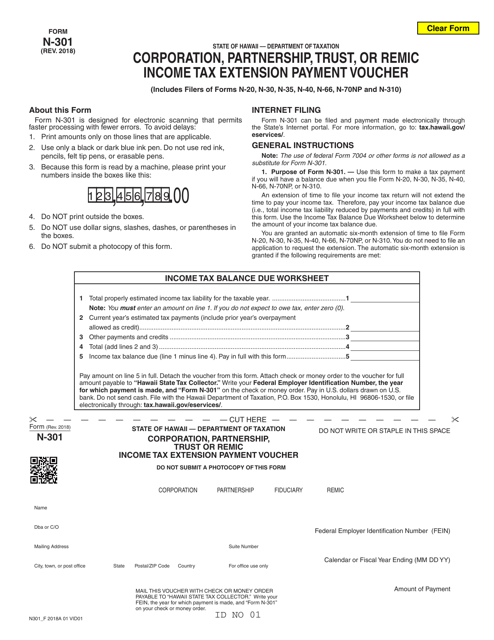

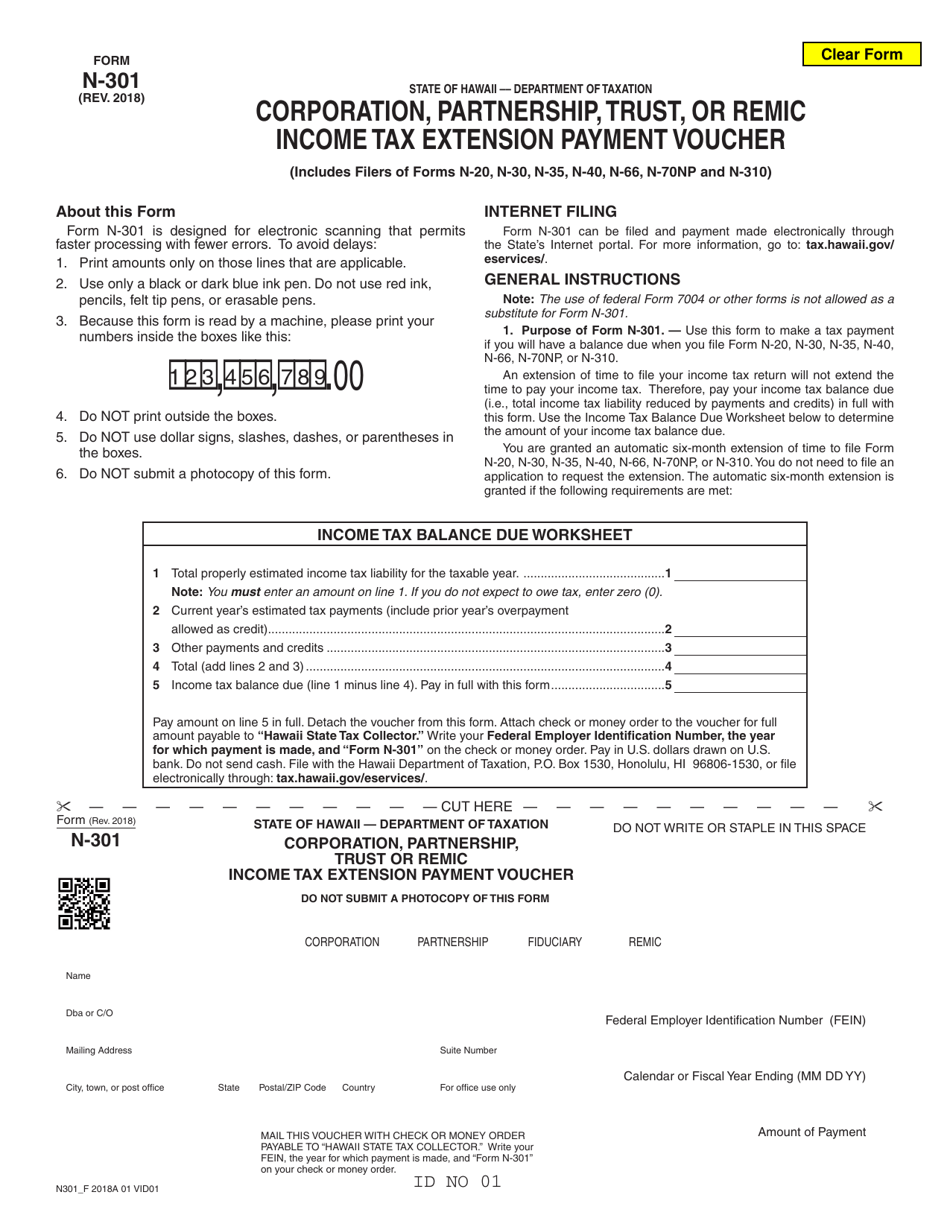

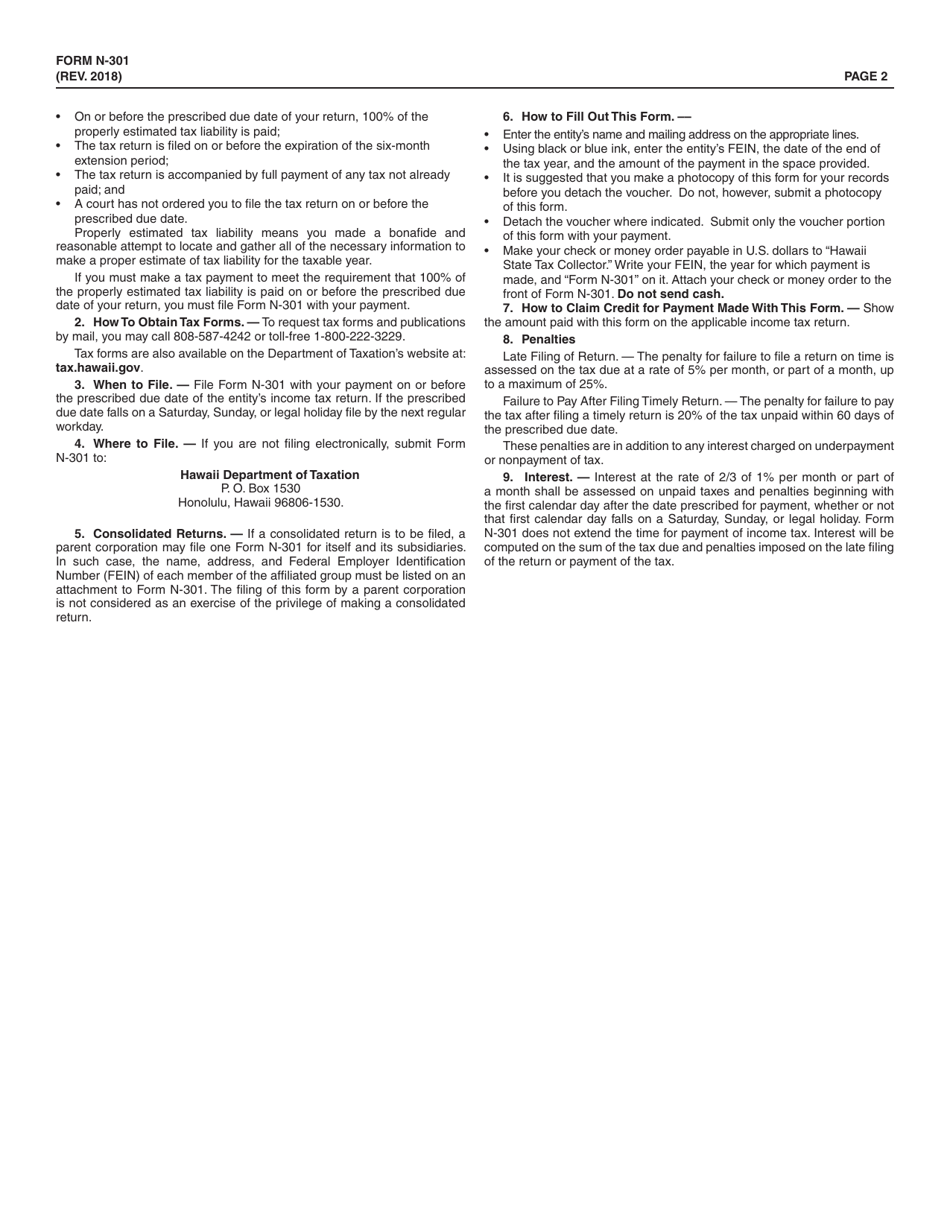

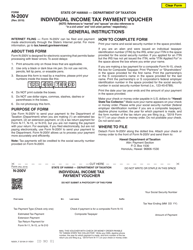

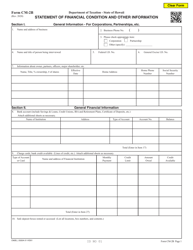

Form N-301 Corporation, Partnership, Trust, or REMIC Income Tax Extension Payment Voucher - Hawaii

What Is Form N-301?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form N-301?

A: Form N-301 is the Corporation, Partnership, Trust, or Remic Income Tax Extension Payment Voucher for Hawaii.

Q: Who needs to use Form N-301?

A: Corporations, partnerships, trusts, or REMIC (Real Estate Mortgage Investment Conduits) who are filing for an income tax extension in Hawaii need to use Form N-301.

Q: What is the purpose of Form N-301?

A: The purpose of Form N-301 is to provide a payment voucher for those filing for an income tax extension in Hawaii for corporations, partnerships, trusts, or REMICs.

Q: How do I fill out Form N-301?

A: To fill out Form N-301, you will need to provide your name, contact information, tax identification number, and the amount of the extension payment.

Q: When is Form N-301 due?

A: Form N-301 is due on the original due date of the tax return, which is typically March 31st of the following year.

Q: What happens if I don't file an extension with Form N-301?

A: If you don't file an extension with Form N-301 and fail to file your tax return on time, you may face penalties and interest on the unpaid tax amount.

Form Details:

- Released on January 1, 2018;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form N-301 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.