This version of the form is not currently in use and is provided for reference only. Download this version of

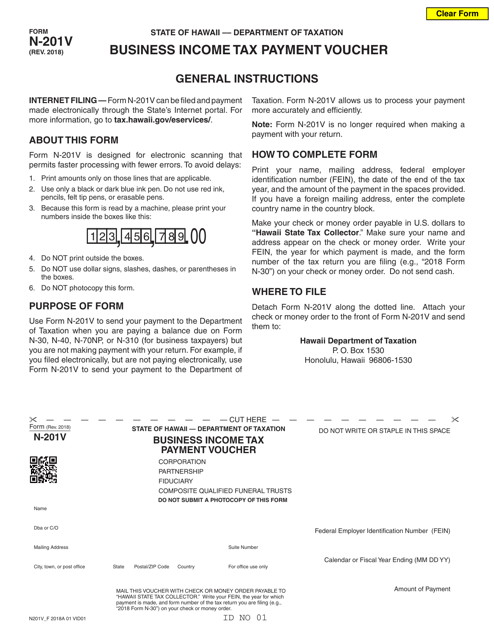

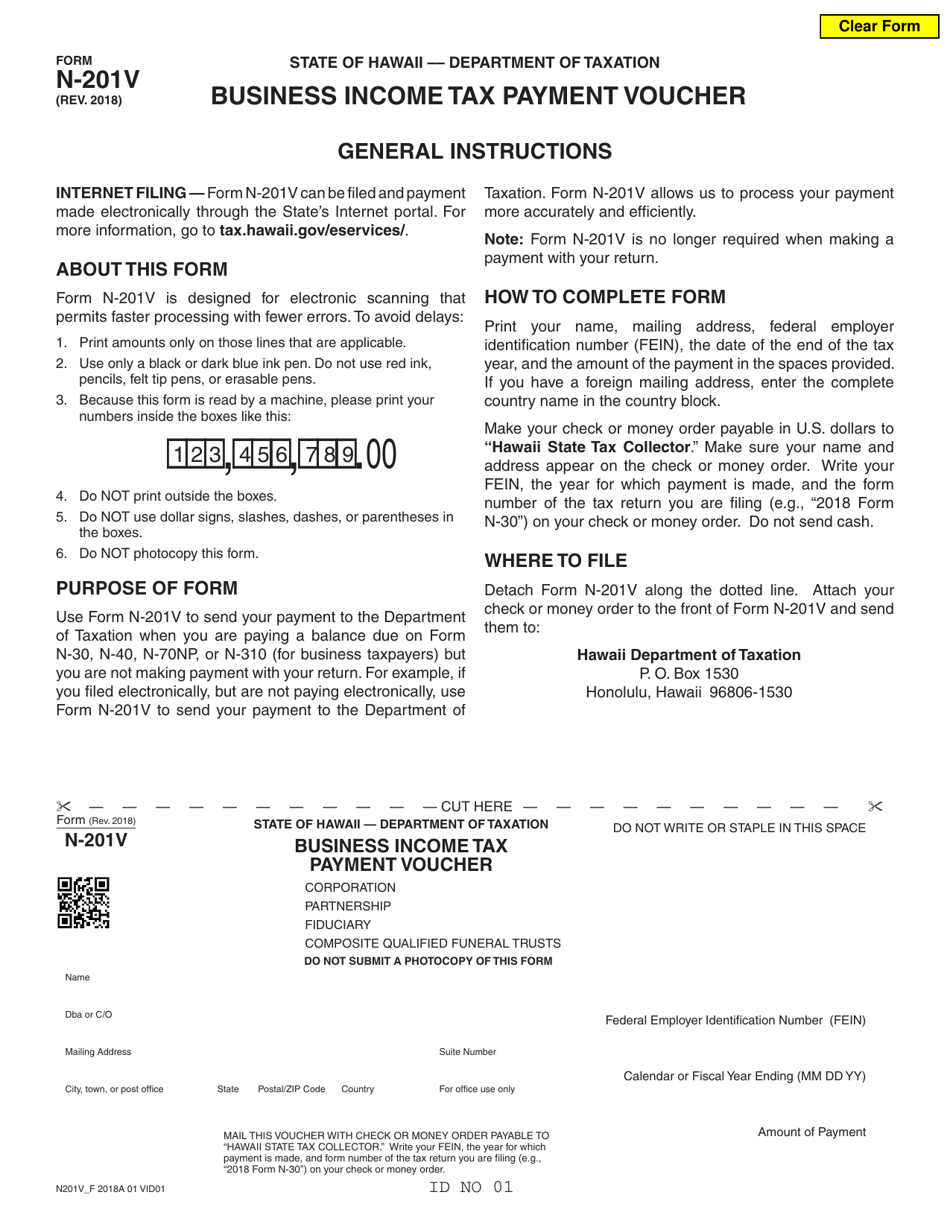

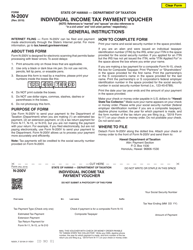

Form N-201V

for the current year.

Form N-201V Business Income Tax Payment Voucher - Hawaii

What Is Form N-201V?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

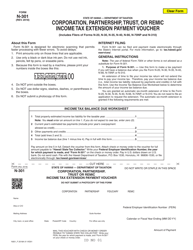

Q: What is Form N-201V?

A: Form N-201V is a Business Income Tax Payment Voucher specific to Hawaii.

Q: What is the purpose of Form N-201V?

A: The purpose of Form N-201V is to make a payment for business income tax in Hawaii.

Q: Who needs to use Form N-201V?

A: Form N-201V needs to be used by businesses in Hawaii that have a tax liability and need to make a payment.

Q: When should Form N-201V be used?

A: Form N-201V should be used when making a payment for business income tax in Hawaii.

Q: Is Form N-201V specific to Hawaii?

A: Yes, Form N-201V is specifically used for business income tax payments in Hawaii.

Form Details:

- Released on January 1, 2018;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form N-201V by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.