This version of the form is not currently in use and is provided for reference only. Download this version of

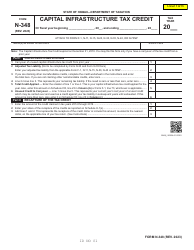

Form N-312

for the current year.

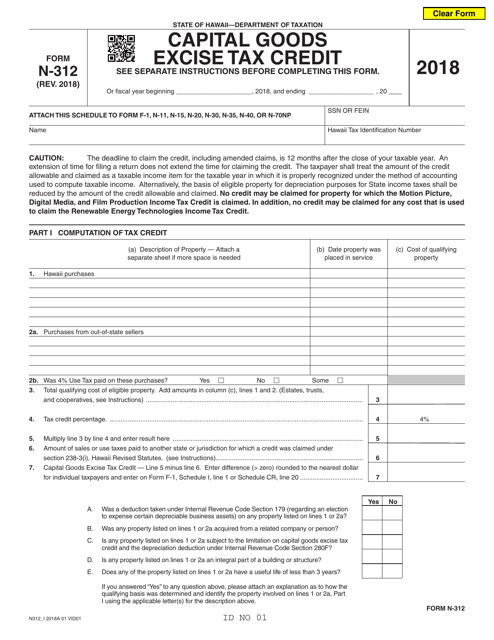

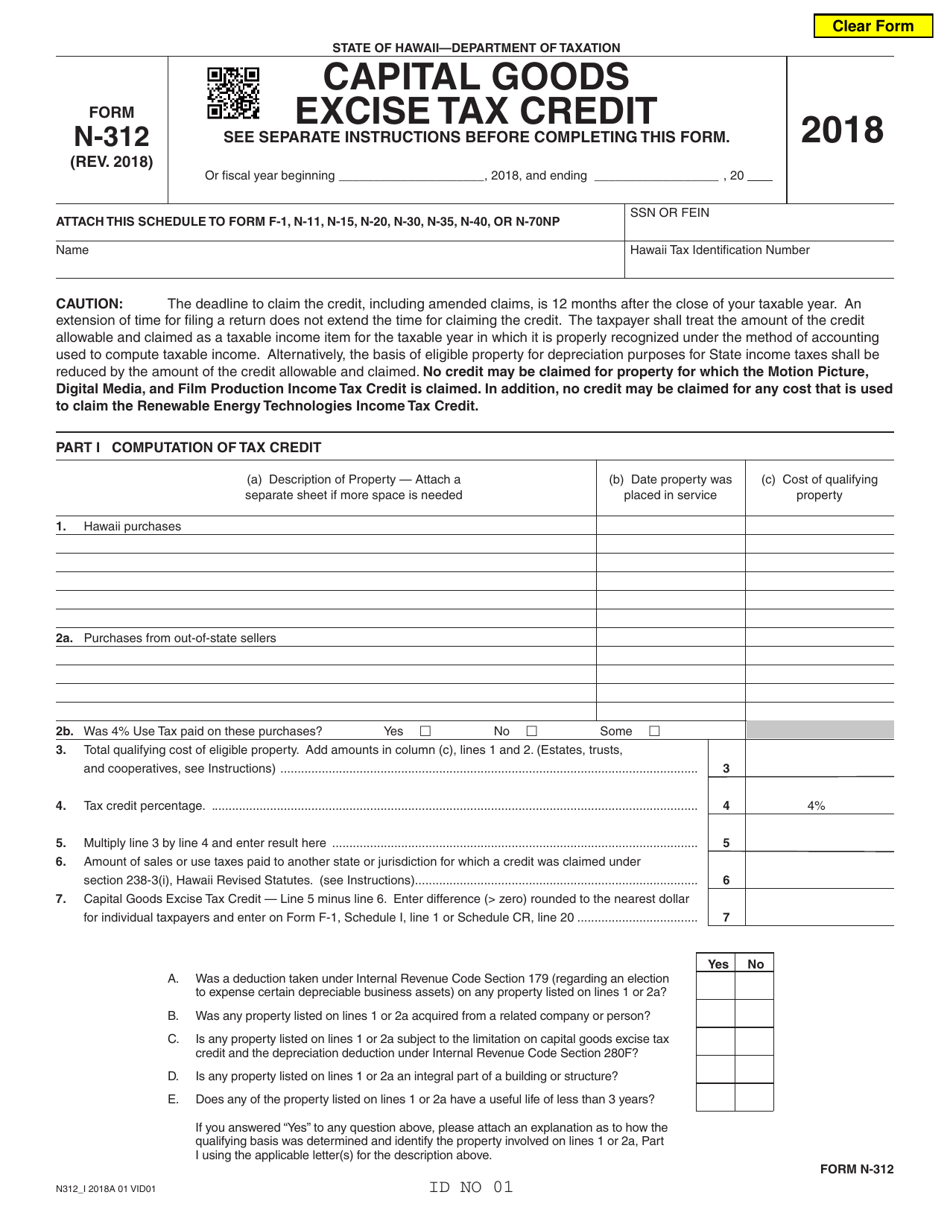

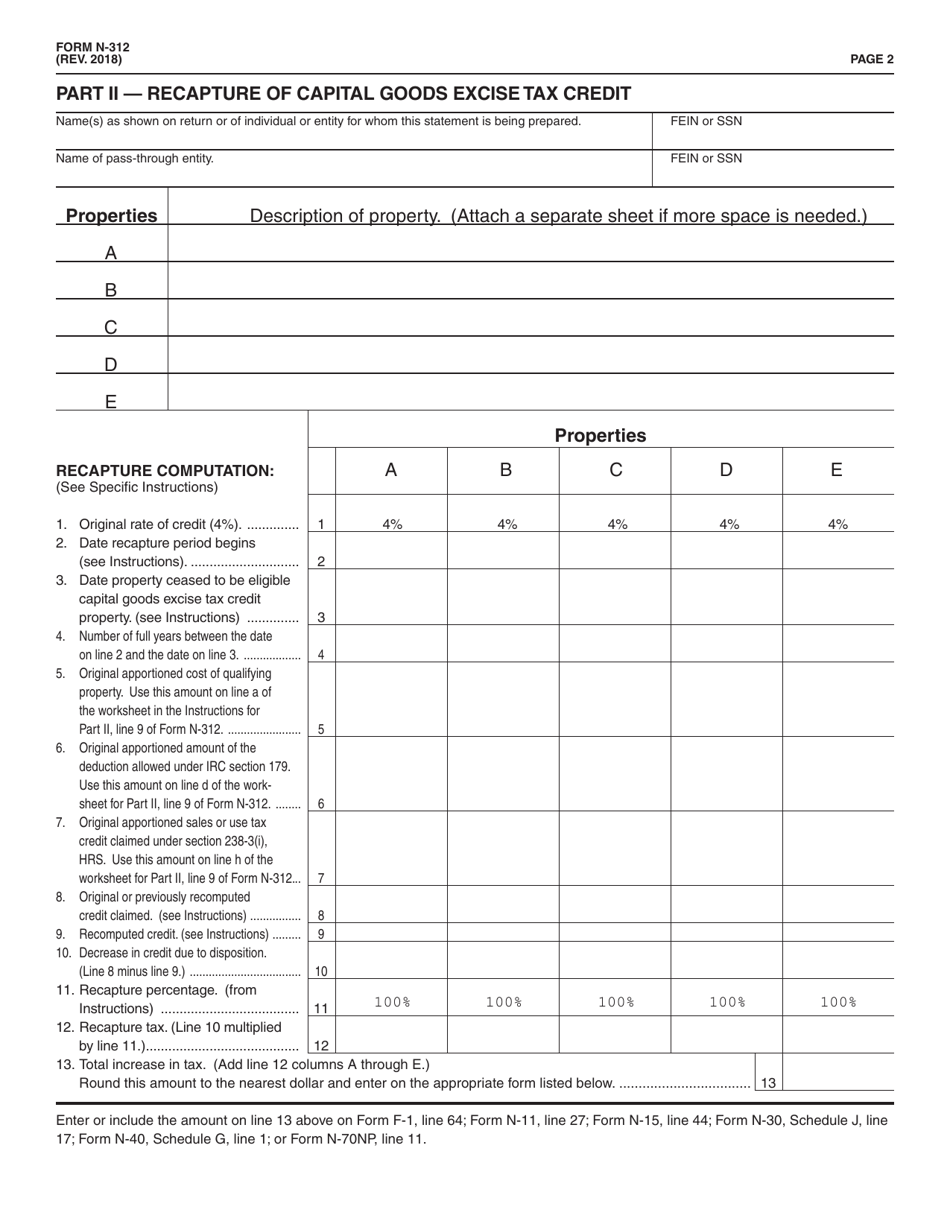

Form N-312 Capital Goods Excise Tax Credit - Hawaii

What Is Form N-312?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

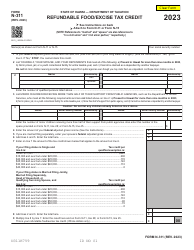

Q: What is Form N-312?

A: Form N-312 is the Capital Goods Excise Tax Credit form in Hawaii.

Q: What is the Capital Goods Excise Tax Credit?

A: The Capital Goods Excise Tax Credit is a credit for qualified capital goods brought into Hawaii.

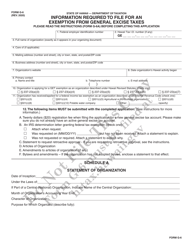

Q: Who is eligible for the Capital Goods Excise Tax Credit?

A: Businesses in Hawaii that purchase qualified capital goods are eligible for this credit.

Q: What are qualified capital goods?

A: Qualified capital goods include machinery, equipment, and other tangible property used for business purposes.

Q: How much is the Capital Goods Excise Tax Credit?

A: The credit is equal to 4% of the cost of qualified capital goods.

Q: How do I claim the Capital Goods Excise Tax Credit?

A: To claim the credit, you must complete and file Form N-312 with the Hawaii Department of Taxation.

Q: Are there any limitations to the Capital Goods Excise Tax Credit?

A: Yes, there is a maximum credit limitation of $125,000 per year.

Q: Can the Capital Goods Excise Tax Credit be carried forward or back?

A: No, the credit cannot be carried forward or back.

Q: Are there any deadlines for filing Form N-312?

A: Yes, the form must be filed by the due date of the tax return for the taxable year in which the qualified capital goods were purchased.

Form Details:

- Released on January 1, 2018;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form N-312 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.