This version of the form is not currently in use and is provided for reference only. Download this version of

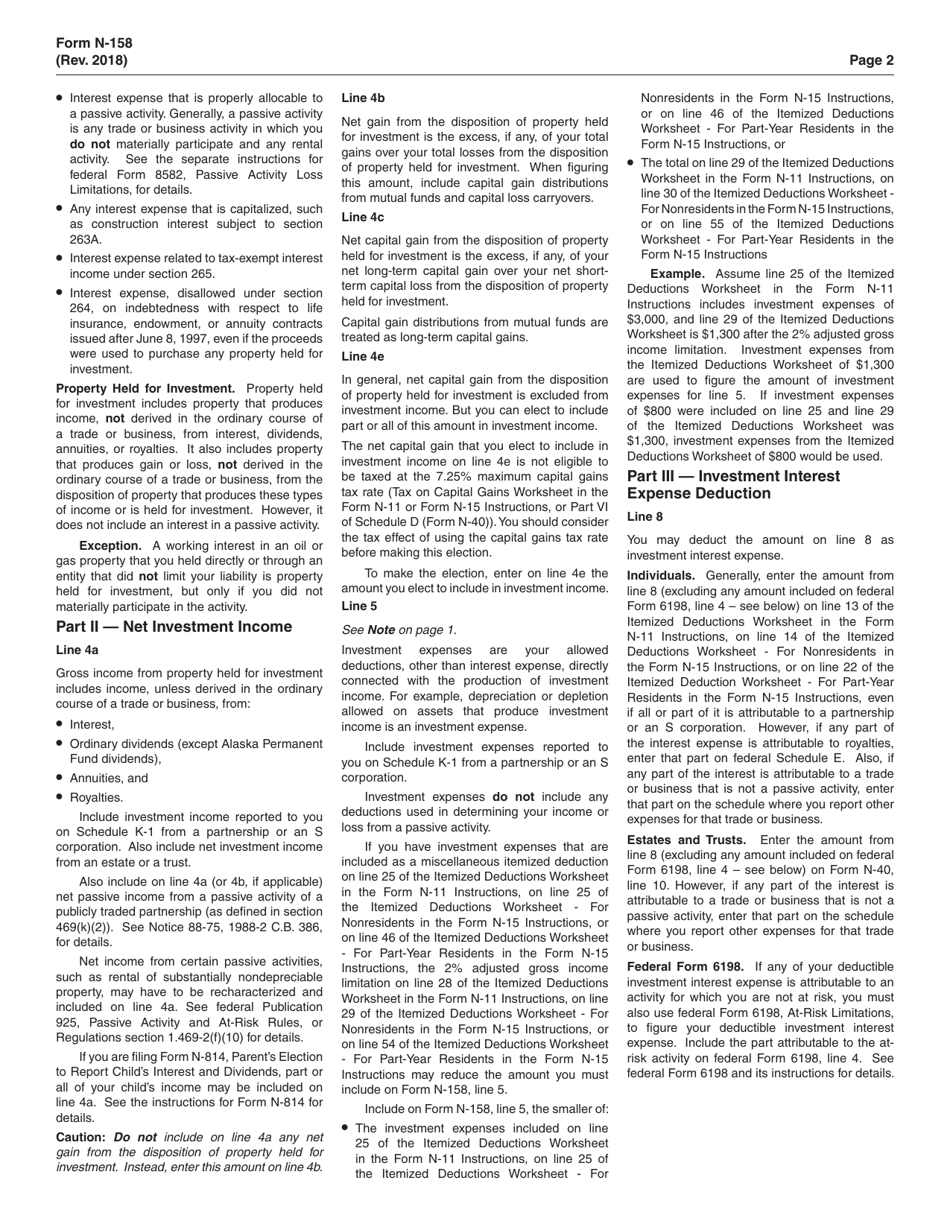

Form N-158

for the current year.

