This version of the form is not currently in use and is provided for reference only. Download this version of

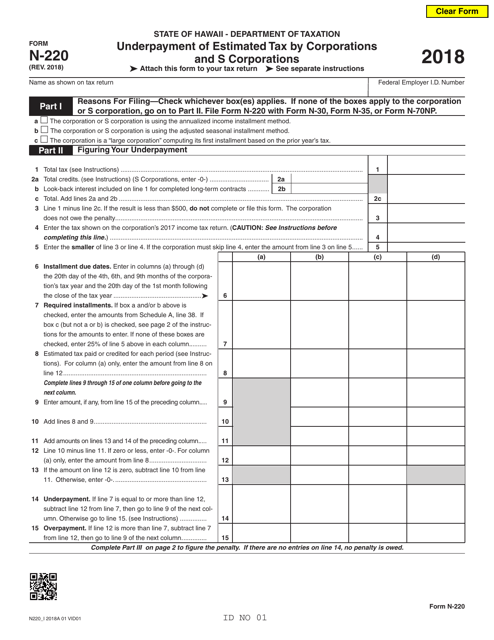

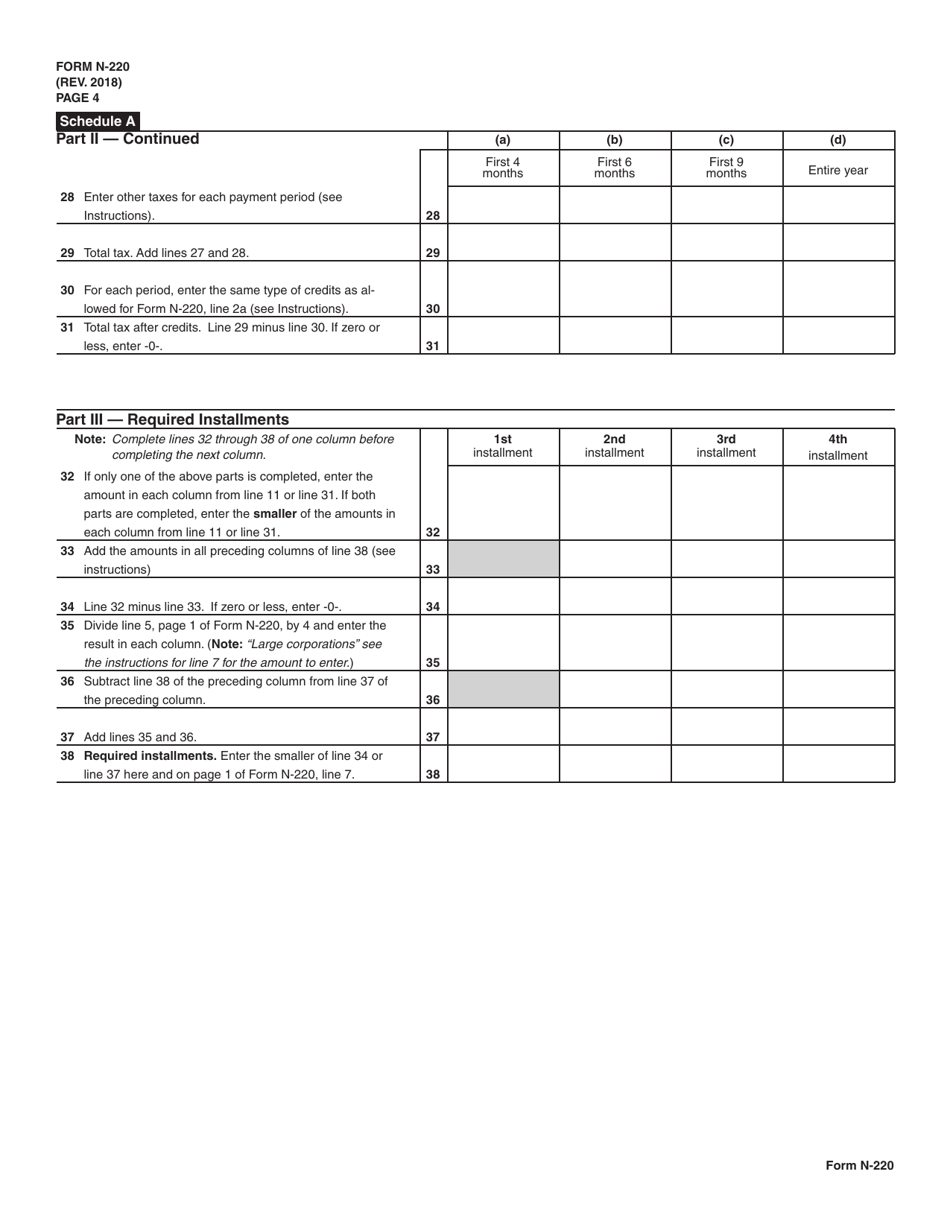

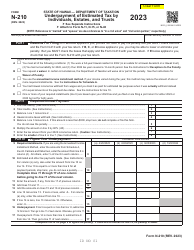

Form N-220

for the current year.

