This version of the form is not currently in use and is provided for reference only. Download this version of

Form N-310

for the current year.

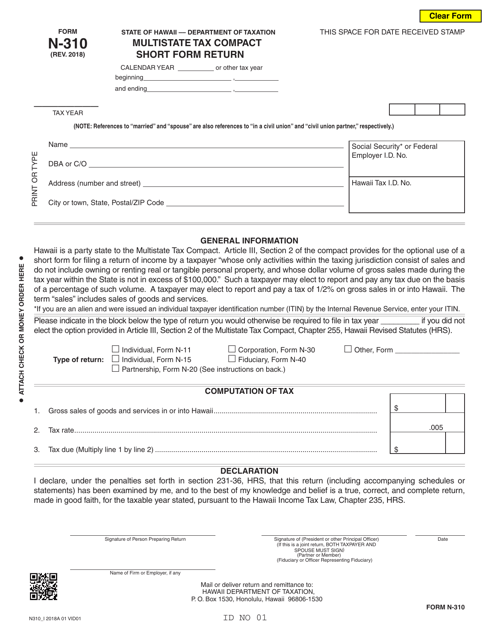

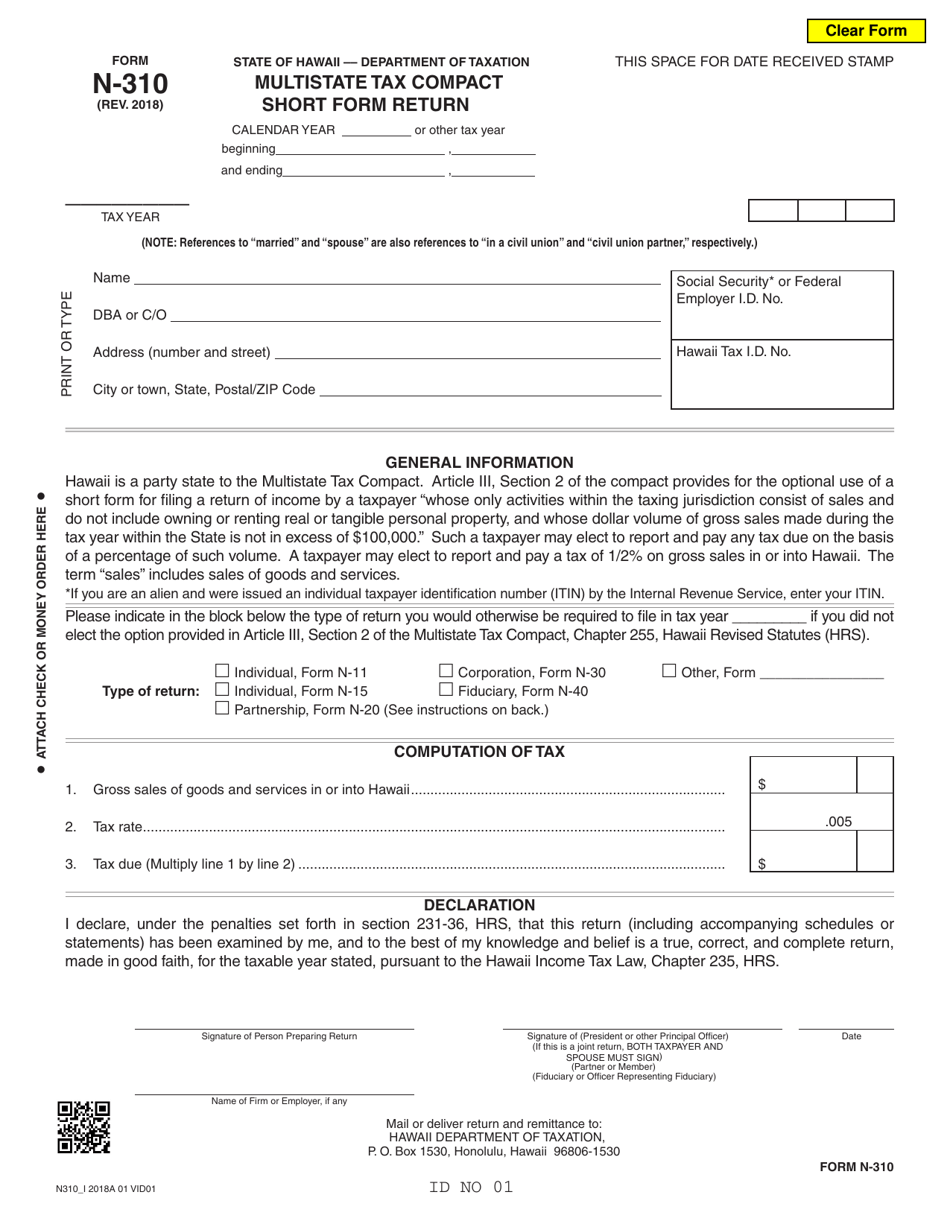

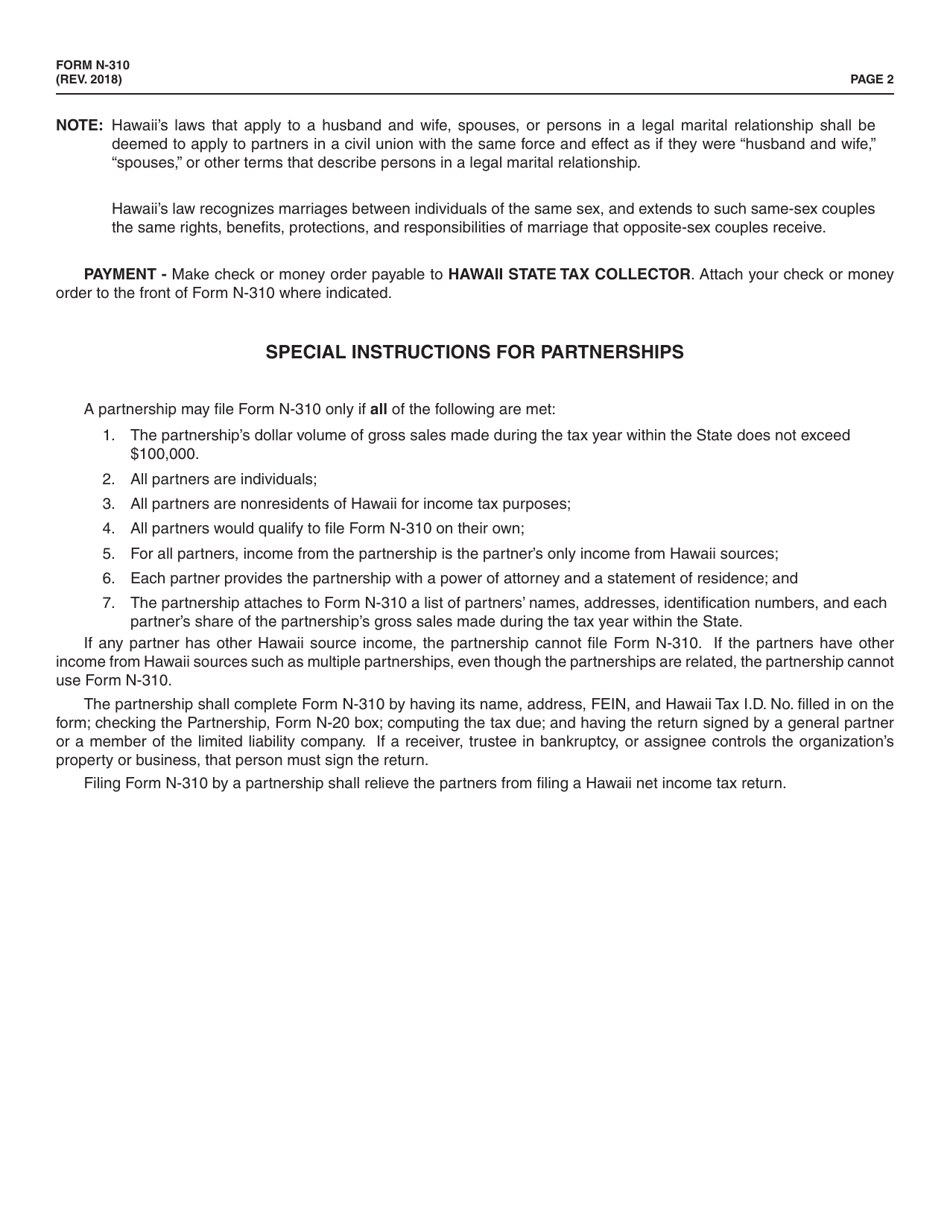

Form N-310 Multistate Tax Compact Short Form Return - Hawaii

What Is Form N-310?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form N-310 Multistate Tax Compact Short Form Return?

A: Form N-310 is a tax form used by residents of Hawaii to report their income and assets as part of the Multistate Tax Compact.

Q: Who needs to file Form N-310?

A: Residents of Hawaii who are members of the Multistate Tax Compact need to file Form N-310.

Q: What is the purpose of the Multistate Tax Compact?

A: The Multistate Tax Compact is an agreement between participating states to simplify tax reporting and reduce double taxation for individuals and businesses that earn income in multiple states.

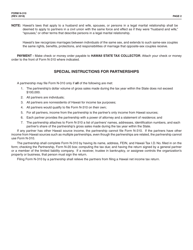

Q: How do I complete Form N-310?

A: You will need to provide information about your income, deductions, and credits on Form N-310. The form includes instructions to guide you through the process.

Q: When is the deadline to file Form N-310?

A: The deadline to file Form N-310 in Hawaii is usually April 20th.

Q: What happens if I don't file Form N-310?

A: If you are required to file Form N-310 and fail to do so, you may face penalties and interest on any taxes owed.

Q: Are there any special considerations for military members filing Form N-310?

A: Yes, military members may have special rules and provisions when it comes to filing Form N-310. It is recommended to consult the instructions or seek professional tax advice.

Form Details:

- Released on January 1, 2018;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form N-310 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.