This version of the form is not currently in use and is provided for reference only. Download this version of

Form N-210

for the current year.

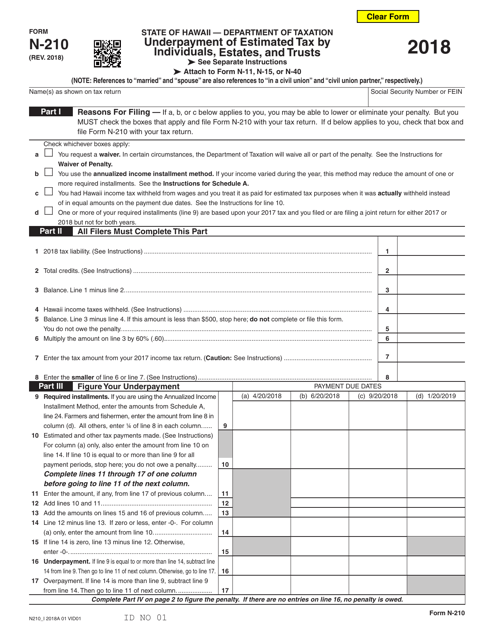

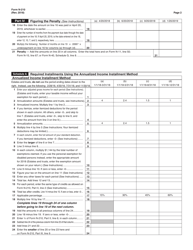

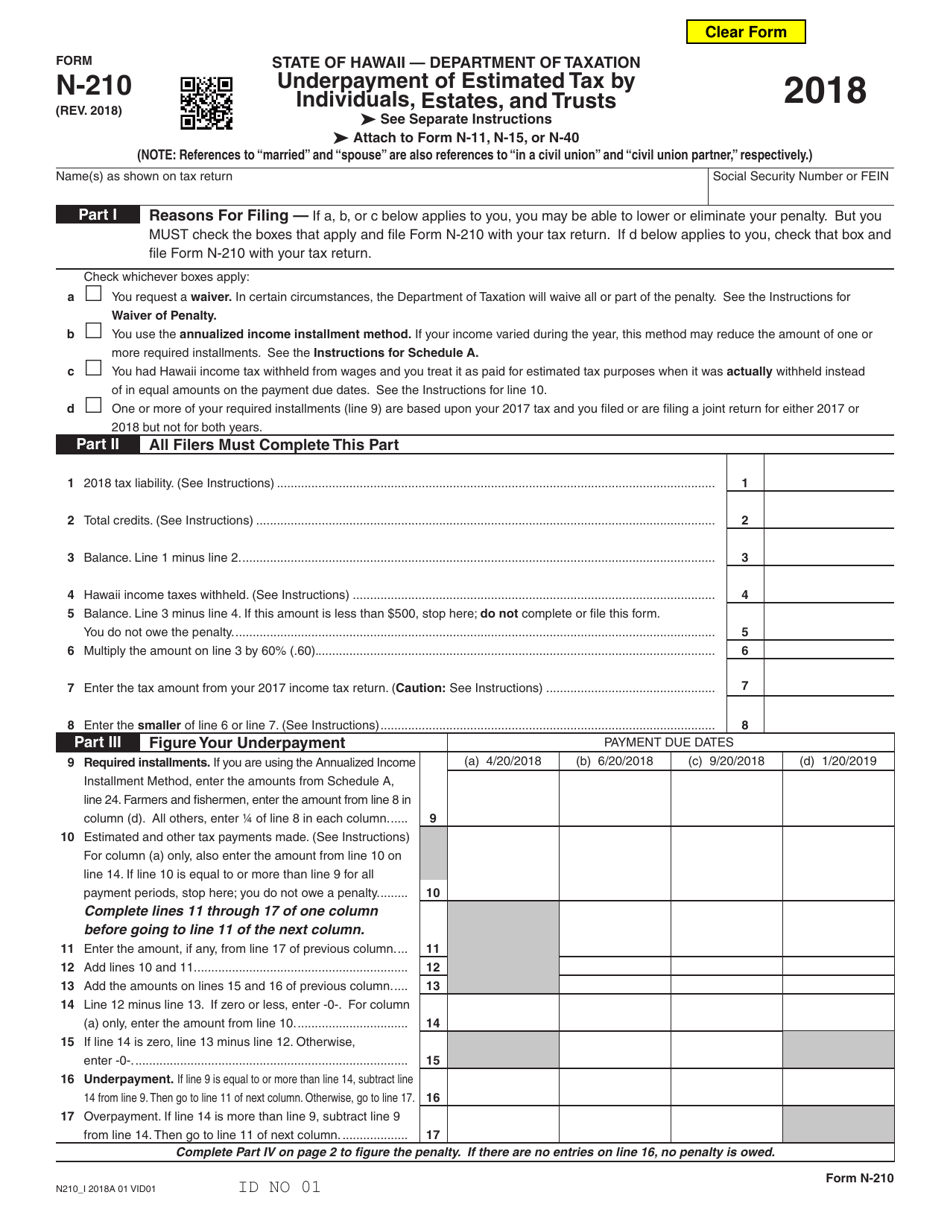

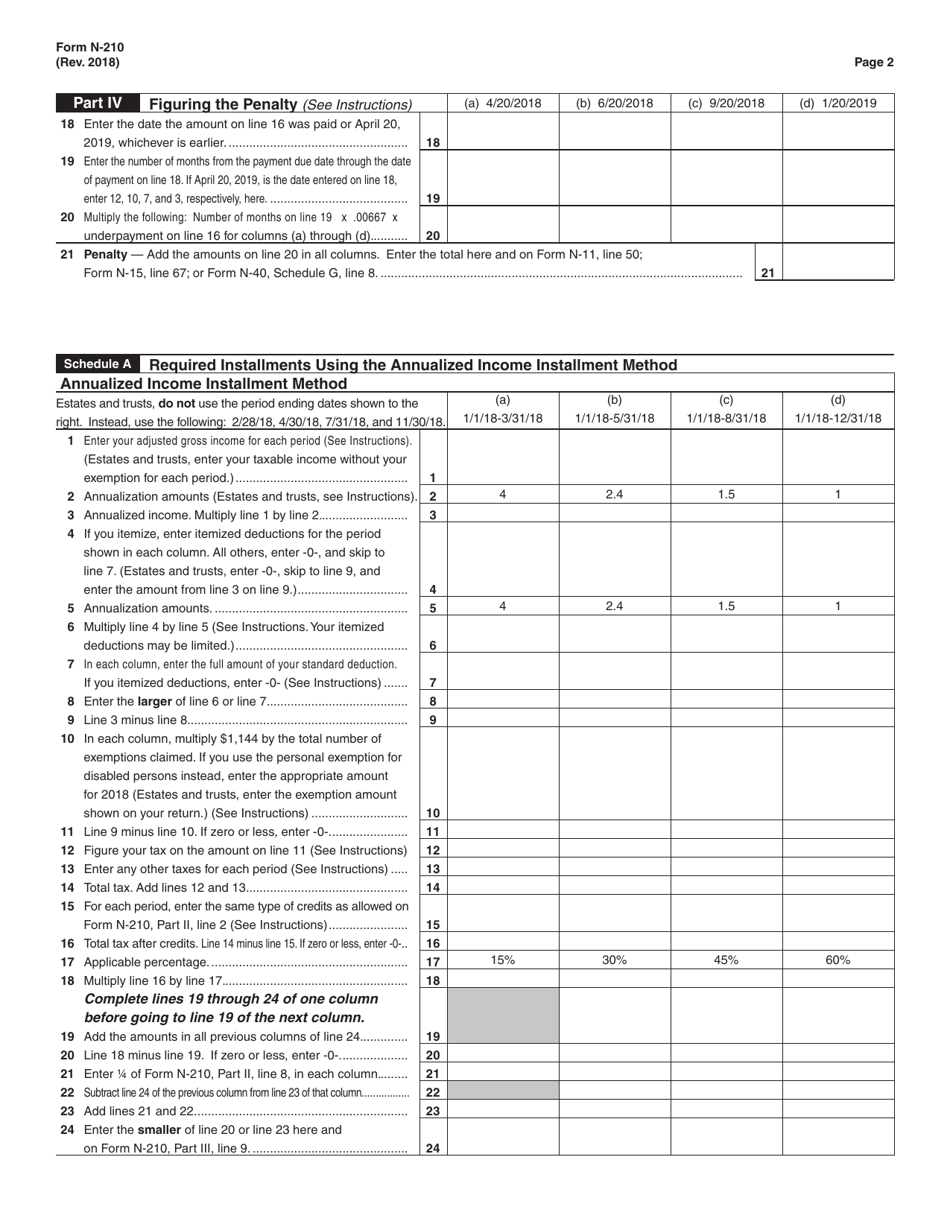

Form N-210 Underpayment of Estimated Tax by Individuals, Estates, and Trusts - Hawaii

What Is Form N-210?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form N-210?

A: Form N-210 is used to calculate and report any underpayment of estimated tax by individuals, estates, and trusts in Hawaii.

Q: Who should file Form N-210?

A: Individuals, estates, and trusts in Hawaii who have underpaid their estimated tax should file Form N-210.

Q: What is considered underpayment of estimated tax?

A: Underpayment of estimated tax occurs when the taxpayer has not paid enough tax throughout the year.

Q: When should Form N-210 be filed?

A: Form N-210 should be filed on or before the 20th day of the 4th month following the close of the taxable year.

Q: Are there any penalties for underpayment of estimated tax?

A: Yes, there may be penalties for underpayment of estimated tax. It is important to accurately calculate and pay your estimated tax to avoid penalties.

Q: Can I make corrections to Form N-210 after filing?

A: Yes, if you need to make corrections to Form N-210 after filing, you can file an amended Form N-210.

Q: Do I need to attach any documents with Form N-210?

A: No, you do not need to attach any documents with Form N-210. However, you should retain all supporting documents for your records in case of an audit.

Q: Can I file Form N-210 electronically?

A: Yes, you can file Form N-210 electronically through the Hawaii Department of Taxation's e-file system or through authorized tax preparation software.

Form Details:

- Released on January 1, 2018;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form N-210 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.