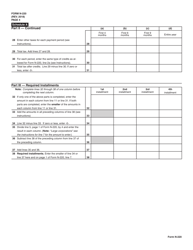

Form N-220 Underpayment of Estimated Tax by Corporations and S Corporations - Hawaii

What Is Form N-220?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form N-220?

A: Form N-220 is a form used by corporations and S corporations in Hawaii to report and calculate any underpayment of estimated tax.

Q: Who needs to file Form N-220?

A: Corporations and S corporations in Hawaii are required to file Form N-220 if they have underpaid their estimated tax.

Q: What is considered underpayment of estimated tax?

A: Underpayment of estimated tax occurs when a corporation or S corporation pays less in estimated tax throughout the year than they owe.

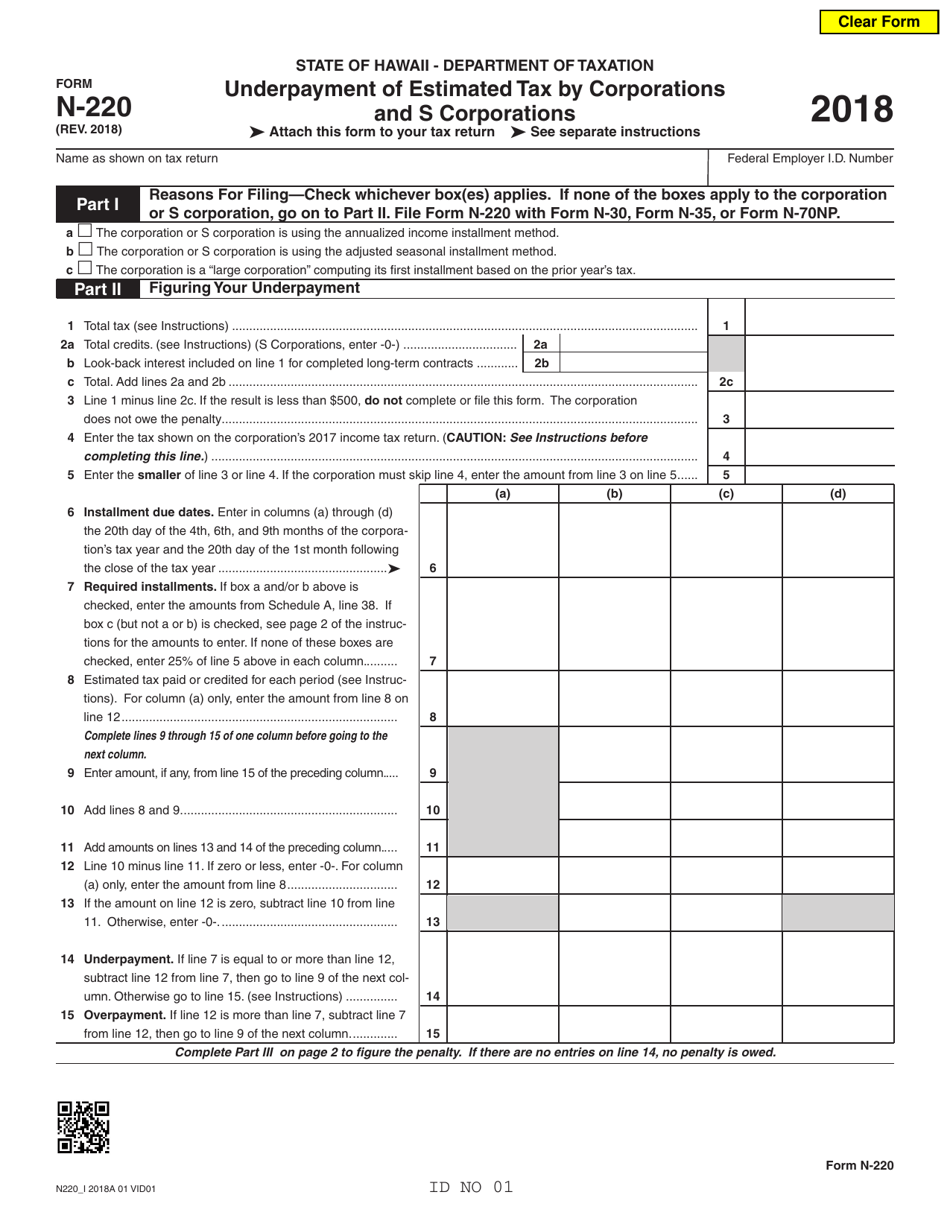

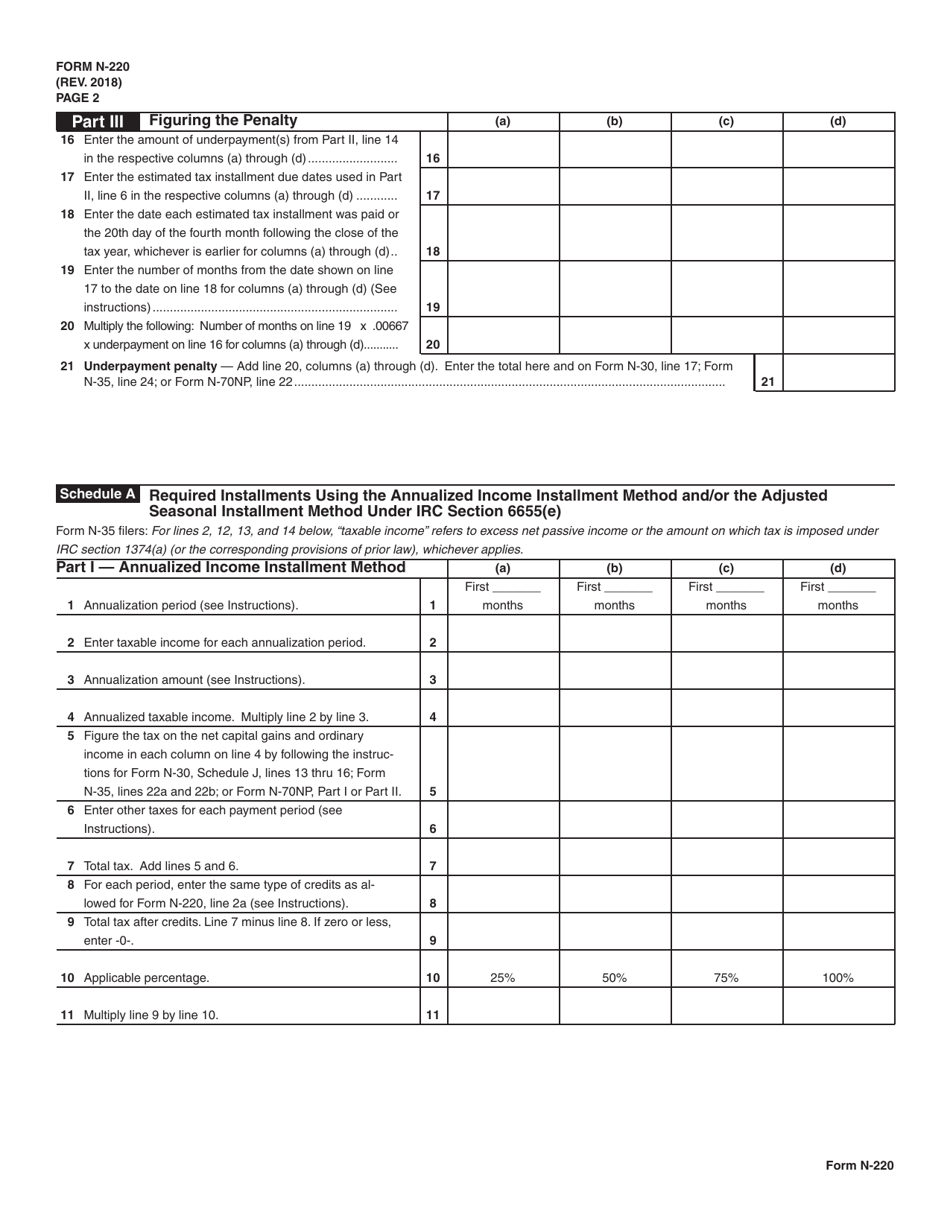

