This version of the form is not currently in use and is provided for reference only. Download this version of

Form N-109

for the current year.

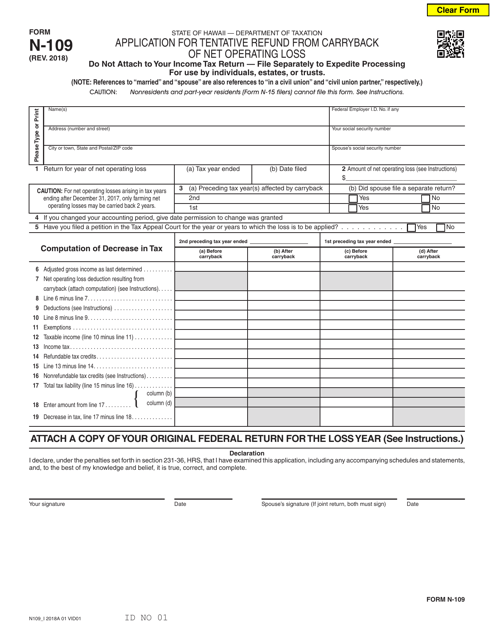

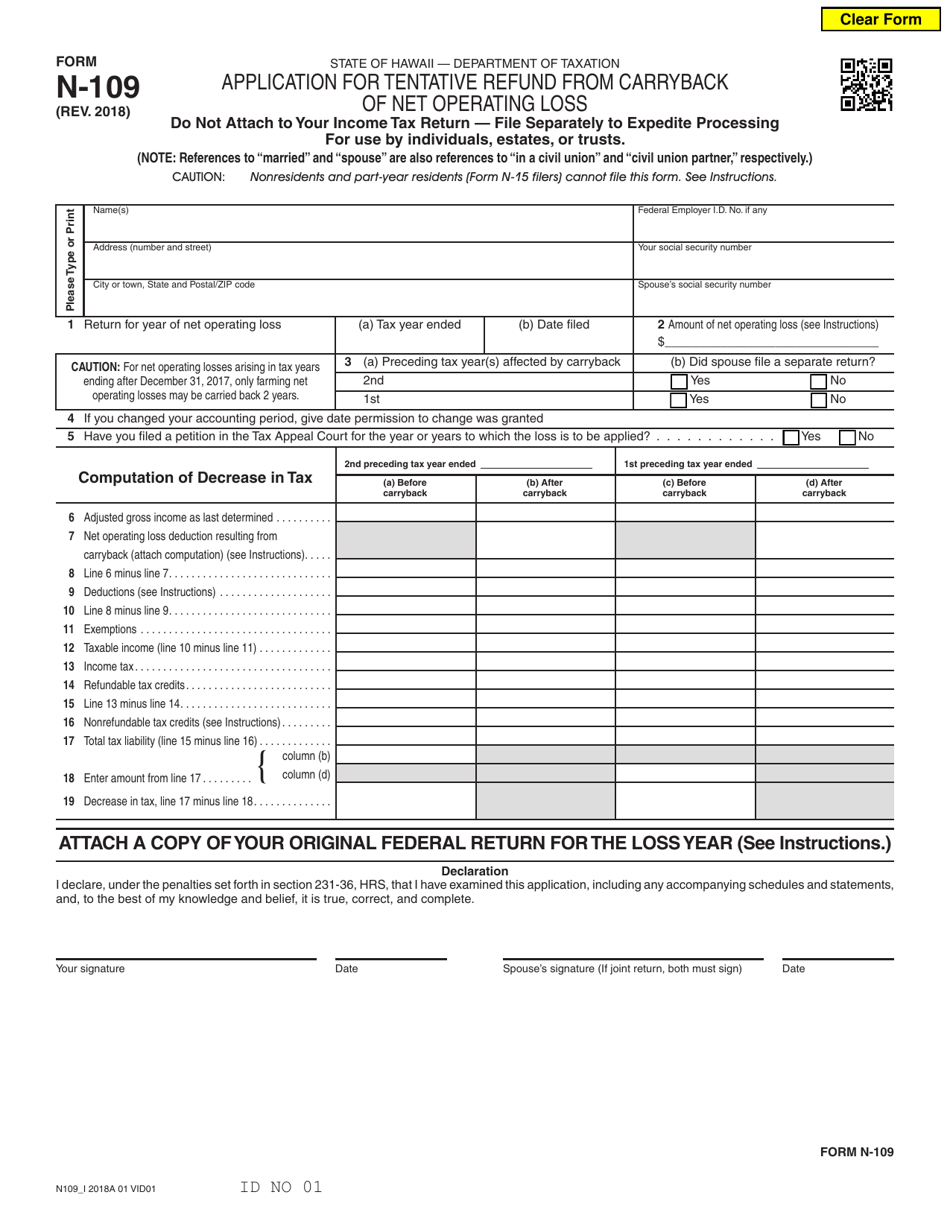

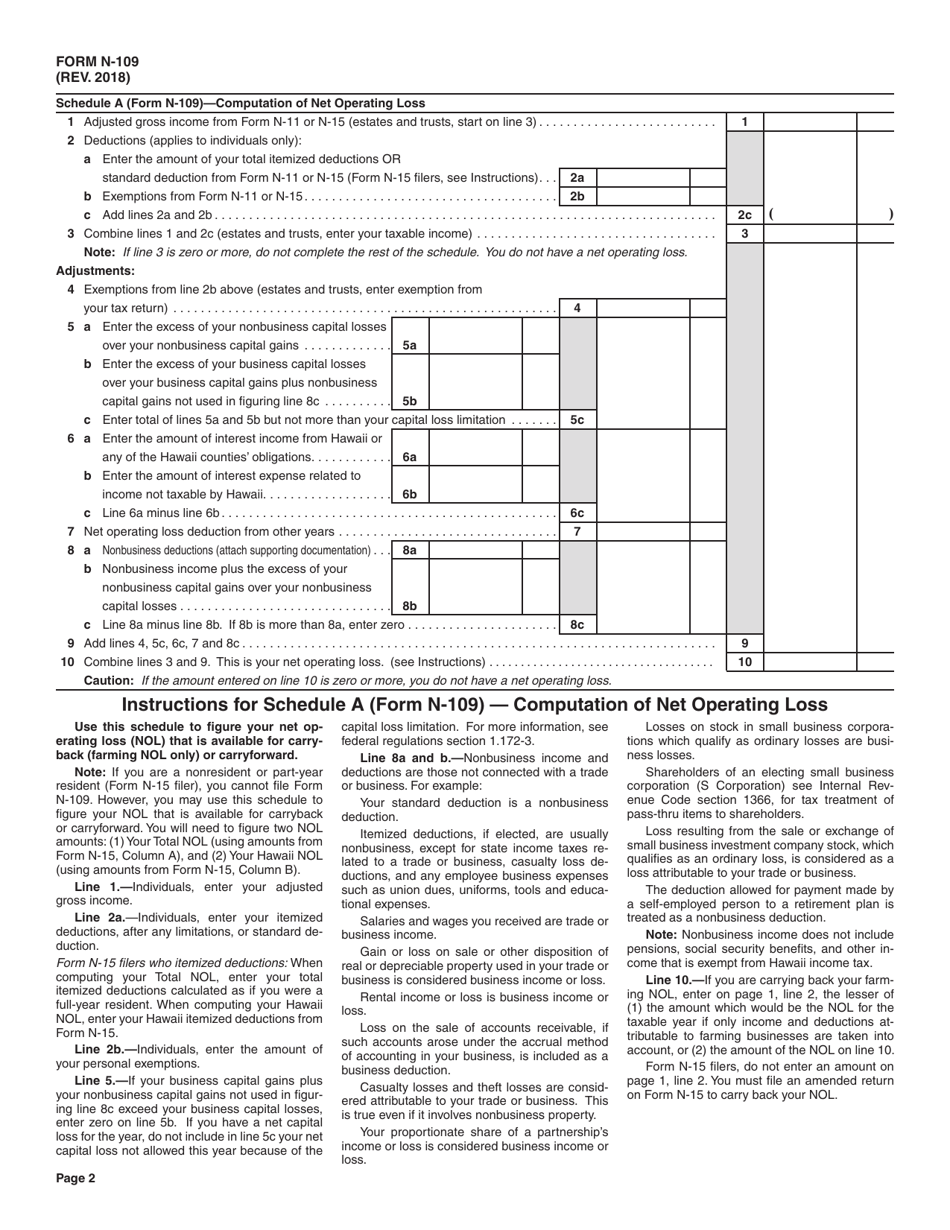

Form N-109 Application for Tentative Refund From Carryback of Net Operating Loss - Hawaii

What Is Form N-109?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

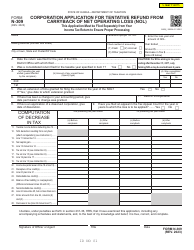

Q: What is Form N-109?

A: Form N-109 is an application for tentative refund from carryback of net operating loss specifically for Hawaii.

Q: What is a net operating loss?

A: A net operating loss occurs when a company's deductible expenses exceed its taxable income.

Q: What is a tentative refund?

A: A tentative refund is a refund that is issued before a final determination is made.

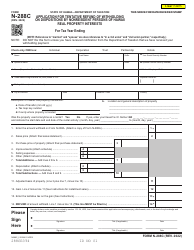

Q: Who can use Form N-109?

A: Individuals, estates, and trusts with a net operating loss carryback from Hawaii source income can use Form N-109.

Q: What supporting documents do I need to include with Form N-109?

A: You must include a copy of your federal Form 1045 or Form 1139 with Form N-109.

Q: What is the deadline to file Form N-109?

A: Form N-109 must be filed within two years from the close of the taxable year in which the net operating loss occurred.

Q: Is there a fee to file Form N-109?

A: No, there is no fee to file Form N-109.

Q: Can I e-file Form N-109?

A: No, Form N-109 must be filed by mail and cannot be e-filed.

Form Details:

- Released on January 1, 2018;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form N-109 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.