This version of the form is not currently in use and is provided for reference only. Download this version of

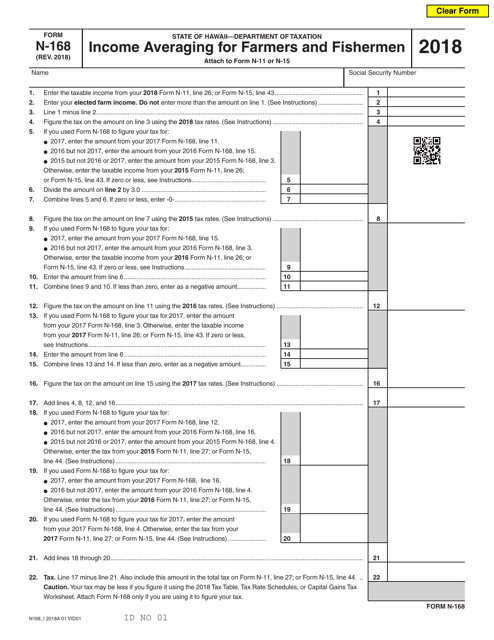

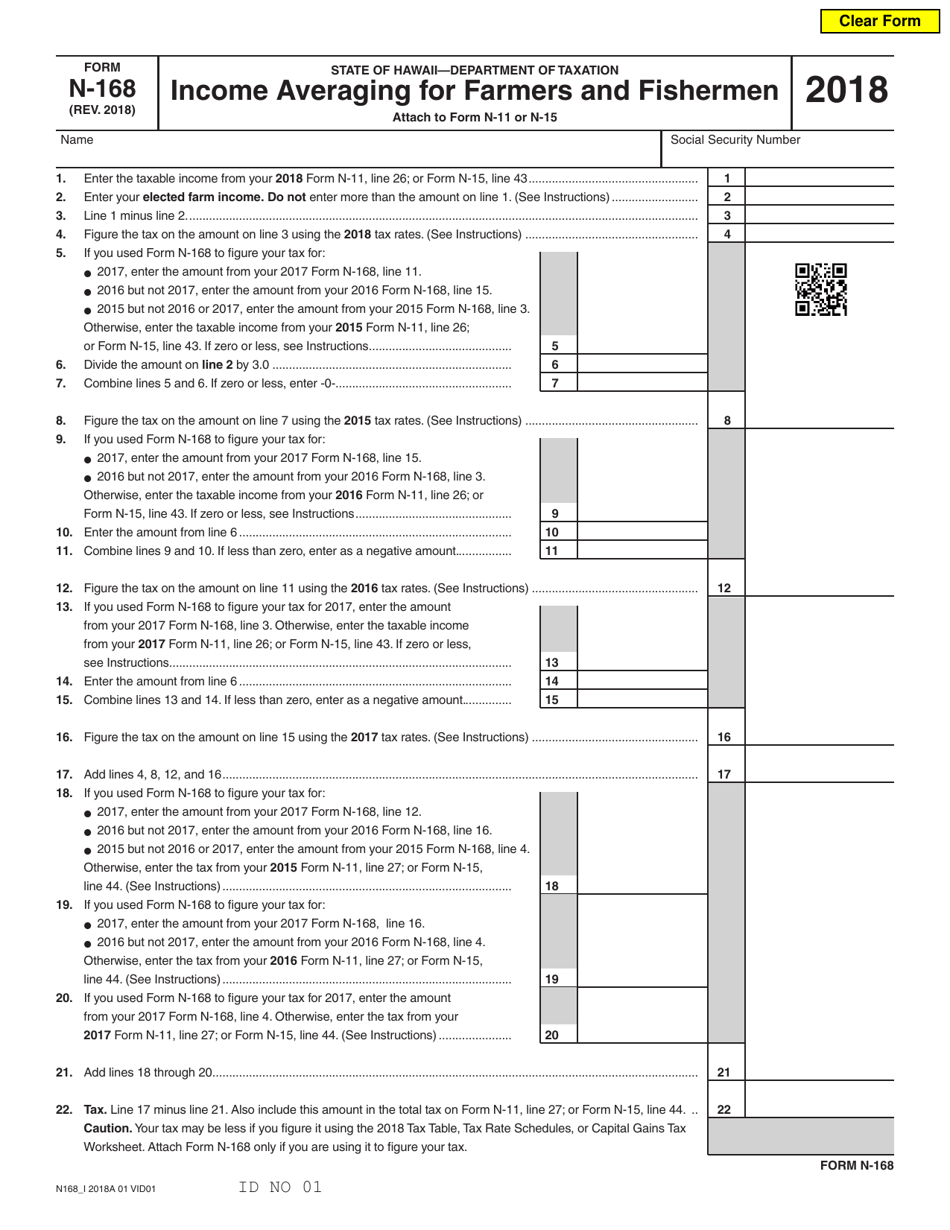

Form N-168

for the current year.

Form N-168 Income Averaging for Farmers and Fishermen - Hawaii

What Is Form N-168?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form N-168?

A: Form N-168 is the Income Averaging for Farmers and Fishermen form specific to Hawaii.

Q: Who can use Form N-168?

A: Farmers and fishermen in Hawaii who meet the specific requirements can use Form N-168 to calculate their income averaging.

Q: What is income averaging?

A: Income averaging is a method that allows farmers and fishermen to average their taxable income over a period of three years.

Q: What are the benefits of income averaging?

A: Income averaging can reduce the tax liability for farmers and fishermen by spreading out their income over multiple years.

Q: How does Form N-168 help farmers and fishermen in Hawaii?

A: Form N-168 helps farmers and fishermen in Hawaii calculate their income averaging by providing specific instructions and information.

Q: What information is required to complete Form N-168?

A: To complete Form N-168, farmers and fishermen will need to provide their income and expenses for the relevant tax years.

Q: Are there any restrictions on who can use Form N-168?

A: Yes, Form N-168 is only applicable to farmers and fishermen in Hawaii who meet the specific requirements.

Q: Can I use income averaging if I am not a farmer or fisherman?

A: No, income averaging is only available for farmers and fishermen.

Q: Are there any deadlines for filing Form N-168?

A: The deadline for filing Form N-168 is the same as the deadline for filing your annual tax return. Check with the Hawaii Department of Taxation for the specific deadline.

Form Details:

- Released on January 1, 2018;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form N-168 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.