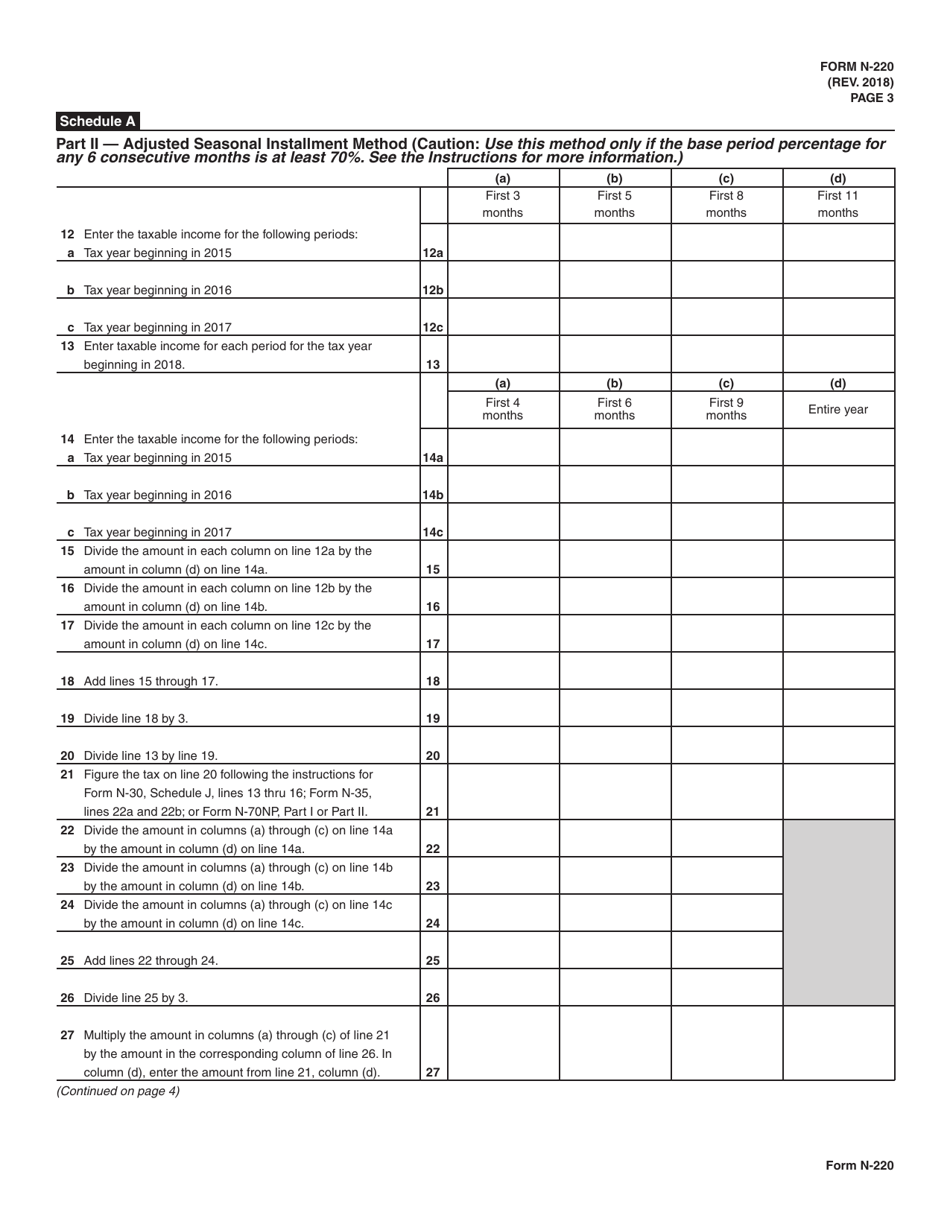

Q: What is the purpose of Form N-220?

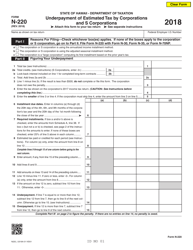

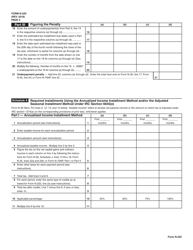

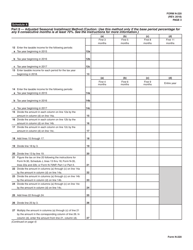

A: The purpose of Form N-220 is to calculate and report any underpayment of estimated tax and to determine if any penalties or interest are owed.

Q: When is Form N-220 due?

A: Form N-220 is due on the same day as the corporation's or S corporation's income tax return, which is generally on or before the 20th day of the fourth month following the close of the tax year.

Q: What information is required on Form N-220?

A: Form N-220 requires information such as the corporation's or S corporation's name, address, federal employer identification number, and the amounts of underpaid estimated tax for each period.

Q: Are there any penalties for underpayment of estimated tax?

A: Yes, if a corporation or S corporation underpays their estimated tax, they may be subject to penalties and interest.

Q: Do I need to file Form N-220 if I did not underpay my estimated tax?

A: No, if you did not underpay your estimated tax, you do not need to file Form N-220.

Q: Can I file Form N-220 electronically?

A: Yes, Form N-220 can be filed electronically through the Hawaii Department of Taxation's e-filing system or through approved tax preparation software.

Form Details:

- Released on January 1, 2018;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form N-220 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.