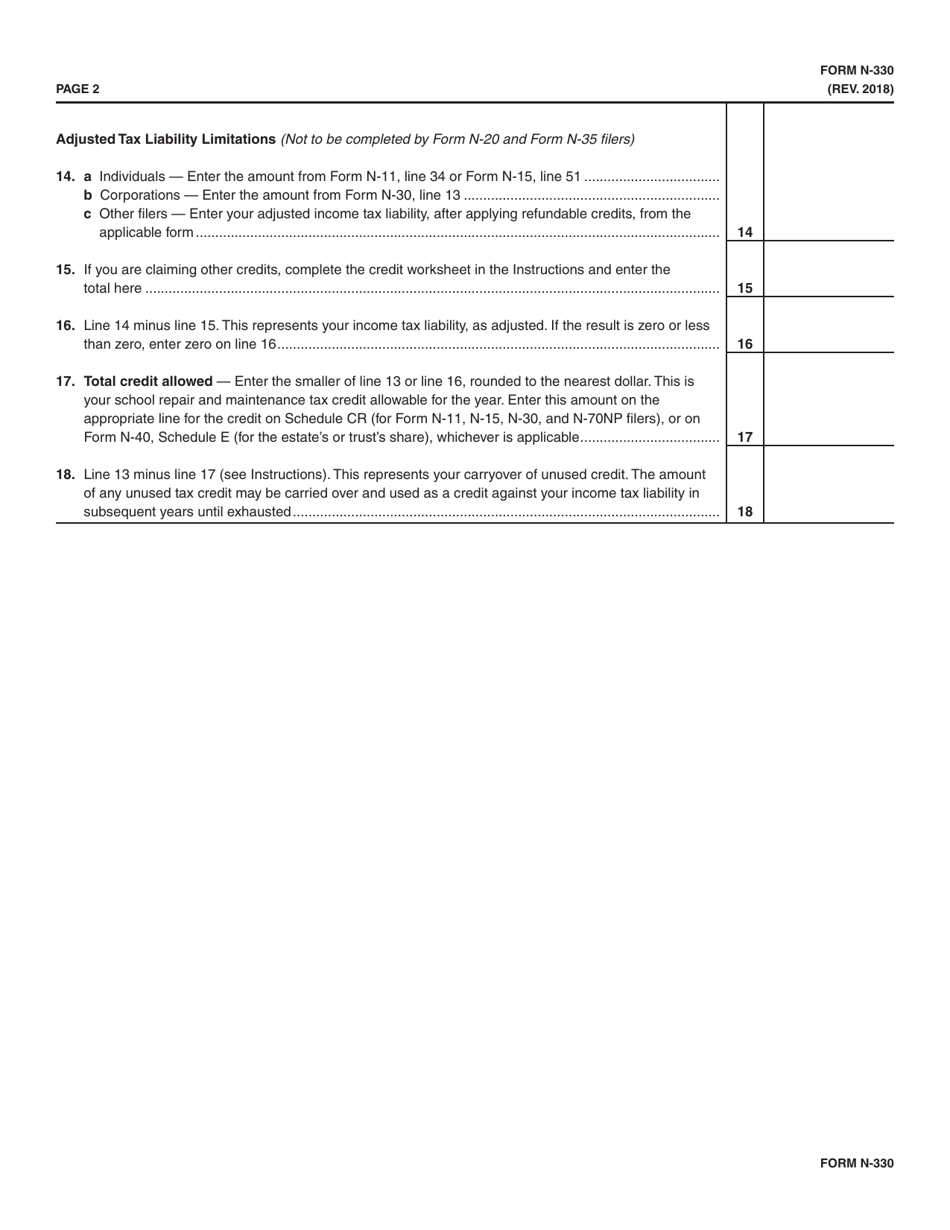

Form N-330 School Repair and Maintenance Tax Credit - Hawaii

What Is Form N-330?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form N-330?

A: Form N-330 is a tax form used in Hawaii to claim the School Repair and Maintenance Tax Credit.

Q: What is the School Repair and Maintenance Tax Credit?

A: The School Repair and Maintenance Tax Credit is a tax credit in Hawaii that allows individuals and businesses to claim a credit for qualified expenses related to repairing and maintaining public schools.

Q: Who is eligible to claim the School Repair and Maintenance Tax Credit?

A: Individuals, corporations, and other entities that incur qualified expenses for repairing and maintaining public schools in Hawaii are eligible to claim the tax credit.

Q: What expenses are eligible for the School Repair and Maintenance Tax Credit?

A: Qualified expenses eligible for the tax credit include costs directly associated with repairing, maintaining, or renovating public school facilities, such as materials, supplies, and labor.

Q: How much is the School Repair and Maintenance Tax Credit?

A: The tax credit is equal to 10% of the qualified expenses incurred in a tax year, up to a maximum credit of $5,000 for individuals and $100,000 for corporations.

Q: How do I claim the School Repair and Maintenance Tax Credit?

A: To claim the tax credit, you must complete and file Form N-330 with the Hawaii Department of Taxation, providing detailed information about the qualified expenses and supporting documentation.

Q: When is the deadline to file Form N-330?

A: Form N-330 must be filed by the due date of your Hawaii state tax return, which is typically April 20th or the 20th day of the 4th month following the close of the tax year.

Q: Can I claim the School Repair and Maintenance Tax Credit if I am a federal employee?

A: Federal employees are not eligible to claim the tax credit, as it is specific to expenses incurred in repairing and maintaining public schools in Hawaii.

Q: Is there a limit on the total amount of credits that can be claimed?

A: Yes, there is an annual cap on the total amount of tax credits that can be claimed for the School Repair and Maintenance Tax Credit. Once the cap is reached, no further credits can be claimed for that tax year.

Form Details:

- Released on January 1, 2018;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form N-330 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.