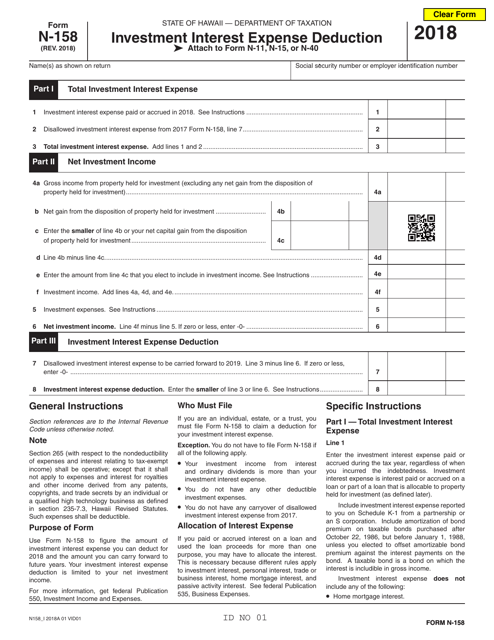

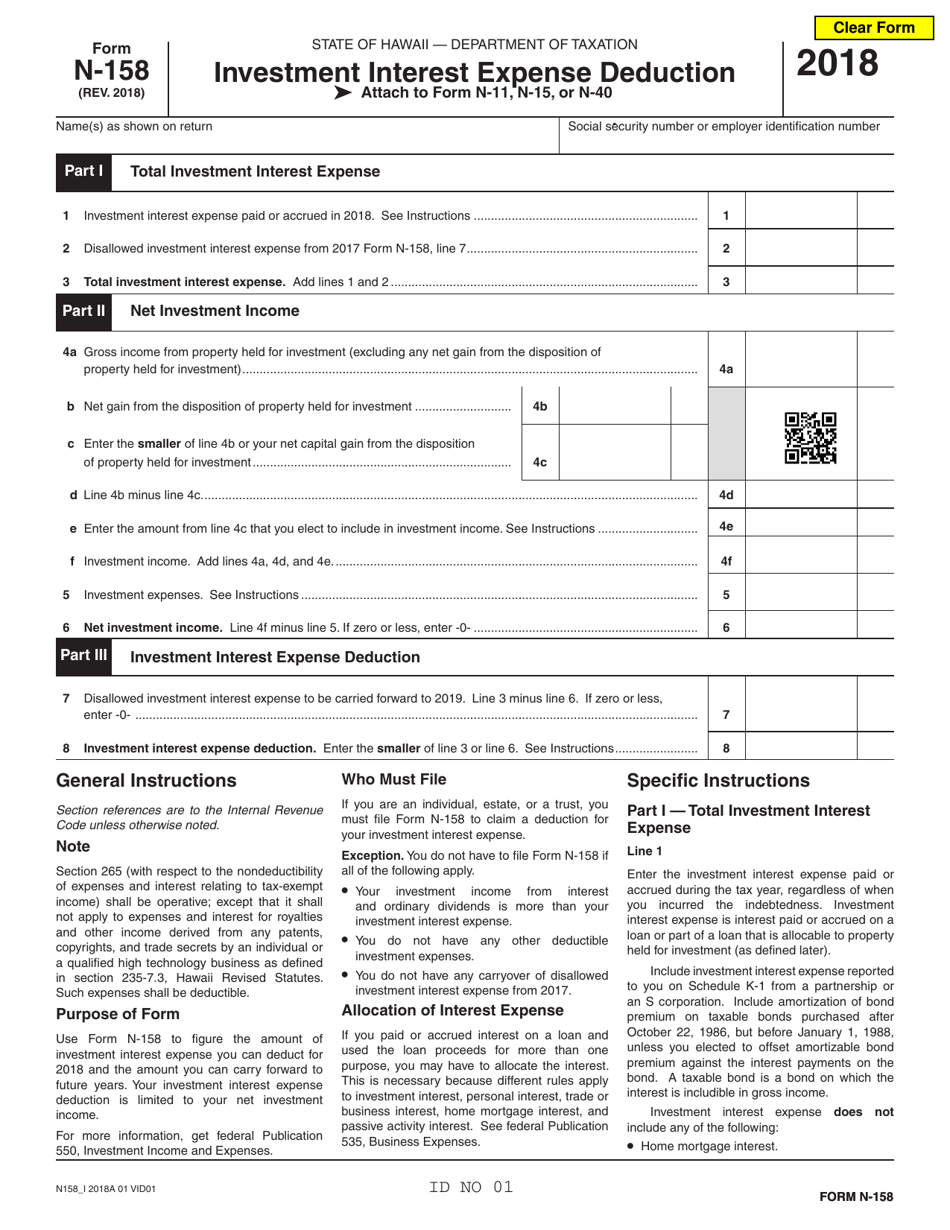

Form N-158 Investment Interest Expense Deduction - Hawaii

What Is Form N-158?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form N-158?

A: Form N-158 is a tax form used to claim the Investment Interest Expense Deduction in Hawaii.

Q: What is the Investment Interest Expense Deduction?

A: The Investment Interest Expense Deduction is a deduction that allows taxpayers to deduct the interest paid on loans used to purchase investments.

Q: Who can use Form N-158?

A: Form N-158 is used by individuals, trusts, and estates that qualify for the Investment Interest Expense Deduction in Hawaii.

Q: What information is required on Form N-158?

A: Form N-158 requires taxpayers to provide information about their investments and the interest they paid on loans used to purchase those investments.

Q: Is the Investment Interest Expense Deduction available in other states?

A: Yes, the Investment Interest Expense Deduction is available in other states, but the specific form and requirements may vary.

Q: What is the deadline for filing Form N-158?

A: The deadline for filing Form N-158 is the same as the deadline for filing your Hawaii state tax return.

Q: Can I e-file Form N-158?

A: Yes, Form N-158 can be e-filed if you are using tax preparation software that supports Hawaii state tax forms.

Form Details:

- Released on January 1, 2018;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form N-158 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.